QUOTE(hafizmamak85 @ Mar 21 2025, 11:37 AM)

The part that really pisses me off and makes my blood boil about your situation is that they are charging you allocation charges again for the additional premium levied when upgrading your plan. You've already made the case that the cost of insurance charges are the same or lesser for the medical coverage of your plan after upgrading.

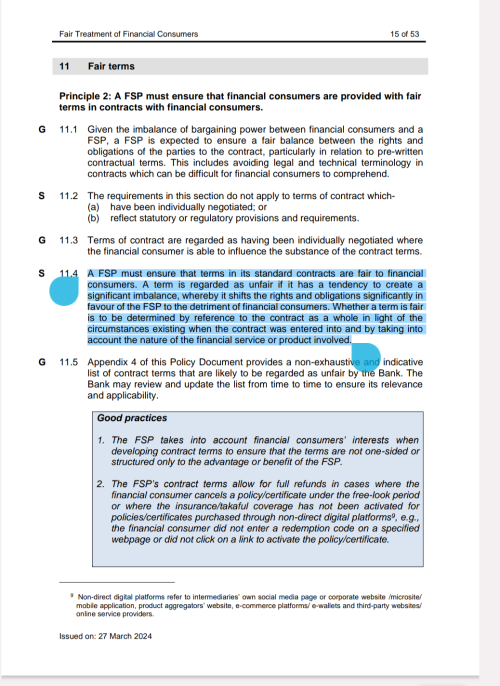

So why should the new premium amount quoted for your plan have any increment in the first place and why should you be expected to pay any further additional charges?????This upgrade is basically an excuse to reprice your policy for sustainability, which maybe the ITO didn't account for sustainability properly in the policy's initial pricing.

Why should you, the consumer, be expected to bear the burden for the ITO's mispricing and other errors???!To policyholders/consumers out there, always be wary about what you're being sold or have bought as part of an investment-linked insurance plan, but do not despair. There are a lot of contradictions, ambiguities, unclear language between and within the contract terms, sales disclosures and Malaysian laws/BNM policies.

BNM has not played its proper role in protecting your rights and interests and in fact, has acted in concert with the insurance industry in enacting policies or interpreting contract terms in favour of ITOs, to your detriment. And our Malaysian actuaries are, sorry to say, and even they would admit to it, 'koyak' when it comes to consumer rights.

In a sensible world, these contradictions and ambiguities will have to be resolved in your favour. So, it would be wise for you to consider initiating a class action lawsuit against the ITOs & BNM.

Whether you had recently upgraded your medical card as part of a guaranteed issuance offer and found yourself paying additional allocation and other charges or had your policy repriced due to sustainability issues (e.g. due to higher cost of insurance charges as part of medical repricing or sub-par unit fund investment performance), always be guided by the following:

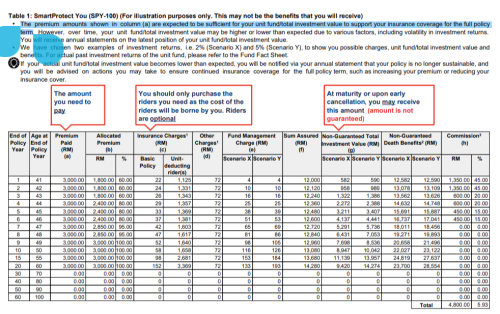

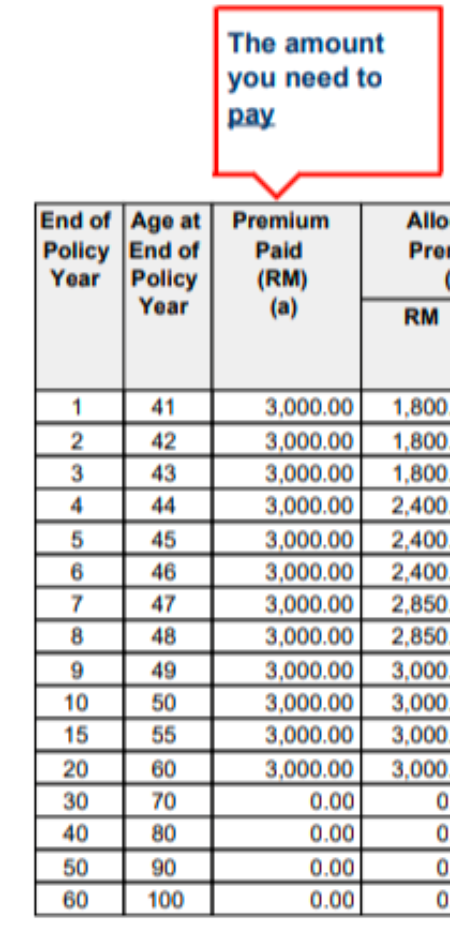

- The consumer did not price investment-linked policies (including cost of insurance and other charges) or set the minimum amount of annual premium required for given insurance policy coverage. The ITOs bear sole responsibility and accountability in this matter.

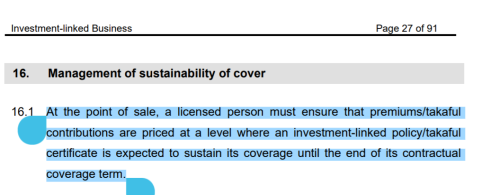

- Built into the pricing of annual premiums, cost of insurance and other charges for long term investment-linked policies is the expectation of sufficiency of annual premiums to sustain the policy, including all its charges, until the end of the contract term. The ITOs bear full responsibility and accountability for this expectation and are expected to have appropriately accounted for their profits, expenses and any long term concerns regarding investment returns, medical inflation and other such matters in the policy's pricing.

- The value or legal force of this expectation, to be imputed into the terms of the contact or read as an implied term, is a no-lapse guarantee for as long as the annual premium payments (premium amount based on initial and not subsequent repricing) are maintained.

- Given the above, the ITOs only have the right to reprice premiums and other charges midway through the contract term when faced with going concern risks, not and never to maintain profit margins.

This post has been edited by hafizmamak85: Mar 22 2025, 06:44 PM

Mar 21 2025, 11:48 AM

Mar 21 2025, 11:48 AM

Quote

Quote

0.0345sec

0.0345sec

0.81

0.81

6 queries

6 queries

GZIP Disabled

GZIP Disabled