QUOTE(lc115 @ Jan 21 2021, 10:41 AM)

Great ! Which fund house offer 0% S charge ? Tks.FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jan 21 2021, 10:51 AM Jan 21 2021, 10:51 AM

Return to original view | Post

#1

|

Junior Member

167 posts Joined: May 2019 |

|

|

|

|

|

|

Jan 21 2021, 02:53 PM Jan 21 2021, 02:53 PM

Return to original view | Post

#2

|

Junior Member

167 posts Joined: May 2019 |

|

|

|

Jan 22 2021, 05:38 PM Jan 22 2021, 05:38 PM

Return to original view | Post

#3

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(yklooi @ Jan 22 2021, 02:51 PM) you are lucky to have bought in later part of 2020, if you happened to invest in Feb 2020, .try look back the performance during mid Feb till End Mar period to see and have a feel of what is it like to see your EPF money used to buy UT had encountered 20~30% losses in just 1month +... what would you do if you see losses like that again in the near future? will you HOLD, SELL or BUY more if you see your investment nose dived by 15~20% in a matters of weeks? 2018 happened and 2020 also happened.... those believers would says....it will come back up in a matters of months.... well, that was PAST,...what will happens to your emotions if it stayed down for sometime longer? well again, if that is not a problem......then buy all means do as you liked to do now....focusing on your currently selected funds I had a very BAD experience with my advisor. In April 2020, I lost about 24K in paper ( my investment value was about 160K, after 10 years of investment thru EPF account investment ). I know nuts about mutual fund and never monitor my investment at all during that 10 years. It was like giving the money to my advisor and he play the game totally. I trust him and thinking that he will make some $ to me in MF. Until 1 day ( in April 2020) my friend who is good in MF investment ( i think ) explained to me that my investments ( 5 funds ), which were under performed for 3 consecutive years ! OMG ! When i checked with my advisor he told me, up and down in MF is common, advised me to do nothing and wait for market to rebound. ;( Immediately i sold all of them ( lost of 24K, of course main reason was due to Covid19 ! ) and follow my friend's advise to buy Technology, Healthcare, AI funds. I start my own investment since May 2020 and now i recovered back my 24K and still making profit now I must thank my friend who advised me to make the change. and i am lucky that during the Pandemic, i can still made some money |

|

|

Feb 2 2021, 10:03 AM Feb 2 2021, 10:03 AM

Return to original view | IPv6 | Post

#4

|

Junior Member

167 posts Joined: May 2019 |

|

|

|

Feb 2 2021, 12:07 PM Feb 2 2021, 12:07 PM

Return to original view | Post

#5

|

Junior Member

167 posts Joined: May 2019 |

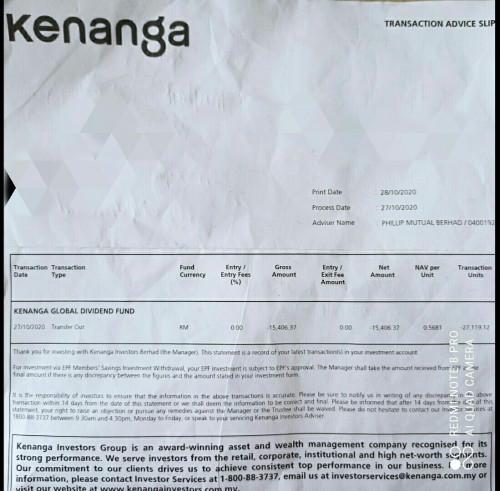

QUOTE(yklooi @ Feb 2 2021, 10:04 AM) Any1 experienced this before on eUnittrust ?Fund : Kenanga Global Dividend Fund. Problem : Phillip Mutual reduced my profit due to transfer of acct from different fund house. ( Kenanga to eUnittrust ) Reason : I cant do online redemption/ switching to other fund. 3 months ago, i requested to transfer all my amount from EPF acct (1000xxxxx) to cash acct ( 9000xxxx ). I received a Transaction Advised Slip from Kenanga Investors Berhad showing the details as below : Date : 27/10/2020 Total unit transferred : 27,119.12 NAV : 0.5681 Market value : 15,406.37 When the amount successfully transferred to my Cash Acct in eUnittrust, the market value dropped ( why not follow the amount that was transferred out by Kenanga ?) from RM 15,406.37 to RM 15,000.00 Any1 can enlighten me why the market value dropped for the above situation ? I am not very convinced from their reply. TQVM. ** replied by Phillip Mutual ** Please be informed that the transfer amount RM15,000.00 is your principal while your market value is RM15,528.41 (RM528.41 is unrealised profit) as per our image. You have redeem 17,000 units amount RM9,350 on 30/10/2020. You balance units is 10,119.12 and balance Principal is (RM15,000- rm9,350) RM5,650. On 10/11/2020 you have top up your investment RM1,300 after 1.50% sales charge nett investment is RM1,280.79 units 2,124.73 at price 0.6028. Subsequent investment on 10/11/2020 RM1,280.79 / 0.6028 = 2,124.73 units Latest market value 2,124.73 units x 0.6239 (latest price) = RM1,325.61 RM1,325.61 - Principal RM1,280.79 = RM44.82 (unrealised profit) Balance units before subsequent 10,119.12 units x 0.6239 (latest price) = RM6,313.31 RM6,313.31 – Principal RM5,650 = RM663.31 (unrealised profit) Your enquiry regarding the different RM406 is unrealised profit as at current price. Due to the price is up trend for this fund your unrealised profit is grow from RM406 to now RM663.31 Trust the above clarifies. For further information, you can contact our customer service at 03-2783 0300 or email us at phillipmutual@poems.com.my. Thank you. Regards, Phillip Mutual Berhad B-2-7, Block B Level 2 Unit 7, Megan Avenue II No. 12 Jln Yap Kwan Seng  Attached thumbnail(s)

|

|

|

Feb 2 2021, 11:39 PM Feb 2 2021, 11:39 PM

Return to original view | Post

#6

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(MUM @ Feb 2 2021, 01:17 PM) plus there are this possibility to be considered too...(either 1 or both??) Exit Fee 1.0% p.a. of the NAV per Unit, within 90 calendar days after investing in the Fund Switching Fee 1.0% p.a. of the NAV per Unit, within 90 calendar days of switching out of the Fund The problem is everytime i call cust service, they never mentioned about switching, transfer or exit fees !!! They keep on explaining that they are taking the average cost ( from my past few buy prices and divide equally ), then only can transfer to my cash account.. It looks like they are not familiar to handle this case ;( Still not satisfied with their answer, I am not buying / top up to the fund, right ? Todate, they have sent 2 emails to me and keep on explaining how they calculate the average NAV, feuh...... My total holding units ( 27,119.12 ) during the request week ( before the transfer )was never changed. Meaning they took NAV = 0.5531 in order to get the amount RM15,000.00. Now, the NAV was never at 0.5531, 5 days before and after the transfer date ??? I feel like kena cheated ;( ;( What do you think all the sifu here ? |

|

|

|

|

|

Feb 3 2021, 10:10 AM Feb 3 2021, 10:10 AM

Return to original view | Post

#7

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(MUM @ Feb 2 2021, 11:45 PM) not sure when they actually did the transaction. Tks, bro.you need to find out the actual date of transaction and the actual NAV value they use to do the transaction. btw, did you kena the EXIT fees? I dont received any charges from eUnittrust after the transfer.. As shown in my attached doc, the processed date was 27/10/20..I believed transaction done on that day. I dont understand why they want to use Average NAV, any Sifu can enlighten me ? I tot whatever amount/ units that transfered out from Kenanga, the same nos will be credited to my cash Account, Very confused ??? |

|

|

Feb 3 2021, 11:37 AM Feb 3 2021, 11:37 AM

Return to original view | Post

#8

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(MUM @ Feb 3 2021, 10:47 AM) mind clarifying ...from your earlier post.. I bought the Kenanga fund thru I-Accout from EPF online.( EPF Platform )"....When the amount successfully transferred to my Cash Acct in eUnittrust, the market value dropped..." this CASH a/c in eunit trust is meant Kenanga Global Dividend Fund in cash form ? (you converted from EPF to cash (of this Kenanga Global Dividend Fund?) which mean from Kenanga Global Dividend Fund in EPF form (bought from Kenanga Investment NOT through Eunitrust) to Kenanga Global Dividend Fund in cash form from Eunittrust platform? I request the transfer simply because i want to cut/ redeem 50% of the fund ( Kenanga ) and use that amount to buy other new fund.. But as my fund was in EPF account ( Eunittrust, acct no - 1000xxxx ), I was not allow to do online redemption, unless i convert it to eUnittrust Cash Acct. This conversion can only be done by going to their office and sign the hard copy forms.( to transfer total amount from eUnittrust EPF acct to eUnittrust Cash Acct ) after approval and the money is successfully parked at eUnittrust Cash Acct, then only I can do online redemption. I went to eUnittrust office ( 19/10 or 20/10, cant remember the actual date )and filled up the transfer forms as requested. after few days, when i see the money/ fund appeared in my eUnittrust Cash Acct, I performed online redemption immediately without realizing there was a dropped in "Market Value" Thats how the problem come in...Customer service try to explain to me about the unrealising profits,, making me more confused |

|

|

Feb 3 2021, 12:37 PM Feb 3 2021, 12:37 PM

Return to original view | Post

#9

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(MUM @ Feb 3 2021, 12:28 PM) you redeemed partially that Kenanga Global Dividend fund that you bought with EPF money ......then have that redeemed money parked in Cash A/c in Eunittrust platform. i think there is actually an increase not a drop..... I was having the same thought as you.,, waiting for the money RM 15,406.37 to be in. BUT when it appeared in my Cash Acct, it was only RM 14,999.95 !!! ( again my mistake that did not check carefully This is the point why eUnittrust not giving me RM 15,406.37 ( which was transferred out and suppose to be transferred in !! ) Sorry for my stupid question |

|

|

Feb 4 2021, 09:43 PM Feb 4 2021, 09:43 PM

Return to original view | Post

#10

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(yklooi @ Jan 28 2021, 09:13 PM) looks like part of Sui Jau's blog posting (in blue) applies.... Yes, bro"The most important advice I would give to anyone who hasn't started (be it man or woman) and is being held back is to starting investing now, but use a small amount. Something you are comfortable with even if you suffer losses. It can be as little as one thousand dollars because that is usually all you need to start investing into a unit trust. Then, as you invest, you will see how markets and such affect your returns and you will be able to learn from your experiences without suffering too much heartache compared to if you placed your entire life savings into the market and lose half of it in a market crash. The key thing is you have to accumulate investing experience. No amount of prior reading up and accumulating of knowledge can compare with actual investing experience which can only be built up by using your own money to invest. You have to experience the emotional pull that comes from market ups and downs and learn how to handle your emotions during those times. And learning from mistakes made is the greatest teacher." This works very well for me newbie as you mentioned. Even 1k will give you great investing experience. Up down up down,,,,roller coaster |

|

|

Feb 5 2021, 10:02 PM Feb 5 2021, 10:02 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

167 posts Joined: May 2019 |

|

|

|

Feb 5 2021, 10:19 PM Feb 5 2021, 10:19 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

167 posts Joined: May 2019 |

|

|

|

Feb 6 2021, 01:15 PM Feb 6 2021, 01:15 PM

Return to original view | Post

#13

|

Junior Member

167 posts Joined: May 2019 |

I have invested 100k in FSM with 20 funds. Focus on Tech funds, AI, China and Gold. Currently with overall profit of 8% .

Is this healthy ? Btw, I am new investor, need more advise from Sifu here |

|

|

|

|

|

Feb 6 2021, 01:29 PM Feb 6 2021, 01:29 PM

Return to original view | Post

#14

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(ky33li @ Feb 6 2021, 01:17 PM) My portfolio allocation is also based on technology and china specific. Let me guess is your portfolio dragged down by gold? Btw, these my allocation for discussion purposes.Need any improvement ? All comments are welcome Allocation. ■Asia ex Japan 2.84% ■US 10.03% ■China 16.17% ■Malaysia 0.56% ■Greater China 20.25% ■China India 6.55% ■Global 43.60% |

|

|

Feb 7 2021, 08:35 PM Feb 7 2021, 08:35 PM

Return to original view | IPv6 | Post

#15

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(KingArthurVI @ Feb 7 2021, 10:03 AM) I don’t claim to be an expert but after two years with my RM I’m starting to see some pattern.. hoping to learn more by having real experience managing it on my own. I need to do a side by side comparison to figure out what the RM and bank’s commission total is, but before that I wanted to check if anyone in LYN has already done that homework for me 😅 I have been letting my RM to do the investing for almost 10 years and ended up 0 profit !!! due to Pandemic great lost ;( ;(It is clearly a conflicts of interest in my case. I have a feeling he is chasing for his KPI Right now i am doing DIY ( about 6 months now ) and quite happy with the returns I only maintained 25% of my investment with RM. Ultimate goal will go for 100% DIY. Still learning very hard on self-learning and paying tuition fees as well Just 1 thing to check with Sifu here, having a same fund in 2 different fund platforms ( eg. FSM and eUnittrust ) is it advisable / wrong strategy ? rgds. |

|

|

Feb 7 2021, 09:12 PM Feb 7 2021, 09:12 PM

Return to original view | IPv6 | Post

#16

|

Junior Member

167 posts Joined: May 2019 |

Hi all, i attached my portfolio here for discussion, do i need to adjust any percentage ? Any possible improvement ? Tks.

Fund % 1 Affin Hwang Select AP (Ex Jpn) Balanced Fund - MYR 1.3 2 Affin Hwang World Series - Global Disruptive 5.5 3 Innovation Fund - MYR Hedged 15.0 4 AmChina A-Shares - MYR Hedged 5.3 5 Manulife China Equity Fund 6.2 6 Manulife Dragon Growth Fund - MYR Hedged 10.7 7 Manulife Investment Greater China Fund 1.2 8 Pheim Asia Ex-Japan Fund 1.2 9 PMB Shariah Growth Fund 10.8 10 Precious Metals Securities 6.0 11 RHB China India Dynamic Growth Fund 7.0 12 RHB Gold And General Fund 2.5 13 RHB Gold Fund - MYR 7.0 14 RHB Shariah China Focus Fund - MYR 6.2 15 RHB-GS US Equity Fund 3.5 16 TA Global Technology Fund 1.3 17 United Global Quality Equity Fund - MYR Hedged 3.2 18 United Global Technology Fund - MYR 2.3 19 United Global Technology Fund - MYR Hedged 1.3 20 United Golden Opportunity Fund - MYR Hedged 6.0 |

|

|

Feb 7 2021, 09:16 PM Feb 7 2021, 09:16 PM

Return to original view | IPv6 | Post

#17

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(yycclin @ Feb 7 2021, 09:12 PM) Hi all, i attached my portfolio here for discussion, do i need to adjust any percentage ? Any possible improvement ? Tks. Sorry some typo mistake , will repost. SORRY....Fund % 1 Affin Hwang Select AP (Ex Jpn) Balanced Fund - MYR 1.3 2 Affin Hwang World Series - Global Disruptive 5.5 3 Innovation Fund - MYR Hedged 15.0 4 AmChina A-Shares - MYR Hedged 5.3 5 Manulife China Equity Fund 6.2 6 Manulife Dragon Growth Fund - MYR Hedged 10.7 7 Manulife Investment Greater China Fund 1.2 8 Pheim Asia Ex-Japan Fund 1.2 9 PMB Shariah Growth Fund 10.8 10 Precious Metals Securities 6.0 11 RHB China India Dynamic Growth Fund 7.0 12 RHB Gold And General Fund 2.5 13 RHB Gold Fund - MYR 7.0 14 RHB Shariah China Focus Fund - MYR 6.2 15 RHB-GS US Equity Fund 3.5 16 TA Global Technology Fund 1.3 17 United Global Quality Equity Fund - MYR Hedged 3.2 18 United Global Technology Fund - MYR 2.3 19 United Global Technology Fund - MYR Hedged 1.3 20 United Golden Opportunity Fund - MYR Hedged 6.0 |

|

|

Feb 8 2021, 08:50 AM Feb 8 2021, 08:50 AM

Return to original view | IPv6 | Post

#18

|

Junior Member

167 posts Joined: May 2019 |

|

|

|

Feb 8 2021, 11:25 PM Feb 8 2021, 11:25 PM

Return to original view | IPv6 | Post

#19

|

Junior Member

167 posts Joined: May 2019 |

At least 60% of my UT investment are recommendation funds from various fund houses. ( Ifast, eUnittrust, PMO, and FSM )

I this a safe way of investing ? |

|

|

Feb 9 2021, 12:37 AM Feb 9 2021, 12:37 AM

Return to original view | IPv6 | Post

#20

|

Junior Member

167 posts Joined: May 2019 |

QUOTE(T231H @ Feb 8 2021, 11:48 PM) 3 Misconceptions Of FSM Recommended Unit Trusts List Tks bro TH,1. RECOMMENDED UNIT TRUSTS = BEST RETURNS 2. IT'S THE ONLY SET OF UNIT TRUSTS ONE CAN BUY 3. I HAVE TO OWN THEM ALL! read indepth about it... https://www.fsmone.com.my/funds/research/ar...o=6041&isRcms=N Will do my reading |

| Change to: |  0.0753sec 0.0753sec

0.48 0.48

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 03:03 AM |