Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

buffa

|

Mar 6 2021, 05:49 PM Mar 6 2021, 05:49 PM

|

|

Hi, I am new to this fsmone. Wanna ask regarding the fees for some UT.

There is one annual management fees 1.5%,

Annual expense ratio 1.61%, trustee fee 0.07% above 18k.

Does that mean total fees are 3.18%?

|

|

|

|

|

|

buffa

|

Mar 6 2021, 06:22 PM Mar 6 2021, 06:22 PM

|

|

QUOTE(MUM @ Mar 6 2021, 06:05 PM) The annual management fees 1.5% & trustee fee 0.07% above 18k......they are the fees that you don't feel or need to pay from your pocket annually. they are computed daily, minused daily and reflected in the daily NAV...in which the NAV are where you calculates your actual returns... Does that mean total fees are 3.18%? no,...as this in ratio "Annual expense ratio 1.61%", Sales charge or (if any redemption fees) are the fees that you need to pay from your cash Thanks for the detailed reply. I hope I understand that mean the total fees are actually 1.61% (averaged yearly) calculated and minus out daily 1.61%/365 in NAV? |

|

|

|

|

|

buffa

|

Mar 11 2021, 10:37 AM Mar 11 2021, 10:37 AM

|

|

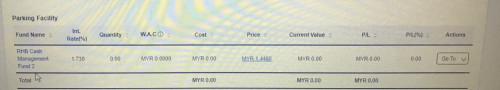

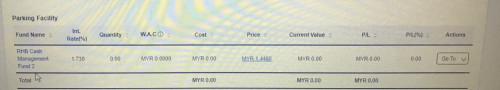

Hi, wanna ask. I used my EPF to purchase a fund, and now it has appeared in my FSM account/epf i akaun.

I notice that from FMSONE, there is Parking Facility under my EPF investment. May I know what is it about? I saw there is int. rate 1.73%, does it mean it will charged 1.73% on this UT's profits or anything?

|

|

|

|

|

|

buffa

|

Mar 11 2021, 10:55 AM Mar 11 2021, 10:55 AM

|

|

QUOTE(CSW1990 @ Mar 11 2021, 10:47 AM) Do you mean this? This is the MMF You can park cash into it to get projected 1.73% rate Not related to your EPF Purchased fund.  Ya, this is it. Mine appear together with my EPF UT. and the amount is exactly same as my EPF's UT. I think I just ignore it, thanks. This post has been edited by buffa: Mar 11 2021, 10:56 AM |

|

|

|

|

|

buffa

|

Mar 19 2021, 09:01 AM Mar 19 2021, 09:01 AM

|

|

Not bad. Rakuten app not so professional polished. Only touch id, no faceid login. I might slowly shift from rakuten to fsm.

|

|

|

|

|

|

buffa

|

Mar 19 2021, 09:36 AM Mar 19 2021, 09:36 AM

|

|

One question, i have cds acc from rakuten, i still need register new cds acc with fsm?

|

|

|

|

|

|

buffa

|

May 8 2021, 11:57 AM May 8 2021, 11:57 AM

|

|

QUOTE(CSW1990 @ May 5 2021, 04:51 PM) Looks like another big correction is on the way ... hold cash and wait opportunity The problem is we wont know when is the timing to enter  I think i will slowly DCA |

|

|

|

|

|

buffa

|

Oct 5 2021, 04:00 PM Oct 5 2021, 04:00 PM

|

|

QUOTE(ragk @ Oct 5 2021, 03:46 PM) FSM can do that for us right? Many other platform i found require u to convert by ur self from MYR to USD (e.g. use 3rd party transfer or open foreign acc) and thn transfer to them Ya, I top up using RM, then convert RM into USD under FSMone app. The convert is instant. Anyone buying US ETF using FSMone? Why seem like no one discussing it? Is it because slightly expensive charges? |

|

|

|

|

|

buffa

|

Oct 6 2021, 03:11 PM Oct 6 2021, 03:11 PM

|

|

QUOTE(jimhorn @ Oct 6 2021, 03:04 PM) I'm interested too but being able to only buy during US market opening times which is 1030pm to 6am Malaysia time is abit troublesome for me. FSM still hasn't introduced the ability to lock orders in advance for the next X number of days right? Nowadays is 9:30pm start, I think next mth will be 10:30, their daylight saving thing. Ya, only during that trading day, then it will auto expired. |

|

|

|

|

|

buffa

|

Oct 6 2021, 03:25 PM Oct 6 2021, 03:25 PM

|

|

QUOTE(xander83 @ Oct 6 2021, 03:18 PM) Can set advance buy day time unless you want live market buy  Is it? Mind to show how? It will be very useful if can set advance buy for US stock. |

|

|

|

|

|

buffa

|

Oct 6 2021, 03:39 PM Oct 6 2021, 03:39 PM

|

|

QUOTE(TOS @ Oct 6 2021, 03:31 PM) Not sure if I am understanding correctly. I think I am using limit order currently. This limit order can only be set once trading day started and will expire at the end of the day. I was asking is there any way to like set buy order before US stock market open. |

|

|

|

|

|

buffa

|

Oct 11 2021, 12:12 PM Oct 11 2021, 12:12 PM

|

|

QUOTE(mois @ Oct 11 2021, 10:36 AM) This is crazy. But how does RM to US conversion work in fsm? ya, USD8.8 per trade. If prepare to hold long term and 1k USD amount per trade. It is decent imo. Checked with my money changer friend, he said the FX conversion rate (RM to USD) given by FSMone is reasonable. |

|

|

|

|

|

buffa

|

Oct 11 2021, 02:36 PM Oct 11 2021, 02:36 PM

|

|

QUOTE(xander83 @ Oct 11 2021, 01:57 PM) Of course better than money changer with markup worse than banks spot rate  But be prepared to pay 2% more than spot rate if anyone DCA  Now fsmone exchange from rm to usd is 1:4.1917 Google the rm to usd 4.169. So the different is around 0.5% Not the 2% you mention. Unless the google rate is wrong too? Then i wonder where you get your rate to compare with fsmone? |

|

|

|

|

|

buffa

|

May 22 2023, 11:25 PM May 22 2023, 11:25 PM

|

|

Been using fsmone RSP for US ETF for a year, weekly contributions with the free process fees promotion last time.

Gonna change to RSP monthly with the process fees.

Anyone also doing RSP with fsmone?

|

|

|

|

|

|

buffa

|

May 23 2023, 09:57 AM May 23 2023, 09:57 AM

|

|

QUOTE(Ramjade @ May 23 2023, 12:06 AM) You can rsp with interactive broker. Cheaper too. Not to mentioned you got access to fractional shares. https://ibkr.info/article/4470I just opened IBKR account few months ago. So far what I found for RSP US ETF is IBKR = MYR > SGD > USD then invest, compare to FSMOne = MYR > USD then buy. Seem like FSMone is easier, and the foreign exchange rate for USD are same as what I can google. Both charges 1USD for each RSP, same commission. I guess both of them are similar for RSP US ETF? Except IBKR can buy/sell US share easily and cheaper. Do I miss anything? |

|

|

|

|

|

buffa

|

May 30 2023, 10:29 PM May 30 2023, 10:29 PM

|

|

QUOTE(Sitting Duck @ May 30 2023, 09:44 PM) I was doing RSP bi-weekly for US ETF for the past year due to free process fee during promotion and have now changed to monthly as well. I am just wondering how much process fee going forward since i only invest small amount monthly. I hope the process fee wouldn't be too high. If it's more than 1% of my invested amount, I probably would change the RSP to Principle Global Titan fund. USD1.00 process fees USD0.22 stamp duty Total USD 1.22 for each rsp etf transaction. FYI, i used to put rm200 weekly when free. Now i am gonna put rm800 monthly. |

|

|

|

|

|

buffa

|

Aug 23 2023, 09:52 AM Aug 23 2023, 09:52 AM

|

|

QUOTE(melondance @ Aug 22 2023, 06:30 PM) I don't think its as bad as 2% currently. But you may check again.. Wise & IBKR transfer isn't that great too nowadays MYR to USD has variable fee of 0.68% and USD to MYR has 0.61%.  Currently, you convert RM > USD > RM in FSMOne, RM1000 turns into RM987. (Conversion only as no USD transfer is involved) In Wise, RM > USD (Transfer), then USD > RM (Conversion), RM1000 turns into RM985. (without covering incoming Wire fee into Wise) Just ignore that fellow. He has been spiting wrong info about high FX rate for fsmone. I calculate before, for fsmone myr to usd compare to WISE, the final USD different is less than 0.5%. |

|

|

|

|

|

buffa

|

Sep 1 2023, 04:37 PM Sep 1 2023, 04:37 PM

|

|

QUOTE(anakkk @ Sep 1 2023, 02:13 PM) anyone traded US etf on FSMone? Me doing RSP US etf. |

|

|

|

|

|

buffa

|

Mar 11 2024, 05:18 PM Mar 11 2024, 05:18 PM

|

|

QUOTE(damien5119 @ Mar 11 2024, 03:12 PM) Looking for some advise. I want to start putting money into VOO and VUSXX. Is FSM the lowest fees platform vs stashaway, versa, moomoo? I dont mind manually purchasing it every month or quarter, but RSP sounds convinient. Been using the FSMone RSP buying VOO and VT since May 2022. The current RSP is just RM1 or 0.08% + Malaysia stamp duty. What I like fsmone is it is very easy to check the purchase history. Suitable for ppl to buy and hold like me. I also have IBKR sg, but it has so many thing, I dont really know how to use it  |

|

|

|

|

|

buffa

|

Apr 8 2024, 01:38 PM Apr 8 2024, 01:38 PM

|

|

QUOTE(chrisderick88 @ Apr 7 2024, 10:36 PM) agreed, I'll DYI on that. Now I'm at -4%, contemplating if I should sell. I just sold my StashAway not long ago, all red. And bought SG bank stock. Best decision ever, i dont have to keep seeing those red, and the SG bank stock are green now. And at least i can get those cold hard dividend from bank stock, if they ever go red too. This post has been edited by buffa: Apr 8 2024, 01:39 PM |

|

|

|

|

Mar 6 2021, 05:49 PM

Mar 6 2021, 05:49 PM

Quote

Quote

0.0607sec

0.0607sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled