QUOTE(Jack&Guild @ Jan 20 2024, 06:46 PM)

Does insurance companies have centralise data centre for sharing information like bank ccris system? Wandering if I got rejected by A company and i went to B company, does B gona know that if i hide the history?

I don't answer the data centre part. I'm answering to "rejected" part.Certain policy, company A might be strict underwriting to level 99. Then reject or postponed your application.

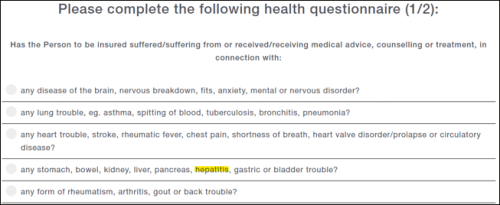

You may try company B, underwriting control might be level 90 then accept your application. You still need to be honest answer all questions during application. Declare health report / medical history.

What ever information you hide that causing the contract break FSA 2013 act .. eventually is not valid by law. Just by luck.

Unless you applying Guaranteed Insurability Offer (GIO) type of policy then no issue.

Jan 20 2024, 11:47 PM

Jan 20 2024, 11:47 PM

Quote

Quote

0.0259sec

0.0259sec

0.47

0.47

6 queries

6 queries

GZIP Disabled

GZIP Disabled