QUOTE(Bendan520 @ May 11 2021, 02:29 PM)

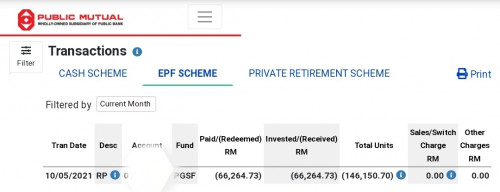

cause I use the 5% rule capital and cut win FREIGHT from bursa then change to SA..

Cause its too hard to trade in bursa nowadays.

Other capital all bag holding right now, slowly cut batch by batch to put in SA

Oh, can't say I know what 5% rule capital and cut win freight means. Cause its too hard to trade in bursa nowadays.

Other capital all bag holding right now, slowly cut batch by batch to put in SA

But I do agree with that Bursa part, getting so fed up with them, lol...then again, it's cuz of my skills and some down luck, surely others have it better.

May 11 2021, 08:57 PM

May 11 2021, 08:57 PM

Quote

Quote

0.0273sec

0.0273sec

0.47

0.47

6 queries

6 queries

GZIP Disabled

GZIP Disabled