Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

viktorherald

|

Oct 13 2020, 06:33 PM Oct 13 2020, 06:33 PM

|

Getting Started

|

QUOTE(whirlwind @ Oct 13 2020, 06:29 PM) Mine kinda similar with yours 👍 Kinda high risk, focusing on equity to maximize profit All through EPF 15% affin hwang select asia (ex japan) balanced fund 15% eastspring investments small-cap fund 15% principal islamic asia pacific dynamic equity fund 15% principal global titans fund 40% principal greater china equity fund too bad i dont have enough basic savings to invest with EPF yet  still working on it |

|

|

|

|

|

whirlwind

|

Oct 13 2020, 06:38 PM Oct 13 2020, 06:38 PM

|

|

QUOTE(viktorherald @ Oct 13 2020, 06:33 PM) too bad i dont have enough basic savings to invest with EPF yet  still working on it On the other hand I’m the opposite, don’t have much cash on hand to invest. Let’s hope the market continue to climb up China looks promising |

|

|

|

|

|

SUSyklooi

|

Oct 13 2020, 07:29 PM Oct 13 2020, 07:29 PM

|

|

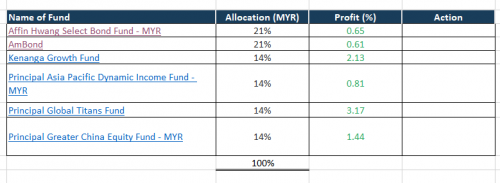

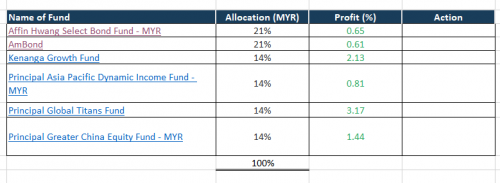

QUOTE(viktorherald @ Oct 13 2020, 05:48 PM)  My current allocation, i did contact with their advisor and this is the fund that he recommend to me. I consider my self a moderately risk person i did read the individual funds, but lets just say.. i didnt put too much thinking to it  i just feel that this is quite diverse in regionality, previously some fund dip into reds and now had all recovered Anyone have good insights to offer?  yes, quite diverse.... just that past few months,....there had been forummers   about Kenanga Growth fund |

|

|

|

|

|

viktorherald

|

Oct 13 2020, 08:40 PM Oct 13 2020, 08:40 PM

|

Getting Started

|

QUOTE(yklooi @ Oct 13 2020, 07:29 PM) yes, quite diverse.... just that past few months,....there had been forummers   about Kenanga Growth fund oooooh, what happened back then? |

|

|

|

|

|

MUM

|

Oct 13 2020, 09:28 PM Oct 13 2020, 09:28 PM

|

|

QUOTE(viktorherald @ Oct 13 2020, 08:40 PM) oooooh, what happened back then? Previously KGF was the "Darling" of most people for its many many years of acceptable and stable performance, then in early 2018 it stopped performing while her peers are still going strolling on... try explore KGF sister fund and compare its composition and mandate against KGF to determine if this sister fund is ok with you This post has been edited by MUM: Oct 13 2020, 09:39 PM Attached thumbnail(s)

|

|

|

|

|

|

pisces88

|

Oct 13 2020, 11:25 PM Oct 13 2020, 11:25 PM

|

|

QUOTE(whirlwind @ Oct 13 2020, 06:38 PM) On the other hand I’m the opposite, don’t have much cash on hand to invest. Let’s hope the market continue to climb up China looks promising china very lovely  Principal Greater China Equity Fund - MYR +30.93% |

|

|

|

|

|

coolguy99

|

Oct 14 2020, 08:55 AM Oct 14 2020, 08:55 AM

|

|

QUOTE(pisces88 @ Oct 13 2020, 11:25 PM) china very lovely  Principal Greater China Equity Fund - MYR +30.93% Yeah despite all the worry with china, they are the best performing fund in my portfolio now. |

|

|

|

|

|

John91

|

Oct 14 2020, 09:24 AM Oct 14 2020, 09:24 AM

|

|

QUOTE(pisces88 @ Oct 14 2020, 12:25 AM) china very lovely  Principal Greater China Equity Fund - MYR +30.93% Amchina A-Shares even higher ahaha... generally all up incl TA Tech. |

|

|

|

|

|

whirlwind

|

Oct 14 2020, 09:45 AM Oct 14 2020, 09:45 AM

|

|

|

|

|

|

|

|

GrumpyNooby

|

Oct 14 2020, 10:09 AM Oct 14 2020, 10:09 AM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:59 AM

|

|

|

|

|

|

killdavid

|

Oct 14 2020, 12:07 PM Oct 14 2020, 12:07 PM

|

|

Hi sifus, which fund or segment now undervalued ?

AP REITS ?

|

|

|

|

|

|

dopp

|

Oct 14 2020, 12:10 PM Oct 14 2020, 12:10 PM

|

|

too late to enternow? QUOTE(pisces88 @ Oct 13 2020, 11:25 PM) china very lovely  Principal Greater China Equity Fund - MYR +30.93% |

|

|

|

|

|

GrumpyNooby

|

Oct 14 2020, 12:12 PM Oct 14 2020, 12:12 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:49 AM

|

|

|

|

|

|

MUM

|

Oct 14 2020, 12:16 PM Oct 14 2020, 12:16 PM

|

|

QUOTE(killdavid @ Oct 14 2020, 12:07 PM) Hi sifus, which fund or segment now undervalued ? AP REITS ? maybe can try read this while waiting for responses? Article as per SEP 28 2020 by JPMorgan Asset management 4Q 2020 Global Asset Allocation Views https://am.jpmorgan.com/us/en/asset-managem...llocation-viewsbtw, undervalued now may also continue to stay undervalued for sometimes longer too This post has been edited by MUM: Oct 14 2020, 12:17 PM |

|

|

|

|

|

pisces88

|

Oct 14 2020, 01:04 PM Oct 14 2020, 01:04 PM

|

|

QUOTE(dopp @ Oct 14 2020, 12:10 PM) Hmm enter batch by batch lo.. china economy in recovery stage |

|

|

|

|

|

ehwee

|

Oct 14 2020, 01:53 PM Oct 14 2020, 01:53 PM

|

|

QUOTE(MUM @ Oct 13 2020, 09:28 PM) Previously KGF was the "Darling" of most people for its many many years of acceptable and stable performance, then in early 2018 it stopped performing while her peers are still going strolling on... try explore KGF sister fund and compare its composition and mandate against KGF to determine if this sister fund is ok with you I think this two funds has some similarities, just KGF is more on stable investments and KGF series 2 is more actively managed and toward smallcap which means KGF series 2 is more volatility than KGF in long run. same as KGOF which is outperforming KGF because it is currently invested heavily on local hot groove makers and health stocks comparably. So If one can withstand volatility and hope for maximum returns than KGOF is the one to go. This post has been edited by ehwee: Oct 14 2020, 01:55 PM |

|

|

|

|

|

GrumpyNooby

|

Oct 14 2020, 02:00 PM Oct 14 2020, 02:00 PM

|

|

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:50 AM

|

|

|

|

|

|

ehwee

|

Oct 14 2020, 02:23 PM Oct 14 2020, 02:23 PM

|

|

QUOTE(GrumpyNooby @ Oct 14 2020, 02:00 PM) But KGOF is concentrated in the small & mid cap segment. KGOF can invest in stock market cap under 4bil if I didn't remember wrongly. So can invest in big cap as well. Need check back the fact sheet and see if correct. This post has been edited by ehwee: Oct 14 2020, 02:24 PM |

|

|

|

|

|

WhitE LighteR

|

Oct 14 2020, 02:38 PM Oct 14 2020, 02:38 PM

|

|

QUOTE(killdavid @ Oct 14 2020, 12:07 PM) Hi sifus, which fund or segment now undervalued ? AP REITS ? AP REITS still has no momentum unfortunately. If u get in now, might remain negative for now. |

|

|

|

|

|

killdavid

|

Oct 14 2020, 02:43 PM Oct 14 2020, 02:43 PM

|

|

QUOTE(WhitE LighteR @ Oct 14 2020, 02:38 PM) AP REITS still has no momentum unfortunately. If u get in now, might remain negative for now. Any sector worth getting into now ? |

|

|

|

|

Oct 13 2020, 06:33 PM

Oct 13 2020, 06:33 PM

Quote

Quote

0.0283sec

0.0283sec

0.40

0.40

6 queries

6 queries

GZIP Disabled

GZIP Disabled