QUOTE(Kaka23 @ Jul 9 2020, 10:31 AM)

in your perceptive, what made you "missed" it?FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jul 9 2020, 10:38 AM Jul 9 2020, 10:38 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Jul 9 2020, 10:40 AM Jul 9 2020, 10:40 AM

|

All Stars

10,340 posts Joined: Jan 2003 |

|

|

|

Jul 9 2020, 10:40 AM Jul 9 2020, 10:40 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

Jul 9 2020, 10:41 AM Jul 9 2020, 10:41 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(WhitE LighteR @ Jul 9 2020, 10:40 AM) I dont encourage anyone to chase the market. haha.. my decisions always go the opposite. Buy something expecting them to go up, but in the end stagnant or downSome ppl are lucky they get in high and escape higher just before it turn back down. Do you feel lucky? |

|

|

Jul 9 2020, 10:42 AM Jul 9 2020, 10:42 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jul 9 2020, 10:45 AM Jul 9 2020, 10:45 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(yklooi @ Jul 9 2020, 10:42 AM) could that be due to your I rebalance from EQ75% to EQ25% before the CNY... March drop only manged to enter a little bit. EQ 25% FI 50% Money market 25%?? but as long as you are happy with that allocation.....it is OK So now with OPR cut, need to think of $ sitting in Money market.. wanna make money work harder a bit |

|

|

|

|

|

Jul 9 2020, 10:47 AM Jul 9 2020, 10:47 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Kaka23 @ Jul 9 2020, 10:45 AM) I rebalance from EQ75% to EQ25% before the CNY... March drop only manged to enter a little bit. On that, do take note about this below post So now with OPR cut, need to think of $ sitting in Money market.. wanna make money work harder a bit QUOTE(WhitE LighteR @ Jul 9 2020, 10:40 AM) |

|

|

Jul 9 2020, 10:50 AM Jul 9 2020, 10:50 AM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(Kaka23 @ Jul 9 2020, 10:41 AM) haha.. my decisions always go the opposite. Buy something expecting them to go up, but in the end stagnant or down cannot be correct all the time. I chase return type. So its important for me to stay invest in equity. When i cant decide which fund for the region is the best, i just buy all of them. It will look like collecting pokemon but the return does varies showing that if you pick the wrong one, the return will be lower or higher. So i rather just average them out. Example Greater China I currently have 3 Eastspring Investments Dinasti Equity Fund Manulife Investment Greater China Fund Principal Greater China Equity Fund - MYR Bought more or less about the same time. But return is : 17.89 22.39 22.65 Dinasti is the less volatile of the 3 with best sharpe ratio, but it also return the lowest for me. So just trade your own plan. |

|

|

Jul 9 2020, 11:22 AM Jul 9 2020, 11:22 AM

|

Senior Member

1,259 posts Joined: Jan 2018 |

|

|

|

Jul 9 2020, 11:55 AM Jul 9 2020, 11:55 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(WhitE LighteR @ Jul 9 2020, 09:44 AM) My indicator are lagging indicators because they are based on price action. I cannot predict before market turn lower. I use a dynamic portfolio sector n region allocation to mitigate this effect which allows me to profit both direction. I have been slowly adding to gold position since Feb. For equity, I've cut my holding by a little bit to lock some profit around Jun. Mostly by 1/3. But after that market continues to rally with a crazy euphoria. Gold new highs. I will share here once I see a momentum change. just noticed latest articles by Affinhwang Am & Principal AmRetail investors are just crazy. https://www.bloomberg.com/news/articles/202...srnd=markets-vp A BRIEF ON GLOBAL & LOCAL MARKETS, INVESTMENT STRATEGY. WEEK IN REVIEW | 29 JUNE – 3 JULY 2020 On portfolio positioning, we remain highly invested with cash levels hovering between 3.0-5.0%. We remain cautious and will continue to monitor developments on the COVID-19 front including progress of a vaccine with several trials having moved to phase 3. https://affinhwangam.com/insights/weekly-market-review Investment Outlook June 2020 by Principal Asset mgmt We’re increasing exposure to equities relating to fixed income,....... https://www.principal.com.my/sites/default/...mmentary_FA.pdf This post has been edited by T231H: Jul 9 2020, 12:38 PM |

|

|

Jul 9 2020, 01:07 PM Jul 9 2020, 01:07 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(T231H @ Jul 9 2020, 11:55 AM) just noticed latest articles by Affinhwang Am & Principal Am I personally feel the fundamentals have changed now. Covid is less of a factor now with the world swimming in cash. So in order not to be left out, many institution have no choice but to invest. But we are diy retail investors. We don't have to do that if we don't want too. We can choose to be defensive if we want like some of our members here do.A BRIEF ON GLOBAL & LOCAL MARKETS, INVESTMENT STRATEGY. WEEK IN REVIEW | 29 JUNE – 3 JULY 2020 On portfolio positioning, we remain highly invested with cash levels hovering between 3.0-5.0%. We remain cautious and will continue to monitor developments on the COVID-19 front including progress of a vaccine with several trials having moved to phase 3. https://affinhwangam.com/insights/weekly-market-review Investment Outlook June 2020 by Principal Asset mgmt We’re increasing exposure to equities relating to fixed income,....... https://www.principal.com.my/sites/default/...mmentary_FA.pdf |

|

|

Jul 9 2020, 02:17 PM Jul 9 2020, 02:17 PM

|

Senior Member

1,269 posts Joined: May 2005 |

QUOTE(T231H @ Jul 9 2020, 11:55 AM) just noticed latest articles by Affinhwang Am & Principal Am Haha FOMO mah.A BRIEF ON GLOBAL & LOCAL MARKETS, INVESTMENT STRATEGY. WEEK IN REVIEW | 29 JUNE – 3 JULY 2020 On portfolio positioning, we remain highly invested with cash levels hovering between 3.0-5.0%. We remain cautious and will continue to monitor developments on the COVID-19 front including progress of a vaccine with several trials having moved to phase 3. https://affinhwangam.com/insights/weekly-market-review Investment Outlook June 2020 by Principal Asset mgmt We’re increasing exposure to equities relating to fixed income,....... https://www.principal.com.my/sites/default/...mmentary_FA.pdf Don’t just think retail investors yang fomo. Even fund managers too. |

|

|

Jul 9 2020, 05:03 PM Jul 9 2020, 05:03 PM

Show posts by this member only | IPv6 | Post

#21953

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 12:58 PM |

|

|

|

|

|

Jul 9 2020, 08:36 PM Jul 9 2020, 08:36 PM

Show posts by this member only | IPv6 | Post

#21954

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(Kaka23 @ Jul 8 2020, 12:52 PM) OK... I should move some CMF2 to some bond funds!!! many thanks! invest this on 25th juneMaybe also take like 10K to gamble short term equity UT.. seeing the ''bull'' does not stop anytime soon and after some tinkering with a close fren of mine both of us decided to pull the trigger on it if the ''bull'' does not stop, one month holding probably will yield at least 6%

This post has been edited by xcxa23: Jul 9 2020, 08:42 PM |

|

|

Jul 9 2020, 09:52 PM Jul 9 2020, 09:52 PM

|

Junior Member

81 posts Joined: Jan 2013 |

Hello. Since the FD rates are notorious. I'm looking at the next safe/decent investment.

Are bond funds in FSM a good buy now? |

|

|

Jul 9 2020, 09:53 PM Jul 9 2020, 09:53 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Jul 9 2020, 10:06 PM Jul 9 2020, 10:06 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(GrumpyCat @ Jul 9 2020, 09:52 PM) Hello. Since the FD rates are notorious. I'm looking at the next safe/decent investment. i think it is, for usually it was mentioned, when interest rates goes up, FI nav goes down.Are bond funds in FSM a good buy now? as the current interest rate trend is down and the rises is not in the near future....so i think FI is a go place to replace some of FD. but as posted by MUM at post 21871, page 1094 earlier, it shows not all FI are equal... |

|

|

Jul 9 2020, 11:40 PM Jul 9 2020, 11:40 PM

Show posts by this member only | IPv6 | Post

#21958

|

Senior Member

5,600 posts Joined: Apr 2011 From: Kuala Lumpur |

Early this year there was a Managed Portfolio promotion by FSM, if you subscribe to their MP you’ll get lifetime 0% subscription fee.

I just confirmed with FSM that I can change the RSP amount and I can still enjoy the 0% subscription fee.

This means that the only fee that I have to pay is 0.50% management fee per annum.

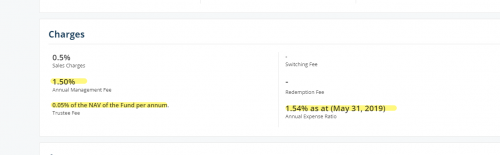

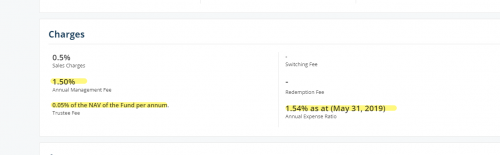

For the MP one of the fund is KGF, if I want to enter KGF normally I’ll have to pay 1.75% sales charge. It also comes with 1.50% annual management fee.

If I were to invest through MP, I can bypass all that and only pay 0.50% annual management fee. Is there anything I’m missing? |

|

|

Jul 9 2020, 11:48 PM Jul 9 2020, 11:48 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(victorian @ Jul 9 2020, 11:40 PM) Early this year there was a Managed Portfolio promotion by FSM, if you subscribe to their MP you’ll get lifetime 0% subscription fee. I just confirmed with FSM that I can change the RSP amount and I can still enjoy the 0% subscription fee.

This means that the only fee that I have to pay is 0.50% management fee per annum.

For the MP one of the fund is KGF, if I want to enter KGF normally I’ll have to pay 1.75% sales charge. It also comes with 1.50% annual management fee.

If I were to invest through MP, I can bypass all that and only pay 0.50% annual management fee. Is there anything I’m missing?  yes and no yes because u indeed dont need to pay for subscription fee for ur MP no because in fact you are still paying the highlighted, but for UT, the highlighted usually doesnt matter because it is absorded and reflected in the NAV, which means the NAV and performance you saw on FSM is already considered and included with the highlighted. |

|

|

Jul 9 2020, 11:58 PM Jul 9 2020, 11:58 PM

|

Senior Member

5,600 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(tadashi987 @ Jul 9 2020, 11:48 PM)  yes and no yes because u indeed dont need to pay for subscription fee for ur MP no because in fact you are still paying the highlighted, but for UT, the highlighted usually doesnt matter because it is absorded and reflected in the NAV, which means the NAV and performance you saw on FSM is already considered and included with the highlighted. |

| Change to: |  0.0561sec 0.0561sec

0.06 0.06

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 03:36 AM |