FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jul 8 2020, 07:38 PM Jul 8 2020, 07:38 PM

Show posts by this member only | IPv6 | Post

#21921

|

Senior Member

2,139 posts Joined: Nov 2007 |

|

|

|

|

|

|

Jul 8 2020, 08:09 PM Jul 8 2020, 08:09 PM

Show posts by this member only | IPv6 | Post

#21922

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 12:57 PM |

|

|

Jul 8 2020, 08:16 PM Jul 8 2020, 08:16 PM

Show posts by this member only | IPv6 | Post

#21923

|

Senior Member

2,139 posts Joined: Nov 2007 |

QUOTE(GrumpyNooby @ Jul 8 2020, 08:09 PM) Not really, it is a hit and run strategy for some of the "growth" stock , definitely not long term, when i have enough it will be switched to a bond fund and repeat if condition is favourable. One got to take the advantage of the 0% sales and switching charge.This post has been edited by backspace66: Jul 8 2020, 08:21 PM |

|

|

Jul 8 2020, 09:08 PM Jul 8 2020, 09:08 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(brokenbomb @ Jul 8 2020, 06:56 PM) VIX still under MA20. So should be ok. Vix is unpredictable. Anytime can change directions.After ytd pullback, thought principal china direct opportunities Would be down. Sekali today Due for a pullback, so gonna ready some bullet to buy the dip. I just waiting for that other shoe to drop. |

|

|

Jul 8 2020, 11:04 PM Jul 8 2020, 11:04 PM

|

Junior Member

529 posts Joined: May 2019 |

Anyone going into any equity recently?

Have some cash in hand, but China, US tech, gold all seems to be on the high side. Been parking at FI, but opportunity doesn’t seem to be coming,lol |

|

|

Jul 8 2020, 11:14 PM Jul 8 2020, 11:14 PM

|

All Stars

10,340 posts Joined: Jan 2003 |

|

|

|

|

|

|

Jul 9 2020, 06:01 AM Jul 9 2020, 06:01 AM

|

Senior Member

1,269 posts Joined: May 2005 |

|

|

|

Jul 9 2020, 08:42 AM Jul 9 2020, 08:42 AM

Show posts by this member only | IPv6 | Post

#21928

|

Senior Member

5,603 posts Joined: Apr 2011 From: Kuala Lumpur |

If I sold my holdings on Tuesday morning, when will the price be locked in ya? I just checked and the units are still inside my account, does it mean that the price is not locked yet?

It’s really giving me a rollercoaster ride, seeing my current holdings fluctuating and my sale order still in process. |

|

|

Jul 9 2020, 08:43 AM Jul 9 2020, 08:43 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted-

This post has been edited by GrumpyNooby: Jan 7 2021, 12:57 PM |

|

|

Jul 9 2020, 08:44 AM Jul 9 2020, 08:44 AM

Show posts by this member only | IPv6 | Post

#21930

|

Senior Member

5,603 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Jul 9 2020, 08:47 AM Jul 9 2020, 08:47 AM

Show posts by this member only | IPv6 | Post

#21931

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Jul 9 2020, 08:48 AM Jul 9 2020, 08:48 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

-deleted- This post has been edited by GrumpyNooby: Jan 7 2021, 12:58 PM ironman16 liked this post

|

|

|

Jul 9 2020, 08:48 AM Jul 9 2020, 08:48 AM

Show posts by this member only | IPv6 | Post

#21933

|

Senior Member

5,603 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

|

|

|

Jul 9 2020, 08:58 AM Jul 9 2020, 08:58 AM

|

All Stars

14,892 posts Joined: Mar 2015 |

QUOTE(victorian @ Jul 9 2020, 08:42 AM) If I sold my holdings on Tuesday morning, when will the price be locked in ya? I just checked and the units are still inside my account, does it mean that the price is not locked yet? Just look for the transaction date in the transaction statement... That is the date the price will be lockedIt’s really giving me a rollercoaster ride, seeing my current holdings fluctuating and my sale order still in process. |

|

|

Jul 9 2020, 09:14 AM Jul 9 2020, 09:14 AM

Show posts by this member only | IPv6 | Post

#21935

|

Senior Member

5,879 posts Joined: Sep 2009 |

QUOTE(WhitE LighteR @ Jul 8 2020, 09:08 PM) equities up like crazy considering the devastation by COVIDjust wonder when it will come crashing down again....... if your indicators turn negative please notify us here, thanks |

|

|

Jul 9 2020, 09:44 AM Jul 9 2020, 09:44 AM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(guy3288 @ Jul 9 2020, 09:14 AM) equities up like crazy considering the devastation by COVID My indicator are lagging indicators because they are based on price action. I cannot predict before market turn lower. I use a dynamic portfolio sector n region allocation to mitigate this effect which allows me to profit both direction. I have been slowly adding to gold position since Feb. For equity, I've cut my holding by a little bit to lock some profit around Jun. Mostly by 1/3. But after that market continues to rally with a crazy euphoria. Gold new highs. I will share here once I see a momentum change.just wonder when it will come crashing down again....... if your indicators turn negative please notify us here, thanks Retail investors are just crazy. https://www.bloomberg.com/news/articles/202...srnd=markets-vp |

|

|

Jul 9 2020, 09:58 AM Jul 9 2020, 09:58 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(WhitE LighteR @ Jul 9 2020, 09:44 AM) My indicator are lagging indicators because they are based on price action. I cannot predict before market turn lower. I use a dynamic portfolio sector n region allocation to mitigate this effect which allows me to profit both direction. I have been slowly adding to gold position since Feb. For equity, I've cut my holding by a little bit to lock some profit around Jun. Mostly by 1/3. But after that market continues to rally with a crazy euphoria. Gold new highs. I will share here once I see a momentum change. Bro.. so now your advice is keep out of equities? Gold as well?Retail investors are just crazy. https://www.bloomberg.com/news/articles/202...srnd=markets-vp Fixed income is best for current situation? |

|

|

Jul 9 2020, 10:15 AM Jul 9 2020, 10:15 AM

|

All Stars

14,892 posts Joined: Mar 2015 |

QUOTE(Kaka23 @ Jul 9 2020, 09:58 AM) Bro.. so now your advice is keep out of equities? Gold as well? while waiting for his responses, you can try read Fixed income is best for current situation? post 21850, page 1093 to follow his UT detailed UT portfolio movement since Jan, to have an understanding of his current allocation post 21893, page 1095 about his current view on bond (FI). |

|

|

Jul 9 2020, 10:19 AM Jul 9 2020, 10:19 AM

|

All Stars

10,340 posts Joined: Jan 2003 |

QUOTE(Kaka23 @ Jul 9 2020, 09:58 AM) Bro.. so now your advice is keep out of equities? Gold as well? I always advocate to stay invested. U can check my allocation here.Fixed income is best for current situation? https://forum.lowyat.net/index.php?showtopi...post&p=97362912 Historical there is a huge penalty to the portfolio return if you are out of the market n waiting at the sidelines with the majority of your portfolio in bond or cash. https://www.fool.com/investing/2019/04/11/w...-in-the-st.aspx At this moment, I don't see anything to buy if u have fresh fund. I also keeping my cash dry now. I keep in money market coz I can capture same day price if I decide to buy something. I can't have same day price if I keep in bond because they need to sell out of bond first. Anyway, bond also drop when momentum change lower recently, and so has gold. But different is gold goes up faster than bond and offer the same protection for me. Coz of this I dont like bond. Just to give some figure for past 12m Gold lowest drawdown -2.14 Downside deviation 0.70 Upside average 4.48 Asnita Bond -3.01 Downside deviation 0.70 Upside average 0.95 Ambond -5.24 Downside deviation 1.42 Upside average 1.57 The only thing that Bond offers is better std dev. Which is important if you dont like to see your port value fluctuate. Not important for me. This post has been edited by WhitE LighteR: Jul 9 2020, 10:36 AM |

|

|

Jul 9 2020, 10:31 AM Jul 9 2020, 10:31 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

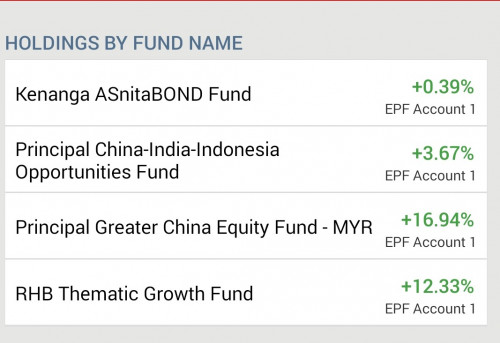

I am now :

EQ 25% FI 50% Money market 25% Already miss the train since the climb from Mar till now |

| Change to: |  0.0238sec 0.0238sec

0.69 0.69

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 10:22 AM |