QUOTE(Ancient-XinG- @ May 17 2019, 07:27 PM)

Some big players should have penetrate ASEAN.

As far as I know, only in the 2 big bad Tigers - Vanguard in Hong Kong, State Street (SPDR) in Singapore

QUOTE(honsiong @ May 17 2019, 10:20 PM)

KLSE:0820EA actual expense ratio is 1%, and the tracking error is high.

BTW if you see KLCI 5Y chart, you wont feel like buying the ETF already.

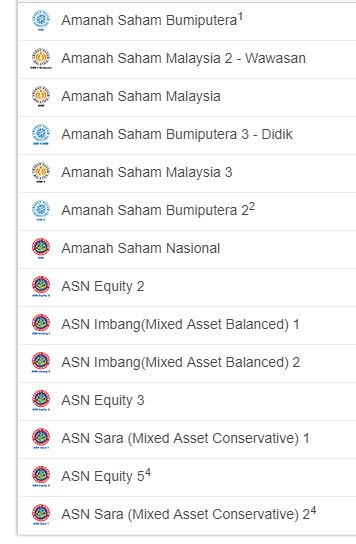

Don't forget dividend yield though - you need to have a look at Total Returns chart instead of price chart. But yeah, 0820EA is incredibly small that even a retail investor can hold more shares than it for counters like Nestle. Plus, there are equity unit trusts available that performs better with less volatility.

QUOTE(alexkos @ May 18 2019, 01:02 PM)

hehe, whichever that float your boat.

VTWAX inside got 60% USA

VTWAX or its ETF equivalent VT is tax unfriendly to non US person - there's VWRD across the ocean, minus half the dividend tax and somewhat negligible small-cap counters

May 17 2019, 11:59 PM

May 17 2019, 11:59 PM

Quote

Quote

0.0226sec

0.0226sec

0.67

0.67

6 queries

6 queries

GZIP Disabled

GZIP Disabled