Outline ·

[ Standard ] ·

Linear+

Conditional High Yield Savings Account

|

mamamia

|

Jul 4 2019, 11:39 PM Jul 4 2019, 11:39 PM

|

|

QUOTE(avinlim @ Jul 4 2019, 05:39 PM) hi...coming here to ask about SC Privilege$aver account .... Min. 3k deposit & 1k card spending (single card not combine cards). Then you get 0.5% board rate + 2% bonus rate (deposit) + 1.5% bonus rate (card spending). If u have wealth product, u can get additional 2% Their website got clear description: https://www.sc.com/my/deposits/privilegesaver/ |

|

|

|

|

|

mamamia

|

Jul 23 2019, 07:27 PM Jul 23 2019, 07:27 PM

|

|

QUOTE(AskarPerang @ Jul 23 2019, 03:09 PM) Just open a privilege saving account at Standard Chartered since I already got a credit card and online account there. Anyway, was asked by the person in charge to take the debit card (annual fees RM8) if not the privilege benefits will not get. Is that true? Coz I highly doubt this debit card is needed to fulfill the required condition to get up to 6% pa interest. Yes, u must have debit card, else u won’t get card spend bonus interest even u fulfill the RM1k spending on credit card.. this is something weird on their system.. dunno why it is debit card since they required credit card spending..I kena b4, ended up still need to go to branch again to get the debit card.. |

|

|

|

|

|

mamamia

|

Jul 25 2019, 09:51 PM Jul 25 2019, 09:51 PM

|

|

QUOTE(rojakwhacker @ Jul 25 2019, 09:40 PM) Good thing about this debit card is it is one of the features and tie to the saving account is that you can withdraw cash in any bank atm (foreign or local bank - MEPS or HOUSE) for free (it charge when you withdraw and credit back by end of the day). That is what i heard.  Yes, it is credited back end of the month provided u have fresh fund deposit to the acc.. if not mistaken, fresh fund is 1.5k / 3k in one shot.. |

|

|

|

|

|

mamamia

|

Jul 25 2019, 09:55 PM Jul 25 2019, 09:55 PM

|

|

QUOTE(rojakwhacker @ Jul 25 2019, 09:54 PM) The fresh fund after deposit can withdraw on the same day too.  Yeah, as long as u fulfill the “deposit” |

|

|

|

|

|

mamamia

|

Aug 10 2019, 06:02 AM Aug 10 2019, 06:02 AM

|

|

QUOTE(cybpsych @ Aug 9 2019, 10:59 PM) Look like a very good deal for this.. tier 1 n 2 is it bonus interest? do u have the full tnc? This post has been edited by mamamia: Aug 10 2019, 06:04 AM |

|

|

|

|

|

mamamia

|

Aug 14 2019, 08:24 PM Aug 14 2019, 08:24 PM

|

|

QUOTE(brutus @ Aug 14 2019, 08:21 PM) HNWI? Not in my books!  Anyways, I usually do not prefer "short term" 6-months FD rates then reverting back to board rates. Also the 70:30 ratio effectively lowers the advertised 4.7% FD rates. If i read correctly using the assumption of 100K 70K @ 4.7% 30K @ 0.5% After 6 months total Interests earned is 1,720/100,000 = 3.44%, no? If u put 30k to PSA, u will earn 4% or up to 6% |

|

|

|

|

|

mamamia

|

Aug 14 2019, 09:19 PM Aug 14 2019, 09:19 PM

|

|

QUOTE(brutus @ Aug 14 2019, 09:06 PM) INM should be a 5Y plan. Not expecting much from this plan though, maybe slightly above FD rates will do for me. Main objective is to utilize the Spend 1K element of PSA. Instead of "spending" on wants, might as well "invest" it. :thumbsup: U mean u r not getting 6% every month? Min. 3k deposit & 1k card spending. Then you get 0.5% board rate + 2% bonus rate (deposit) + 1.5% bonus rate (card spending) + wealth investment of 2% |

|

|

|

|

|

mamamia

|

Sep 11 2019, 06:39 PM Sep 11 2019, 06:39 PM

|

|

QUOTE(tweakity @ Sep 11 2019, 01:22 PM) for SCB, does it work if i already have a credit card now. Then i go apply Savings account later? everything is linked through name/IC, As in, no need to link specific credit card to specific savings account to get the extra % from cc spending No need, they will auto track ur credit card spending.. but u need to have debit card for the PSA account.. I’ve also open the PSA after I’ve credit card.. |

|

|

|

|

|

mamamia

|

Sep 17 2019, 08:07 PM Sep 17 2019, 08:07 PM

|

|

QUOTE(cybpsych @ Sep 17 2019, 08:04 PM) Revision of Deposit Rates (effective 24 September 2019)» Click to show Spoiler - click again to hide... « This is for which bank? |

|

|

|

|

|

mamamia

|

Dec 23 2019, 07:46 PM Dec 23 2019, 07:46 PM

|

|

QUOTE(cybpsych @ Dec 23 2019, 07:34 PM) SCB: Revision of Terms & Conditions of Privilege$aver Campaignhttps://www.sc.com/my/important-information...eaver-campaign/Please take note, effective 11 January 2020, the Terms and Conditions of Privilege$aver Campaign will be revised as follows: www.sc.com/my/terms-and-conditions >> https://av.sc.com/my/content/docs/privilege...campaign-tc.pdfIf you have any questions, please speak to our branch personnel, call our 24-hour Client Care Centre at 1300 888 888 (or +603-7711 8888 if you are calling from overseas) or email us at Malaysia.Feedback@sc.com.

Added on SCB: Extension of Campaign Period of Privilege$aver Campaignhttps://www.sc.com/my/important-information...-privilegeaver/Please be informed that the Campaign Period for Privilege$aver Campaign will be extended from 31 December 2019 to 10 January 2020. Please refer to the Campaign Terms and Conditions here: http://www.sc.com/my/terms-and-conditions/>> https://av.sc.com/my/content/docs/privilege...c-extension.pdfIf you have any questions, please speak to our branch personnel, call our 24-hour Client Care Centre at 1300 888 888 (or +603-7711 8888 if you are calling from overseas) or email us at Malaysia.Feedback@sc.com. Wow, good news. Hope ocbc won't change their rate too |

|

|

|

|

|

mamamia

|

Dec 24 2019, 01:24 PM Dec 24 2019, 01:24 PM

|

|

QUOTE(wym6977 @ Dec 23 2019, 11:15 PM) Why you say so? I thought it has been 1.5% this while (based on 10. July.19 TnC) Also the new TnC (11.Jan.20) there is no cap for the deposit bonus...so the revised TnC looks slightly better offer... As I know all the while no cap for deposit bonus interest. Only cap for credit card spending bonus interest. So, it is just extension of the bonus interest. This post has been edited by mamamia: Dec 24 2019, 01:24 PM |

|

|

|

|

|

mamamia

|

Jan 9 2020, 09:05 AM Jan 9 2020, 09:05 AM

|

|

QUOTE(chowyeen @ Jan 9 2020, 05:05 AM) Does this SCB PrivilegeSaver has a cap amount of money in the account to enjoy the high interest rate like OCBC360 is RM100k? Yes, capped at 100k deposit for card spend bonus interest.. base + deposit Bonus interest u can get unlimited interest |

|

|

|

|

|

mamamia

|

Jan 27 2020, 10:36 PM Jan 27 2020, 10:36 PM

|

|

QUOTE(smartfreak @ Jan 27 2020, 09:47 AM) I am using web. Anyway, I have contacted standard charted customer support. I'm not the only one having these issue. They will investigate and get back to me. Normally it will refund to u by T+2 |

|

|

|

|

|

mamamia

|

Mar 12 2020, 04:58 PM Mar 12 2020, 04:58 PM

|

|

|

|

|

|

|

|

mamamia

|

Mar 27 2020, 04:50 PM Mar 27 2020, 04:50 PM

|

|

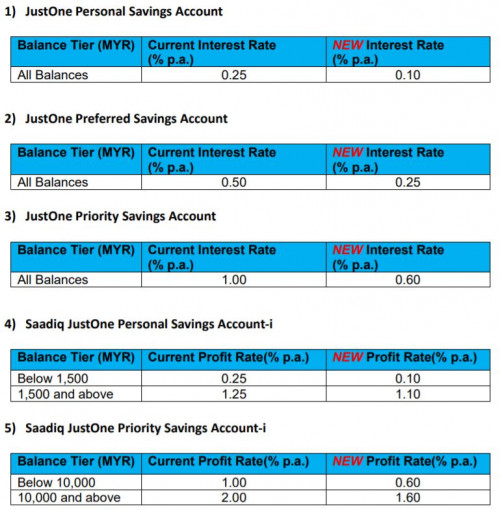

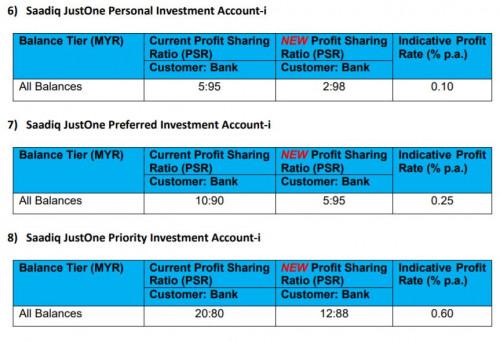

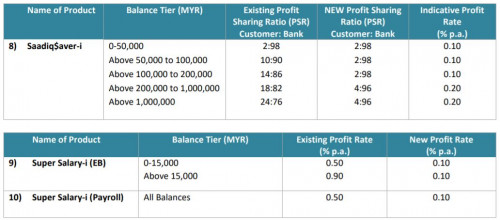

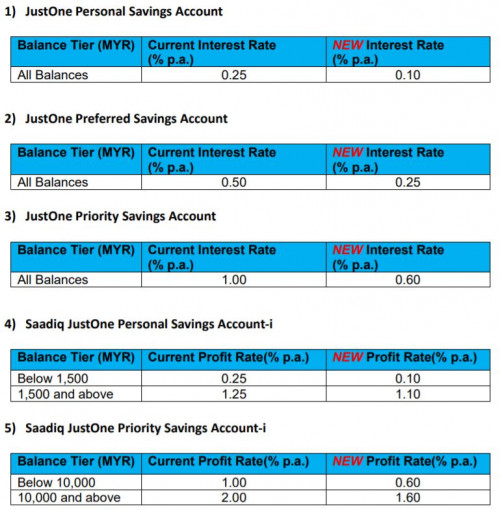

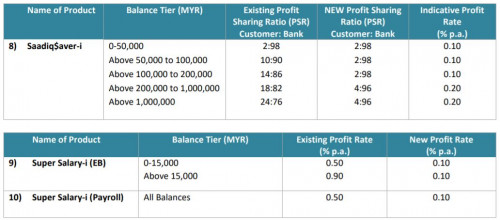

QUOTE(GrumpyNooby @ Mar 27 2020, 07:54 AM) REVISION OF JUSTONE INTEREST/PROFIT RATE/ PROFIT SHARING RATIO Kindly be informed that the interest/profit rate/profit sharing ratio (PSR) for JustOne Accounts will be revised as follows. All other product features, fees and charges will remain unchanged. EFFECTIVE DATE: 17 APRIL 2020 EFFECTIVE DATE: 1 MAY 2020 EFFECTIVE DATE: 1 MAY 2020 https://av.sc.com/my/content/docs/my-revisi...profit-rate.pdf https://av.sc.com/my/content/docs/my-revisi...profit-rate.pdfThis is the ethical business that will give us notice, not like OCBC is immediate effect...  |

|

|

|

|

|

mamamia

|

Apr 10 2020, 06:15 PM Apr 10 2020, 06:15 PM

|

|

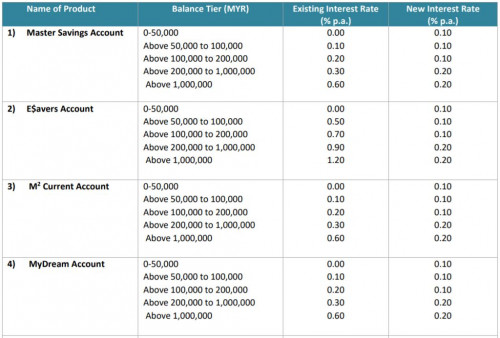

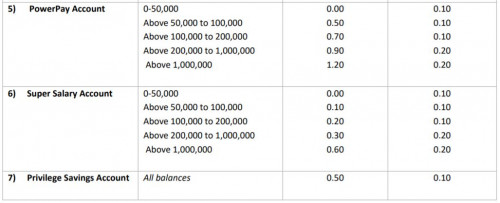

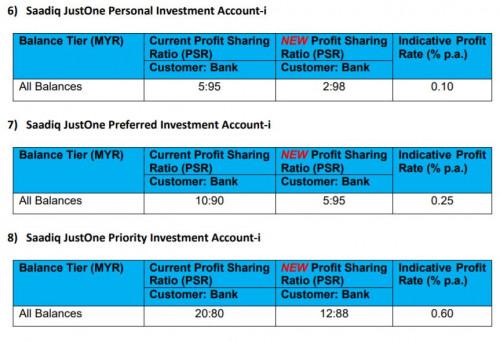

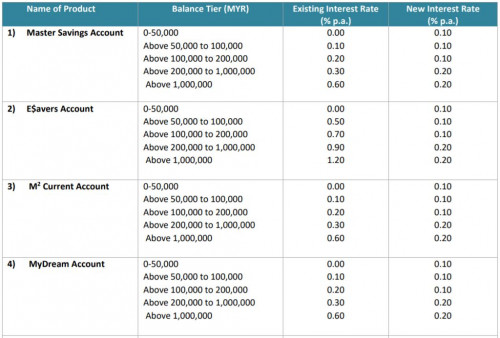

QUOTE(GrumpyNooby @ Apr 9 2020, 08:08 PM) Revision of Product Board Rate and Profit Sharing Ratio (effective 1 May 2020) Kindly be informed that effective 1 May 2020, the board rates for the following products will be revised as follows. All other product features, fees and charges will remain unchanged.    https://av.sc.com/my/content/docs/revision-...aring-ratio.pdf https://av.sc.com/my/content/docs/revision-...aring-ratio.pdfSo PSA will be 3.6% d |

|

|

|

|

|

mamamia

|

Jun 10 2020, 11:49 AM Jun 10 2020, 11:49 AM

|

|

QUOTE(!@#$%^ @ May 20 2020, 10:45 PM) takut although i open in May, they still count Jan to April MAB as 0. otherwise i tunggu 1st july only open. i think if u open the account due to the interest rate, u should have enough money to keep in there... RHB Smart Account seem like can open online, no need to walk in branch... is their debit card also will courier to us? any charges for the debit card? Wonder anyone try to open online b4 QUOTE Base Rate

Maintain a minimum account balance of RM1,000 and get 0.25% p.a. on your daily account balance

Base Rate is calculated daily and credited monthly.

Bonus Payout

Deposit a minimum account balance of RM2,000 monthly to get 2.00% p.a.* and to qualify for other bonus payouts.

Pay a minimum of 3 bills monthly via RHB Now Internet or Mobile Banking and get 0.5% p.a.*

Spend a minimum of RM1,000 monthly using your RHB Credit or Debit Card and get 0.5% p.a.*

Invest a minimum of RM1,000 monthly with selected RHB investment products and get 1.0%**

Terms & Conditions:

*Bonus payout based on monthly average account balance up to RM100,000

** Bonus payout based on 1.0% of net investment amount.

Bonus Payout earned will be credited on 15th calendar day of the next occurring month subject to criteria met. |

|

|

|

|

|

mamamia

|

Jul 30 2020, 10:24 PM Jul 30 2020, 10:24 PM

|

|

QUOTE(CPURanger @ Jul 30 2020, 07:52 PM) Regarding Standard Chartered (SC), I just opened PSA recently at SC Subang Jaya and have been offer for RM70k in FD with 2.9%, RM30K in PSA with 2.1%. Yes, it is not advertise, have to go branch to enquire. Need to have RM 100K in SC account for at least 14 days to apply. Offer ends at end of August. Y PSA only 2.1% and not 3.6%? |

|

|

|

|

|

mamamia

|

Sep 16 2020, 05:26 PM Sep 16 2020, 05:26 PM

|

|

For RHB smart account, can I open it at Islamic branch? Nearby my area have a RHB Islamic

|

|

|

|

|

|

mamamia

|

Sep 16 2020, 05:31 PM Sep 16 2020, 05:31 PM

|

|

QUOTE(!@#$%^ @ Sep 16 2020, 05:30 PM) sure. there're conventional and islamic versions of smart account. Thanks, so, both conventional & Islamic also same tnc ? Do I need to get Islamic credit card too? |

|

|

|

|

Jul 4 2019, 11:39 PM

Jul 4 2019, 11:39 PM

Quote

Quote

0.0438sec

0.0438sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled