I use to buy unit trust. Cheaper than using public mutual

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Aug 13 2024, 09:34 PM Aug 13 2024, 09:34 PM

|

Senior Member

1,362 posts Joined: Sep 2013 |

I use to buy unit trust. Cheaper than using public mutual

|

|

|

|

|

|

Aug 18 2024, 02:29 AM Aug 18 2024, 02:29 AM

Show posts by this member only | IPv6 | Post

#30822

|

Junior Member

321 posts Joined: Jan 2013 |

QUOTE(guanteik @ Jun 13 2024, 11:27 AM) Finally I got the answer from experience, and would like to share it here. The process to transfer-out from FSM is completely manual as below Since it's such a hassle to transfer, isn't it easier to do an online liquidation? What is the benefit of transfer out to make you prefer to go through the hassle?1. Print out the transfer-form, fill up together with IC and send it back to the FSM office. Make sure you use a fast postage like NinjaVan or Poslaju. Eta ~2 work days 2. Once FSM received the form, someone will call for verification based on what you had written in the "reason of transfer out". Make sure you have USD $2 / counter filled in the form in your Cash Account (and not the Sweep Account). Eta ~5 work days 3. Once you noticed USD has been deducted from your Cash Account, that's when the start of the position transfer to the DTC. Be prepared for another ~10 work days. 4. Receiving broker will verify the incoming positions. ETA ~5 work days. Summing up these ETAs, it's no wonder taking 4-6 weeks as listed in their process. 4-6 weeks indeed quite a long process because we could have not wanting to hold on to the positions or missed out the dividend reinvestments offered by the receiving broker. On the same day, I had also submitted a transfer-out from another broker, the whole process got completed within 2 weeks. Hopefully this is insightful for those needed the information. |

|

|

Aug 18 2024, 08:28 AM Aug 18 2024, 08:28 AM

|

All Stars

14,857 posts Joined: Mar 2015 |

QUOTE(lioncarlsberg @ Aug 18 2024, 02:29 AM) Since it's such a hassle to transfer, isn't it easier to do an online liquidation? What is the benefit of transfer out to make you prefer to go through the hassle? While waiting for his response, My wild guess, Could it be due to the saving? Will there be transaction cost incurred to liquidate and buy it again? Will there be forex exchange related cost when having that currency converted during inbound and outbound again? |

|

|

Aug 18 2024, 11:27 AM Aug 18 2024, 11:27 AM

Show posts by this member only | IPv6 | Post

#30824

|

Junior Member

321 posts Joined: Jan 2013 |

QUOTE(MUM @ Aug 18 2024, 08:28 AM) While waiting for his response, There should not be any charges upon liquidation. However, to use the proceeds to then purchase a new batch of funds would incur the sales charges.My wild guess, Could it be due to the saving? Will there be transaction cost incurred to liquidate and buy it again? Will there be forex exchange related cost when having that currency converted during inbound and outbound again? |

|

|

Aug 18 2024, 08:57 PM Aug 18 2024, 08:57 PM

|

Senior Member

2,656 posts Joined: Jan 2003 |

QUOTE(MUM @ Aug 18 2024, 08:28 AM) While waiting for his response, You're spot on. My wild guess, Could it be due to the saving? Will there be transaction cost incurred to liquidate and buy it again? Will there be forex exchange related cost when having that currency converted during inbound and outbound again? ioncarlsberg There are charges when liquidating with FSM platform. Not to mention the charges are even higher when I am holding huge positions within FSM. I won't elaborate much on this, please experience the trx on your own. |

|

|

Aug 18 2024, 09:10 PM Aug 18 2024, 09:10 PM

Show posts by this member only | IPv6 | Post

#30826

|

Junior Member

321 posts Joined: Jan 2013 |

QUOTE(guanteik @ Aug 18 2024, 08:57 PM) You're spot on. Thanks for the heads-up bro. It wouldn't have crossed my mind that there are additional charges when liquidating unit trust funds. It's unheard of! The conventional UT's from the banks like CIMB, Public, etc have no hidden charges upon liquidation. I expect nothing worse from FSM.ioncarlsberg There are charges when liquidating with FSM platform. Not to mention the charges are even higher when I am holding huge positions within FSM. I won't elaborate much on this, please experience the trx on your own. |

|

|

|

|

|

Aug 18 2024, 09:57 PM Aug 18 2024, 09:57 PM

Show posts by this member only | IPv6 | Post

#30827

|

Junior Member

321 posts Joined: Jan 2013 |

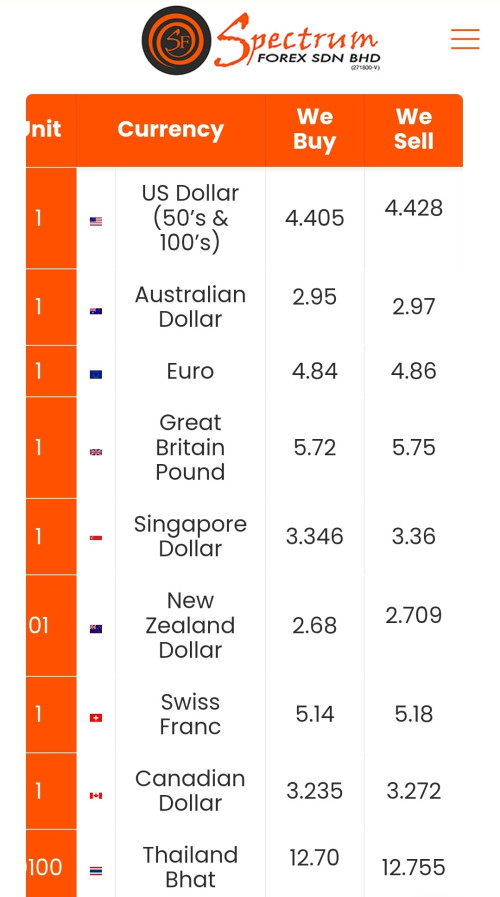

QUOTE(Barricade @ Apr 25 2024, 07:46 PM) Not a good idea. I just tested with RM25k for you guys. Once I deposit it convert to USD5202 which is pretty good rate. But the value in RM dropped to around RM24,700. How is this calculated? FSM sell USD back to MYR rate at 4.75. So unless USD increase, I already lost about RM300 on forex alone. That's about 1%. So unless USD rate improve against MYR, I will be making less than putting in Versa. Based on your calculation, it shows that the Spread on the currency exchange is about 1% (4.75 Buy and 4.8 Sell). Compare this to Versa or others, what are they charging on the Spread? We should also compare with the actual money changers in Mid Valley. I have checked from one example "Spectrum" it is showing 4.405 Buy and 4.428 Sell, which is much cheaper at about 0.5% |

|

|

Aug 19 2024, 05:46 AM Aug 19 2024, 05:46 AM

|

All Stars

14,857 posts Joined: Mar 2015 |

QUOTE(lioncarlsberg @ Aug 18 2024, 09:10 PM) Thanks for the heads-up bro. It wouldn't have crossed my mind that there are additional charges when liquidating unit trust funds. It's unheard of! The conventional UT's from the banks like CIMB, Public, etc have no hidden charges upon liquidation. I expect nothing worse from FSM. I think what forumer "guanteik" posted earlier is not refering to transfer out of unit trust fund purchased and held in FSM platform.Attached thumbnail(s)

|

|

|

Aug 19 2024, 08:27 AM Aug 19 2024, 08:27 AM

Show posts by this member only | IPv6 | Post

#30829

|

Senior Member

6,793 posts Joined: Oct 2008 From: Kuala Lumpur |

QUOTE(lioncarlsberg @ Aug 18 2024, 09:10 PM) Thanks for the heads-up bro. It wouldn't have crossed my mind that there are additional charges when liquidating unit trust funds. It's unheard of! The conventional UT's from the banks like CIMB, Public, etc have no hidden charges upon liquidation. I expect nothing worse from FSM. Of course no liquidation charges for the local unit trust fund. However you can't say the same for overseas ETFs especially when you convert back the currency to MYR. |

|

|

Sep 5 2024, 01:25 PM Sep 5 2024, 01:25 PM

|

Junior Member

472 posts Joined: Jul 2006 |

I'm listening to Bloomberg Business News and heard that Kamala Harris wants t increase the Capital Gain Tax from current 20% to 28%.

Would this affect the US Stocks / ETF that we are buying since ETF dividend has a withholding tax of 30%? Does it mean that when one sells US Stocks / ETF, there would also be a withholding tax of 30% and capital gain tax? |

|

|

Sep 5 2024, 01:57 PM Sep 5 2024, 01:57 PM

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Sitting Duck @ Sep 5 2024, 01:25 PM) I'm listening to Bloomberg Business News and heard that Kamala Harris wants t increase the Capital Gain Tax from current 20% to 28%. withholding tax is for dividends, not capital gains.Would this affect the US Stocks / ETF that we are buying since ETF dividend has a withholding tax of 30%? Does it mean that when one sells US Stocks / ETF, there would also be a withholding tax of 30% and capital gain tax? they are mutually exclusive. As of today, capital gain tax is not applied to foreign investors or foreign persons filling w8-ben form. So, even the 20% was not applied to you as of today. Speculatively speaking, changing it to 28% will unlikely automatically changing the above applicability (to foreign investors). However, any changes to tax structures even if it ONLY affects US entities, will have ripple or rocking effect to the market. Case in Point BRK / Buffet is on a selling spree, ostensibly due to tax structure and looming taxes applied to capital gains of their BRK holdings. So, they have been selling AAPL by the billions and BAC by the billions daily, and you can see it causes the market to move. Normally increase in tax is usually not a great thing for investors and speculators, at least in the short term. Sitting Duck liked this post

|

|

|

Sep 9 2024, 10:31 PM Sep 9 2024, 10:31 PM

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

Sep 20 2024, 02:17 PM Sep 20 2024, 02:17 PM

Show posts by this member only | IPv6 | Post

#30833

|

Junior Member

472 posts Joined: Jul 2006 |

Hi Sifu,

Now that RM is strengthening against USD. What's your strategy on US ETF and stocks? Are you planning to exit from US market and take profit before exchange rate wipe out the profit for the past years. Re-enter once the RM to USD stabilizes or just continue to DCA? My portfolio for US market was having 25% earnings but now down to 15% despite the price at ATH. The gain probably may continue to reduce significantly till end of the year since prediction is that RM will continue to strengthen against USD. My gold portfolio is also taken a small hit due to stronger RM. Despite gold at ATH, the gold price in RM was slightly lower before gold hit ATH. |

|

|

|

|

|

Sep 20 2024, 02:55 PM Sep 20 2024, 02:55 PM

|

Junior Member

112 posts Joined: May 2019 |

QUOTE(Sitting Duck @ Sep 20 2024, 02:17 PM) Hi Sifu, This sounds like you are trying to time the market. I would just DCA.Now that RM is strengthening against USD. What's your strategy on US ETF and stocks? Are you planning to exit from US market and take profit before exchange rate wipe out the profit for the past years. Re-enter once the RM to USD stabilizes or just continue to DCA? My portfolio for US market was having 25% earnings but now down to 15% despite the price at ATH. The gain probably may continue to reduce significantly till end of the year since prediction is that RM will continue to strengthen against USD. My gold portfolio is also taken a small hit due to stronger RM. Despite gold at ATH, the gold price in RM was slightly lower before gold hit ATH. |

|

|

Oct 7 2024, 11:54 AM Oct 7 2024, 11:54 AM

Show posts by this member only | IPv6 | Post

#30835

|

Junior Member

167 posts Joined: May 2019 |

Hi all Sifus here,

Can some one advise me on this fund ? "AHAM World Series - Global Disruptive Innovation Fund - MYR Hedged" I am still holding 15K (rm) and facing " - 55% " lost in my portfolio. I hold the fund for almost 3 years! Shall i cut lost now ? or wait for better NAV ? ( wonder this fund can perform or not ?? ) |

|

|

Oct 7 2024, 12:02 PM Oct 7 2024, 12:02 PM

Show posts by this member only | IPv6 | Post

#30836

|

Junior Member

458 posts Joined: Mar 2005 From: home |

QUOTE(yycclin @ Oct 7 2024, 11:54 AM) Hi all Sifus here, If I were you, I will cut lost immediately. Dont think those Innovation Fund will ever come back up.Can some one advise me on this fund ? "AHAM World Series - Global Disruptive Innovation Fund - MYR Hedged" I am still holding 15K (rm) and facing " - 55% " lost in my portfolio. I hold the fund for almost 3 years! Shall i cut lost now ? or wait for better NAV ? ( wonder this fund can perform or not ?? ) I did cut lost on few funds I bought during covid time, I think same period like you. Use that money to DCA into few of the most popular US ETF, using IBKR. Higher chance to have return. yycclin liked this post

|

|

|

Oct 7 2024, 12:09 PM Oct 7 2024, 12:09 PM

|

All Stars

14,857 posts Joined: Mar 2015 |

QUOTE(yycclin @ Oct 7 2024, 11:54 AM) Hi all Sifus here, How much is this fund (with the current value), now stands in your whole ut portfolio?Can some one advise me on this fund ? "AHAM World Series - Global Disruptive Innovation Fund - MYR Hedged" I am still holding 15K (rm) and facing " - 55% " lost in my portfolio. I hold the fund for almost 3 years! Shall i cut lost now ? or wait for better NAV ? ( wonder this fund can perform or not ?? ) I mean this fund is now with the current value is how many % of your portfolio? Do you hv any more thus type of highly focused fund in your ut portfolio? |

|

|

Oct 7 2024, 01:45 PM Oct 7 2024, 01:45 PM

Show posts by this member only | IPv6 | Post

#30838

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(MUM @ Oct 7 2024, 12:09 PM) How much is this fund (with the current value), now stands in your whole ut portfolio? ..I am having 100k RM on my portfolio now.I mean this fund is now with the current value is how many % of your portfolio? Do you hv any more thus type of highly focused fund in your ut portfolio? Shall I wait for better NAV? |

|

|

Oct 7 2024, 01:53 PM Oct 7 2024, 01:53 PM

|

All Stars

14,857 posts Joined: Mar 2015 |

QUOTE(yycclin @ Oct 7 2024, 01:45 PM) 15k initial, now is balance 6750 (after -55% losses).6750 out of 100k portfolio is abt 6.75%. If there is no more highly focused sectorial or country specific fund in my portfolio, I will just keep this 6.75% fund in my portfolio as my risk appetite still allows it. |

|

|

Oct 7 2024, 01:59 PM Oct 7 2024, 01:59 PM

Show posts by this member only | IPv6 | Post

#30840

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(MUM @ Oct 7 2024, 01:53 PM) 15k initial, now is balance 6750 (after -55% losses). Alright, thanks bro.6750 out of 100k portfolio is abt 6.75%. If there is no more highly focused sectorial or country specific fund in my portfolio, I will just keep this 6.75% fund in my portfolio as my risk appetite still allows it. yycclin liked this post

|

| Change to: |  0.0329sec 0.0329sec

0.55 0.55

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 06:35 AM |