Outline ·

[ Standard ] ·

Linear+

Conditional High Yield Savings Account

|

Hobbez

|

Jul 30 2020, 06:17 PM Jul 30 2020, 06:17 PM

|

|

QUOTE(David_Yang @ Jul 20 2020, 03:15 PM) Note that you can get a very good FD rate for 6 month as a new SC customer. Better than the 2.1% of the PSA for sure, maybe 3.5% now. Need to put 70% in the FD and 30% in the PSA. Unbeatable nowadays. Sure or not? Sounds very good but how come I don't read about it anywhere? I have been using Alliance SavePlus all this while, but recently they again lowered the tier payout and added one new one, which is RM 350,000+ then only can get 2.25% (which sucks anyway). All this while, their highest tier was RM200,000 with 2.25% interest. I am looking for other options, including 6 months or more FDs which pay monthly interest that will surely be better than this. Two potential good ones are Am Bank and Bank Rakyat i-Term deposits.... This post has been edited by Hobbez: Jul 30 2020, 06:20 PM |

|

|

|

|

|

Hobbez

|

Aug 5 2020, 07:16 PM Aug 5 2020, 07:16 PM

|

|

QUOTE(zenquix @ Jul 31 2020, 02:19 PM) yeah it is 1-time only. once u lose your virgin status .. later when want to get it also cannot. basically once u put in >RM100k with SC, if you don't take up the fd offer now, you lose it forever Hmmm, why the SC bank staffs never mentioned these to me and instead tried to sell me a package of "Savings Plan" + FD? I guess they only get commission thru this.... The thing I don't like about Saving Plans is the banks tie you up for many years and you cannot ever withdraw the capital, only the interest. Typically 10-20 years thing. Or should I insist on the basic savings plus FD only. I have enough funds to even become a SC Premier customer overnight..... This post has been edited by Hobbez: Aug 5 2020, 07:18 PM |

|

|

|

|

|

Hobbez

|

Aug 5 2020, 07:25 PM Aug 5 2020, 07:25 PM

|

|

QUOTE(GrumpyNooby @ Aug 5 2020, 07:18 PM) The Savings Plan is to earn extra 2% Invest Bonus interest for PSA? I'm not sure, but I was shown this plan they have going with Prudential, where you must commit to a sum to save every year and they pay a guaranteed payment annually. And then at the end of the maturity (when you are old and maybe dead and gone), they will pay a big lump sum. Not related to PSA. But they tie it with their FD package.....6 mths at 7+%. But the FD amount to be accepted is proportionate with what you put into the Savings Plan.... The problem is, this one ties you up long term for 15 years I believe. Premature withdrawal will lead to loss of capital as the penalty. This post has been edited by Hobbez: Aug 5 2020, 07:27 PM |

|

|

|

|

|

Hobbez

|

Aug 8 2020, 12:47 PM Aug 8 2020, 12:47 PM

|

|

QUOTE(GrumpyNooby @ Aug 5 2020, 07:26 PM) That's why it is called "Savings Plan".  I think the best option is to sign up for their Bancassurance or Unit Trust to meet the criteria to get 2% interest for the Saving Account which is 2.1% but will drop to 1.5% in Sept. Put some money into their unit trust and then can get overall rate of 3.5% which is still very attractive. What do you think?  This post has been edited by Hobbez: Aug 8 2020, 12:47 PM This post has been edited by Hobbez: Aug 8 2020, 12:47 PM |

|

|

|

|

|

Hobbez

|

Aug 8 2020, 02:24 PM Aug 8 2020, 02:24 PM

|

|

QUOTE(GrumpyNooby @ Aug 8 2020, 12:49 PM) Make sure the product you selected to commit will have a decent return; other you might as well invest yourself. Then, the Invest Bonus is up to RM 20k for normal banking customer. What is this Invest Bonus? Didn't hear anyone mention it. Is it related to their Bancassurance Unit Trust program? |

|

|

|

|

|

Hobbez

|

Aug 8 2020, 04:00 PM Aug 8 2020, 04:00 PM

|

|

QUOTE(!@#$%^ @ Aug 8 2020, 12:48 PM) how much sales charge before u get stg out of it? I don't know, but I only commit the minimum for their unit trust plan. |

|

|

|

|

|

Hobbez

|

Aug 8 2020, 04:13 PM Aug 8 2020, 04:13 PM

|

|

QUOTE(MUM @ Aug 8 2020, 04:09 PM) Any idea the minimum unit trust amount needed to purchase to be eligible for the 3.5% saving rate? I think RM12000-15000 per year, for 5 years. |

|

|

|

|

|

Hobbez

|

Aug 8 2020, 04:27 PM Aug 8 2020, 04:27 PM

|

|

QUOTE(MUM @ Aug 8 2020, 04:22 PM) Usually banks would charge abt 5%-6% sales charges for each ut buy..... Just not sure abt the sales charges of this ut that you gonna buy n also maybe there is a quota or ratio that you must hold between ut n saving to be eligible for that 3.5% rate. Example, just example... For I am not sure.... UT 20k can qualify to hv max 40k in saving to qualify for the 3.5% rate. Do they hv tis quota? I don't think so. This not like other typical FD + CASA plans. It's not actually even a plan offered by the bank, but just suggested by the bank staff, cos I really don't want any long term savings or insurance or UTs. |

|

|

|

|

|

Hobbez

|

Aug 8 2020, 04:58 PM Aug 8 2020, 04:58 PM

|

|

QUOTE(MUM @ Aug 8 2020, 04:33 PM) So it is just a plan suggested by the bank staff n not a requirement that come together to be eligible for the 3.5% saving rate product from the bank... Uuumph... Ok. Thks for telling No, the base PSA account only gives you 2.1% (next month 1.5%). But by investing into their Bancassurance (unit trust) plan, bank offer the PSA another 2%. This post has been edited by Hobbez: Aug 8 2020, 04:59 PM |

|

|

|

|

|

Hobbez

|

Aug 12 2020, 02:32 PM Aug 12 2020, 02:32 PM

|

|

What other conditional savings acct plans have very low tiers or no tiers to pay out an interest?

|

|

|

|

|

|

Hobbez

|

Aug 12 2020, 04:01 PM Aug 12 2020, 04:01 PM

|

|

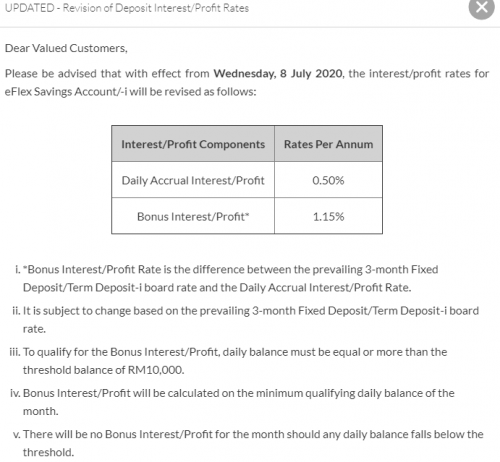

QUOTE(GrumpyNooby @ Aug 12 2020, 02:33 PM) Thanks, but it seems minimum funds must be RM10k. Others like UOB Invest Pro and Alliance SavePlus also won't pay anything for small amounts < RM 10k (at least). |

|

|

|

|

|

Hobbez

|

Sep 28 2020, 09:43 PM Sep 28 2020, 09:43 PM

|

|

So RHB is the best? I tried applying for their credit card but no success. I heard is not easy to get RHB credit card, especially for self employed.

And OCBC even not accepting credit card applications now.

So their 360 accounts cannot "work" without a credit card from them.

What other banks offer this kind of conditional savings acct where you spend with CC will get interest into the savings acct...?

This post has been edited by Hobbez: Sep 28 2020, 09:45 PM

|

|

|

|

|

|

Hobbez

|

Sep 28 2020, 10:36 PM Sep 28 2020, 10:36 PM

|

|

QUOTE(CPURanger @ Sep 28 2020, 09:55 PM) You can use debit card with 360 for spending. Debit card not suitable for my spending circumstances. I am planning to spend online at foreign site, not local. And I doubt they accept debit cards. |

|

|

|

|

|

Hobbez

|

Apr 16 2021, 03:13 AM Apr 16 2021, 03:13 AM

|

|

RHB sucks. From my experience.

The only other one doing this is StanChart.

|

|

|

|

|

Jul 30 2020, 06:17 PM

Jul 30 2020, 06:17 PM

Quote

Quote

0.0524sec

0.0524sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled