Any1 experienced this before on eUnittrust ?

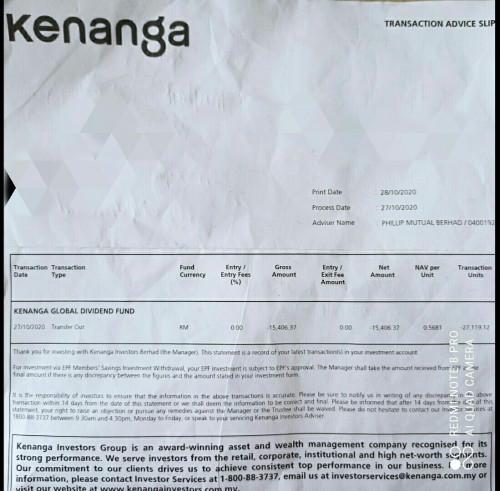

Fund : Kenanga Global Dividend Fund.

Problem : Phillip Mutual reduced my profit due to transfer of acct from

different fund house. ( Kenanga to eUnittrust )

Reason : I cant do online redemption/ switching to other fund.

3 months ago, i requested to transfer all my amount from EPF acct (1000xxxxx)

to cash acct ( 9000xxxx ). I received a Transaction Advised Slip from Kenanga Investors Berhad showing the details as below :

Date : 27/10/2020

Total unit transferred : 27,119.12

NAV : 0.5681

Market value : 15,406.37

When the amount successfully transferred to my Cash Acct in eUnittrust, the market value dropped ( why not follow the amount that was transferred out by Kenanga ?) from RM 15,406.37 to RM 15,000.00

Any1 can enlighten me why the market value dropped for the above situation ? I am not very convinced from their reply.

TQVM.

** replied by Phillip Mutual **

Please be informed that the transfer amount RM15,000.00 is your principal while your market value is RM15,528.41 (RM528.41 is unrealised profit) as per our image.

You have redeem 17,000 units amount RM9,350 on 30/10/2020. You balance units is 10,119.12 and balance Principal is (RM15,000- rm9,350) RM5,650.

On 10/11/2020 you have top up your investment RM1,300 after 1.50% sales charge nett investment is RM1,280.79 units 2,124.73 at price 0.6028.

Subsequent investment on 10/11/2020

RM1,280.79 / 0.6028 = 2,124.73 units

Latest market value 2,124.73 units x 0.6239 (latest price) = RM1,325.61

RM1,325.61 - Principal RM1,280.79 = RM44.82 (unrealised profit)

Balance units before subsequent

10,119.12 units x 0.6239 (latest price) = RM6,313.31

RM6,313.31 – Principal RM5,650 = RM663.31 (unrealised profit)

Your enquiry regarding the different RM406 is unrealised profit as at current price.

Due to the price is up trend for this fund your unrealised profit is grow from RM406 to now RM663.31

Trust the above clarifies.

For further information, you can contact our customer service at 03-2783 0300 or email us at phillipmutual@poems.com.my.

Thank you.

Regards,

Phillip Mutual Berhad

B-2-7, Block B Level 2 Unit 7, Megan Avenue II

No. 12 Jln Yap Kwan Seng

Firstly, wrong thread.

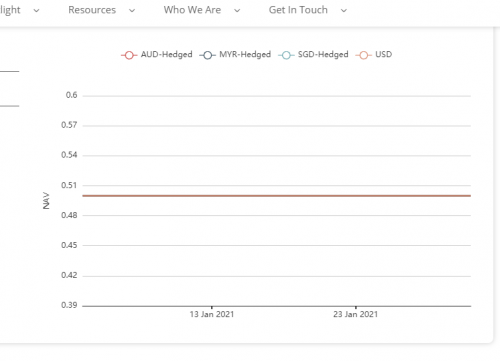

Secondly, their NAV indicator lags behind one or two days as they are not the direct fund provider.

You didn't provide the transaction slip for the receiving end, only provided for the kenanga side.

But assuming the units transferred are correct and is the same amount of 27,119.12 units. Multiply it by by the NAV of 26th instead of 27th.

May 26 2020, 08:21 PM

May 26 2020, 08:21 PM

Quote

Quote

0.7558sec

0.7558sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled