QUOTE(AgoNi @ Dec 26 2023, 03:30 PM)

Hey guys just want to ask how you guys buy shares if IBKR does not provide real-time data in the stock market?

tradingview us stock price is real time please correct me if i m wrong

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Dec 29 2023, 12:11 PM Dec 29 2023, 12:11 PM

Show posts by this member only | IPv6 | Post

#7361

|

Junior Member

105 posts Joined: Mar 2019 |

|

|

|

|

|

|

Dec 30 2023, 06:46 PM Dec 30 2023, 06:46 PM

|

Senior Member

3,000 posts Joined: Sep 2005 From: Puchong, Selangor |

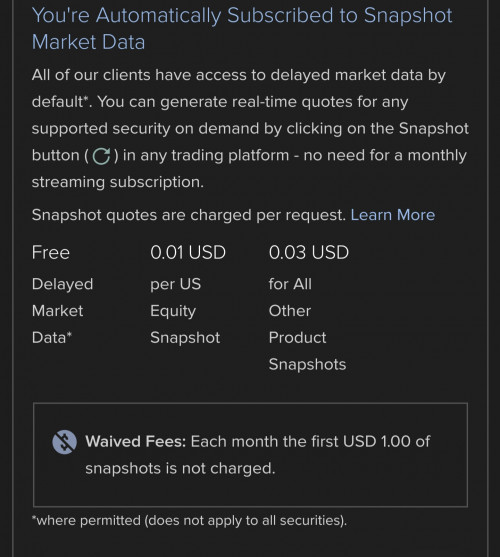

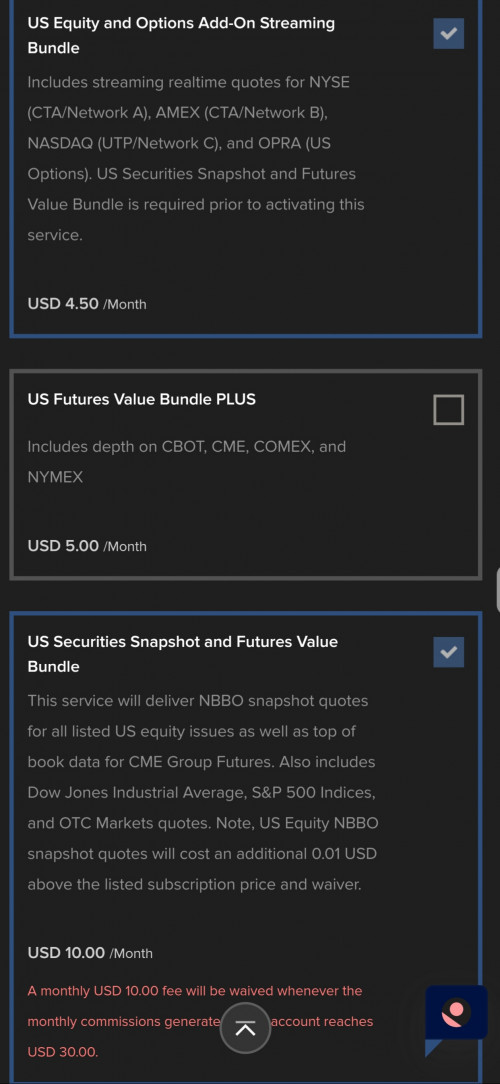

QUOTE(AgoNi @ Dec 26 2023, 03:30 PM) Hey guys just want to ask how you guys buy shares if IBKR does not provide real-time data in the stock market? Use IBKR Snapshots. USD 0.01 per snapshot, up to USD 1 waived per month. Previous post about this:QUOTE(dkzk86 @ Apr 3 2020, 02:56 PM) You can make use of the snapshots. IBKR gives free USD1 worth of snapshots each month. That's about 100 free snapshots for equities. https://forum.lowyat.net/index.php?showtopi...post&p=96160148 I'm not too sure on which subscription is applicable for Equities only but my guess is it's the same as mine.  For US market, I use Webull to check prices (free L1 data), then make my market order accordingly. For other markets, I just hentam. Maybe should've used Snapshots lol. |

|

|

Jan 8 2024, 12:11 AM Jan 8 2024, 12:11 AM

Show posts by this member only | IPv6 | Post

#7363

|

Junior Member

505 posts Joined: Jul 2015 |

is it a good idea for malaysian use transfer MYR via Wise to IBKR, convert to US and just sit there n get interest (USD) from IBKR?

|

|

|

Jan 8 2024, 06:12 AM Jan 8 2024, 06:12 AM

|

All Stars

24,424 posts Joined: Feb 2011 |

QUOTE(privatequity @ Jan 8 2024, 12:11 AM) is it a good idea for malaysian use transfer MYR via Wise to IBKR, convert to US and just sit there n get interest (USD) from IBKR? No. Wise lousy rates. Better use rhb multi currency acocunt.Secondly very stupid to hold USD in cash especially now interest rate coming down which mean going forward in the future, you won't get 4.x% (effective interest as first Usd10k no interest). Invest it and you can get 5%p.a eventually. |

|

|

Jan 8 2024, 08:23 AM Jan 8 2024, 08:23 AM

|

Senior Member

3,500 posts Joined: Jan 2003 |

USD now is RM4.65, a drop of 5% (5% is the annual returns in RHB MCA I think) is RM4.42. If lower, then you'll actually start losing money.

So, normally ppl exchange into USD to buy US stocks This post has been edited by Medufsaid: Jan 8 2024, 08:24 AM |

|

|

Jan 8 2024, 10:35 AM Jan 8 2024, 10:35 AM

|

Senior Member

6,248 posts Joined: Jun 2006 |

QUOTE(Medufsaid @ Jan 8 2024, 08:23 AM) USD now is RM4.65, a drop of 5% (5% is the annual returns in RHB MCA I think) is RM4.42. If lower, then you'll actually start losing money. you also have ppl saving usd for kid's study... or just hedging against myr... but ibkr is not the best vehicle for theseSo, normally ppl exchange into USD to buy US stocks |

|

|

|

|

|

Jan 8 2024, 11:40 AM Jan 8 2024, 11:40 AM

Show posts by this member only | IPv6 | Post

#7367

|

|

Staff

5,568 posts Joined: Jan 2003 From: the lack of sleep |

QUOTE(Medufsaid @ Jan 8 2024, 08:23 AM) USD now is RM4.65, a drop of 5% (5% is the annual returns in RHB MCA I think) is RM4.42. If lower, then you'll actually start losing money. 2024 is geared up to be year of rate cuts unless another war starts somewhere, we are likely to see the USD drop as people wind down their carry trades.So, normally ppl exchange into USD to buy US stocks |

|

|

Jan 10 2024, 12:17 AM Jan 10 2024, 12:17 AM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(Ramjade @ Dec 3 2023, 11:20 AM) Yes. Can. I link my DBS my account to IBKR for USD deposit frok my USD cashback from shopping.I can send USD straight into IBKR without need to convert anymore. Do you know whether withdrawal from IBKR to DBS multicurrency (USD) got any charge by DBS?I don't have HSBC. |

|

|

Jan 10 2024, 02:40 AM Jan 10 2024, 02:40 AM

|

All Stars

24,424 posts Joined: Feb 2011 |

QUOTE(Yggdrasil @ Jan 10 2024, 12:17 AM) Sure got charge cause wire transfer. If use wise no charge. imforumer liked this post

|

|

|

Jan 10 2024, 04:41 PM Jan 10 2024, 04:41 PM

Show posts by this member only | IPv6 | Post

#7370

|

Junior Member

242 posts Joined: Jan 2014 |

QUOTE(Ramjade @ Jan 8 2024, 06:12 AM) No. Wise lousy rates. Better use rhb multi currency acocunt. why not hold cash via T-bills?Secondly very stupid to hold USD in cash especially now interest rate coming down which mean going forward in the future, you won't get 4.x% (effective interest as first Usd10k no interest). Invest it and you can get 5%p.a eventually. |

|

|

Jan 10 2024, 06:04 PM Jan 10 2024, 06:04 PM

|

All Stars

24,424 posts Joined: Feb 2011 |

|

|

|

Jan 10 2024, 06:09 PM Jan 10 2024, 06:09 PM

|

Junior Member

242 posts Joined: Jan 2014 |

|

|

|

Jan 10 2024, 06:19 PM Jan 10 2024, 06:19 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(watzisname @ Jan 10 2024, 06:09 PM) Not everyone is 100% invested 100% of the time. For those of us that have cash portion in our asset allocation can park in t bills Generally, unless your cash size is large enough to offset the 5 USD per trade commission for US T-bills, you are better off holding BIL ETF or other money market ETFs. Also, try not to keep foreign currencies in Malaysia. BNM can never print USD, CHF or SGD and in the worst case, it's the big importers who will be prioritized over us retail investors when the FX reserve runs low. |

|

|

|

|

|

Jan 10 2024, 06:29 PM Jan 10 2024, 06:29 PM

|

Junior Member

242 posts Joined: Jan 2014 |

QUOTE(TOS @ Jan 10 2024, 06:19 PM) Generally, unless your cash size is large enough to offset the 5 USD per trade commission for US T-bills, you are better off holding BIL ETF or other money market ETFs. How much is enough to offset the usd5 commision ?Also, try not to keep foreign currencies in Malaysia. BNM can never print USD, CHF or SGD and in the worst case, it's the big importers who will be prioritized over us retail investors when the FX reserve runs low. |

|

|

Jan 10 2024, 06:32 PM Jan 10 2024, 06:32 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(watzisname @ Jan 10 2024, 06:29 PM) That's up to you to decide. Minimum purchase for US T-bill is 1k USD. 5/1000*100% = 0.5%. For myself, a typical purchase of US shares is around 500 USD and commission is usually 0.35 USD, so that works out to be around 0.07%. You need to compute the commissions as a percentage of your purchase amount and decide how low a percentage you wish to go. Hope that helps. |

|

|

Jan 10 2024, 06:32 PM Jan 10 2024, 06:32 PM

Show posts by this member only | IPv6 | Post

#7376

|

Junior Member

505 posts Joined: Jul 2015 |

QUOTE(Ramjade @ Jan 8 2024, 06:12 AM) No. Wise lousy rates. Better use rhb multi currency acocunt. I do have other investments that give me good yields, with higher risks of course. Thinking to set a portion for risk-free investments, preferably not in MYR/malaysian brokerage a/c.Secondly very stupid to hold USD in cash especially now interest rate coming down which mean going forward in the future, you won't get 4.x% (effective interest as first Usd10k no interest). Invest it and you can get 5%p.a eventually. |

|

|

Jan 10 2024, 06:34 PM Jan 10 2024, 06:34 PM

Show posts by this member only | IPv6 | Post

#7377

|

Junior Member

505 posts Joined: Jul 2015 |

QUOTE(watzisname @ Jan 10 2024, 06:09 PM) Not everyone is 100% invested 100% of the time. For those of us that have cash portion in our asset allocation can park in t bills For cash portion (assuming am mostly in MYR in savings acc now) - do u think its good idea to move some of it to Interactive Brokers (USD) and keep it as cash (receive the 4.8%) and/or park in t bills? any other better options? |

|

|

Jan 10 2024, 06:36 PM Jan 10 2024, 06:36 PM

|

All Stars

24,424 posts Joined: Feb 2011 |

QUOTE(privatequity @ Jan 10 2024, 06:34 PM) For cash portion (assuming am mostly in MYR in savings acc now) - do u think its good idea to move some of it to Interactive Brokers (USD) and keep it as cash (receive the 4.8%) and/or park in t bills? Go get yourself a tiger account and put your money in mmf. Can get 5%+. Of course not for long once US fed start cutting interest rate.any other better options? |

|

|

Jan 10 2024, 06:44 PM Jan 10 2024, 06:44 PM

Show posts by this member only | IPv6 | Post

#7379

|

Junior Member

505 posts Joined: Jul 2015 |

QUOTE(Ramjade @ Jan 10 2024, 06:36 PM) Go get yourself a tiger account and put your money in mmf. Can get 5%+. Of course not for long once US fed start cutting interest rate. is the best way - open a Maybank (Singapore Account) - link to Tiger Broker, transferred RM to Maybank Singapore, and fund Tiger Broker acc? |

|

|

Jan 10 2024, 06:53 PM Jan 10 2024, 06:53 PM

|

All Stars

24,424 posts Joined: Feb 2011 |

QUOTE(privatequity @ Jan 10 2024, 06:44 PM) is the best way - open a Maybank (Singapore Account) - link to Tiger Broker, transferred RM to Maybank Singapore, and fund Tiger Broker acc? CIMB Sg. Don't use Maybank sg. Not sure what is moomoo exchange rate yo.This post has been edited by Ramjade: Jan 10 2024, 06:53 PM |

| Change to: |  0.0222sec 0.0222sec

0.49 0.49

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 05:52 PM |