Hi,

For the Rhb smart acc,

is it within 6month, if even only one day my account <Rm1000 i will be charge RM10?

Conditional High Yield Savings Account

Conditional High Yield Savings Account

|

|

Aug 10 2020, 10:14 AM Aug 10 2020, 10:14 AM

|

Senior Member

1,367 posts Joined: Jan 2003 |

Hi,

For the Rhb smart acc, is it within 6month, if even only one day my account <Rm1000 i will be charge RM10? |

|

|

|

|

|

Aug 11 2020, 08:20 PM Aug 11 2020, 08:20 PM

Show posts by this member only | IPv6 | Post

#542

|

||||||||||||||

All Stars

12,387 posts Joined: Feb 2020 |

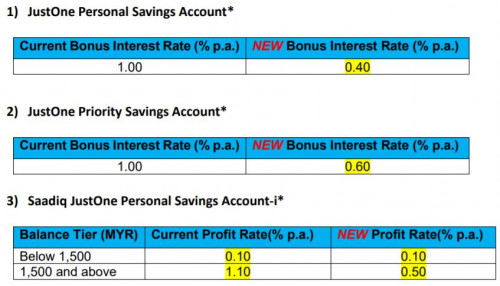

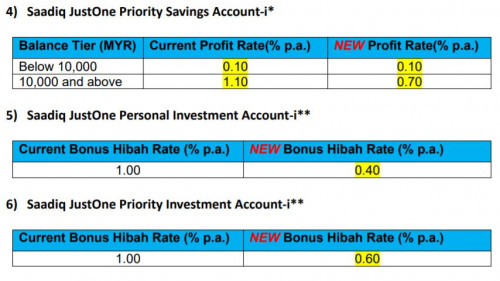

JUSTONE PRODUCT STREAMLINING AND REVISION OF BONUS INTEREST/BONUS HIBAH/PROFIT RATE

Kindly be informed that to simplify our product offerings, we are streamlining some of our products. Therefore, effective 1 September 2020, the accounts as mentioned in Table 1, Section A below will be known as the accounts named in Table 1, Section B. All other product features, account numbers, fees and charges will remain unchanged.

Please take note that effective 1 September 2020, the bonus interest/bonus hibah/profit rate for JustOne Accounts will be revised as follows.   https://av.sc.com/my/content/docs/Announcem...-Sept-20-v3.pdf |

||||||||||||||

|

|

Aug 11 2020, 11:31 PM Aug 11 2020, 11:31 PM

|

Junior Member

62 posts Joined: Jul 2019 |

QUOTE(MUM @ Aug 8 2020, 05:31 PM) so to get the extra 2%pa interest for that RM20000 you need to put into UT RM1k per month Current Invest plan not worth it compare to previous.2%pa on RM20k is RM400 pa or RM33.30 pm extra untung invest 1k per month, unit trust fees if 5% sales charges is RM50 per month sales charges...extra expenses.... siapa lagi untung? bank or me? Previous version: UT RM1K/month and balance RM 100,000 get extra 2% Sales charge 2-2.5% And last long 1 year. |

|

|

Aug 11 2020, 11:35 PM Aug 11 2020, 11:35 PM

|

All Stars

14,929 posts Joined: Mar 2015 |

|

|

|

Aug 12 2020, 02:32 PM Aug 12 2020, 02:32 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

What other conditional savings acct plans have very low tiers or no tiers to pay out an interest?

|

|

|

Aug 12 2020, 02:33 PM Aug 12 2020, 02:33 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

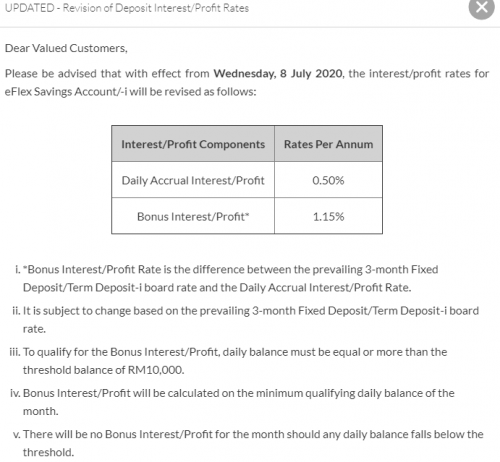

QUOTE(Hobbez @ Aug 12 2020, 02:32 PM) AmBank eFlex: https://www.ambank.com.my/eng/eflex This post has been edited by GrumpyNooby: Aug 12 2020, 02:35 PM |

|

|

|

|

|

Aug 12 2020, 04:01 PM Aug 12 2020, 04:01 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

QUOTE(GrumpyNooby @ Aug 12 2020, 02:33 PM) Thanks, but it seems minimum funds must be RM10k.Others like UOB Invest Pro and Alliance SavePlus also won't pay anything for small amounts < RM 10k (at least). |

|

|

Aug 12 2020, 08:13 PM Aug 12 2020, 08:13 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

TIME TO STASH UP MORE ON EARNINGS (1 August2020 to 31 October 2020)

Campaign link: https://www.uob.com.my/web-resources/person...phase-steps.png T&C link: https://www.uob.com.my/web-resources/person...est-tnc-eng.pdf |

|

|

Aug 22 2020, 11:10 AM Aug 22 2020, 11:10 AM

Show posts by this member only | IPv6 | Post

#549

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

thinking of getting a debit card to help fulfill the 'spend' portion of rhb smart account. anything good about this VISA WWF Debit Card-i ?

https://www.rhbgroup.com/ocean/index.html |

|

|

Aug 22 2020, 11:14 AM Aug 22 2020, 11:14 AM

Show posts by this member only | IPv6 | Post

#550

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(sl3ge @ Aug 10 2020, 10:14 AM) Hi, while waiting for value added information, if i'm not mistaken it follows monthly average balance. as long as the average for the month is more than 1k, should be no fees. for example, u have 30k on 1st september then withdraw everything on 2nd september. then for the month of september, the monthly average balance is still 1k.For the Rhb smart acc, is it within 6month, if even only one day my account <Rm1000 i will be charge RM10? correct me if i'm wrong sifus. |

|

|

Aug 22 2020, 11:36 AM Aug 22 2020, 11:36 AM

|

Senior Member

1,367 posts Joined: Jan 2003 |

QUOTE(!@#$%^ @ Aug 22 2020, 11:14 AM) while waiting for value added information, if i'm not mistaken it follows monthly average balance. as long as the average for the month is more than 1k, should be no fees. for example, u have 30k on 1st september then withdraw everything on 2nd september. then for the month of september, the monthly average balance is still 1k. I accidentally with draw all money in my account for around 1 week.correct me if i'm wrong sifus. then quickly put back the money. Hope anyone can clarify this. |

|

|

Aug 22 2020, 05:59 PM Aug 22 2020, 05:59 PM

|

Senior Member

1,509 posts Joined: Sep 2019 |

QUOTE(sl3ge @ Aug 10 2020, 10:14 AM) Hi, If my understanding is correct, if your MAB is less than Rm1k for 6 months then will charge RM10.For the Rhb smart acc, is it within 6month, if even only one day my account <Rm1000 i will be charge RM10? QUOTE Thank you for you message With regard to your concern Current Account with OD facility, Basic CA without OD facility & RHB Smart Account will be charge half yearly service charge of RM10.00 is levied if a monthly average balance is less than RM1,000.00 in preceding 6 months **monthly average balance is less than RM1,000.00 in preceding 6 months **Sum of day end balance in the preceding 6 months / number of days Should you require further assistance about other RHB banking products & services, you may send another message and we would be glad to assist you. Thank you for using www.rhbgroup.com |

|

|

Aug 23 2020, 03:56 PM Aug 23 2020, 03:56 PM

|

Senior Member

1,603 posts Joined: Aug 2014 |

I would like to ask about RHB Smart Account, as I am considering whether to open this current account or not.

I already have a RHB Basic Savings Account, and its RHB debit card is without annual fee (withdrawals limited to 8 times in a month). Can I choose not to tag my RHB debit card to RHB Smart Account, to avoid debit card annual fee? Well, if I want to withdraw money from my RHB Smart Account, I would prefer to use RHBNow internet banking website transfer money to my RHB Basic Savings Account, or to my savings accounts in other bank via Instant Fund Transfer. In other words, I do not need to withdraw money via ATM, directly from RHB Smart Account. thank you for your information. This post has been edited by kart: Aug 23 2020, 03:58 PM |

|

|

|

|

|

Aug 23 2020, 04:02 PM Aug 23 2020, 04:02 PM

Show posts by this member only | IPv6 | Post

#554

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(kart @ Aug 23 2020, 03:56 PM) I would like to ask about RHB Smart Account, as I am considering whether to open this current account or not. if u choose to open conventional smart account, then u will have no choice but to tag ur existing basic savings account debit card to it. the workaround is open islamic smart account-i, then u will not be forced to tag the debit card. I already have a RHB Basic Savings Account, and its RHB debit card is without annual fee (withdrawals limited to 8 times in a month). Can I choose not to tag my RHB debit card to RHB Smart Account, to avoid debit card annual fee? Well, if I want to withdraw money from my RHB Smart Account, I would prefer to use RHBNow internet banking website transfer money to my RHB Basic Savings Account, or to my savings accounts in other bank via Instant Fund Transfer. In other words, I do not need to withdraw money via ATM, directly from RHB Smart Account. thank you for your information. QUOTE(kart @ Aug 23 2020, 03:56 PM) Well, if I want to withdraw money from my RHB Smart Account, I would prefer to use RHBNow internet banking website transfer money to my RHB Basic Savings Account, or to my savings accounts in other bank via Instant Fund Transfer. In other words, I do not need to withdraw money via ATM, directly from RHB Smart Account. u can do so, but do note that in order to fulfill the 'spend' requirement, u need a rhb credit card or debit card tagged to this smart account.thank you for your information. |

|

|

Aug 23 2020, 04:12 PM Aug 23 2020, 04:12 PM

|

Senior Member

1,603 posts Joined: Aug 2014 |

Thanks for your answer, !@#$%^.

Well, I am interested in only Deposit Interest of 1.80% p.a. and Base Interest Rate of 0.05% p.a. Is there any difference between RHB Smart Account and RHB Smart Account-i? Are we getting the same 1.80% p.a. and 0.05% p.a. interest rate from either RHB Smart Account or RHB Smart Account-i? This post has been edited by kart: Aug 23 2020, 04:12 PM |

|

|

Aug 23 2020, 04:14 PM Aug 23 2020, 04:14 PM

Show posts by this member only | IPv6 | Post

#556

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

|

|

|

Aug 23 2020, 04:21 PM Aug 23 2020, 04:21 PM

|

Senior Member

1,603 posts Joined: Aug 2014 |

Regarding the deposit interest, the minimum holding period of RM 2000 which is deposited into RHB Smart Account is not mentioned in the terms and conditions.

So, is it possible to withdraw RM 2000 after RM 2000 is deposited into RHB Smart Account, and we are still entitled to the Deposit Interest of 1.80% p.a.? smartfreak previously mentioned that the pay interest 0.5% p.a. is granted, when RM 1 is paid three times to same biller. As such, it is also possible to get pay interest 0.5% p.a. This post has been edited by kart: Aug 23 2020, 04:25 PM |

|

|

Aug 23 2020, 11:04 PM Aug 23 2020, 11:04 PM

|

Senior Member

1,509 posts Joined: Sep 2019 |

QUOTE(kart @ Aug 23 2020, 04:21 PM) Regarding the deposit interest, the minimum holding period of RM 2000 which is deposited into RHB Smart Account is not mentioned in the terms and conditions. I believe it is possible.So, is it possible to withdraw RM 2000 after RM 2000 is deposited into RHB Smart Account, and we are still entitled to the Deposit Interest of 1.80% p.a.? smartfreak previously mentioned that the pay interest 0.5% p.a. is granted, when RM 1 is paid three times to same biller. As such, it is also possible to get pay interest 0.5% p.a. RHB smart account has a transaction running table for you to check when you login. Usually, the table will be updated after 2 days. So after you deposited rm2k, you can check back after 2 days to confirm.  |

|

|

Aug 24 2020, 09:45 PM Aug 24 2020, 09:45 PM

|

Senior Member

1,603 posts Joined: Aug 2014 |

Thanks for your answer, smartfreak. Both your and !@#$%^'s advices are very useful.

Alright, I just have to carefully think, before opening RHB Smart Account. There are caveats for this account (as we all know): - Half yearly service charge of RM10.00 is levied if monthly average balance is less than RM1,000.00 in preceding 6 months. - RM 20 fee is imposed on account closure within 3 months from the date it is opened (in case that I may need to close RHB Smart Account, if I do not manage to get the desired savings interest). This post has been edited by kart: Aug 24 2020, 09:47 PM |

|

|

Aug 25 2020, 04:50 PM Aug 25 2020, 04:50 PM

Show posts by this member only | IPv6 | Post

#560

|

All Stars

12,387 posts Joined: Feb 2020 |

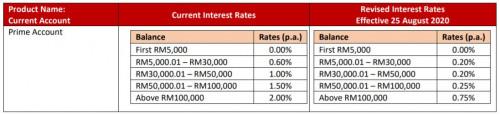

IMPORTANT NOTICE ON REVISION OF INTEREST RATES FOR PRIME ACCOUNT [for CIMB]

Dear Valued Customers, Effective 25 August 2020, our interest rate for Prime Account will be revised as below.  https://www.cimb.com.my/content/dam/cimb/pe...ime_Account.pdf |

| Change to: |  0.0296sec 0.0296sec

0.73 0.73

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 07:05 PM |