QUOTE(dasecret @ Mar 22 2017, 11:35 AM)

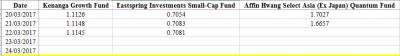

We discussed this last week. Main issue I have with this fund is the crazy volatility. It did increased by 2.4% in a day last week; but maybe today will fall by the same quantum seeing how asia markets are tumbling down

Crystal ball does not approve this fund

Speaking of which

xuzen, does ponzi 1.0 still not in crystal ball's good books?

If one is asking to compare between Ponzi One and Ponzi Two, my answer is thus:

Choose Ponzi One if one likes the swing up and down drastically? It that excites you, then this is the Asia Pac ex Japan UTF of choice for you.

Conversely, if one is seeks more stable UTF, Ponzi Two is the one for you.

Both are good proxies to exposure to the Asia Pac ex Japan theatre.

QUOTE(puchongite @ Mar 22 2017, 11:59 AM)

Multi million dollar question.

Let's ask our in-thread crystal balls ?

My data are not going to be meaningful if looked at on a day to day basis and it should not be; as UTF is meant to be for those "selamba" type investor. It would be ideal for those that seek to escape from being glued to the computer monitor day in and day out looking to do buy-sell all the time.

I went through those type of experience before. That is why I decided to hire professional fund manager, pay them some fee and be more aloof towards investment.

I choose to smell the roses. It is a lifestyle choice.

Most of the time all these day to day variance is just noise and six months down the line when you made your gain, you will look back and laugh at your silly self for being so "kan-cheong" all the time,

Noobs, don't worry. I too went through that phase... you'll get use to the ups and down eventually.

Xuzen

p/s: Look at my joining date, that is, Oct 2008. How many cycles of doom and gloom have I gone through? Did those gloom and doom happened? Is my money still with those UTMC? Is FSM, eUT etc still around? Have they cabut lari and tipu orang?

Compare these with those multitude gold investment scheme, forex etc that comes and go and went fly by night type. Some of the directors are being charged and are awaiting trial, some disappear without a trace...

This post has been edited by xuzen: Mar 22 2017, 11:52 PM

Mar 22 2017, 02:10 PM

Mar 22 2017, 02:10 PM

Quote

Quote

0.0216sec

0.0216sec

0.64

0.64

6 queries

6 queries

GZIP Disabled

GZIP Disabled