QUOTE(Avangelice @ Apr 12 2024, 05:05 PM)

I bought UOB and OCBC, cause not enough for DBS that time.FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Apr 13 2024, 10:42 AM Apr 13 2024, 10:42 AM

|

Junior Member

458 posts Joined: Mar 2005 From: home |

|

|

|

|

|

|

Apr 13 2024, 10:50 AM Apr 13 2024, 10:50 AM

Show posts by this member only | IPv6 | Post

#30702

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Apr 16 2024, 11:31 AM Apr 16 2024, 11:31 AM

|

Junior Member

51 posts Joined: Sep 2005 |

Hi Peeps,

Just would like to get a 2nd opinion Nearly all my UT has recovered except 1 which are still in the red (China) UT Considering that it was a slow and painful recovery pre/post Covid, i am now considering to sell all my fund with the war impending. Appreciate some thoughts or debate on this. Thanks |

|

|

Apr 16 2024, 11:38 AM Apr 16 2024, 11:38 AM

|

All Stars

14,865 posts Joined: Mar 2015 |

QUOTE(Th3D3vil @ Apr 16 2024, 11:31 AM) Hi Peeps, How much % of your equity investment portfolio are in China currently?Just would like to get a 2nd opinion Nearly all my UT has recovered except 1 which are still in the red (China) UT Considering that it was a slow and painful recovery pre/post Covid, i am now considering to sell all my fund with the war impending. Appreciate some thoughts or debate on this. Thanks |

|

|

Apr 16 2024, 01:23 PM Apr 16 2024, 01:23 PM

|

Junior Member

51 posts Joined: Sep 2005 |

|

|

|

Apr 16 2024, 01:45 PM Apr 16 2024, 01:45 PM

|

All Stars

14,865 posts Joined: Mar 2015 |

QUOTE(Th3D3vil @ Apr 16 2024, 01:23 PM) With just <14% of your investment in China out of your total investment, ...I think it is still okay to keep it for a diversified portfolio Anyway, it is still up to you to decide on your actual comfort level to set your own % of allocation to Greater China. This post has been edited by MUM: Apr 16 2024, 01:48 PM |

|

|

|

|

|

Apr 16 2024, 01:58 PM Apr 16 2024, 01:58 PM

Show posts by this member only | IPv6 | Post

#30707

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(Th3D3vil @ Apr 16 2024, 11:31 AM) Hi Peeps, The reason why most of us have disappeared and this sub is essentially dead as there are better vehicles of investment at much cheaper fees. I don't hold any UT equities any longerJust would like to get a 2nd opinion Nearly all my UT has recovered except 1 which are still in the red (China) UT Considering that it was a slow and painful recovery pre/post Covid, i am now considering to sell all my fund with the war impending. Appreciate some thoughts or debate on this. Thanks Th3D3vil liked this post

|

|

|

Apr 16 2024, 02:29 PM Apr 16 2024, 02:29 PM

|

Junior Member

51 posts Joined: Sep 2005 |

QUOTE(Avangelice @ Apr 16 2024, 02:58 PM) The reason why most of us have disappeared and this sub is essentially dead as there are better vehicles of investment at much cheaper fees. I don't hold any UT equities any longer Thanks for sharing.Do advice if there are any other vehicles which does provide a better return than UT. |

|

|

Apr 16 2024, 02:32 PM Apr 16 2024, 02:32 PM

Show posts by this member only | IPv6 | Post

#30709

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(Th3D3vil @ Apr 16 2024, 02:29 PM) Thanks for sharing. US etf. No platform fees. No management fees.Do advice if there are any other vehicles which does provide a better return than UT. Fsm is now entering its twilight years since it has multiple competitors that offer cheaper services. Only caveat is it's easy to put money in fsm and take it out or convert but you pay higher fees for the convenience. If UT is so good why is the sub dead? |

|

|

Apr 16 2024, 02:40 PM Apr 16 2024, 02:40 PM

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(Avangelice @ Apr 16 2024, 02:32 PM) US etf. No platform fees. No management fees. because investing in passive index etf is the easiest and brainless way to invest, there is noone to blame except the market.Fsm is now entering its twilight years since it has multiple competitors that offer cheaper services. Only caveat is it's easy to put money in fsm and take it out or convert but you pay higher fees for the convenience. If UT is so good why is the sub dead? there are many UT option there, not many have the knowledge to pick the performing UT     This post has been edited by zebras: Apr 16 2024, 02:45 PM |

|

|

Apr 16 2024, 02:49 PM Apr 16 2024, 02:49 PM

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

Apr 16 2024, 02:51 PM Apr 16 2024, 02:51 PM

Show posts by this member only | IPv6 | Post

#30712

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(zebras @ Apr 16 2024, 02:40 PM) because investing in unit trust is the easiest and brainless way to invest, there is noone to blame except the fund manager . Fixed it for you zebras liked this post

|

|

|

Apr 16 2024, 02:55 PM Apr 16 2024, 02:55 PM

|

Junior Member

302 posts Joined: Mar 2010 |

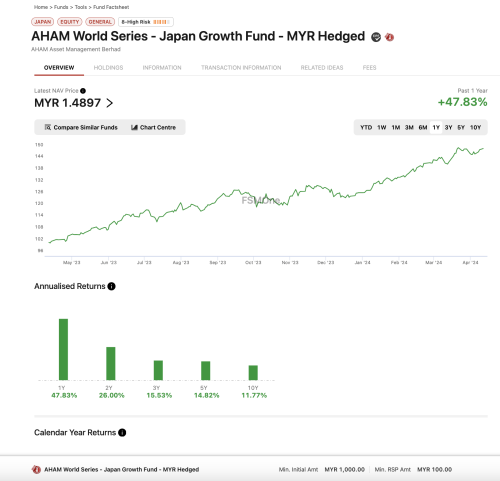

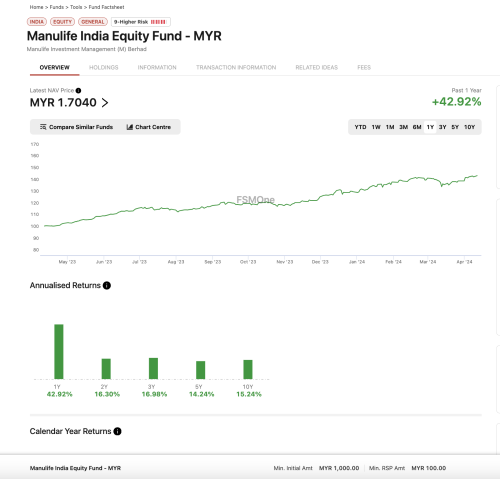

QUOTE(Avangelice @ Apr 16 2024, 02:51 PM) open to all ideas and opportunities,putting all egg into 1 basket may not be the best idea - there are fixed income UT for investor with lower risk appetite that regularly giving return higher than FD - there are opportunities out of US too, eg: Japan, Asia, India   This post has been edited by zebras: Apr 16 2024, 02:57 PM |

|

|

|

|

|

Apr 16 2024, 03:10 PM Apr 16 2024, 03:10 PM

Show posts by this member only | IPv6 | Post

#30714

|

All Stars

24,341 posts Joined: Feb 2011 |

QUOTE(Th3D3vil @ Apr 16 2024, 11:31 AM) Hi Peeps, You buy etf also you will be down. Why? Cause it's china and china bows down to emperor xi. Emperor xi word is the law. National service first above shareholders. Something to consider if you want to invest in China.Just would like to get a 2nd opinion Nearly all my UT has recovered except 1 which are still in the red (China) UT Considering that it was a slow and painful recovery pre/post Covid, i am now considering to sell all my fund with the war impending. Appreciate some thoughts or debate on this. Thanks That's why I pull out my principal Asia Pacific ex Japan income fund and switch to to something with US holdings for my PRS. zebras liked this post

|

|

|

Apr 16 2024, 03:21 PM Apr 16 2024, 03:21 PM

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(Ramjade @ Apr 16 2024, 03:10 PM) You buy etf also you will be down. Why? Cause it's china and china bows down to emperor xi. Emperor xi word is the law. National service first above shareholders. Something to consider if you want to invest in China. many people are still looking at product (UT/ETF) instead of That's why I pull out my principal Asia Pacific ex Japan income fund and switch to to something with US holdings for my PRS. - asset class (Equity/Fixed Income/etc) - market (US/China/Japan/India/etc) - sector (Tech/Semicon/etc) personally I invest in both UT and ETF, there are asset class/market/sector that UT normally outperform ETF, eg: Malaysia, Asia, Fixed Income meanwhile there are market that UT hardly beat passive index ETF in long term, eg: US |

|

|

Apr 16 2024, 03:29 PM Apr 16 2024, 03:29 PM

|

Junior Member

51 posts Joined: Sep 2005 |

Thanks. I do invest in ETF as well, just that it's in small sum.

Decided to sell all except my China UT .. Hopefully the day i retire the UT funds will recover. |

|

|

Apr 16 2024, 10:57 PM Apr 16 2024, 10:57 PM

Show posts by this member only | IPv6 | Post

#30717

|

Senior Member

3,789 posts Joined: Aug 2007 |

QUOTE(Avangelice @ Apr 16 2024, 02:32 PM) US etf. No platform fees. No management fees. Not quite true.Fsm is now entering its twilight years since it has multiple competitors that offer cheaper services. Only caveat is it's easy to put money in fsm and take it out or convert but you pay higher fees for the convenience. If UT is so good why is the sub dead? Any investment in the US is at least subject to US withholding tax of 30% and when the monies are repatriated back to Malaysia, it's subject to foreign source income i.e. 24%. Actually, we are seeing the rise of FSM and the decline of UTMCs. The reason being, FSM is a distributor, they don't take on the fund manager risk. If a fund fails, they can just shift the blame to the fund manager or the investors poor choice for not doing their due diligence. FSM doesn't take on the risk of fund establishment but rather enjoys the ability to sell funds from different manufacturers. FSM is no different from Lazada, Shoppee or TnG. They offer a space and the vendor can put their product on their shelf/platform for a fee. FSM doesn't take on the product risk. UT is somewhat dead because of the erratic pattern it has displayed post covid19. It has its best run in 2021 but subsequently tanked, when China's economy started to sputter, Ukraine war, rising interest rates by central bank and fed and reopening. You should have seen what happened during Covid and towards the tail end, it was crazy! In any case, I would agree with @zebras , UTs may be good in certain stuff and ETFs just dominate in certain areas as well (unless you bought Malaysia ETF, well then good luck to you). This post has been edited by aurora97: Apr 16 2024, 11:14 PM zebras liked this post

|

|

|

Apr 16 2024, 11:06 PM Apr 16 2024, 11:06 PM

Show posts by this member only | IPv6 | Post

#30718

|

Senior Member

3,789 posts Joined: Aug 2007 |

Alamak accidentally press post. Anyway, just buy a fund that you are comfortable and have track record. Do dollar cost averaging and avoid timing the market. Don't have to chase thematic funds, even local funds can do just as good. Furthermore, most investors invest in MYR-Hedged class, which negate the foreign currency fluctuation. AHAM Tactical - YTD is 13.5% AHAM SOF - YTD is 15.7% This post has been edited by aurora97: Apr 16 2024, 11:10 PM Attached thumbnail(s)

zebras liked this post

|

|

|

Apr 17 2024, 08:12 AM Apr 17 2024, 08:12 AM

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

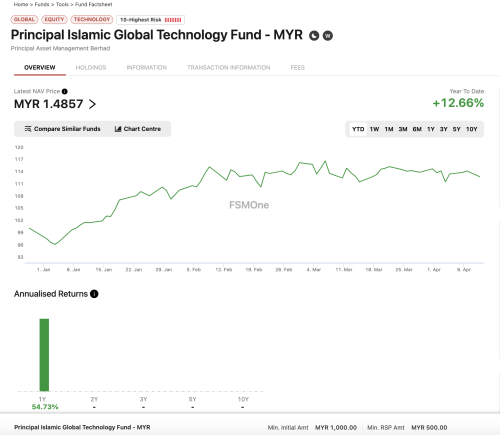

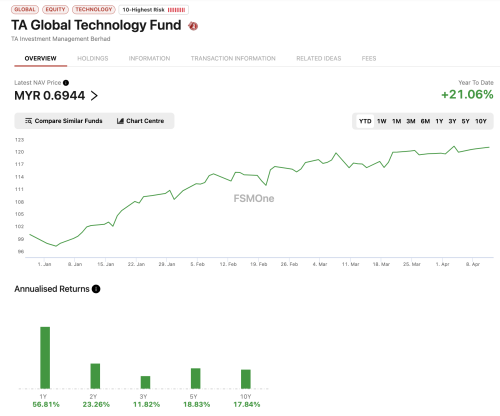

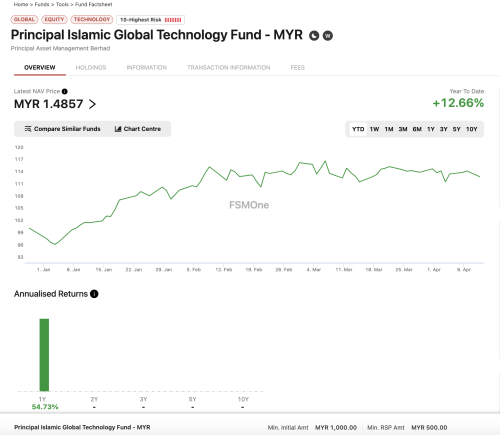

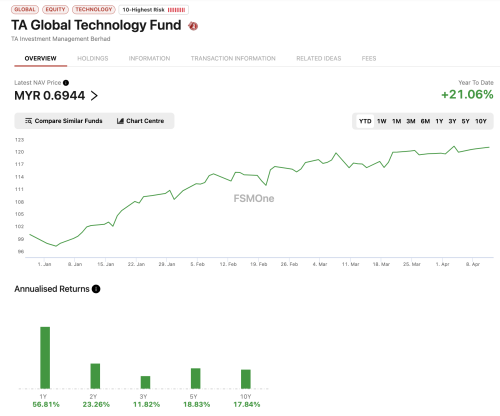

QUOTE(zebras @ Apr 16 2024, 02:40 PM) because investing in passive index etf is the easiest and brainless way to invest, there is noone to blame except the market. Appreciate your help in providing examples. But after decades I too have come to understanding that Mutual funds are few and far in between in those able to outperform indices.there are many UT option there, not many have the knowledge to pick the performing UT     1.Principal Islamic Tech- A very short tenured fund - track record is uncertain. Purely from a returns perspective, yes outperforming index. But frankly you buy any Mag 7 in a basket and you will outperform from 2022 onwards. It was a greatly timed opening. Not to mention the fees you pay Principal for helping you buy the exact same thing from Franklin templeton for much much less fees. This fund is a great rent seeker. if you want another example - United global tech fund. Super outperform Nasdaq / SPY500 during launch but now is stagnant. Same as ARKK. 2. TA global tech - A favourite, but again just the equivalent of QQQ over 3 years and 5 years and 10 years. Unless you are looking to trade your unit trust after a year which is weird since you pay what up to 5% in fees, it washes away all your small gains. Holding it long - you pay 2% fees every year which again cumulates to a lot of fees. Avangelice liked this post

|

|

|

Apr 17 2024, 08:41 AM Apr 17 2024, 08:41 AM

|

All Stars

14,865 posts Joined: Mar 2015 |

Usually and normally, ... The performance of UT funds are based on bid to bid price (NAV to NAV) with dividend reinvested option. Thus all the annual fees charges incurred by that fund had be included in the fund performance calculations zebras liked this post

|

| Change to: |  0.0253sec 0.0253sec

0.39 0.39

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 01:33 PM |