Did some research. Real viable option is only BigPay. The rest dont allow you withdraw if top up with CC

Conditional High Yield Savings Account

Conditional High Yield Savings Account

|

|

Jul 23 2020, 01:59 AM Jul 23 2020, 01:59 AM

|

Junior Member

154 posts Joined: Oct 2019 |

Did some research. Real viable option is only BigPay. The rest dont allow you withdraw if top up with CC

|

|

|

|

|

|

Jul 24 2020, 09:05 PM Jul 24 2020, 09:05 PM

Show posts by this member only | IPv6 | Post

#502

|

All Stars

12,387 posts Joined: Feb 2020 |

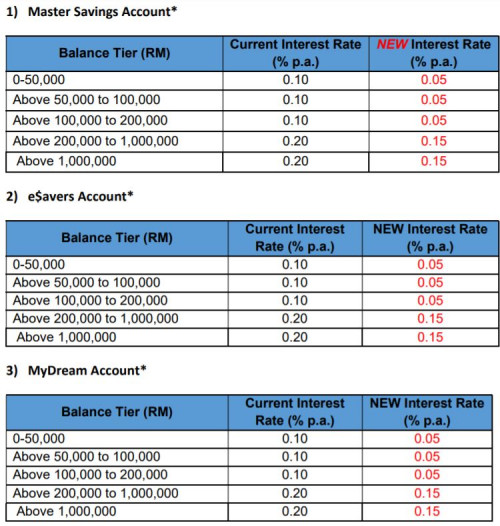

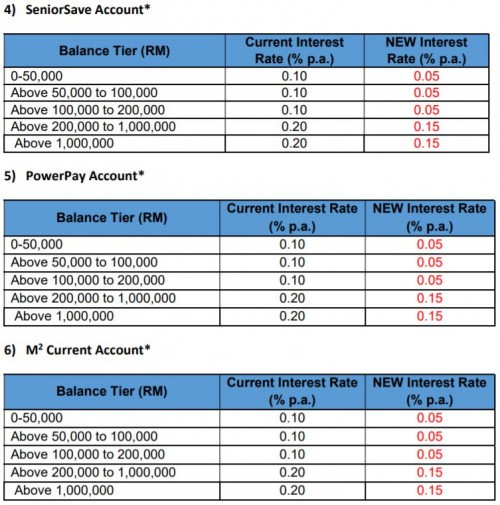

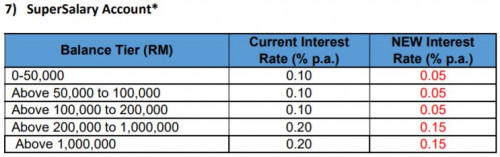

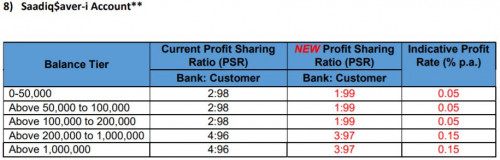

Revision of Product Board Rates and Profit-Sharing Ratio effective 1 August 2020 [for SC]

https://av.sc.com/my/content/docs/my-revisi...ates-august.pdf |

|

|

Jul 30 2020, 06:17 PM Jul 30 2020, 06:17 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

QUOTE(David_Yang @ Jul 20 2020, 03:15 PM) Note that you can get a very good FD rate for 6 month as a new SC customer. Better than the 2.1% of the PSA for sure, maybe 3.5% now. Need to put 70% in the FD and 30% in the PSA. Unbeatable nowadays. Sure or not? Sounds very good but how come I don't read about it anywhere?I have been using Alliance SavePlus all this while, but recently they again lowered the tier payout and added one new one, which is RM 350,000+ then only can get 2.25% (which sucks anyway). All this while, their highest tier was RM200,000 with 2.25% interest. I am looking for other options, including 6 months or more FDs which pay monthly interest that will surely be better than this. Two potential good ones are Am Bank and Bank Rakyat i-Term deposits.... This post has been edited by Hobbez: Jul 30 2020, 06:20 PM |

|

|

Jul 30 2020, 07:52 PM Jul 30 2020, 07:52 PM

|

Senior Member

889 posts Joined: Jun 2008 |

QUOTE(Hobbez @ Jul 30 2020, 06:17 PM) Sure or not? Sounds very good but how come I don't read about it anywhere? Regarding Standard Chartered (SC), I just opened PSA recently at SC Subang Jaya and have been offer for RM70k in FD with 2.9%, RM30K in PSA with 2.1%. Yes, it is not advertise, have to go branch to enquire. Need to have RM 100K in SC account for at least 14 days to apply. Offer ends at end of August.I have been using Alliance SavePlus all this while, but recently they again lowered the tier payout and added one new one, which is RM 350,000+ then only can get 2.25% (which sucks anyway). All this while, their highest tier was RM200,000 with 2.25% interest. I am looking for other options, including 6 months or more FDs which pay monthly interest that will surely be better than this. Two potential good ones are Am Bank and Bank Rakyat i-Term deposits.... This post has been edited by CPURanger: Jul 30 2020, 07:54 PM |

|

|

Jul 30 2020, 10:24 PM Jul 30 2020, 10:24 PM

|

Senior Member

6,429 posts Joined: Jun 2005 |

QUOTE(CPURanger @ Jul 30 2020, 07:52 PM) Regarding Standard Chartered (SC), I just opened PSA recently at SC Subang Jaya and have been offer for RM70k in FD with 2.9%, RM30K in PSA with 2.1%. Yes, it is not advertise, have to go branch to enquire. Need to have RM 100K in SC account for at least 14 days to apply. Offer ends at end of August. Y PSA only 2.1% and not 3.6%? |

|

|

Jul 31 2020, 10:56 AM Jul 31 2020, 10:56 AM

|

Senior Member

889 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jul 31 2020, 01:15 PM Jul 31 2020, 01:15 PM

|

Senior Member

2,552 posts Joined: Jan 2008 |

QUOTE(CPURanger @ Jul 31 2020, 10:56 AM) Not sure, I think she mean savings part but did not mention spending and invest part. I didn't ask further as not interested at that time. your bank officer also forgot to mention it is for new to bank Premium (100k - 249k) and Priority customers (>250k) only.BTW the offer is only for six months deposit. Promo used to be on the website but is currently verbal only. |

|

|

Jul 31 2020, 02:13 PM Jul 31 2020, 02:13 PM

|

Senior Member

889 posts Joined: Jun 2008 |

QUOTE(zenquix @ Jul 31 2020, 01:15 PM) your bank officer also forgot to mention it is for new to bank Premium (100k - 249k) and Priority customers (>250k) only. Yeah she did mention about Premium account. Too much info like investments for me to remember. All I want is just PSA & CC Promo used to be on the website but is currently verbal only. This post has been edited by CPURanger: Jul 31 2020, 02:16 PM |

|

|

Jul 31 2020, 02:19 PM Jul 31 2020, 02:19 PM

|

Senior Member

2,552 posts Joined: Jan 2008 |

QUOTE(CPURanger @ Jul 31 2020, 02:13 PM) Yeah she did mention about Premium account. Too much info like investments for me to remember. All I want is just PSA & CC yeah it is 1-time only. once u lose your virgin status .. later when want to get it also cannot.basically once u put in >RM100k with SC, if you don't take up the fd offer now, you lose it forever This post has been edited by zenquix: Jul 31 2020, 02:20 PM |

|

|

Jul 31 2020, 11:16 PM Jul 31 2020, 11:16 PM

|

Senior Member

889 posts Joined: Jun 2008 |

QUOTE(zenquix @ Jul 31 2020, 02:19 PM) yeah it is 1-time only. once u lose your virgin status .. later when want to get it also cannot. Ha ha. I am no virgin. Good rates. Probably won't be seeing this kind of rate for a long time after this offer. May consider.basically once u put in >RM100k with SC, if you don't take up the fd offer now, you lose it forever This post has been edited by CPURanger: Jul 31 2020, 11:17 PM |

|

|

Aug 1 2020, 08:12 AM Aug 1 2020, 08:12 AM

Show posts by this member only | IPv6 | Post

#511

|

Junior Member

701 posts Joined: Oct 2009 |

Do debit is a must for rhb smart account?

I already have rhb cc and also rhb now online |

|

|

Aug 3 2020, 09:00 AM Aug 3 2020, 09:00 AM

|

Senior Member

1,509 posts Joined: Sep 2019 |

|

|

|

Aug 3 2020, 08:12 PM Aug 3 2020, 08:12 PM

Show posts by this member only | IPv6 | Post

#513

|

Junior Member

701 posts Joined: Oct 2009 |

|

|

|

|

|

|

Aug 3 2020, 08:25 PM Aug 3 2020, 08:25 PM

|

Senior Member

1,509 posts Joined: Sep 2019 |

QUOTE(Leroi2x @ Aug 3 2020, 08:12 PM) Yes, I paid my bills using jompay desktop website. Leroi2x liked this post

|

|

|

Aug 3 2020, 08:55 PM Aug 3 2020, 08:55 PM

Show posts by this member only | IPv6 | Post

#515

|

Senior Member

1,628 posts Joined: May 2013 |

Anyone is using UOB One account?

Does the interest rate is giving out monthly 1st or 15th? Since this saving account will need to tie to UOB credit card, does my annual card fee for my credit card will have any change and also debit card? Can this One account set up can be done online without require to branch? |

|

|

Aug 3 2020, 09:00 PM Aug 3 2020, 09:00 PM

Show posts by this member only | IPv6 | Post

#516

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(rocketm @ Aug 3 2020, 08:55 PM) Anyone is using UOB One account? Yes, can open onlineDoes the interest rate is giving out monthly 1st or 15th? Since this saving account will need to tie to UOB credit card, does my annual card fee for my credit card will have any change and also debit card? Can this One account set up can be done online without require to branch?  If you have PIB access, can also open from PIB:    Product link: https://www.uob.com.my/personal/save/saving...ne-account.page This post has been edited by GrumpyNooby: Aug 3 2020, 09:02 PM |

|

|

Aug 4 2020, 01:09 PM Aug 4 2020, 01:09 PM

Show posts by this member only | IPv6 | Post

#517

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(GrumpyNooby @ Aug 3 2020, 10:00 PM) Yes, can open online Just to clarify the meaning of first RM 50k in this table for UOB One account: If you have PIB access, can also open from PIB:    Product link: https://www.uob.com.my/personal/save/saving...ne-account.page

If I keep my monthly saving about RM3k -4k and fulfill the 2 criteria, am I eligible for 1.65% pa interest for that month? Does the first RM50k means the minimum of monthly saving of RM50k and also fulfill the 2 criteria? |

|

|

Aug 4 2020, 01:13 PM Aug 4 2020, 01:13 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(rocketm @ Aug 4 2020, 01:09 PM) Just to clarify the meaning of first RM 50k in this table for UOB One account: MAB up to RM 50k will earn 1.65% pa

If I keep my monthly saving about RM3k -4k and fulfill the 2 criteria, am I eligible for 1.65% pa interest for that month? Does the first RM50k means the minimum of monthly saving of RM50k and also fulfill the 2 criteria? Next RM 50k (MAB from RM 50,001 to RM 100,000) will earn 2.65% pa (max EIR = 2.15% pa) And of course, all conditions need to be fulfilled. MAB = monthly average balance This post has been edited by GrumpyNooby: Aug 4 2020, 01:14 PM |

|

|

Aug 4 2020, 01:20 PM Aug 4 2020, 01:20 PM

Show posts by this member only | IPv6 | Post

#519

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(GrumpyNooby @ Aug 4 2020, 02:13 PM) MAB up to RM 50k will earn 1.65% pa ok, in this case MAB 3k-4k and fulfill all conditions can get 1.65% pa and from RM50,001, the whole MAB is 2.15% pa? Right?Next RM 50k (MAB from RM 50,001 to RM 100,000) will earn 2.65% pa (max EIR = 2.15% pa) And of course, all conditions need to be fulfilled. MAB = monthly average balance |

|

|

Aug 4 2020, 01:22 PM Aug 4 2020, 01:22 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(rocketm @ Aug 4 2020, 01:20 PM) ok, in this case MAB 3k-4k and fulfill all conditions can get 1.65% pa and from RM50,001, the whole MAB is 2.15% pa? Right? If your MAB is RM 3k to 4k, then you earn 1.65% pa If your MAB is RM 50,001, then you earn 2.15% pa This post has been edited by GrumpyNooby: Aug 4 2020, 01:22 PM |

| Change to: |  0.0300sec 0.0300sec

0.62 0.62

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 01:21 PM |