QUOTE(daimon @ May 22 2019, 11:02 PM)

Hemm can i know which one you invested on?

and roughly how many years you can earn the profile?

hmm not sure my question is correct or not

If you're asking which how much risk you should take, you can take Vanguard's retirement target date fund as a guide:

Start: 80:20 (growth:protective) accumulating (working) phase of your life

Between: Slow glide towards end ratio

End: 30:70 (growth:protective) around 7 years after retirement

Risk Index = Growth:Protective

6.5% = 44.4:55.6 (safest)

10% = 50.2:49.8 (even safer)

15% = 56:44 (safer)

20% = 69:31 (7 years after retirement)

26% = 80.5:19.5 (working)

30% = 85.8:14.2 (riskier)

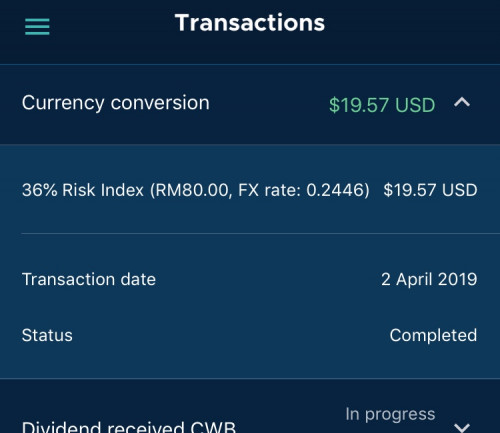

36% = 98:2 (riskiest)

Dial towards safer if you have other risky investments outside StashAway - shares, crypto, p2p lending

Dial towards riskier if you have other safe investments outside StashAway - FD, Amanah Saham, bonds

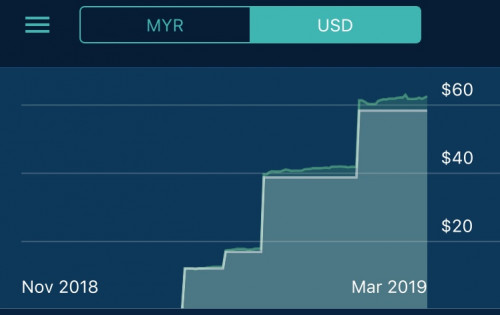

For how many years before earning, you can take a look at StashAway's projection graph for individual risk index as

indication (remember, no guarantee)

Mar 30 2019, 10:22 PM

Mar 30 2019, 10:22 PM

Quote

Quote

0.4536sec

0.4536sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled