QUOTE(GrumpyNooby @ Aug 4 2020, 01:22 PM)

note the term "maximum"if MAB is 50,001. u earn 1.65% * RM50000 and RM1 * 2.65%. EIR is not 2.15%

This post has been edited by zenquix: Aug 4 2020, 03:52 PM

Conditional High Yield Savings Account

|

|

Aug 4 2020, 03:52 PM Aug 4 2020, 03:52 PM

|

Senior Member

2,552 posts Joined: Jan 2008 |

|

|

|

|

|

|

Aug 4 2020, 03:59 PM Aug 4 2020, 03:59 PM

Show posts by this member only | IPv6 | Post

#522

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Aug 5 2020, 06:16 PM Aug 5 2020, 06:16 PM

Show posts by this member only | IPv6 | Post

#523

|

All Stars

12,387 posts Joined: Feb 2020 |

Revision of Privilege$aver Campaign Terms & Conditions

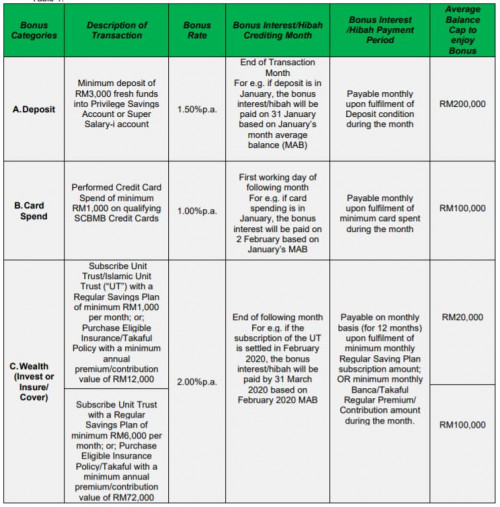

Please take note, effective 1 Sep 2020, Deposit Bonus Interest of Privilege Savings Account /Deposit Bonus Hibah of Super Salary-i and Credit Card Spend Bonus Interest will be revised as follows: Clause 11 Table 1. • Deposit Bonus Interest/Hibah will be revised from 2.00% p.a. to 1.50% p.a. with average balance cap of RM 200,000 during the month • Credit Card Bonus Interest will be revised from 1.50% p.a. to 1.00% p.a. Clause 14 Eligible Account holders can earn up to 4.60% p.a. (from 5.60% p.a.) in the promotion account based on total interest/return earned from the Base Rate and total Bonus Rates on all Bonus Categories of Deposit, Card Spend and Wealth Management as seen in Table 1 of the Campaign Terms and Conditions. https://av.sc.com/my/content/docs/my-revisi...egeaver-tcs.pdf |

|

|

Aug 5 2020, 07:16 PM Aug 5 2020, 07:16 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

QUOTE(zenquix @ Jul 31 2020, 02:19 PM) yeah it is 1-time only. once u lose your virgin status .. later when want to get it also cannot. Hmmm, why the SC bank staffs never mentioned these to me and instead tried to sell me a package of "Savings Plan" + FD? I guess they only get commission thru this....basically once u put in >RM100k with SC, if you don't take up the fd offer now, you lose it forever The thing I don't like about Saving Plans is the banks tie you up for many years and you cannot ever withdraw the capital, only the interest. Typically 10-20 years thing. Or should I insist on the basic savings plus FD only. I have enough funds to even become a SC Premier customer overnight..... This post has been edited by Hobbez: Aug 5 2020, 07:18 PM |

|

|

Aug 5 2020, 07:18 PM Aug 5 2020, 07:18 PM

Show posts by this member only | IPv6 | Post

#525

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Hobbez @ Aug 5 2020, 07:16 PM) Hmmm, why the SC bank staffs never mentioned these to me and instead tried to sell me a package of "Savings Plan" + FD? I guess they only get commission thru this.... The Savings Plan is to earn extra 2% Invest Bonus interest for PSA?The thing I don't like about Saving Plans is the banks tie you up for many years and you cannot ever withdraw the capital, only the interest. Typically 10-20 years thing. Or should I insist on the basic savings plus FD only. |

|

|

Aug 5 2020, 07:25 PM Aug 5 2020, 07:25 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

QUOTE(GrumpyNooby @ Aug 5 2020, 07:18 PM) I'm not sure, but I was shown this plan they have going with Prudential, where you must commit to a sum to save every year and they pay a guaranteed payment annually. And then at the end of the maturity (when you are old and maybe dead and gone), they will pay a big lump sum. Not related to PSA. But they tie it with their FD package.....6 mths at 7+%. But the FD amount to be accepted is proportionate with what you put into the Savings Plan....The problem is, this one ties you up long term for 15 years I believe. Premature withdrawal will lead to loss of capital as the penalty. This post has been edited by Hobbez: Aug 5 2020, 07:27 PM |

|

|

|

|

|

Aug 5 2020, 07:26 PM Aug 5 2020, 07:26 PM

Show posts by this member only | IPv6 | Post

#527

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Hobbez @ Aug 5 2020, 07:25 PM) I'm not sure, but I was shown this plan they have going with Prudential, where you must commit to a sum to save every year and they pay a guaranteed payment annually. And then at the end of the maturity (when you are old and maybe dead and gone), they will pay a big lump sum. That's why it is called "Savings Plan". The problem is, this one ties you up long term for 15 years I believe. Premature withdrawal will lead to loss of capital as the penalty. |

|

|

Aug 8 2020, 12:47 PM Aug 8 2020, 12:47 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

QUOTE(GrumpyNooby @ Aug 5 2020, 07:26 PM) I think the best option is to sign up for their Bancassurance or Unit Trust to meet the criteria to get 2% interest for the Saving Account which is 2.1% but will drop to 1.5% in Sept.Put some money into their unit trust and then can get overall rate of 3.5% which is still very attractive. What do you think? This post has been edited by Hobbez: Aug 8 2020, 12:47 PM |

|

|

Aug 8 2020, 12:48 PM Aug 8 2020, 12:48 PM

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

QUOTE(Hobbez @ Aug 8 2020, 12:47 PM) I think the best option is to sign up for their Bancassurance or Unit Trust to meet the criteria to get 2% interest for the Saving Account which is 2.1% but will drop to 1.5% in Sept. how much sales charge before u get stg out of it?Put some money into their unit trust and then can get overall rate of 3.5% which is still very attractive. What do you think? |

|

|

Aug 8 2020, 12:49 PM Aug 8 2020, 12:49 PM

Show posts by this member only | IPv6 | Post

#530

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Hobbez @ Aug 8 2020, 12:47 PM) I think the best option is to sign up for their Bancassurance or Unit Trust to meet the criteria to get 2% interest for the Saving Account which is 2.1% but will drop to 1.5% in Sept. Make sure the product you selected to commit will have a decent return; other you might as well invest yourself.Put some money into their unit trust and then can get overall rate of 3.5% which is still very attractive. What do you think? Then, the Invest Bonus is up to RM 20k for normal banking customer. |

|

|

Aug 8 2020, 02:24 PM Aug 8 2020, 02:24 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

QUOTE(GrumpyNooby @ Aug 8 2020, 12:49 PM) Make sure the product you selected to commit will have a decent return; other you might as well invest yourself. What is this Invest Bonus? Didn't hear anyone mention it. Is it related to their Bancassurance Unit Trust program?Then, the Invest Bonus is up to RM 20k for normal banking customer. |

|

|

Aug 8 2020, 04:00 PM Aug 8 2020, 04:00 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

|

|

|

Aug 8 2020, 04:09 PM Aug 8 2020, 04:09 PM

Show posts by this member only | IPv6 | Post

#533

|

All Stars

14,931 posts Joined: Mar 2015 |

|

|

|

|

|

|

Aug 8 2020, 04:13 PM Aug 8 2020, 04:13 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

|

|

|

Aug 8 2020, 04:22 PM Aug 8 2020, 04:22 PM

Show posts by this member only | IPv6 | Post

#535

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(Hobbez @ Aug 8 2020, 04:13 PM) Usually banks would charge abt 5%-6% sales charges for each ut buy..... Just not sure abt the sales charges of this ut that you gonna buy n also maybe there is a quota or ratio that you must hold between ut n saving to be eligible for that 3.5% rate. Example, just example... For I am not sure.... UT 20k can qualify to hv max 40k in saving to qualify for the 3.5% rate. Do they hv tis quota? |

|

|

Aug 8 2020, 04:27 PM Aug 8 2020, 04:27 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

QUOTE(MUM @ Aug 8 2020, 04:22 PM) Usually banks would charge abt 5%-6% sales charges for each ut buy..... Just not sure abt the sales charges of this ut that you gonna buy n also maybe there is a quota or ratio that you must hold between ut n saving to be eligible for that 3.5% rate. I don't think so. This not like other typical FD + CASA plans. Example, just example... For I am not sure.... UT 20k can qualify to hv max 40k in saving to qualify for the 3.5% rate. Do they hv tis quota? It's not actually even a plan offered by the bank, but just suggested by the bank staff, cos I really don't want any long term savings or insurance or UTs. |

|

|

Aug 8 2020, 04:33 PM Aug 8 2020, 04:33 PM

Show posts by this member only | IPv6 | Post

#537

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(Hobbez @ Aug 8 2020, 04:27 PM) I don't think so. This not like other typical FD + CASA plans. So it is just a plan suggested by the bank staff n not a requirement that come together to be eligible for the 3.5% saving rate product from the bank...It's not actually even a plan offered by the bank, but just suggested by the bank staff, cos I really don't want any long term savings or insurance or UTs. Uuumph... Ok. Thks for telling |

|

|

Aug 8 2020, 04:58 PM Aug 8 2020, 04:58 PM

|

Senior Member

1,235 posts Joined: Dec 2009 |

QUOTE(MUM @ Aug 8 2020, 04:33 PM) So it is just a plan suggested by the bank staff n not a requirement that come together to be eligible for the 3.5% saving rate product from the bank... No, the base PSA account only gives you 2.1% (next month 1.5%).Uuumph... Ok. Thks for telling But by investing into their Bancassurance (unit trust) plan, bank offer the PSA another 2%. This post has been edited by Hobbez: Aug 8 2020, 04:59 PM |

|

|

Aug 8 2020, 05:02 PM Aug 8 2020, 05:02 PM

Show posts by this member only | IPv6 | Post

#539

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Hobbez @ Aug 8 2020, 04:58 PM) No, the base PSA account only gives you 2.1% (next month 1.5%). That is the Invest Bonus for PSA that I was pointing:But by investing into their Bancassurance (unit trust) plan, bank offer the PSA another 2%.  If your contribution to their WMP is RM 12k per year, the Invest Bonus will be eligible for the 1st RM 20k. For Priority Banking Clients, if your contribution to their WMP is RM 72k per year, the Invest Bonus will be eligible for the 1st RM 100k. This post has been edited by GrumpyNooby: Aug 8 2020, 05:44 PM MUM liked this post

|

|

|

Aug 8 2020, 05:31 PM Aug 8 2020, 05:31 PM

|

All Stars

14,931 posts Joined: Mar 2015 |

so to get the extra 2%pa interest for that RM20000 you need to put into UT RM1k per month

2%pa on RM20k is RM400 pa or RM33.30 pm extra untung invest 1k per month, unit trust fees if 5% sales charges is RM50 per month sales charges...extra expenses.... siapa lagi untung? bank or me? This post has been edited by MUM: Aug 8 2020, 05:33 PM |

| Change to: |  0.0269sec 0.0269sec

0.54 0.54

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 02:56 AM |