Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

guanteik

|

Apr 19 2024, 05:45 PM Apr 19 2024, 05:45 PM

|

|

As you knew FSM launched the Auto-Sweep in the Cash Solutions. Have anyone any idea how or when does the profit being shown up in the system? Our usual Cash Solution accounts deposits interest on the 1st every month on remaining balances. How about this Auto Sweep?

Thanks in advance should you have any information.

|

|

|

|

|

|

zebras

|

Apr 19 2024, 05:57 PM Apr 19 2024, 05:57 PM

|

|

QUOTE(guanteik @ Apr 19 2024, 05:45 PM) As you knew FSM launched the Auto-Sweep in the Cash Solutions. Have anyone any idea how or when does the profit being shown up in the system? Our usual Cash Solution accounts deposits interest on the 1st every month on remaining balances. How about this Auto Sweep? Thanks in advance should you have any information.  https://www.fsmone.com.my/support/frequentl...tUniqueKey=3005 https://www.fsmone.com.my/support/frequentl...tUniqueKey=3005 |

|

|

|

|

|

guanteik

|

Apr 19 2024, 07:51 PM Apr 19 2024, 07:51 PM

|

|

QUOTE(zebras @ Apr 19 2024, 05:57 PM) My bad I missed this! Thank you so much for sharing |

|

|

|

|

|

SiChaoBear

|

Apr 21 2024, 11:21 AM Apr 21 2024, 11:21 AM

|

New Member

|

Hi guys I'm selling my holdings for the first time. However, I couldn't proceed as I keep receiving "INVALID OTP" from the system despite I entered the correct OTP. Any idea what happened? Thanks.  This post has been edited by SiChaoBear: Apr 21 2024, 11:22 AM This post has been edited by SiChaoBear: Apr 21 2024, 11:22 AM |

|

|

|

|

|

Barricade

|

Apr 24 2024, 08:47 AM Apr 24 2024, 08:47 AM

|

|

how's FSM exchange rate? If invest in this auto sweep means we need to convert USD back to MYR if want to withdraw right?

This post has been edited by Barricade: Apr 24 2024, 08:48 AM

|

|

|

|

|

|

tadashi987

|

Apr 24 2024, 09:21 AM Apr 24 2024, 09:21 AM

|

|

QUOTE(Barricade @ Apr 24 2024, 08:47 AM) how's FSM exchange rate? If invest in this auto sweep means we need to convert USD back to MYR if want to withdraw right? can check it out urself, as at just now, on FSM i can get MYR 5000 > USD 1,040.75 for Wise, i get MYR 5,003.71 > USD 1,040.75 for ur second question, yep, u need to convert back MYR if u want to withdraw to ur MYR bank account unless you have USD bank account to withdraw to, i not sure if FSM support USD withdrawal from their platform |

|

|

|

|

|

frankliew

|

Apr 24 2024, 09:47 AM Apr 24 2024, 09:47 AM

|

|

FSM Expensive. Moomoo SG much much cheaper.

|

|

|

|

|

|

Barricade

|

Apr 24 2024, 10:56 AM Apr 24 2024, 10:56 AM

|

|

QUOTE(frankliew @ Apr 24 2024, 09:47 AM) FSM Expensive. Moomoo SG much much cheaper. Moomoo SG CSOP need to convert MYR to SGD to USD FSM USD sweep MYR to USD Which one more worth? |

|

|

|

|

|

Ramjade

|

Apr 24 2024, 11:07 AM Apr 24 2024, 11:07 AM

|

|

QUOTE(Barricade @ Apr 24 2024, 10:56 AM) Moomoo SG CSOP need to convert MYR to SGD to USD FSM USD sweep MYR to USD Which one more worth? I don't think FSM sweep got good rates. From using that in FSM Singapore. Try rhb multicurrency account |

|

|

|

|

|

Davidtcf

|

Apr 24 2024, 07:32 PM Apr 24 2024, 07:32 PM

|

|

Is FSM one US auto sweep worth using? Offering 4.523% interest. Just realize Versa interest dropped so much to 3.77% and next mth will be worse forcing users to deposit into their invest plans for more interest.

Or should.i just stick to KDI save?

|

|

|

|

|

|

Ramjade

|

Apr 24 2024, 07:54 PM Apr 24 2024, 07:54 PM

|

|

QUOTE(Davidtcf @ Apr 24 2024, 07:32 PM) Is FSM one US auto sweep worth using? Offering 4.523% interest. Just realize Versa interest dropped so much to 3.77% and next mth will be worse forcing users to deposit into their invest plans for more interest. Or should.i just stick to KDI save? Depends on what do you want. For me, I will say moomoo sg CSOP US > FSM by miles. Just make sure to use RHB multicurrency to convert RM to USD then TT it over. If you want a place to keep your ringgit, KDI save. If you want highest return, CSOP USD MMF |

|

|

|

|

|

lownet

|

Apr 24 2024, 09:06 PM Apr 24 2024, 09:06 PM

|

New Member

|

QUOTE(Ramjade @ Apr 24 2024, 07:54 PM) Depends on what do you want. For me, I will say moomoo sg CSOP US > FSM by miles. Just make sure to use RHB multicurrency to convert RM to USD then TT it over. If you want a place to keep your ringgit, KDI save. If you want highest return, CSOP USD MMF I noticed FSM also has CSOP USD MMF https://www.fsmone.com.my/etfs/tools/etfs-f...HKEX&stock=9096 . Just curious, what are the pros and cons of buying this on FSM vs putting funds in FSM's USD auto-sweep? This post has been edited by lownet: Apr 24 2024, 09:12 PM |

|

|

|

|

|

Ramjade

|

Apr 24 2024, 09:53 PM Apr 24 2024, 09:53 PM

|

|

QUOTE(lownet @ Apr 24 2024, 09:06 PM) I noticed FSM also has CSOP USD MMF https://www.fsmone.com.my/etfs/tools/etfs-f...HKEX&stock=9096 . Just curious, what are the pros and cons of buying this on FSM vs putting funds in FSM's USD auto-sweep? The one you saw in FSM is some kind of etf on HK. If I am not wrong. Csop offer higher returns than FSM. You may not get your money back as fast as auto sweep. |

|

|

|

|

|

killeralta

|

Apr 25 2024, 11:45 AM Apr 25 2024, 11:45 AM

|

Getting Started

|

QUOTE(Ramjade @ Apr 24 2024, 07:54 PM) Depends on what do you want. For me, I will say moomoo sg CSOP US > FSM by miles. Just make sure to use RHB multicurrency to convert RM to USD then TT it over. If you want a place to keep your ringgit, KDI save. If you want highest return, CSOP USD MMF Why don't just convert the USD and put in RHB term deposit? Can save back on the TT fees as well |

|

|

|

|

|

Ramjade

|

Apr 25 2024, 01:00 PM Apr 25 2024, 01:00 PM

|

|

QUOTE(killeralta @ Apr 25 2024, 11:45 AM) Why don't just convert the USD and put in RHB term deposit? Can save back on the TT fees as well You lock your money up. Mmf you get FD rates without locking your money up. |

|

|

|

|

|

gccy1997

|

Apr 25 2024, 07:17 PM Apr 25 2024, 07:17 PM

|

New Member

|

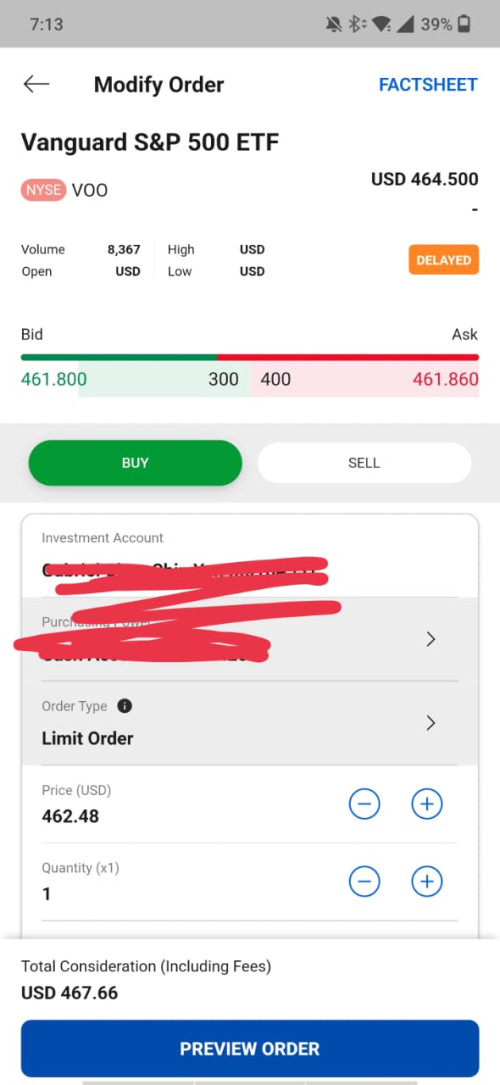

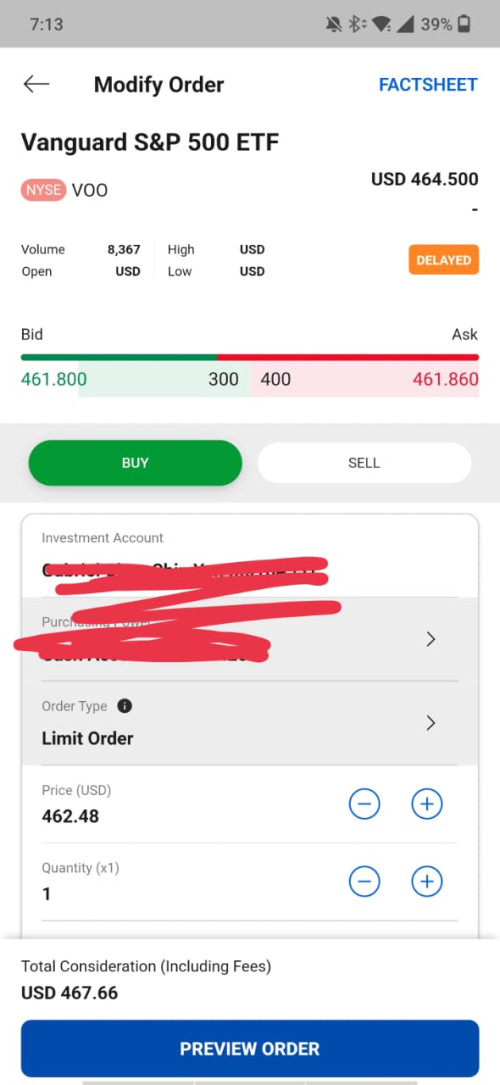

Hi guys, can someone teach me why is my order not fulfilled when it is already much higher than the ask price? Few hours dy |

|

|

|

|

|

thecurious

|

Apr 25 2024, 07:20 PM Apr 25 2024, 07:20 PM

|

|

QUOTE(gccy1997 @ Apr 25 2024, 07:17 PM)  Hi guys, can someone teach me why is my order not fulfilled when it is already much higher than the ask price? Few hours dy The platform doesn't support pre market. US Market opens at 9.30pm This post has been edited by thecurious: Apr 25 2024, 07:21 PM |

|

|

|

|

|

polarzbearz

|

Apr 25 2024, 07:20 PM Apr 25 2024, 07:20 PM

|

|

QUOTE(gccy1997 @ Apr 25 2024, 07:17 PM)  Hi guys, can someone teach me why is my order not fulfilled when it is already much higher than the ask price? Few hours dy Could it be because of the trading hours? Probably yesterday midnight over there. Also for US denominated ETFs if you're buying and holding long term, gotta watch out for estate tax (on your demise) and also dividend withholding tax (for distributing ETFs) since Malaysia doesn't have tax treaty with the US. I personally go for the Ireland denominated ETFs route. Edit: since it's via FSM, make sure to check the fees also in case of dividend distribution. Don't know about FSMMY but last time when I used FSM HK for USD holdings, after all the fees I essentially got almost nil dividend (and that was the triggering point of me jumping into the whole IBKR route) This post has been edited by polarzbearz: Apr 25 2024, 07:22 PM |

|

|

|

|

|

gccy1997

|

Apr 25 2024, 07:33 PM Apr 25 2024, 07:33 PM

|

New Member

|

QUOTE(polarzbearz @ Apr 25 2024, 07:20 PM) Could it be because of the trading hours? Probably yesterday midnight over there. Also for US denominated ETFs if you're buying and holding long term, gotta watch out for estate tax (on your demise) and also dividend withholding tax (for distributing ETFs) since Malaysia doesn't have tax treaty with the US. I personally go for the Ireland denominated ETFs route. Edit: since it's via FSM, make sure to check the fees also in case of dividend distribution. Don't know about FSMMY but last time when I used FSM HK for USD holdings, after all the fees I essentially got almost nil dividend (and that was the triggering point of me jumping into the whole IBKR route) Thank you for the reply, appreciate it. Last I check FSM do not charge for dividend distribution, I think they used to. I already put some amount in IBKR for ireland dominated ETF. Just using fsm for monthly small dca, got some dilemma in putting too much money on overseas platform. |

|

|

|

|

|

Barricade

|

Apr 25 2024, 07:46 PM Apr 25 2024, 07:46 PM

|

|

QUOTE(Davidtcf @ Apr 24 2024, 07:32 PM) Is FSM one US auto sweep worth using? Offering 4.523% interest. Just realize Versa interest dropped so much to 3.77% and next mth will be worse forcing users to deposit into their invest plans for more interest. Or should.i just stick to KDI save? Not a good idea. I just tested with RM25k for you guys. Once I deposit it convert to USD5202 which is pretty good rate. But the value in RM dropped to around RM24,700. How is this calculated? FSM sell USD back to MYR rate at 4.75. So unless USD increase, I already lost about RM300 on forex alone. That's about 1%. So unless USD rate improve against MYR, I will be making less than putting in Versa. |

|

|

|

|

Apr 19 2024, 05:45 PM

Apr 19 2024, 05:45 PM

Quote

Quote

0.0358sec

0.0358sec

0.38

0.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled