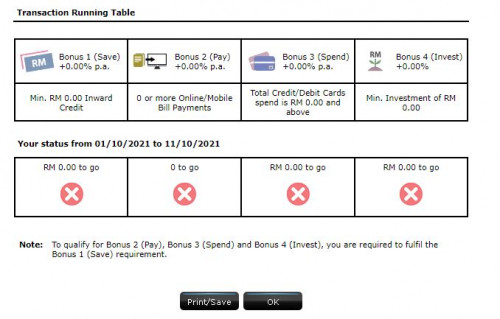

I have few question regarding RHB Smart account.

I have saving account with a debit card.

Just to confirm, I do not need to go to RHB branch for verification and get a debit card or apply their credit card if I open the Smart account online. This mean I just "Upgrade my saving account" while maintaining my debit card. How about existing saving account?

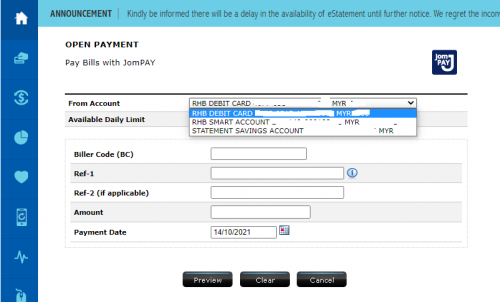

For Pay bonus, is it qualify if all bill payment is using JomPay to different account number (kindly refer to the example below)?

Is their minimum amount per bill payment?

Example:

TM a/c:00001 RM10 method: JomPay

TM a/c:00007 RM10 method: JomPay

TNB a/c: 10346 RM10 method: JomPay

For Spend bonus, I will be using debit card.

- Does it accept online shopping using debit card? Does it allow pay using online banking (FPX) or need to insert debit card and other card details?

- For retail spending, accept paywave or need to insert the card pin?

Aug 3 2020, 08:55 PM

Aug 3 2020, 08:55 PM

Quote

Quote

0.0480sec

0.0480sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled