QUOTE(lee82gx @ Apr 17 2024, 08:12 AM)

Appreciate your help in providing examples. But after decades I too have come to understanding that Mutual funds are few and far in between in those able to outperform indices.

1.Principal Islamic Tech- A very short tenured fund - track record is uncertain. Purely from a returns perspective, yes outperforming index. But frankly you buy any Mag 7 in a basket and you will outperform from 2022 onwards. It was a greatly timed opening. Not to mention the fees you pay Principal for helping you buy the exact same thing from Franklin templeton for much much less fees. This fund is a great rent seeker.

if you want another example - United global tech fund. Super outperform Nasdaq / SPY500 during launch but now is stagnant. Same as ARKK.

2. TA global tech - A favourite, but again just the equivalent of QQQ over 3 years and 5 years and 10 years.

Unless you are looking to trade your unit trust after a year which is weird since you pay what up to 5% in fees, it washes away all your small gains.

Holding it long - you pay 2% fees every year which again cumulates to a lot of fees.

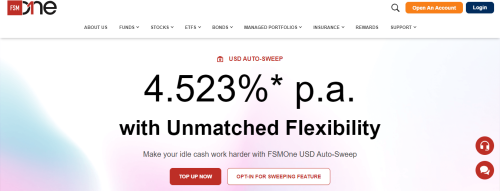

What he said is exactly why most of us abandon UT. Plus some of the UTs we buy are actually funding another underlying mutual fund which causes a double charge of management fees. Please read your prospectus and platform fees! Last time fsm was popular because not many of us have what we have not. Opening Singapore bank accounts to wise transfers to brokers.1.Principal Islamic Tech- A very short tenured fund - track record is uncertain. Purely from a returns perspective, yes outperforming index. But frankly you buy any Mag 7 in a basket and you will outperform from 2022 onwards. It was a greatly timed opening. Not to mention the fees you pay Principal for helping you buy the exact same thing from Franklin templeton for much much less fees. This fund is a great rent seeker.

if you want another example - United global tech fund. Super outperform Nasdaq / SPY500 during launch but now is stagnant. Same as ARKK.

2. TA global tech - A favourite, but again just the equivalent of QQQ over 3 years and 5 years and 10 years.

Unless you are looking to trade your unit trust after a year which is weird since you pay what up to 5% in fees, it washes away all your small gains.

Holding it long - you pay 2% fees every year which again cumulates to a lot of fees.

Apr 17 2024, 11:16 AM

Apr 17 2024, 11:16 AM

Quote

Quote

0.0266sec

0.0266sec

0.62

0.62

6 queries

6 queries

GZIP Disabled

GZIP Disabled