Why REIT is on highest risk on FSM?

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 5 2020, 09:18 PM Mar 5 2020, 09:18 PM

Return to original view | Post

#1

|

Senior Member

2,106 posts Joined: Jul 2018 |

Why REIT is on highest risk on FSM?

|

|

|

|

|

|

Mar 6 2020, 05:50 PM Mar 6 2020, 05:50 PM

Return to original view | Post

#2

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(GrumpyNooby @ Mar 6 2020, 05:29 PM) I think for existing FI funds which has fastest redemption process is from Opus Asset Management.in Opus Touch thread, i think it is proven that if u redeem before today 4:00pm u will get it by T+1 end of day. on FSM i compared with other fund house's FI, no ones can be beat that. on FSM, Opus FI redemption period is stated as T+1 as well, but never done redemption of Opus FI funds on FSM so can't be sure |

|

|

Mar 8 2020, 10:36 AM Mar 8 2020, 10:36 AM

Return to original view | Post

#3

|

Senior Member

2,106 posts Joined: Jul 2018 |

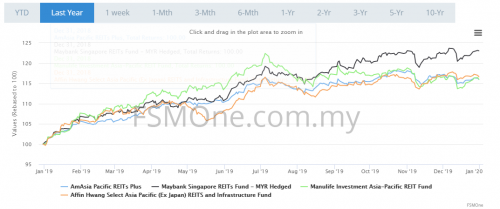

Anyone is eyeing /holding on MAYBANK SINGAPORE REITS FUND?

performance is quite good. Thou it is wholesale fund entry point higher |

|

|

Mar 8 2020, 10:48 AM Mar 8 2020, 10:48 AM

Return to original view | Post

#4

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(GrumpyNooby @ Mar 8 2020, 10:42 AM) if sale charge is not the concern, this fund is the only REIT that focusing on SG REITS? as it really outperform other REIT if taking last year as past benchmark thou it is a rather young (just launched 2018) fund  This post has been edited by tadashi987: Mar 8 2020, 10:50 AM |

|

|

Mar 8 2020, 08:44 PM Mar 8 2020, 08:44 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 9 2020, 11:57 AM Mar 9 2020, 11:57 AM

Return to original view | Post

#6

|

Senior Member

2,106 posts Joined: Jul 2018 |

a noob question here, Fixed Income (FI) fund and REITS fund are not sensitive / relevant to stock market right?

I am thinking if my Ambond funds / AM Reits would drop as today stock market is crashing @@ |

|

|

|

|

|

Mar 9 2020, 12:08 PM Mar 9 2020, 12:08 PM

Return to original view | Post

#7

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 9 2020, 01:03 PM Mar 9 2020, 01:03 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 10 2020, 10:19 PM Mar 10 2020, 10:19 PM

Return to original view | Post

#9

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(palm05wince @ Mar 10 2020, 06:56 PM) Usually if rate cut bond yield will go up?then MMF fund yield will drop. correct me if i am wrong https://www.thestar.com.my/business/busines...ined-for-bonds/ https://www.theedgemarkets.com/article/yiel...valuation-bonds This post has been edited by tadashi987: Mar 10 2020, 10:20 PM |

|

|

Mar 12 2020, 12:18 AM Mar 12 2020, 12:18 AM

Return to original view | Post

#10

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 16 2020, 02:28 PM Mar 16 2020, 02:28 PM

Return to original view | Post

#11

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 16 2020, 05:48 PM Mar 16 2020, 05:48 PM

Return to original view | Post

#12

|

Senior Member

2,106 posts Joined: Jul 2018 |

wanna enquire how long usually is switching take?

e.g. switch ambond to kenanga asnita bond which ambond: T + 3 business days Buy Processing Time T + 4 business days Redemption Processing Time which kenanga asnita bond: T + 3 business days Buy Processing Time T + 4 business days Redemption Processing Time so is it the total switch process will take one week of business days as T + 4 business days AMBOND Redemption Processing Time + T + 3 business days Kenanga Asnita Bond Buy Processing Time This post has been edited by tadashi987: Mar 16 2020, 05:48 PM |

|

|

Mar 16 2020, 11:06 PM Mar 16 2020, 11:06 PM

Return to original view | Post

#13

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

|

|

|

Mar 20 2020, 10:12 AM Mar 20 2020, 10:12 AM

Return to original view | Post

#14

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(fjoru103 @ Mar 20 2020, 09:52 AM) Hi sorry i apologized before hand, Idea of Forward Pricing - FSMcause since I invest in fsm, i never top up, so I have no idea lol if i were to top up for existing fund now, I aware it is T+3 business days, example I deposit today, it will reflected by Wednesday is it? And which day it will capture the price I buy?(I mean which day the price it will buy) not sure how to ask this haha |

|

|

Mar 21 2020, 09:02 PM Mar 21 2020, 09:02 PM

Return to original view | Post

#15

|

Senior Member

2,106 posts Joined: Jul 2018 |

Try to search "void" and "refund" but to no avail.

search FAQ in fsm but that's on cooling proceeding. would like to enquire, If i void an order, 1) how long would the refund be credited back to me? 2) it will be credited to my FPX bank? or my FSM cash account? |

|

|

Mar 21 2020, 09:39 PM Mar 21 2020, 09:39 PM

Return to original view | Post

#16

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(MUM @ Mar 21 2020, 09:09 PM) just a note: oya first time from that particular fund house, so the return is as per cooling off?the fund that you wanted to 'return" during the cooling off period.....MUS not from the fund same fund house that you had bought before.... have you ever bought from that fund house before? this must be the 1st time you bought from that fund house  |

|

|

Mar 24 2020, 08:49 PM Mar 24 2020, 08:49 PM

Return to original view | Post

#17

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 24 2020, 10:46 PM Mar 24 2020, 10:46 PM

Return to original view | Post

#18

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 27 2020, 04:45 PM Mar 27 2020, 04:45 PM

Return to original view | Post

#19

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 27 2020, 05:10 PM Mar 27 2020, 05:10 PM

Return to original view | Post

#20

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

| Change to: |  0.0717sec 0.0717sec

0.97 0.97

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 08:06 AM |