Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

|

Mar 6 2020, 09:45 AM Mar 6 2020, 09:45 AM

Show posts by this member only | IPv6 | Post

#241

|

Junior Member

205 posts Joined: Aug 2013 |

|

|

|

|

|

|

Mar 6 2020, 09:46 AM Mar 6 2020, 09:46 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 6 2020, 11:14 AM Mar 6 2020, 11:14 AM

|

Senior Member

1,274 posts Joined: Sep 2010 |

|

|

|

Mar 6 2020, 01:02 PM Mar 6 2020, 01:02 PM

Show posts by this member only | IPv6 | Post

#244

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

|

|

|

Mar 6 2020, 01:19 PM Mar 6 2020, 01:19 PM

|

Senior Member

2,552 posts Joined: Jan 2008 |

|

|

|

Mar 6 2020, 01:20 PM Mar 6 2020, 01:20 PM

|

Senior Member

6,266 posts Joined: Jul 2005 From: UEP Subang Jaya |

QUOTE(bokbokchai @ Mar 6 2020, 08:59 AM) RM0 for me. But maybe special case as I already had a stan chart credit card (but not savings account). The CS officer just told me to transfer money in from another bank account once the account showed up on my online banking portal. |

|

|

|

|

|

Mar 7 2020, 01:18 AM Mar 7 2020, 01:18 AM

|

Junior Member

205 posts Joined: Aug 2013 |

|

|

|

Mar 7 2020, 10:48 AM Mar 7 2020, 10:48 AM

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(bokbokchai @ Mar 6 2020, 08:59 AM) QUOTE(LostAndFound @ Mar 6 2020, 01:20 PM) RM0 for me. But maybe special case as I already had a stan chart credit card (but not savings account). The CS officer just told me to transfer money in from another bank account once the account showed up on my online banking portal. Same for me, existing card user opened with RM0 and bank transfer later. But if I remembered correctly I thought I heard the banker say RM20 for new to bank customers. |

|

|

Mar 7 2020, 11:06 PM Mar 7 2020, 11:06 PM

|

Junior Member

552 posts Joined: Aug 2010 |

|

|

|

Mar 7 2020, 11:06 PM Mar 7 2020, 11:06 PM

Show posts by this member only | IPv6 | Post

#250

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 7 2020, 11:27 PM Mar 7 2020, 11:27 PM

|

Senior Member

1,190 posts Joined: May 2018 From: Kuala Lumpur, Malaysia |

QUOTE(westernkl @ Mar 7 2020, 11:06 PM) Just in case you want more infohttps://www.comparehero.my/banking-finance/...pact-malaysians |

|

|

Mar 7 2020, 11:53 PM Mar 7 2020, 11:53 PM

Show posts by this member only | IPv6 | Post

#252

|

All Stars

12,387 posts Joined: Feb 2020 |

Additional reading:

OPR down to 2.5% for first time in a decade https://www.theedgemarkets.com/article/opr-...rst-time-decade |

|

|

Mar 9 2020, 06:06 AM Mar 9 2020, 06:06 AM

|

Senior Member

1,603 posts Joined: Aug 2014 |

If I choose not to get SC Debit Card, am I still eligible to get the additional Save Interest of 2%, assuming that I will deposit RM 3000 once per month via IBFT into my Privilege$aver savings account?

Thank you for your information. This post has been edited by kart: Mar 9 2020, 06:07 AM |

|

|

|

|

|

Mar 9 2020, 07:14 AM Mar 9 2020, 07:14 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(kart @ Mar 9 2020, 06:06 AM) If I choose not to get SC Debit Card, am I still eligible to get the additional Save Interest of 2%, assuming that I will deposit RM 3000 once per month via IBFT into my Privilege$aver savings account? No as per TnC - Clause 15.Thank you for your information. https://av.sc.com/my/content/docs/my-revise...er-campaign.pdf This post has been edited by GrumpyNooby: Mar 9 2020, 07:16 AM |

|

|

Mar 9 2020, 07:38 AM Mar 9 2020, 07:38 AM

|

Senior Member

1,603 posts Joined: Aug 2014 |

Thank you for your reply, GrumpyNooby.

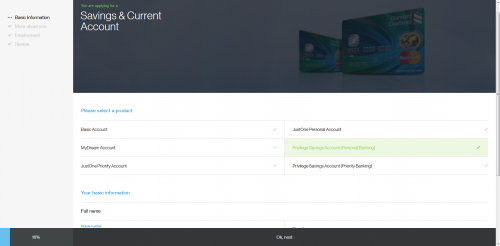

Since I am not interested at all in card spend interest of 1.5%, my sole focus is just Save Interest of 2%. I believe that the annual fee of SC debit card is RM 8.00. And, I only intend to keep less than RM 1000 in Privilege$aver savings account. If I have any more disposable income, I will just keep in ASNB, or invest it. If my intended balance in Privilege$aver savings account is less than RM 1000, Save Interest of 2% and the base interest of 0.5% are inadequate to offset the annual fee of SC debit card of RM 8.00. Note that I already have access to SC online banking website, since I have JustOne Personal Savings and Current Account, without SC Debit Card. Sigh, maybe Privilege$aver savings account is not suitable for me. This post has been edited by kart: Mar 9 2020, 07:39 AM |

|

|

Mar 9 2020, 07:40 AM Mar 9 2020, 07:40 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(kart @ Mar 9 2020, 07:38 AM) Thank you for your reply, GrumpyNooby. At first I was excited like you for not having the debit card.Since I am not interested at all in card spend interest of 1.5%, my sole focus is just Save Interest of 2%. I believe that the annual fee of SC debit card is RM 8.00. And, I only intend to keep less than RM 1000 in Privilege$aver savings account. If I have anymore disposable income, I will just keep in ASNB, or invest it. If my intended balance in Privilege$aver savings account is less than RM 1000, Save Interest of 2% and the base interest of 0.5% are inadequate to offset the annual fee of SC debit card of RM 8.00. Note that I already have access to SC online banking website, since I have JustOne Personal Savings and Current Account, without SC Debit Card. Sigh, maybe Privilege$aver savings account is not suitable for me. Then I asked my banker to double check with her team superior. Her superior had called the HQ in KL and they said having a debit card is necessary. Some in here said that AF for the debit card is FOC for first year. This post has been edited by GrumpyNooby: Mar 9 2020, 07:41 AM |

|

|

Mar 9 2020, 07:47 AM Mar 9 2020, 07:47 AM

|

Senior Member

1,603 posts Joined: Aug 2014 |

QUOTE(GrumpyNooby @ Mar 9 2020, 07:40 AM) Her superior had called the HQ in KL and they said having a debit card is necessary. I am not as rich as many other posters in this forum, so my intended balance in Privilege$aver savings account is less than RM 1000.Some in here said that AF for the debit card is FOC for first year. Yeah, some people may have the opinion that SC debit card has no annual fee. Then again, it is better to rely on the actual real-life experience of SC Privilege$aver savings account customers without any SC debit card. If after 1 year of having this savings account, the savings account eStatement shows that there is no debit card annual fee to be paid by the customers, then we will believe that there is no debit card annual fee. This post has been edited by kart: Mar 9 2020, 07:48 AM |

|

|

Mar 9 2020, 08:56 AM Mar 9 2020, 08:56 AM

|

Senior Member

6,266 posts Joined: Jul 2005 From: UEP Subang Jaya |

QUOTE(kart @ Mar 9 2020, 07:47 AM) I am not as rich as many other posters in this forum, so my intended balance in Privilege$aver savings account is less than RM 1000. If your intended balance is less than 1000 then over the course of 1 year (at the 2% bonus interest) it is only RM25 interest. Why would you look for a high-interest savings account and then put relatively small amounts inside? Doesn't make sense. Save your hassle, get a BSA at a convenient bank to you with free debit card and no annual fees. |

|

|

Mar 9 2020, 12:02 PM Mar 9 2020, 12:02 PM

|

Senior Member

1,603 posts Joined: Aug 2014 |

LostAndFound

I already have several basic savings accounts, with no-annual-fee debit cards. Most of my disposable income is in Maybank M2U Savers. After twice cuts in OPR, the interest rate is now just 1.35%. So, I am looking for a savings account with higher interest rates. If I have more than RM 1000 that I do not intend to use in next few months, I would save the money in ASNB, or invest in PRS. In short, I do not need more than RM 1000 of money for easy withdrawal and ad hoc spending. This Privilege$aver account is meant to bridge the gap between my BSA and ASNB, and acts as a compromise between liquidity and high interest rate. This post has been edited by kart: Mar 9 2020, 12:07 PM |

|

|

Mar 9 2020, 12:13 PM Mar 9 2020, 12:13 PM

Show posts by this member only | IPv6 | Post

#260

|

All Stars

18,455 posts Joined: Oct 2010 |

QUOTE(kart @ Mar 9 2020, 12:02 PM) LostAndFound With this amount of savings, it will be a few rm difference per year of interest, not worth the effort to burn your brain cells.I already have several basic savings accounts, with no-annual-fee debit cards. Most of my disposable income is in Maybank M2U Savers. After twice cuts in OPR, the interest rate is now just 1.35%. So, I am looking for a savings account with higher interest rates. If I have more than RM 1000 that I do not intend to use in next few months, I would save the money in ASNB, or invest in PRS. In short, I do not need more than RM 1000 of money for easy withdrawal and ad hoc spending. This Privilege$aver account is meant to bridge the gap between my BSA and ASNB, and acts as a compromise between liquidity and high interest rate. |

| Change to: |  0.0241sec 0.0241sec

0.62 0.62

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 06:14 AM |