Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

YoungMan

|

Aug 13 2019, 11:55 AM Aug 13 2019, 11:55 AM

|

|

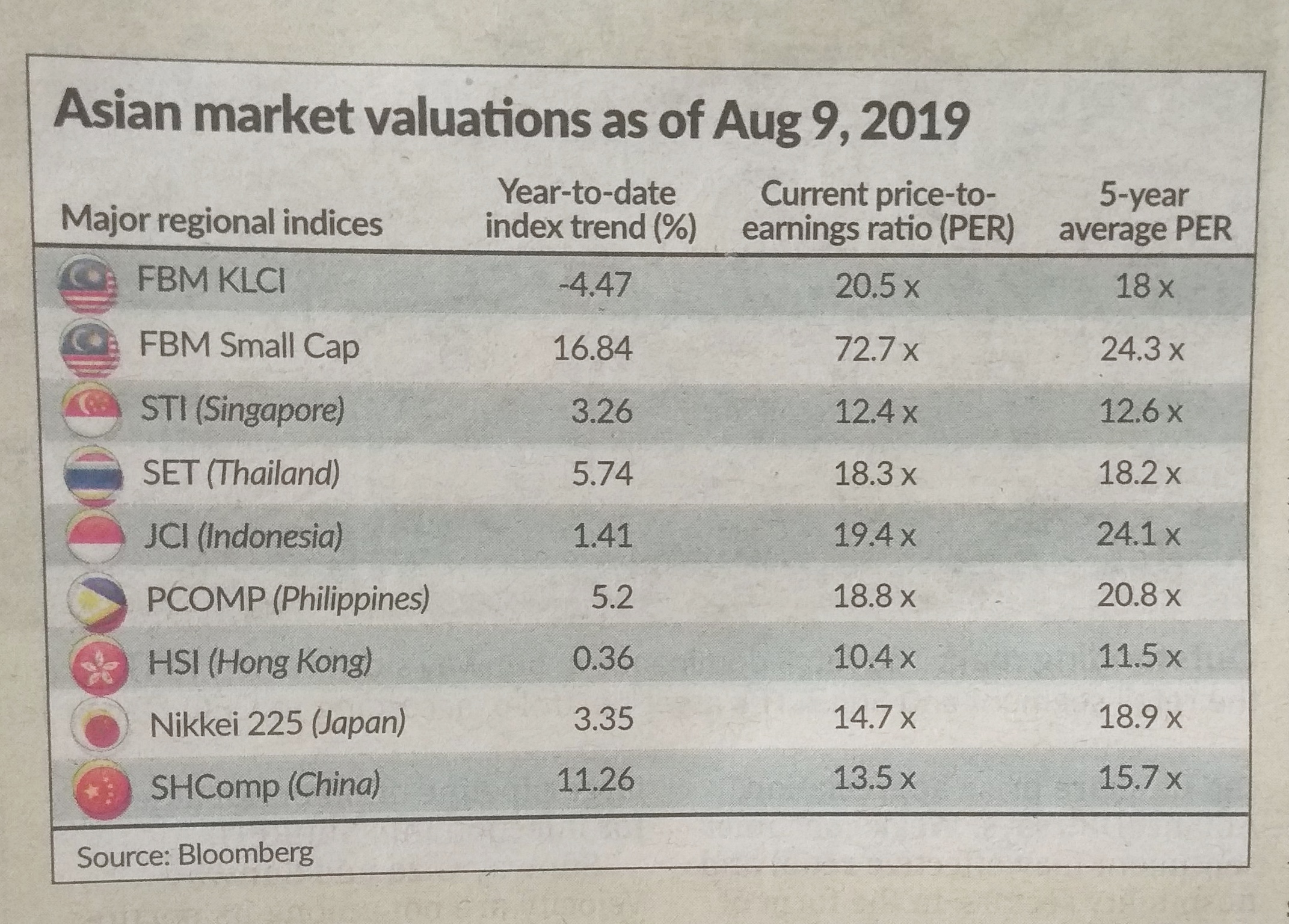

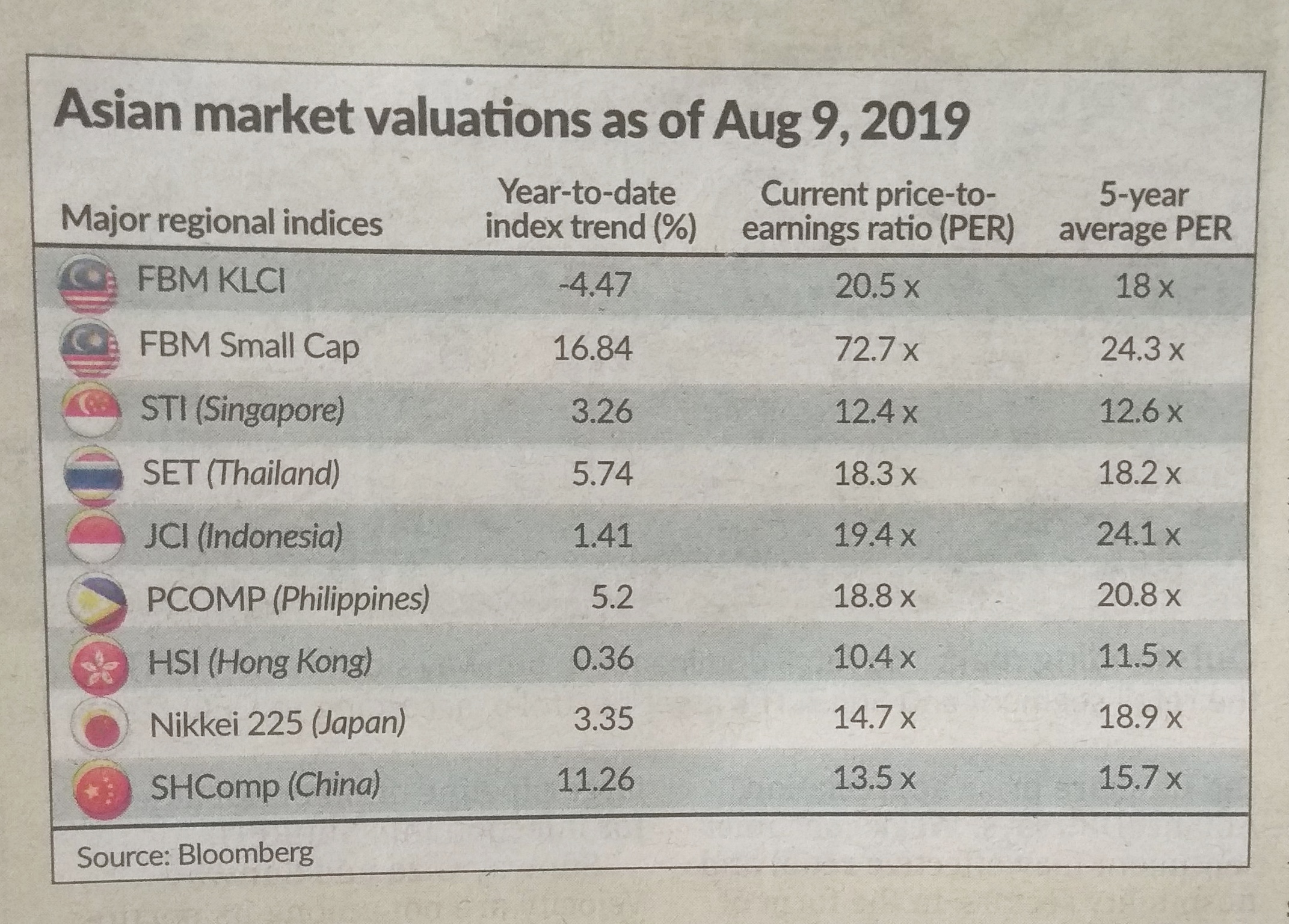

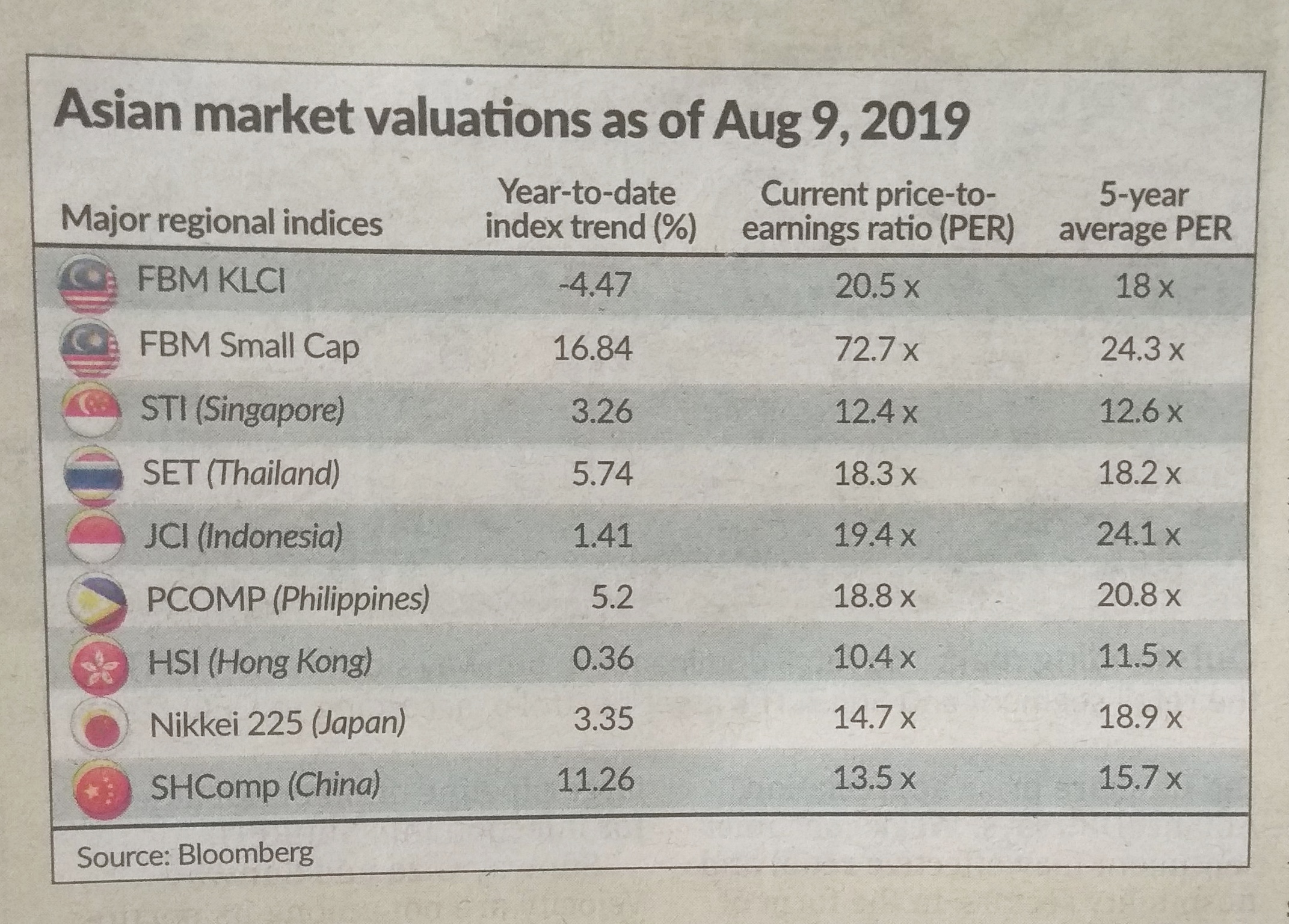

QUOTE(Drian @ Aug 13 2019, 12:32 PM) FSM Balanced return since April 2019 +0.02% Normura i-income return since late May 2019 +4.04% AM Dynamic Bond return since early August 2019 +0.35% Libra Anita Bond Fund return since late May 2019 +2.57% Stashaway ETF, risk index 6.5% since early August 2019 +1.6% Haih, really don't want to keep this managed fund but I need it as a benchmark for my own performance. My guess they are performing poorly because they put in too much allocation to malaysia equity scene which is the worst performing index in Asia.  Picture gotten from here. https://forum.lowyat.net/index.php?showtopi...orst+performingSo for safekeeping the Normura i-income is not bad for the moment? |

|

|

|

|

|

YoungMan

|

Aug 14 2019, 08:28 AM Aug 14 2019, 08:28 AM

|

|

QUOTE(coolguy99 @ Aug 13 2019, 10:26 PM) Not sure. I always thought when interest rate is dropping, currency deteriorating, economy outlook unstable, that is when gold demand will surge as it is deemed as 'safe' investment? Correct me if I am wrong lol But I feel gold is already too high to buy now. Pull back quite substancial amount into AmDynamic bond recently. Let's see in weeks to come how will Equity react to the announcement of tariff delay. |

|

|

|

|

|

YoungMan

|

Aug 15 2019, 12:09 PM Aug 15 2019, 12:09 PM

|

|

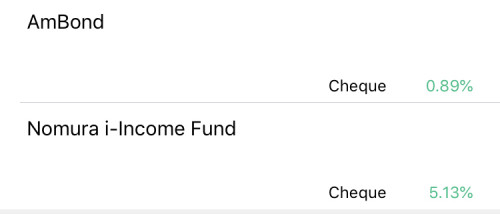

QUOTE(ky33li @ Aug 15 2019, 12:47 PM)  Nomura income fund 5.13% already But those below the income ratio if you buy, will FSM call on you to check? I saw the notice and I backed out from buying. |

|

|

|

|

|

YoungMan

|

Aug 19 2019, 08:15 AM Aug 19 2019, 08:15 AM

|

|

QUOTE(WhitE LighteR @ Aug 18 2019, 11:56 PM) I wouldn't want to touch HK right now. Seems risky. Haha same. I am thinking HK haven't tank enough for us to get in, unless you can take the lost now. |

|

|

|

|

|

YoungMan

|

Aug 19 2019, 07:54 PM Aug 19 2019, 07:54 PM

|

|

QUOTE(xcxa23 @ Aug 19 2019, 05:06 PM) seems like most of the sale charges only 0.5% pretty tempting to go in  My only worry is finding fund which can perform better than EPF now. |

|

|

|

|

|

YoungMan

|

Aug 19 2019, 09:21 PM Aug 19 2019, 09:21 PM

|

|

QUOTE(CardNoob @ Aug 19 2019, 08:55 PM) Nobody is forcing you to participate. EPF is just offering you an option if you wish to diversify as EPF cannot guarantee that they can sustain the payout dividend rate to be always above 6%. Lol I know. The sales charge is damn tempting to not participate. QUOTE(xcxa23 @ Aug 19 2019, 10:04 PM) well, afaik, in their t&c, their promised/guaranteed return is 2.5%, non for syariah compliant or you can try, max out self contribution, 60k/annum then only diy yup.. it was just 5 years back.. which year is that?? As average income earner I can't max out now. Plus once put in have to wait until 55Y to withdraw. |

|

|

|

|

|

YoungMan

|

Sep 4 2019, 08:48 PM Sep 4 2019, 08:48 PM

|

|

QUOTE(Red_rustyjelly @ Sep 4 2019, 08:35 PM) Time to buy back Manulife reits? I still think it is too early to go back in. 90% in bond now. |

|

|

|

|

|

YoungMan

|

Sep 11 2019, 10:18 PM Sep 11 2019, 10:18 PM

|

|

QUOTE(WhitE LighteR @ Sep 11 2019, 06:20 PM) Almost everything is down. Where all the money go to?  even gold gets hammered a lot this 2 days. Wonderring if can still get in since it's lowered. |

|

|

|

|

|

YoungMan

|

Sep 11 2019, 10:51 PM Sep 11 2019, 10:51 PM

|

|

QUOTE(WhitE LighteR @ Sep 11 2019, 11:32 PM) If after this pullback it goes up again, I might consider to add a little more. Coz REIT seems hopeless now  Just look at PRECIOUS METALS SECURITIES for the past 3 business days. It burn alot. |

|

|

|

|

|

YoungMan

|

Oct 24 2019, 08:02 PM Oct 24 2019, 08:02 PM

|

|

RHB Gold no sign of going up...

|

|

|

|

|

|

YoungMan

|

Oct 25 2019, 08:01 PM Oct 25 2019, 08:01 PM

|

|

QUOTE(ctraveller @ Oct 25 2019, 02:16 PM) If you still want, do small amount. Don't be greedy, they said. I already lost 5+% in gold. If it goes down further I might quit and park somewhere. A bit regret I did not park into eastspring small cap. |

|

|

|

|

|

YoungMan

|

Nov 2 2019, 10:17 AM Nov 2 2019, 10:17 AM

|

|

How about small cap fund. Too late to get in now or still got hope? What is your opinion.

|

|

|

|

|

|

YoungMan

|

Jan 28 2020, 07:28 PM Jan 28 2020, 07:28 PM

|

|

QUOTE(xcxa23 @ Jan 28 2020, 06:19 PM) i just lock in profit just before CNY and money just in the rhb cash account. time to do some shopping soon But switching from the RHB cash account took about 1 week plus. Sometimes in dilemma, feels better pay direct using bank. |

|

|

|

|

|

YoungMan

|

Jan 28 2020, 08:48 PM Jan 28 2020, 08:48 PM

|

|

QUOTE(xcxa23 @ Jan 28 2020, 09:15 PM) you meant switch to rhb right? if buy using rhb cash account, there's no need to wait 1 week, it follow their standard cut off time for processing The RHB CMF 2 account can switch to other fund houses that fast? |

|

|

|

|

|

YoungMan

|

Feb 7 2020, 07:36 PM Feb 7 2020, 07:36 PM

|

|

QUOTE(lolwei @ Feb 7 2020, 06:45 PM) Late to the party for CIMB Greater China.  Bought at NAV 1.03 (5th Feb). Same... I also bought atFeb 5 NAV price. Want to go in a day early but too busy with work. |

|

|

|

|

|

YoungMan

|

Feb 19 2020, 02:53 PM Feb 19 2020, 02:53 PM

|

|

Any views on REITs? Will the current low interest rate helps or is REITs not so viable now due to covet.

|

|

|

|

|

|

YoungMan

|

Feb 20 2020, 07:52 PM Feb 20 2020, 07:52 PM

|

|

QUOTE(WhitE LighteR @ Feb 20 2020, 12:14 AM) I sold all my holding in RHB gold. buying at the wrong pricing and seeing it did not perform over the past few months. |

|

|

|

|

|

YoungMan

|

Feb 20 2020, 09:26 PM Feb 20 2020, 09:26 PM

|

|

QUOTE(WhitE LighteR @ Feb 20 2020, 09:18 PM) Gold new high again today. Those holding equity fund keep your attention on high alert. ok. Btw anyone going into REITs? I am eyeing AmAsia Pacific REITs -Class B (MYR) but seems too high now. Looking at its past performance quite good, and not too much exposure into china/HK. This post has been edited by YoungMan: Feb 20 2020, 09:29 PM |

|

|

|

|

|

YoungMan

|

Feb 20 2020, 09:40 PM Feb 20 2020, 09:40 PM

|

|

QUOTE(GrumpyNooby @ Feb 20 2020, 10:30 PM) I have Manulife Investment Asia-Pacific REIT Fund. Just curious, how is the performance so far over the AmFund? Haven't go and look through the factsheet of Manulife REITs. QUOTE(abcn1n @ Feb 20 2020, 10:30 PM) I haven't invested in REITs yet. Am not sure what to buy at the moment. Guess will take my time to investigate what is suitable Nvm. Just want to look for opinion. |

|

|

|

|

|

YoungMan

|

Feb 20 2020, 10:43 PM Feb 20 2020, 10:43 PM

|

|

QUOTE(pisces88 @ Feb 20 2020, 11:34 PM) true. Im also concerned on China n HK reits. So I'm ok with Amasia's REITs, 2%+ in china.  still ok laa This Am Asia REITs is heavy on Singapore. Though interest rate lower but the return last year is very good. I just do not see any temporary going down, so guest have to enter little by little, testing water. |

|

|

|

|

Aug 13 2019, 11:55 AM

Aug 13 2019, 11:55 AM

Quote

Quote

0.0476sec

0.0476sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled