QUOTE(ronnie @ Jan 16 2024, 05:45 PM)

is this plan by Great Eastern any good ?

https://www.greateasternlife.com/my/en/pers...gen-wealth.html

What's your objective?https://www.greateasternlife.com/my/en/pers...gen-wealth.html

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Jan 16 2024, 06:11 PM Jan 16 2024, 06:11 PM

Show posts by this member only | IPv6 | Post

#4781

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(ronnie @ Jan 16 2024, 05:45 PM) is this plan by Great Eastern any good ? What's your objective?https://www.greateasternlife.com/my/en/pers...gen-wealth.html |

|

|

|

|

|

Jan 16 2024, 06:22 PM Jan 16 2024, 06:22 PM

Show posts by this member only | IPv6 | Post

#4782

|

Senior Member

4,728 posts Joined: Jul 2013 |

QUOTE(contestchris @ Jan 16 2024, 06:01 PM) Is Etiqa Ezy-Secure the absolute cheapest pure life insurance in Malaysia? Try fi.life also. Recently a friend bought from fi.life I'm seeing a quote of RM555/year until age 37, after which it gradually starts going up. Compared to a few other companies (e.g. GE's Great Term Direct), the premium is nearly halved! Previously there is promo code from BFM. Not sure still got or not. Both this etiqa plan and fi.life will have increasing premium as you grow older. |

|

|

Jan 16 2024, 06:29 PM Jan 16 2024, 06:29 PM

|

Senior Member

5,592 posts Joined: Aug 2011 |

QUOTE(adele123 @ Jan 16 2024, 06:22 PM) Try fi.life also. Recently a friend bought from fi.life I just checked Fi.Life...for RM500k cover for basic life/TPD it is RM650 until age 34 and then gradually increases.Previously there is promo code from BFM. Not sure still got or not. Both this etiqa plan and fi.life will have increasing premium as you grow older. Age 32 Etiqa Ezy-Secure: RM555 Fi.Life: RM650 Age 40 Etiqa Ezy-Secure: RM640 Fi.Life: RM900 Age 60 Etiqa Ezy-Secure: RM5,465 Fi.Life: RM7,790 Age 75 Etiqa Ezy-Secure: RM28,055 Fi.Life: RM31,185 Etiqa seems to be around 20% cheaper than Fi.Life at the same age points. |

|

|

Jan 16 2024, 07:56 PM Jan 16 2024, 07:56 PM

Show posts by this member only | IPv6 | Post

#4784

|

Junior Member

107 posts Joined: Aug 2007 |

QUOTE(contestchris @ Jan 16 2024, 06:29 PM) I just checked Fi.Life...for RM500k cover for basic life/TPD it is RM650 until age 34 and then gradually increases. I've also been relooking on my insurance based on all the good sharing here.Age 32 Etiqa Ezy-Secure: RM555 Fi.Life: RM650 Age 40 Etiqa Ezy-Secure: RM640 Fi.Life: RM900 Age 60 Etiqa Ezy-Secure: RM5,465 Fi.Life: RM7,790 Age 75 Etiqa Ezy-Secure: RM28,055 Fi.Life: RM31,185 Etiqa seems to be around 20% cheaper than Fi.Life at the same age points. For pure life insurance, you can consider FWD Takaful which is level term (https://www.fwd.com.my/direct/protect-direct/), so far found this to be cheapest. Another level term life is Tokio Marine Term Defender. This is quoted in Fi.Life too, if you clicked on the "prefer Level term". MUM liked this post

|

|

|

Jan 16 2024, 08:01 PM Jan 16 2024, 08:01 PM

Show posts by this member only | IPv6 | Post

#4785

|

Senior Member

5,592 posts Joined: Aug 2011 |

QUOTE(Katrinah @ Jan 16 2024, 07:56 PM) I've also been relooking on my insurance based on all the good sharing here. Personally I think level-term is too restrictive and locks you into something for that 10/20/30/50 year period. My personal belief is that by the time I hit 60 or 65, I shouldn't need life insurance anymore.For pure life insurance, you can consider FWD Takaful which is level term (https://www.fwd.com.my/direct/protect-direct/), so far found this to be cheapest. Another level term life is Tokio Marine Term Defender. This is quoted in Fi.Life too, if you clicked on the "prefer Level term". You get penalized badly by cancelling a level-term life insurance early, as the latter year's premiums are front-loaded to your earlier years. But yes, if you can commit to the very end and are super sure about it, then I believe a level term will be ever so slightly cheaper than the equivalent yearly increasing premium life insurance. This post has been edited by contestchris: Jan 16 2024, 08:02 PM |

|

|

Jan 16 2024, 08:25 PM Jan 16 2024, 08:25 PM

Show posts by this member only | IPv6 | Post

#4786

|

Senior Member

5,592 posts Joined: Aug 2011 |

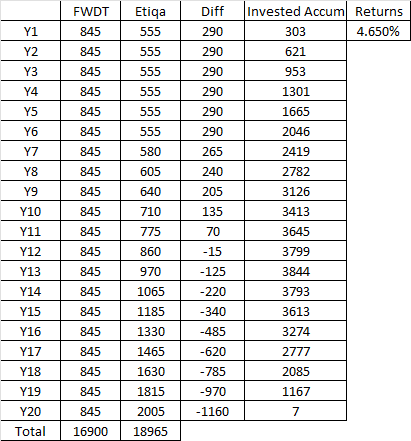

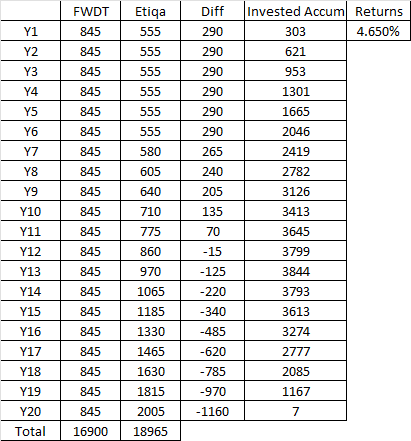

QUOTE(Katrinah @ Jan 16 2024, 07:56 PM) I've also been relooking on my insurance based on all the good sharing here. I just did some projection for a 20Y policy comparison between FWD Takaful level premium term insurance vs Etiqa increasing premium life insurance.For pure life insurance, you can consider FWD Takaful which is level term (https://www.fwd.com.my/direct/protect-direct/), so far found this to be cheapest. Another level term life is Tokio Marine Term Defender. This is quoted in Fi.Life too, if you clicked on the "prefer Level term". To match the level premium using time value of money approach, the premiums saved in the initial years from the increasing premium has to be invested at 4.65%. Meaning to say, if you are certain you can get returns above 4.65% on the saved premiums, then the level premium term insurance might not be the best idea. Overall, now that I've run the numbers, I actually think it's a good deal with obvious drawbacks of level term insurance being as follows: 1. Early termination of such a policy is at your loss as you overpay in the earlier years. 2. You have to be very sure about the policy term at the point of purchase, as a 30Y term life will cost significantly more than a 20Y term life and you have to commit to it for the entire duration. 3. You will not have much flexibility and lock yourself into a multi-decade contract. Projection for 30M with coverage at RM500k:  Edit: I don't understand how FDW Takaful has got such competitive rates! Great Eastern's increasing premium direct life insurance (purchased from their website) already starts in 4 figures and keep rising!  This post has been edited by contestchris: Jan 16 2024, 08:38 PM |

|

|

|

|

|

Jan 16 2024, 08:43 PM Jan 16 2024, 08:43 PM

Show posts by this member only | IPv6 | Post

#4787

|

Junior Member

107 posts Joined: Aug 2007 |

QUOTE(contestchris @ Jan 16 2024, 08:01 PM) Personally I think level-term is too restrictive and locks you into something for that 10/20/30/50 year period. My personal belief is that by the time I hit 60 or 65, I shouldn't need life insurance anymore. Age 32... level term 30, age 62. Just nice, no? So cheap too, bonus You get penalized badly by cancelling a level-term life insurance early, as the latter year's premiums are front-loaded to your earlier years. But yes, if you can commit to the very end and are super sure about it, then I believe a level term will be ever so slightly cheaper than the equivalent yearly increasing premium life insurance. For quotes such as Fi.life and others. It's not only that the rate increases as you age, it's also not guaranteed. So it could be higher (or lower, but what are the odds). My thought process is that the role of Life Insurance is straightforward, nothing too nitty gritty. Die within the insured period, family gets the 'safety net' you prepared. So if I can go cheap, I go cheap here lol. Instead more money can be parked into med/CI insurance, where there are soo many diff T&Cs and coverage depending on what you need. And them rates gets even more sky high as we age lol. I dont really get what you mean that one gets penalized by cancelling level-term life. |

|

|

Jan 16 2024, 08:45 PM Jan 16 2024, 08:45 PM

Show posts by this member only | IPv6 | Post

#4788

|

Senior Member

5,592 posts Joined: Aug 2011 |

QUOTE(Katrinah @ Jan 16 2024, 08:43 PM) Age 32... level term 30, age 62. Just nice, no? So cheap too, bonus Have you been on the FWD level premium plan for more than a year? Do they declare surplus profits? If so, how much? For quotes such as Fi.life and others. It's not only that the rate increases as you age, it's also not guaranteed. So it could be higher (or lower, but what are the odds). My thought process is that the role of Life Insurance is straightforward, nothing too nitty gritty. Die within the insured period, family gets the 'safety net' you prepared. So if I can go cheap, I go cheap here lol. Instead more money can be parked into med/CI insurance, where there are soo many diff T&Cs and coverage depending on what you need. And them rates gets even more sky high as we age lol. I dont really get what you mean that one gets penalized by cancelling level-term life. Has anyone bought term Takaful, any idea if you get surplus profits, and if so, how much? |

|

|

Jan 16 2024, 08:59 PM Jan 16 2024, 08:59 PM

|

Junior Member

107 posts Joined: Aug 2007 |

QUOTE(contestchris @ Jan 16 2024, 08:45 PM) Have you been on the FWD level premium plan for more than a year? Do they declare surplus profits? If so, how much? No I've not signed up with them yet, still doing comparison for my med/CI and want to have a holistic view before I do anything (cancel ILP).Has anyone bought term Takaful, any idea if you get surplus profits, and if so, how much? But pretty much decided to go with them for Life Insurance. Anyway I was surprised and tot the rate was too good to be true, so I checked PIDM website and they're in the insurer member list. So if things go south (touch wood), at least PIDM will cover, up to rm500k. https://www.pidm.gov.my/en/how-we-protect-y...insurer-members |

|

|

Jan 16 2024, 09:58 PM Jan 16 2024, 09:58 PM

Show posts by this member only | IPv6 | Post

#4790

|

All Stars

24,432 posts Joined: Feb 2011 |

QUOTE(contestchris @ Jan 16 2024, 08:25 PM) I just did some projection for a 20Y policy comparison between FWD Takaful level premium term insurance vs Etiqa increasing premium life insurance. Now you know why I got a shock when Singapore part can quote me Rm7k flat rate for RM500k with multiplier for critical illness. AIA offer me RM14k for RM500k with lesser perks.To match the level premium using time value of money approach, the premiums saved in the initial years from the increasing premium has to be invested at 4.65%. Meaning to say, if you are certain you can get returns above 4.65% on the saved premiums, then the level premium term insurance might not be the best idea. Overall, now that I've run the numbers, I actually think it's a good deal with obvious drawbacks of level term insurance being as follows: 1. Early termination of such a policy is at your loss as you overpay in the earlier years. 2. You have to be very sure about the policy term at the point of purchase, as a 30Y term life will cost significantly more than a 20Y term life and you have to commit to it for the entire duration. 3. You will not have much flexibility and lock yourself into a multi-decade contract. Projection for 30M with coverage at RM500k:  Edit: I don't understand how FDW Takaful has got such competitive rates! Great Eastern's increasing premium direct life insurance (purchased from their website) already starts in 4 figures and keep rising!  Life insurance can be very cheap. Shop around. |

|

|

Jan 16 2024, 10:37 PM Jan 16 2024, 10:37 PM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Jan 16 2024, 11:00 PM Jan 16 2024, 11:00 PM

Show posts by this member only | IPv6 | Post

#4792

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(ronnie @ Jan 16 2024, 10:37 PM) typically i know the returns are poor via insurance... does this plan also falls into the same category ? Taking from the brochure.Every journey in life has a beginning and an ending. But by growing your wealth and protecting it for your loved ones, you can ensure that your legacy lives on for generations and continues to provide for your children and grandchildren to come. GREAT Multi-Gen Wealth is a limited pay whole life plan with investment boosters. It is designed to sustain and safeguard the wealth that you have built over the years – giving you and your family a future to look forward to. When the time is right, you can pass on your legacy through change of policy ownership and life coverage to your loved ones to support and protect their future. The plan gives you the flexibility to choose your premium payment term from 5, 10 or 20 years for a coverage up to 70 years, 80 years or 90 years old next birthday. A regular stream of yearly income will be credited into the total investment value throughout your policy term. You can also celebrate at the end of your policy term with a lump sum maturity benefit! Should the unfortunate occur, GREAT Multi-Gen Wealth has you covered as well. You will be financially protected against death with no medical underwriting required. Does the product description fit what you are looking for? I don't see anywhere in the description promising high returns though. |

|

|

Jan 17 2024, 12:46 PM Jan 17 2024, 12:46 PM

Show posts by this member only | IPv6 | Post

#4793

|

Junior Member

685 posts Joined: Jul 2012 From: Kuala Lumpur |

QUOTE(ronnie @ Jan 16 2024, 05:45 PM) is this plan by Great Eastern any good ? This plan have the following terms whereby you canhttps://www.greateasternlife.com/my/en/pers...gen-wealth.html 1. Have secondary life assured 2. Alternate policy owner 3. Change life assured Payment term 5,10,20. It called generation plan because grandparents as life assured and secondary life assured can put to grand children etc. |

|

|

|

|

|

Jan 17 2024, 10:20 PM Jan 17 2024, 10:20 PM

|

Senior Member

1,348 posts Joined: Nov 2008 |

QUOTE(Ramjade @ Jan 15 2024, 11:43 PM) All insurance sama only. Got vitality or no vitality, everyone abuse insurance. Hence this picture is very accurate. Aiseh... means you're not taking full advantage of AIA Vitality benefits with your MediFlex plan. Rather than cracking your head trying to "abuse" insurance, why not get rewarded for keeping an active lifestyle? I'm sure you agree that nothing is worth trading your health kan? Why not get rewarded for keeping a healthier longer and better life? Check around (if you care to) and you'll realize that Vitality program is now actively contributing to better claims experiences, hence some here are saying that they are not experiencing as steep a rate hike compared to the others. You don't have to trust me. Go dig up the numbers from your own research. |

|

|

Jan 19 2024, 03:13 PM Jan 19 2024, 03:13 PM

|

Senior Member

1,269 posts Joined: Dec 2005 From: Sibu, KL |

Hi, any Prudential agent here? I have an insurance policy PRUValue Med since 2013, came across PruMan and also PruMillion Med. I did call the insurance and they say can only upgrade to PruMillion Med. later on I saw there's an add-on booster for our current insurance as well.

Would like to know if it is worth surrender to get PruMen because of financial benefit on PruMan or go with add-on booster, just to benefit NCB RM500. just want to upgrade since 2013 |

|

|

Jan 19 2024, 03:22 PM Jan 19 2024, 03:22 PM

Show posts by this member only | IPv6 | Post

#4796

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(David900924 @ Jan 19 2024, 03:13 PM) Hi, any Prudential agent here? I have an insurance policy PRUValue Med since 2013, came across PruMan and also PruMillion Med. I did call the insurance and they say can only upgrade to PruMillion Med. later on I saw there's an add-on booster for our current insurance as well. HiWould like to know if it is worth surrender to get PruMen because of financial benefit on PruMan or go with add-on booster, just to benefit NCB RM500. just want to upgrade since 2013 PruMan is offer CI coverage which may compliment to your existing coverage and may not be a replacement. Perhaps you would like to review your existing coverage to see what you lack of? |

|

|

Jan 19 2024, 07:38 PM Jan 19 2024, 07:38 PM

Show posts by this member only | IPv6 | Post

#4797

|

Senior Member

4,728 posts Joined: Jul 2013 |

QUOTE(David900924 @ Jan 19 2024, 03:13 PM) Hi, any Prudential agent here? I have an insurance policy PRUValue Med since 2013, came across PruMan and also PruMillion Med. I did call the insurance and they say can only upgrade to PruMillion Med. later on I saw there's an add-on booster for our current insurance as well. I caveat, i am not expert on pru, but i know some surface information. Would like to know if it is worth surrender to get PruMen because of financial benefit on PruMan or go with add-on booster, just to benefit NCB RM500. just want to upgrade since 2013 If you want to upgrade to prumillion med, you can go ahead. Ask for higher deductible option if possible. Rm500 if got. 1k better still... As for the booster, i think you should evaluate the cost vs benefit. If i recall, alot of the benefits are very "fluff". The NCB rm500 got alot of restriction or something. And you are paying more money to prudential, so you get rm500 back. To me, abit stupid la. As for pruman, it is a standalone plan, that's why you cant upgrade per se. It's like changing house instead of upgrading your house. At the end of the day the financial benefit on pruman, comes at cost. Which is not so cheap premium to you. There is no free lunch in this world. Money has to come from somewhere. Please dont looknat financial benefit from your insurance policy. And your policy is since 2013, you would have paid off alot of initial charges. Please dont surrender and buy a new plan where possible. Especially pruman is probably not a replacement of your current plan. This post has been edited by adele123: Jan 19 2024, 07:39 PM David900924 liked this post

|

|

|

Jan 20 2024, 06:46 PM Jan 20 2024, 06:46 PM

|

Junior Member

632 posts Joined: Mar 2008 |

Does insurance companies have centralise data centre for sharing information like bank ccris system? Wandering if I got rejected by A company and i went to B company, does B gona know that if i hide the history?

|

|

|

Jan 20 2024, 07:26 PM Jan 20 2024, 07:26 PM

Show posts by this member only | IPv6 | Post

#4799

|

Senior Member

5,592 posts Joined: Aug 2011 |

QUOTE(Jack&Guild @ Jan 20 2024, 06:46 PM) Does insurance companies have centralise data centre for sharing information like bank ccris system? Wandering if I got rejected by A company and i went to B company, does B gona know that if i hide the history? Not a good idea mate. Even if they don't know now, they could find out in the future and void your entire policy. You'll be in for a world of hurt then. |

|

|

Jan 20 2024, 09:54 PM Jan 20 2024, 09:54 PM

|

Senior Member

1,922 posts Joined: Jan 2005 |

|

| Change to: |  0.0279sec 0.0279sec

0.14 0.14

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 06:22 PM |