Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

drew86

|

Mar 6 2017, 08:43 PM Mar 6 2017, 08:43 PM

|

Getting Started

|

QUOTE(Ramjade @ Mar 6 2017, 07:36 PM) Well I aren't going to buy from them if I can help it IF eUT can offer 0% SC for bond funds above RM5k purchase. Only if eUT offer that, I will buy from them. Until then, continue to pay platform fees yearly    Will need to moniter if eUT have 0% for Affin Hwang Select Bond Fund. tonytyk do you have Affin Hwang Select Bond Fund with eUT? If yes, any charges when you buy from them? Interested to know too. Where can we find that min 5k purchase waive SC statement? Their web interface is a pain in the arse to use.. |

|

|

|

|

|

Ramjade

|

Mar 6 2017, 08:49 PM Mar 6 2017, 08:49 PM

|

|

QUOTE(drew86 @ Mar 6 2017, 08:43 PM) Interested to know too. Where can we find that min 5k purchase waive SC statement? Their web interface is a pain in the arse to use.. Don't know how often they update the page. Tell me about it. The SG interface also   |

|

|

|

|

|

woonsc

|

Mar 6 2017, 08:50 PM Mar 6 2017, 08:50 PM

|

|

QUOTE(drew86 @ Mar 6 2017, 08:43 PM) Interested to know too. Where can we find that min 5k purchase waive SC statement? Their web interface is a pain in the arse to use.. QUOTE(Ramjade @ Mar 6 2017, 08:49 PM) https://www.eunittrust.com.my/fundInfo/promotions.aspDon't know how often they update the page. Tell me about it. The SG interface also    FSM bond funds all 0% SC? |

|

|

|

|

|

Ramjade

|

Mar 6 2017, 08:53 PM Mar 6 2017, 08:53 PM

|

|

QUOTE(woonsc @ Mar 6 2017, 08:50 PM)  FSM bond funds all 0% SC? All FSM bond funds have 0% SC but you pay platform fees la every quarter.    |

|

|

|

|

|

T231H

|

Mar 6 2017, 09:03 PM Mar 6 2017, 09:03 PM

|

|

QUOTE(Ramjade @ Mar 6 2017, 08:53 PM) ya-lor...for every RM100 000 in Bond must pay them 0.4% (RM400) for year, but then some people also said,...why invest in UT EQ funds when for every RM100 000 in EQ must pay them 2% SC (RM2000) + 1.5~2% Mgmt fees (RM1500~RM2000) per year  |

|

|

|

|

|

Ramjade

|

Mar 6 2017, 09:29 PM Mar 6 2017, 09:29 PM

|

|

QUOTE(T231H @ Mar 6 2017, 09:03 PM) ya-lor...for every RM100 000 in Bond must pay them 0.4% (RM400) for year, but then some people also said,...why invest in UT EQ funds when for every RM100 000 in EQ must pay them 2% SC (RM2000) + 1.5~2% Mgmt fees (RM1500~RM2000) per year  Management fees the manager is doing work. That one ok la pay. Service charge, one time payment for using FSM website. Ok pay like brokerage fees. But platform fees? Why need to pay every year? You don't see brokerage charging platform fees. |

|

|

|

|

|

T231H

|

Mar 6 2017, 09:31 PM Mar 6 2017, 09:31 PM

|

|

QUOTE(Ramjade @ Mar 6 2017, 09:29 PM) Management fees the manager is doing work. That one ok la pay. Service charge, one time payment for using FSM website. Ok pay like brokerage fees.

But platform fees? Why need to pay every year? You don't see brokerage charging platform fees.

Maybe bcos of not paying Service charge, one time payment for using FSM website? but then, there are people that dun mind the 0.4% pa.... just like some people would not mind doing this..... (while others would says "Siow" or Crazy) https://www.youtube.com/watch?v=TwGvqfZ_PIwThis post has been edited by T231H: Mar 6 2017, 09:42 PM |

|

|

|

|

|

biastee

|

Mar 6 2017, 09:42 PM Mar 6 2017, 09:42 PM

|

Getting Started

|

QUOTE(Ramjade @ Mar 6 2017, 08:53 PM) QUOTE(T231H @ Mar 6 2017, 09:03 PM) ya-lor...for every RM100 000 in Bond must pay them 0.4% (RM400) for year, but then some people also said,...why invest in UT EQ funds when for every RM100 000 in EQ must pay them 2% SC (RM2000) + 1.5~2% Mgmt fees (RM1500~RM2000) per year  If buying either RHB Bond or RHB Islamic Bond, it is cheaper to do so on CIMB as there is neither s/c nor platform fee for these two. :-) Can buy on CIMB and then quietly transfer them to FSM? This post has been edited by biastee: Mar 6 2017, 09:44 PM |

|

|

|

|

|

Ramjade

|

Mar 6 2017, 09:44 PM Mar 6 2017, 09:44 PM

|

|

QUOTE(biastee @ Mar 6 2017, 09:42 PM) If buying either RHB Bond or RHB Islamic Bond, it is cheaper to do so on CIMB as there is neither s/c nor platform fee for these two. Thanks for the info.  I am looking for platform for Affin Select Bond Fund with 0% SC and 0% platform fees. |

|

|

|

|

|

T231H

|

Mar 6 2017, 09:44 PM Mar 6 2017, 09:44 PM

|

|

QUOTE(biastee @ Mar 6 2017, 09:42 PM) If buying either RHB Bond or RHB Islamic Bond, it is cheaper to do so on CIMB as there is neither s/c nor platform fee for these two. :-) Can buy on CIMB and then quietly transfer them to FSM? after you quitely transferred...still will kena the platform fees wor This post has been edited by T231H: Mar 6 2017, 09:48 PM |

|

|

|

|

|

puchongite

|

Mar 6 2017, 09:47 PM Mar 6 2017, 09:47 PM

|

|

QUOTE(biastee @ Mar 6 2017, 09:42 PM) If buying either RHB Bond or RHB Islamic Bond, it is cheaper to do so on CIMB as there is neither s/c nor platform fee for these two. :-) Can buy on CIMB and then quietly transfer them to FSM? Too bad not really interested in those two local funds. How about RHB EMBF ? |

|

|

|

|

|

!@#$%^

|

Mar 6 2017, 09:54 PM Mar 6 2017, 09:54 PM

|

|

QUOTE(biastee @ Mar 6 2017, 09:42 PM) If buying either RHB Bond or RHB Islamic Bond, it is cheaper to do so on CIMB as there is neither s/c nor platform fee for these two. :-) Can buy on CIMB and then quietly transfer them to FSM? if no fees at all, why not just keep in CIMB? |

|

|

|

|

|

xuzen

|

Mar 6 2017, 09:57 PM Mar 6 2017, 09:57 PM

|

|

QUOTE(Ramjade @ Mar 6 2017, 08:53 PM) MYR 100K park in bonds pay MYR 400.00 per annum platform fee is equivalent to MYR 33.33 per month equivalent to SGD 10.00 per month. For someone who has no qualms to take a trip to the Red Dot Island down south to open an account and to spend more than that per annum on transport, food and maybe lodgings, to kow-peh-kow-bu, is perplexing. And I bet that same person max only put in MYR 10K in the bond = MYR 40.00 per annum = MYR 3.33 per month = SGD 1.00 per month only. Sometimes hor penny wise pounds foolish. Xuzen |

|

|

|

|

|

Ramjade

|

Mar 6 2017, 09:58 PM Mar 6 2017, 09:58 PM

|

|

QUOTE(xuzen @ Mar 6 2017, 09:57 PM) MYR 100K park in bonds pay MYR 400.00 per annum platform fee is equivalent to MYR 33.33 per month equivalent to SGD 10.00 per month. For someone who has no qualms to take a trip to the Red Dot Island down south to open an account and to spend more than that per annum on transport, food and maybe lodgings, to kow-peh-kow-bu, is perplexing. And I bet that same person max only put in MYR 10K in the bond = MYR 40.00 per annum = MYR 3.33 per month = SGD 1.00 per month only. Sometimes hor penny wise pounds foolish. Xuzen SG 0% SC, 0% platform fees    One trip down = min SGD60 save vs TTing using banks even after count transport  It's all about principles. I refused to pay for platform fees/annual fees. You want to pay you pay. Why should one pay if someone kasi you for free? You so much money? Better I pay the platform fees to charity then FSM. Free no good paid also no good?  This post has been edited by Ramjade: Mar 6 2017, 10:03 PM This post has been edited by Ramjade: Mar 6 2017, 10:03 PM |

|

|

|

|

|

tonytyk

|

Mar 6 2017, 09:59 PM Mar 6 2017, 09:59 PM

|

|

QUOTE(Ramjade @ Mar 6 2017, 07:36 PM) Old news. That's already part of my future strategy (using Affin Hwang Select Bond Fund only as my "FD"). They forgot to mention that they will be earning platform fees from their clients. Smart move eh? Include in "no sales charge and redemption fees" but "leave out the platform fees"   Should have mentioned about the platform fees.  Well I aren't going to buy from them if I can help it IF eUT can offer 0% SC for bond funds above RM5k purchase. Only if eUT offer that, I will buy from them. Until then, continue to pay platform fees yearly    Will need to moniter if eUT have 0% for Affin Hwang Select Bond Fund. tonytyk do you have Affin Hwang Select Bond Fund with eUT? If yes, any charges when you buy from them? I got 0% sc from them earlier, and no platform fee |

|

|

|

|

|

Ramjade

|

Mar 6 2017, 10:02 PM Mar 6 2017, 10:02 PM

|

|

QUOTE(tonytyk @ Mar 6 2017, 09:59 PM) I got 0% sc from them earlier, and no platform fee Nice.    Must keep an eye on eUT already   Now we know we have alternatives to platform free affin hwang select bond fund. The only question is when is the next promo...  This post has been edited by Ramjade: Mar 6 2017, 10:06 PM This post has been edited by Ramjade: Mar 6 2017, 10:06 PM |

|

|

|

|

|

xuzen

|

Mar 6 2017, 10:05 PM Mar 6 2017, 10:05 PM

|

|

One more thing one may not be aware is, as your fortune grow, you need to start thinking about distribution as well. You actually need to think if you demise suddenly, you will want your next-of-kin to be able to obtain your estate as fast as possible.

If you put your money here and there, is like, sorok here, sorok there, how will they know where to find your money? It is as good as becoming government's money. Why? Cause there is an Unclaimed Money Act (UMA) where is the account remains dormant and the beneficiaries remain untraceable, the money goes to our Jabatan Akauntan Negara.

If you consolidate your wealth in an easy to find manner, you save them a ton of trouble and hassle. Once I attended a Rockwill presentation and the speaker said those Malaysians think very action want to buy property in London lar, in Australia lar....

Wait till you die and your next of kin need to claim your property that time... then you baru tau the hassle. Think very funny hor, buy here, buy there....

Xuzen

|

|

|

|

|

|

biastee

|

Mar 6 2017, 10:07 PM Mar 6 2017, 10:07 PM

|

Getting Started

|

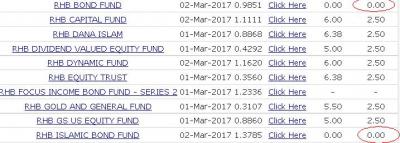

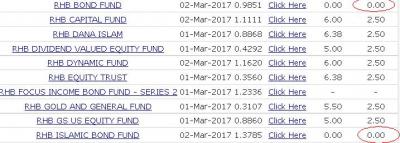

QUOTE(Ramjade @ Mar 6 2017, 09:44 PM) Thanks for the info.  I am looking for platform for Affin Select Bond Fund with 0% SC and 0% platform fees. Me too! If I recall correctly, there was a 0% s/c promo at EUT last year. Anyway, won't this month should be an opportune time to buy this fund as it historically distributes in mid-March? QUOTE(T231H @ Mar 6 2017, 09:44 PM) I don't know how to provide a link as the relevant page is behind a login. However the screen capture shows the relevant fund with the 0% s/c in red circles.

|

|

|

|

|

|

puchongite

|

Mar 6 2017, 10:08 PM Mar 6 2017, 10:08 PM

|

|

QUOTE(Ramjade @ Mar 6 2017, 10:02 PM) Nice.  :thumbsup:  Must keep an eye on eUT already   That's during promo lar. You probably have to wait till Merdeka day. LOL. Right now the Lipper award promotion in both eUT and FSM are pretty boring. |

|

|

|

|

|

Ramjade

|

Mar 6 2017, 10:11 PM Mar 6 2017, 10:11 PM

|

|

QUOTE(biastee @ Mar 6 2017, 10:07 PM) Me too! If I recall correctly, there was a 0% s/c promo at EUT last year. Anyway, won't this month should be an opportune time to buy this fund as it historically distributes in mid-March? Distribution is not important in UT. In addition, for a stable bond fund, one can buy anytime. QUOTE(puchongite @ Mar 6 2017, 10:08 PM) That's during promo lar. You probably have to wait till Merdeka day. LOL. Right now the Lipper award promotion in both eUT and FSM are pretty boring. Thanks for the heads up. Will buy during that time. |

|

|

|

|

Mar 6 2017, 08:43 PM

Mar 6 2017, 08:43 PM

Quote

Quote

0.0170sec

0.0170sec

0.52

0.52

6 queries

6 queries

GZIP Disabled

GZIP Disabled