QUOTE(MGM @ Mar 9 2020, 12:13 PM)

With this amount of savings, it will be a few rm difference per year of interest, not worth the effort to burn your brain cells.

Exactly.Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

|

Mar 9 2020, 12:44 PM Mar 9 2020, 12:44 PM

|

Senior Member

6,266 posts Joined: Jul 2005 From: UEP Subang Jaya |

|

|

|

|

|

|

Mar 9 2020, 01:07 PM Mar 9 2020, 01:07 PM

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

|

|

|

Mar 9 2020, 06:09 PM Mar 9 2020, 06:09 PM

|

Senior Member

1,679 posts Joined: Sep 2006 From: Penang |

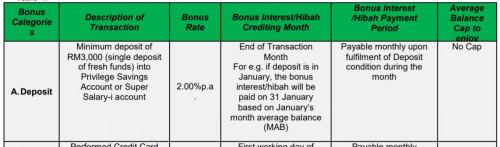

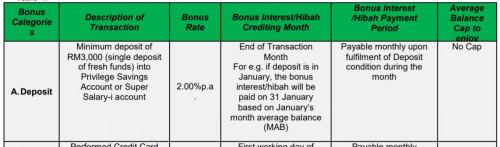

to get the 2% + 2% ....

i need to : 1. spend RM1000 credit card 2. fresh fund of RM3500 monthly. need to go to branch to open ? or can do ONLINE ? planning to transfer from OCBC-360 , current = 3.6% . |

|

|

Mar 9 2020, 06:12 PM Mar 9 2020, 06:12 PM

Show posts by this member only | IPv6 | Post

#264

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(paogeh @ Mar 9 2020, 06:09 PM) to get the 2% + 2% .... If you have SC credit cards, you can do at the booth with a qualified bank staff if there's (not CC agent).i need to : 1. spend RM1000 credit card 2. fresh fund of RM3500 monthly. need to go to branch to open ? or can do ONLINE ? planning to transfer from OCBC-360 , current = 3.6% . |

|

|

Mar 9 2020, 06:12 PM Mar 9 2020, 06:12 PM

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(paogeh @ Mar 9 2020, 06:09 PM) to get the 2% + 2% .... Yes.i need to : 1. spend RM1000 credit card 2. fresh fund of RM3500 monthly. need to go to branch to open ? or can do ONLINE ? planning to transfer from OCBC-360 , current = 3.6% . Can open online if you have an existing relationship with SCB like having their cc or other saving acc. Or else, you may have to go to a branch |

|

|

Mar 9 2020, 08:56 PM Mar 9 2020, 08:56 PM

|

Senior Member

1,516 posts Joined: Oct 2005 |

|

|

|

|

|

|

Mar 9 2020, 09:01 PM Mar 9 2020, 09:01 PM

|

Senior Member

1,274 posts Joined: Sep 2010 |

Extra amount after 100k in SC Privilege Savers Account is 2.5%, correct?

This is much higher than the after 100k in OCBC 360 which is only 0.1%, am I right on the 0.1%? So if greater than 200k the balance I will be better off putting in SCB PSA. Just temporarily stash in SCB and OCBC before transferring it out on last few days of March to 1st of April |

|

|

Mar 9 2020, 09:05 PM Mar 9 2020, 09:05 PM

Show posts by this member only | IPv6 | Post

#268

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Sumofwhich @ Mar 9 2020, 09:01 PM) Extra amount after 100k in SC Privilege Savers Account is 2.5%, correct? This is much higher than the after 100k in OCBC 360 which is only 0.1%, am I right on the 0.1%? So if greater than 200k the balance I will be better off putting in SCB PSA. Just temporarily stash in SCB and OCBC before transferring it out on last few days of March to 1st of April  https://av.sc.com/my/content/docs/my-revise...er-campaign.pdf Isn't the base interest for PSA itself of 0.5% is still higher than 360 base interest of 0.1%? This post has been edited by GrumpyNooby: Mar 9 2020, 09:06 PM |

|

|

Mar 9 2020, 09:13 PM Mar 9 2020, 09:13 PM

|

Senior Member

1,274 posts Joined: Sep 2010 |

QUOTE(GrumpyNooby @ Mar 9 2020, 09:05 PM)  https://av.sc.com/my/content/docs/my-revise...er-campaign.pdf Isn't the base interest for PSA itself of 0.5% is still higher than 360 base interest of 0.1%? Thanks This post has been edited by Sumofwhich: Mar 9 2020, 09:14 PM |

|

|

Mar 9 2020, 09:17 PM Mar 9 2020, 09:17 PM

Show posts by this member only | IPv6 | Post

#270

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 9 2020, 09:22 PM Mar 9 2020, 09:22 PM

|

Senior Member

1,274 posts Joined: Sep 2010 |

|

|

|

Mar 9 2020, 10:49 PM Mar 9 2020, 10:49 PM

|

Junior Member

38 posts Joined: Dec 2019 |

I'm new to this

One of the criteria is to put 1k/month into UT/insurance. If I don't want put 1k for UT /insurance is this worth to register? |

|

|

Mar 9 2020, 10:50 PM Mar 9 2020, 10:50 PM

|

Senior Member

2,552 posts Joined: Jan 2008 |

QUOTE(paogeh @ Mar 9 2020, 06:09 PM) to get the 2% + 2% .... fresh fund 3ki need to : 1. spend RM1000 credit card 2. fresh fund of RM3500 monthly. need to go to branch to open ? or can do ONLINE ? planning to transfer from OCBC-360 , current = 3.6% . QUOTE(Messiahword @ Mar 9 2020, 10:49 PM) I'm new to this yes. The UT / insurance is a bit of trap. Read earlier in the thread for the analysis. Note that it is also only applicable for first 12mOne of the criteria is to put 1k/month into UT/insurance. If I don't want put 1k for UT /insurance is this worth to register? This post has been edited by zenquix: Mar 9 2020, 10:51 PM |

|

|

|

|

|

Mar 10 2020, 08:18 AM Mar 10 2020, 08:18 AM

|

Junior Member

38 posts Joined: Dec 2019 |

QUOTE(zenquix @ Mar 9 2020, 10:50 PM) fresh fund 3k That means I'll get 2+2 % with just spending 1k on credit card and deposit rm3k fresh fund when open account? yes. The UT / insurance is a bit of trap. Read earlier in the thread for the analysis. Note that it is also only applicable for first 12m I need to bring cash or can fund transfer when I'm opening account? And do I need to pay for debit card annual fee? |

|

|

Mar 10 2020, 08:21 AM Mar 10 2020, 08:21 AM

Show posts by this member only | IPv6 | Post

#275

|

Senior Member

3,305 posts Joined: Dec 2012 |

QUOTE(Messiahword @ Mar 10 2020, 08:18 AM) That means I'll get 2+2 % with just spending 1k on credit card and deposit rm3k fresh fund when open account? I open new account last year. Just need to ATM set password etc after take the card.I need to bring cash or can fund transfer when I'm opening account? And do I need to pay for debit card annual fee? Then only transfer online to the account. You can bring maybe RM250 Cash if want be safe. |

|

|

Mar 10 2020, 08:25 AM Mar 10 2020, 08:25 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(jiaen0509 @ Mar 10 2020, 08:21 AM) I open new account last year. Just need to ATM set password etc after take the card. ATM/Debit Card PIN can now be set online; either via SC portal or app.Then only transfer online to the account. You can bring maybe RM250 Cash if want be safe. This post has been edited by GrumpyNooby: Mar 10 2020, 08:30 AM |

|

|

Mar 10 2020, 10:50 AM Mar 10 2020, 10:50 AM

|

Senior Member

2,965 posts Joined: Jul 2014 |

|

|

|

Mar 10 2020, 10:53 AM Mar 10 2020, 10:53 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(avinlim @ Mar 10 2020, 10:50 AM) 3k fresh fund? means cannot do deposit and transfer method?? every month need 3k increment only can get the 2% 10. “Fresh Funds” means funds which do not originate from any accounts held with the SCBMB or SCSBhttps://av.sc.com/my/content/docs/my-revise...er-campaign.pdf |

|

|

Mar 10 2020, 11:27 AM Mar 10 2020, 11:27 AM

Show posts by this member only | IPv6 | Post

#279

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

|

|

|

Mar 10 2020, 11:27 AM Mar 10 2020, 11:27 AM

|

Senior Member

1,616 posts Joined: Jul 2016 |

|

| Change to: |  0.0266sec 0.0266sec

0.54 0.54

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 06:52 PM |