QUOTE(cms @ Mar 23 2025, 07:54 PM)

How could hospitals dictate especially with the ITOs as paymasters ? In fact a few well known hospitals have been removed from the panel listing of a few big ITOs.

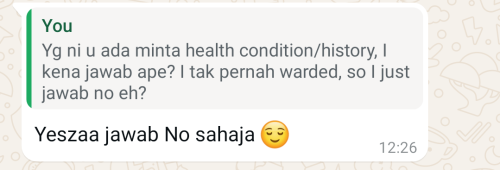

On the premium calculation, i suspect the ITOs computed a low assumption thus when claims went up and the amount soared they quickly revised their premium to a more updated premium.

Perhaps govt could mandate max profit margin for hospitals and ITOs on the very extreme case. Alternatively impose that only allow very high deductible products exist such as maybe 20k so reduces unnecessary claims and hospitals also be weary to charge excessive. Thus changing the entire medical coverage landscape in Msia.

Else i dont see how things will change. Companies will want to profit and consumer behaviours wont change on its on.

The hospitals and specialist centres can, in a sense, 'dictate' because they are the product/resource/service the money will have to follow. The only problem, there's a strong monopoly within the ITO industry due to the agency structure, which allows the ITOs to bully the hospitals.

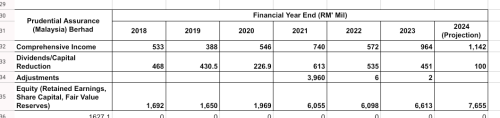

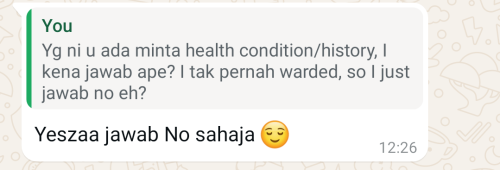

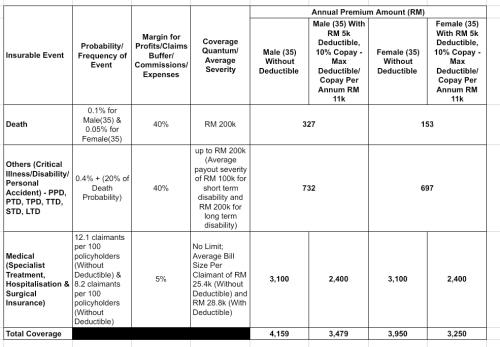

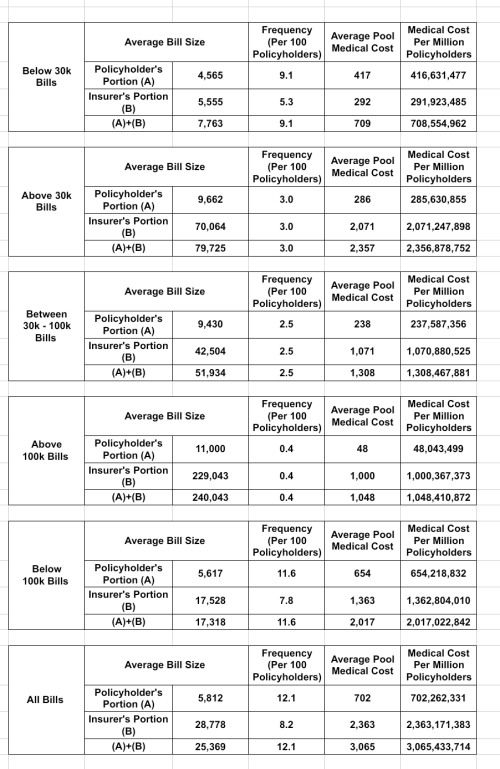

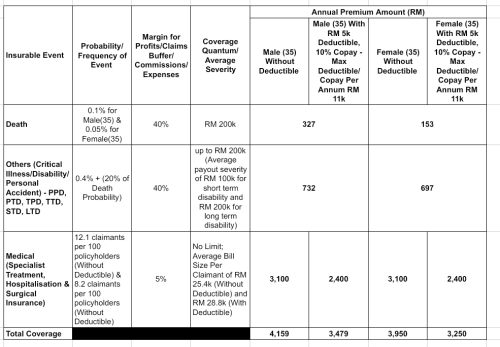

This issue has been in the making for many years because past and current governments failed at painting for us, the public, the true picture in relation to healthcare costs and the true state of KKM. It's untenable for the government to provide free healthcare for everyone and the ones who have to pay (above 10k households) will have to wake up to the rude reality of having to fork out at least RM6k per annum to cover their families (this is even with high deductibles like RM5k).

Which is why I proposed for hospitals and specialist centres to tie up with

digital insurers and takaful operators, the new upstarts, who have a low cost base and are not encumbered by the agency structure. Plus DITOs don't have a large number of policyholders to throw their weight around and dictate terms to hospitals/specialist centres. Both DITOs and hospitals/specialist centres will find it in their best interests to tie up as they are in many ways weak without the other party but stronger together. Of course, goes without saying, they both need to find an acceptable third party administrator.

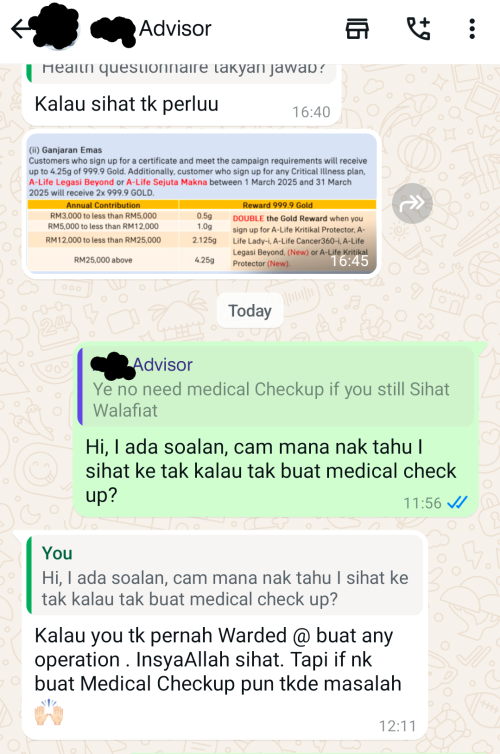

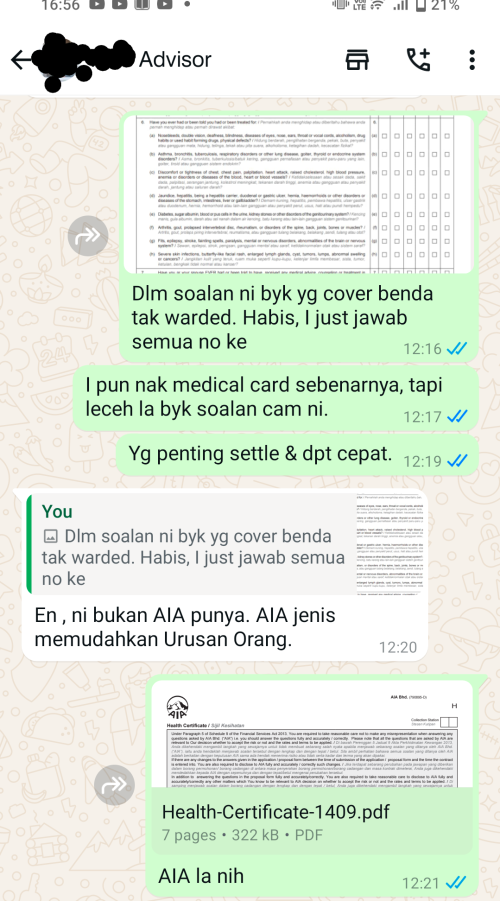

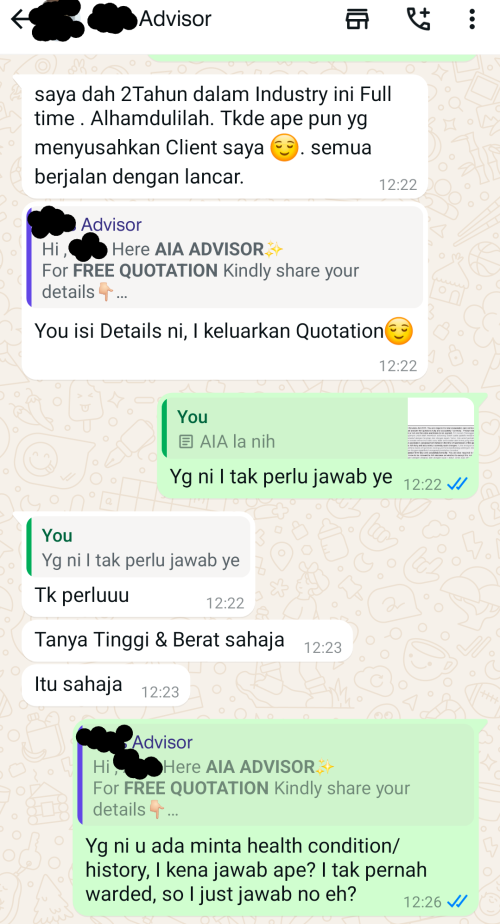

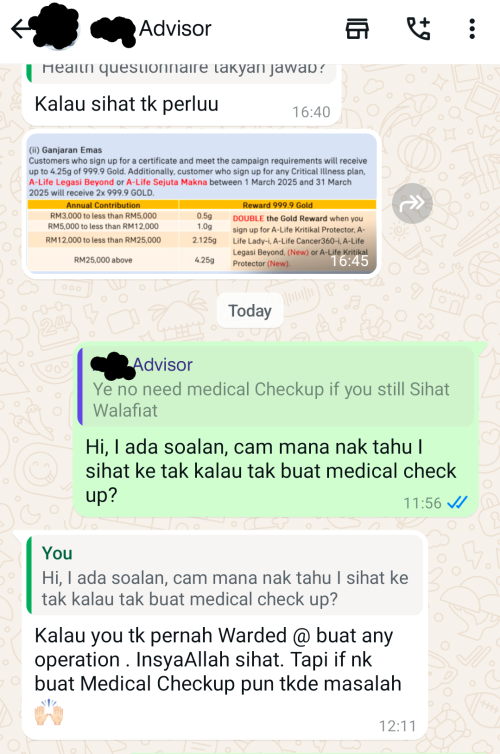

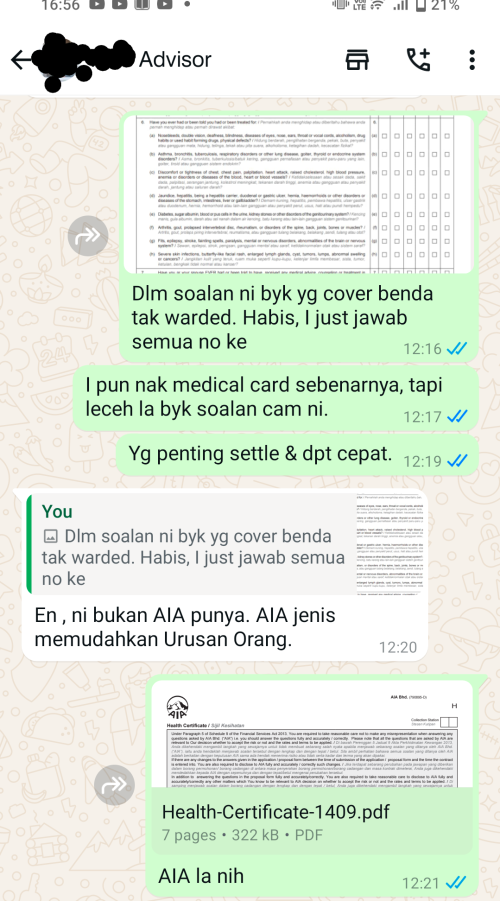

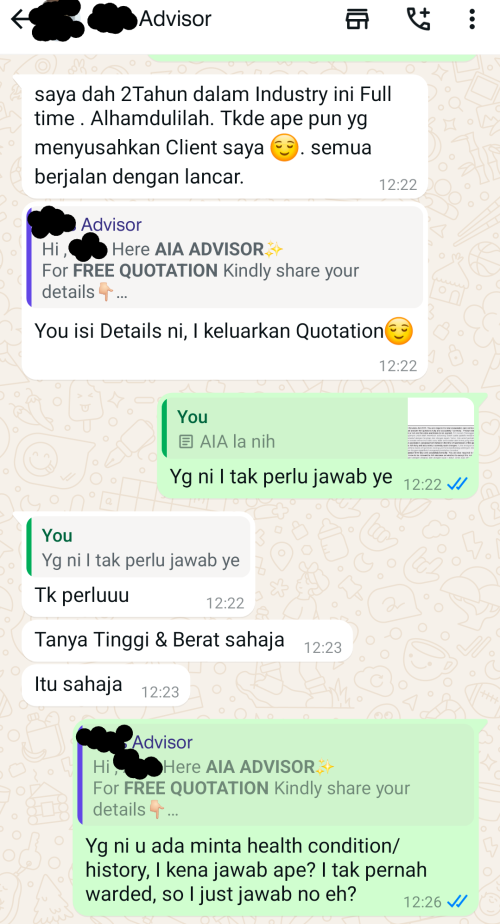

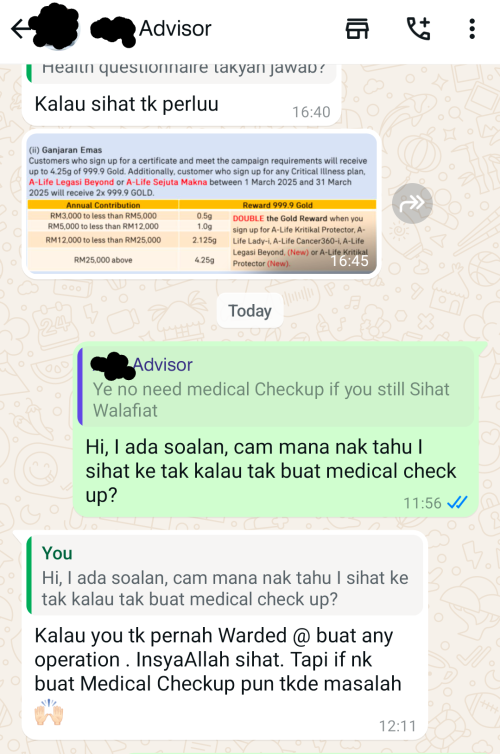

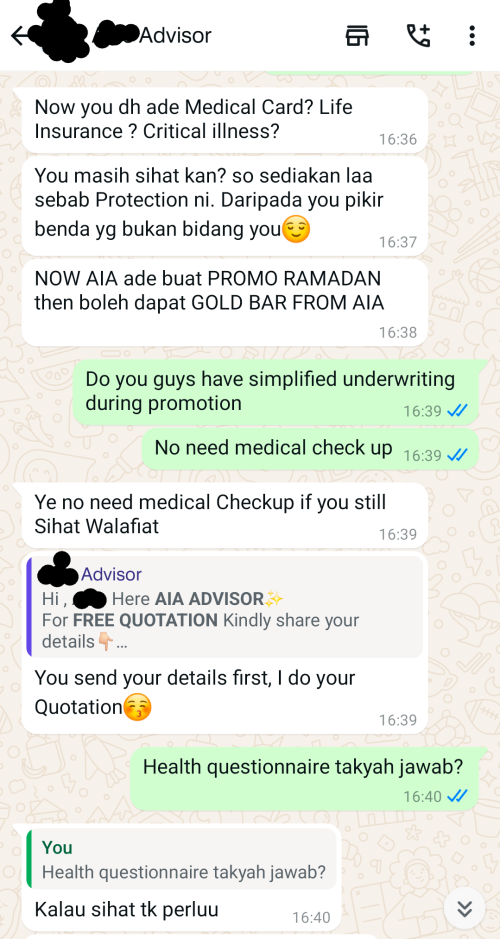

And oh, I forgot the best part, the hospitals/specialists can sweeten the pot by offering the DITOs to do a medical check up on the potential policyholder prior to onboarding at either low rates or for free. Right now, consumers are not required to answer health questionnaires or do medical check-ups but are still subjected to pre-existing condition exclusions and wrong disclosures with agents may be held against them (e.g. on health condition, weight, height, smoker status etc.). The questions asked by agents, who themselves are not medical professionals, are asked and answered in conversational 'tepuk dada, tanya selera' kinda way where if you 'feel' like your health condition is good, you declare it to the agent to be good and if you feel you're not a smoker, you declare you're not a smoker. There's nothing specific to be answered about family health history, any previous history of blood pressure spikes or readings of high cholesterol /sugar levels and take up of related medications. Rather than having a pointing fingers contest later on, it's just much better for the industry to cover all pre-existing conditions and get a full medical check up done prior to onboarding to gauge overall risk exposure levels

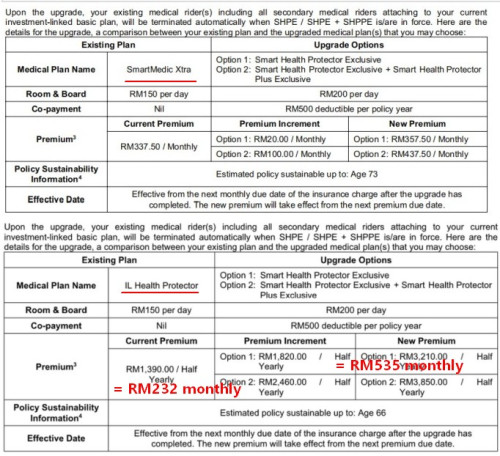

Yes, the entrenched ITOs with their problematic agency force underpriced or mispriced their investment-linked products because they know they can only sell it with medical cover within the RM5k range if they squeezed the hospital coverage component. In many ways this has always been a battle between the producer and supplier/distributor. Most people buy investment-linked policies because they want medical coverage during their old age but soon find that it is not possible without massive top ups due not only to the high and untenable cost of insurance charges, but mainly because their policies' investment/savings component failed to perform in line with expectations. Mispricing/underpricing and failure of contract performance, in line with expectations, are the many ways in which the system has been gamed against consumers/policyholders.

Let's say you are a 'good' actor (ITO wanting to provide medical coverage for all age groups, pre-existing conditions etc. at affordable prices) and I'm the 'bad' actor (ITO wanting to maximize profit). If you practice simplified underwriting, partial community rating, coverage for pre-existing conditions etc., all I have to do to upset your apple cart and gain the upper hand is focus on the younger ages, below 60, and practice competitive pricing, stringent underwriting&claims and provide massive amounts no claim discounts. It's possible for me to suck up all the good lives and leave you with a poorly performing medical portfolio. There is a sweet spot between this good and bad actor that the regulator has to nail. Medical is the anchor product. But this anchor has got a significant social element in it, so can't be amenable to a purely profit maximizing enterprise. The rules may have to be designed or gamed to slightly favour the 'good' actor - e.g. introduce rules saying that medical insurance products must cover all ages and must have partial community rating where the price ratio between the highest and lowest priced policies cannot exceed X and no lives can be turned away, everyone must be provided a quotation for cover and there must be portability of coverage from one insurer to another etc.. This would be preferable rather than limitation on profits but it would also be wise to have minimum claims ratio requirements especially when products are sold on a bouquet basis, e.g. overall claims ratio must be above 85% or something like that.

The problem with a 20k deductible is that it is too high. 5k is only half a month's income in a 10k income per month household and it's possible to take frequent hits, e.g. 3 per decade, with a lower deductible amount without crushing the family's financial resources. This is a volume game and we need as many households to be able to participate. Best to have at least 3 million households. Hopefully the deductible also helps further lower the frequency of claims effectively. And to support these households and incentivise them to purchase insurance, employers should perhaps be mandated to pay extra into EPF maybe something like 2 to 3k per annum for these staff's medical expenses - locked up in EPF and can only be used for purchase of medical insurance and/or to pay for medical bills. Also, we have nearly or more than 7 million IL policies paying over RM 4k per annum. So, there is demand for this and instead of employers paying for group insurance, might as well pay the employee to manage their own family's medical expenses.

This post has been edited by hafizmamak85: Mar 24 2025, 01:34 AM

Mar 23 2025, 02:41 PM

Mar 23 2025, 02:41 PM

Quote

Quote

0.0232sec

0.0232sec

0.67

0.67

6 queries

6 queries

GZIP Disabled

GZIP Disabled