Updated: 25th Aug 2020.

To use IBKR, you have 3 options:

1. via IBKR main website;

2. via TradeStation Global, TSG (not to be confused with TradeStation International);

3. via Captrader, please refer to another thread.

via IBKR

Just google Interactive Brokers and register there.

There's a monthly activity / inactivity fee of $10 per month, but can be waived if your net liquidation (cash + equities + bonds etc) is above $100k.

If you can meet the min requirement, this would be better as their fees (and margin rates) are lower than TSG.

Fees - https://www1.interactivebrokers.com/en/index.php?f=1590

via TSG

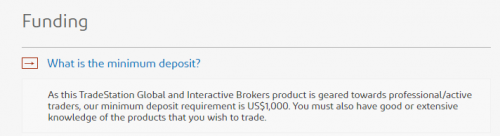

No monthly inactivity fee if balance is above $2500.

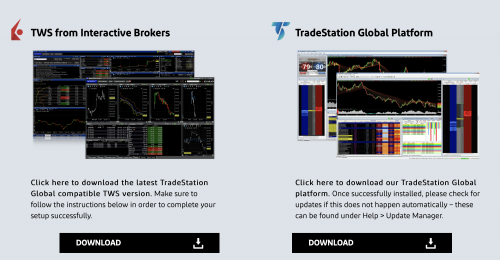

After registration, you'll have access to two platforms:

1. You may use the IBKR platform known as Traders Work Station (TWS) on both Windows and MacOS.

2. You may also use the platform developed independently by TSG, only available on Windows.

Note: In order to link TSG with IBKR, you SHOULD open your IBKR via TSG website. You'll be redirected to an IBKR website (could be HK, Australia etc).

If you opened an IBKR yourself without going through TSG website, you may not be able to link these entities.

Fees - https://www.tradestation-international.com/...ng-commissions/

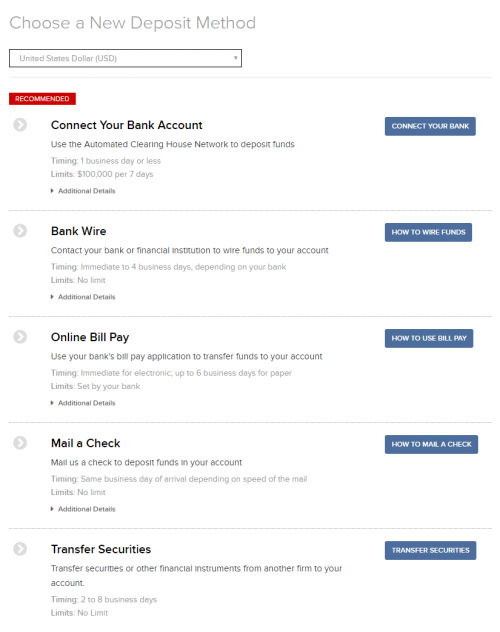

Money transfer

These methods have worked in the past:

1. InstaRem: transfer HKD, SGD, GBP to IBKR (EUR - worked for some, rejected for some (25th Aug 2020));

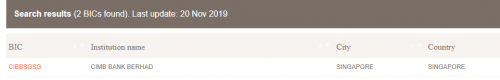

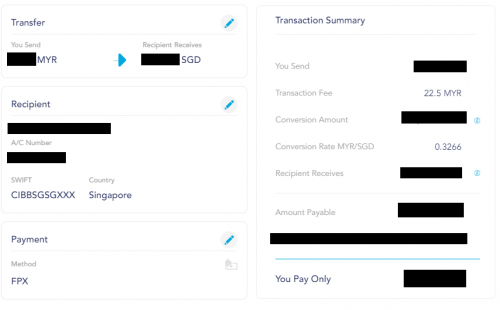

2. CIMB: transfer money (via CIMB transfer or InstaRem or Transferwise) to CIMB SG, from CIMB SG to IBKR in SGD;

» Click to show Spoiler - click again to hide... «

3. Transferwise: transfer SGD, AUD, GBP, EUR, HKD, CAD to IBKR (for Canadian dollars, it takes longer than usual. Beware!);4. Bank Islam (over the counter);

5. Maybank Internet banking, about $25 for fees;

6. BigPay (to deposit SGD) but can't enter your own reference number.

Not proven yet:

1. deposit USD via InstaRem, Transferwise.

Notes:

1. Your IBKR base currency doesn't matter. You can deposit in any currency!!!

No automatic currency conversion. All currency conversion must be done manually on the platform. You want to buy SG stocks? You convert your money to SGD. You want to buy HK stocks? You convert your money to HKD. NO AUTOMATIC CONVERSION!!

2. For live market data, subscription fees may be required.

3. Whether it's account opening or trading or money transfer, it's really not that difficult. Just click, click, click.... and you'll find your way. Nothing is finalised until you click the final button CONFIRM etc etc. So, don't worry!

For more info:

https://forum.lowyat.net/topic/4744515

https://betterspider.com/funding-your-accou...ractivebrokers/

Special thanks to:

1. Ramjade

2. dwRK

3. Yggdrasil

4. powerlinkers

5. erizdagreat

6. Lakeambience

7. TOS

-----------------------------------------------------------------------

Updated 02 Jun 2020

For withdrawal, you can withdraw to your bank account in any developed country like Australia, UK, Singapore, HK etc.

Alternatively, you can also open an account with Transferwise and get a borderless account. It's possible to withdraw EUR from IBKR to TW Borderless account. I haven't tried other currencies yet but will keep this post updated as more info comes in from other users.

For more info: https://forum.lowyat.net/index.php?showtopi...post&p=96979697

-----------------------------------------------------------------------

more info, courtesy of polarzbearz

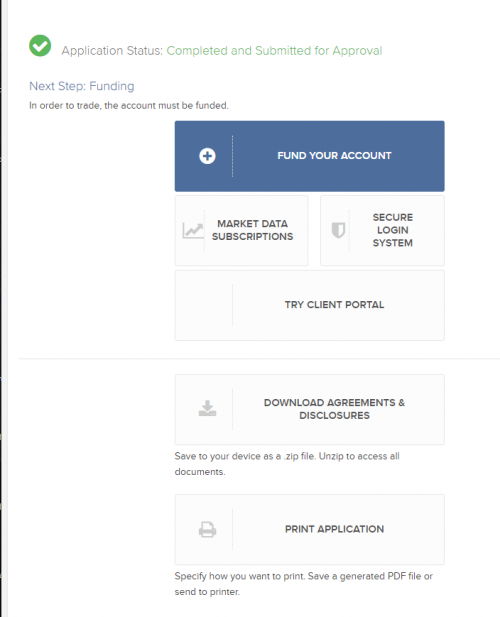

Step-by-step to getting started via TradeStation Global (Interactive Brokers)

This post has been edited by moosset: Jan 3 2021, 09:26 PM

Sep 28 2019, 09:11 PM, updated 5y ago

Sep 28 2019, 09:11 PM, updated 5y ago

Quote

Quote

0.2203sec

0.2203sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled