Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

viktorherald

|

Jul 20 2020, 11:10 PM Jul 20 2020, 11:10 PM

|

Getting Started

|

Just created an account, any guide for a newbie on the good indicators to select a fund that is suitable for one self?

i tried to just click2 on the available funds but that is just too much choice for me. Generally my aim will be medium period.

|

|

|

|

|

|

viktorherald

|

Oct 13 2020, 04:49 PM Oct 13 2020, 04:49 PM

|

Getting Started

|

May i ask what is the difference of PRS Fund vs the normal funds offered in FSMone?

|

|

|

|

|

|

viktorherald

|

Oct 13 2020, 04:59 PM Oct 13 2020, 04:59 PM

|

Getting Started

|

QUOTE(GrumpyNooby @ Oct 13 2020, 04:57 PM) PRS is special fund under Private Retirement Scheme There's a dedicated thread for this. In summary, it's just unit trust running in EPF way. yeah, cause under my impression, PRS is something like another mutual fund that can occasionally enjoy some tax benefits |

|

|

|

|

|

viktorherald

|

Oct 13 2020, 05:08 PM Oct 13 2020, 05:08 PM

|

Getting Started

|

QUOTE(GrumpyNooby @ Oct 13 2020, 05:01 PM) Moat of the PRS providers don't reinvent the wheel. They're feeding into existing pools of funds under their own management with certain % of allocation assessed based with associated risk. cause previously i got do some searching and some banks also provide PRS, however it is more like with monthly or annual deposits. something like a saving scheme, which is not really my thing thanks, will give this promotion a look |

|

|

|

|

|

viktorherald

|

Oct 13 2020, 05:48 PM Oct 13 2020, 05:48 PM

|

Getting Started

|

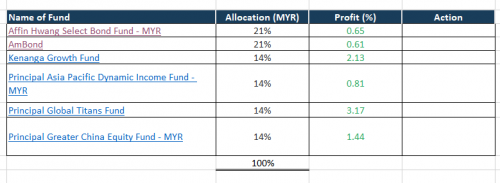

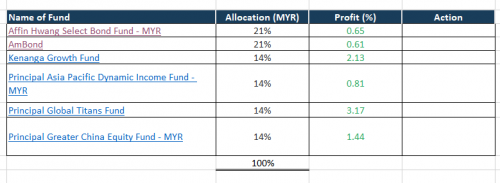

My current allocation, i did contact with their advisor and this is the fund that he recommend to me. I consider my self a moderately risk person i did read the individual funds, but lets just say.. i didnt put too much thinking to it  i just feel that this is quite diverse in regionality, previously some fund dip into reds and now had all recovered Anyone have good insights to offer?  |

|

|

|

|

|

viktorherald

|

Oct 13 2020, 06:33 PM Oct 13 2020, 06:33 PM

|

Getting Started

|

QUOTE(whirlwind @ Oct 13 2020, 06:29 PM) Mine kinda similar with yours 👍 Kinda high risk, focusing on equity to maximize profit All through EPF 15% affin hwang select asia (ex japan) balanced fund 15% eastspring investments small-cap fund 15% principal islamic asia pacific dynamic equity fund 15% principal global titans fund 40% principal greater china equity fund too bad i dont have enough basic savings to invest with EPF yet  still working on it |

|

|

|

|

|

viktorherald

|

Oct 13 2020, 08:40 PM Oct 13 2020, 08:40 PM

|

Getting Started

|

QUOTE(yklooi @ Oct 13 2020, 07:29 PM) yes, quite diverse.... just that past few months,....there had been forummers   about Kenanga Growth fund oooooh, what happened back then? |

|

|

|

|

|

viktorherald

|

Apr 24 2021, 04:39 PM Apr 24 2021, 04:39 PM

|

Getting Started

|

Sold off Ambond, non prerforming, will put it to an liquid investment

|

|

|

|

|

|

viktorherald

|

Sep 30 2021, 04:46 PM Sep 30 2021, 04:46 PM

|

Getting Started

|

QUOTE(xander83 @ Sep 30 2021, 02:19 AM) Principal China A shares Affin New China’s Tracker AmInvest China Manulife China Too many others I haven’t checked out yet Evergrande shadow bailout by CCP read more on how CCP forced shadow bailout without triggering the overall generally banking system and liquidity injections before Golden Week still wise to buy China's fund with recent Evergrande news? Noob question from me |

|

|

|

|

|

viktorherald

|

Oct 18 2023, 11:08 AM Oct 18 2023, 11:08 AM

|

Getting Started

|

QUOTE(coyouth @ Oct 18 2023, 09:30 AM) i'm planning to withdraw everything from FSM. so called managed by professionals, but at this kind of rate, no difference i'm investing myself personally. you mean not even to hand pick own funds to buy in FSM? |

|

|

|

|

|

viktorherald

|

Aug 12 2024, 10:24 AM Aug 12 2024, 10:24 AM

|

Getting Started

|

pushing the thread, hows everyone in FSM doing nowadays?

|

|

|

|

|

Jul 20 2020, 11:10 PM

Jul 20 2020, 11:10 PM

Quote

Quote

0.8149sec

0.8149sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled