QUOTE(MUM @ Oct 12 2020, 11:24 PM)

30% of what you had invested can be withdrawn subjected to i think 8% tax

the remaining 70% have to wait till retirement

I see, thank you.the remaining 70% have to wait till retirement

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Oct 12 2020, 11:47 PM Oct 12 2020, 11:47 PM

Show posts by this member only | IPv6 | Post

#23421

|

Junior Member

654 posts Joined: May 2020 |

|

|

|

|

|

|

Oct 13 2020, 12:01 AM Oct 13 2020, 12:01 AM

Show posts by this member only | IPv6 | Post

#23422

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(datolee32 @ Oct 12 2020, 11:22 PM) Pre-Retirement Withdrawal for General Purposes can be made, in part or in full, from Sub-Account B, which holds 30% of a member’s PRS savings. Such withdrawals are allowed one year after the date of enrolment, once per calendar year and are subjected to an 8% tax penalty on the withdrawn amount. https://www.ppa.my/prs-and-you/prs-faq/ QUOTE(MUM @ Oct 12 2020, 11:24 PM) 30% of what you had invested can be withdrawn subjected to i think 8% tax looks like they had added some new additional withdrawal scenarios the remaining 70% have to wait till retirement https://www.ppa.my/prs-and-you/prs-faq/ Attached thumbnail(s)

datolee32 liked this post

|

|

|

Oct 13 2020, 06:48 AM Oct 13 2020, 06:48 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:57 AM |

|

|

Oct 13 2020, 08:41 AM Oct 13 2020, 08:41 AM

|

Senior Member

7,547 posts Joined: May 2012 |

|

|

|

Oct 13 2020, 09:28 AM Oct 13 2020, 09:28 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted- This post has been edited by GrumpyNooby: Jan 7 2021, 11:58 AM whirlwind liked this post

|

|

|

Oct 13 2020, 10:50 AM Oct 13 2020, 10:50 AM

|

Senior Member

2,379 posts Joined: Sep 2017 |

|

|

|

|

|

|

Oct 13 2020, 03:53 PM Oct 13 2020, 03:53 PM

|

Senior Member

4,816 posts Joined: Apr 2007 |

|

|

|

Oct 13 2020, 04:49 PM Oct 13 2020, 04:49 PM

Show posts by this member only | IPv6 | Post

#23428

|

Junior Member

172 posts Joined: Jan 2017 |

May i ask what is the difference of PRS Fund vs the normal funds offered in FSMone?

|

|

|

Oct 13 2020, 04:56 PM Oct 13 2020, 04:56 PM

Show posts by this member only | IPv6 | Post

#23429

|

All Stars

14,857 posts Joined: Mar 2015 |

|

|

|

Oct 13 2020, 04:57 PM Oct 13 2020, 04:57 PM

Show posts by this member only | IPv6 | Post

#23430

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:58 AM |

|

|

Oct 13 2020, 04:59 PM Oct 13 2020, 04:59 PM

Show posts by this member only | IPv6 | Post

#23431

|

Junior Member

172 posts Joined: Jan 2017 |

QUOTE(GrumpyNooby @ Oct 13 2020, 04:57 PM) PRS is special fund under Private Retirement Scheme yeah, cause under my impression, PRS is something like another mutual fund that can occasionally enjoy some tax benefitsThere's a dedicated thread for this. In summary, it's just unit trust running in EPF way. |

|

|

Oct 13 2020, 05:01 PM Oct 13 2020, 05:01 PM

Show posts by this member only | IPv6 | Post

#23432

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:58 AM |

|

|

Oct 13 2020, 05:08 PM Oct 13 2020, 05:08 PM

Show posts by this member only | IPv6 | Post

#23433

|

Junior Member

172 posts Joined: Jan 2017 |

QUOTE(GrumpyNooby @ Oct 13 2020, 05:01 PM) Moat of the PRS providers don't reinvent the wheel. cause previously i got do some searching and some banks also provide PRS, however it is more like with monthly or annual deposits.They're feeding into existing pools of funds under their own management with certain % of allocation assessed based with associated risk. something like a saving scheme, which is not really my thing thanks, will give this promotion a look |

|

|

|

|

|

Oct 13 2020, 05:09 PM Oct 13 2020, 05:09 PM

Show posts by this member only | IPv6 | Post

#23434

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:58 AM |

|

|

Oct 13 2020, 05:10 PM Oct 13 2020, 05:10 PM

Show posts by this member only | IPv6 | Post

#23435

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:59 AM |

|

|

Oct 13 2020, 05:33 PM Oct 13 2020, 05:33 PM

Show posts by this member only | IPv6 | Post

#23436

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 11:59 AM |

|

|

Oct 13 2020, 05:48 PM Oct 13 2020, 05:48 PM

Show posts by this member only | IPv6 | Post

#23437

|

Junior Member

172 posts Joined: Jan 2017 |

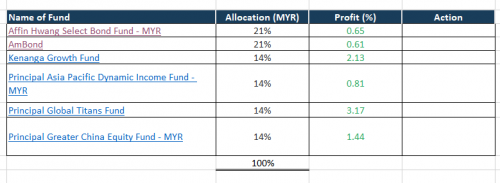

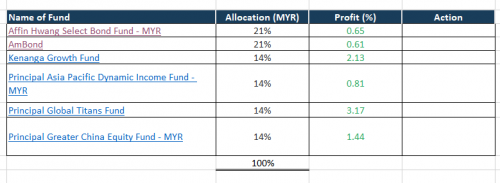

My current allocation, i did contact with their advisor and this is the fund that he recommend to me. I consider my self a moderately risk person i did read the individual funds, but lets just say.. i didnt put too much thinking to it i just feel that this is quite diverse in regionality, previously some fund dip into reds and now had all recovered Anyone have good insights to offer? |

|

|

Oct 13 2020, 06:17 PM Oct 13 2020, 06:17 PM

Show posts by this member only | IPv6 | Post

#23438

|

Senior Member

3,602 posts Joined: Jan 2003 |

|

|

|

Oct 13 2020, 06:17 PM Oct 13 2020, 06:17 PM

Show posts by this member only | IPv6 | Post

#23439

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted- This post has been edited by GrumpyNooby: Jan 7 2021, 11:59 AM whirlwind liked this post

|

|

|

Oct 13 2020, 06:29 PM Oct 13 2020, 06:29 PM

Show posts by this member only | IPv6 | Post

#23440

|

Senior Member

3,602 posts Joined: Jan 2003 |

QUOTE(viktorherald @ Oct 13 2020, 05:48 PM)  My current allocation, i did contact with their advisor and this is the fund that he recommend to me. I consider my self a moderately risk person i did read the individual funds, but lets just say.. i didnt put too much thinking to it i just feel that this is quite diverse in regionality, previously some fund dip into reds and now had all recovered Anyone have good insights to offer? Kinda high risk, focusing on equity to maximize profit All through EPF 15% affin hwang select asia (ex japan) balanced fund 15% eastspring investments small-cap fund 15% principal islamic asia pacific dynamic equity fund 15% principal global titans fund 40% principal greater china equity fund |

| Change to: |  0.0258sec 0.0258sec

0.15 0.15

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 02:37 AM |