QUOTE(rocketm @ Sep 2 2021, 10:43 AM)

Hi guys, just want to confirm on HLBB TIA-i calculation.

I chat with them and got my refund for the shortage of profit amount.

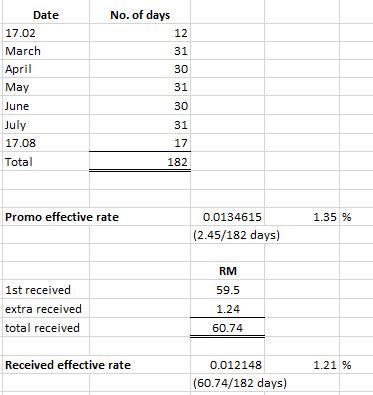

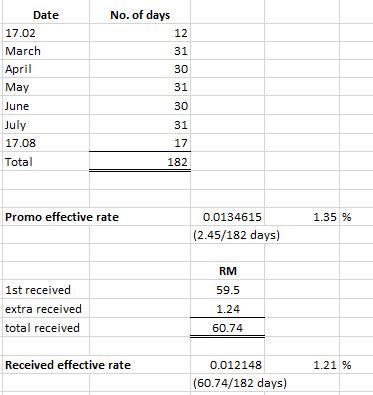

Promo rate: 2.45% p.a

Tenure: 6 months

Principal: RM 5k

Placement tenure: 17.02.21 - 17.08.21

Total profit received RM59.50 + RM1.24 = RM60.74

===================================

[url=https://pictr.com/image/B66QC2]

Does the amount that I received is still not based on the promo rate?

You do not know and understand the meaning of the term Maturity Date and as a direct result you do not know how to count the number of days involved for FD calculation of interest.

In Malaysia, Maturity Date is the day AFTER the full term/tenor is COMPLETED. After completion only is the customer eligible to get the interest/profit. This usual statement in financial or investment guides is not very helpful by itself without explanation and has naturally given rise to ambiguity due to its lack of precision and understandable teaching communication for those not familiar or working in such matters. It is like giving some idiom or some esoteric phrase in Tao or kungfu or an essay or debate topic and somehow the student suddenly understands all the intricacies and variations and exceptions at once without thought, questioning, experiment, practice on accurate examples. Spoonfeeding, copy and paste and blind application without analysis of assumptions and different conditions/situations and research of possibilities can only give halfbaked results and matters are not helped by bad questions.

The proper question is - When is the full tenor completed? Precisely this is when the tenor ends at midnite of the last tenor day and the next day begins as Maturity Day. Suppose an eFD is placed on 1 January. When does the year end for a year tenor? When it reaches midnite and becomes 1st January instead. Practically, the change may be seen in your internet banking account shortly after midnite rollover OR around a specified creditting time which may be mentioned in the T&C like 6 am etc on Maturity Date (on 1st January if the system is set to work then in this example). So in your case, you had 182 days because what you did was to treat Maturity Date as part of the tenor. The days for August was actually 16 and not 17 as the last tenor date was 16 August 2021 whilst the Maturity Date was 17 August.

However, for OTC FD and some eFD, they may still follow the old legacy method, where when the tenor ends on weekends and public holidays, interest at the original placement rate is maintained for the days till the first bank working day occurs. There are 2 ways usually practiced in Malaysia. The first way is that the tenor ends and interest is creditted backwards and another extra interest is given for extra days. The second way is that the interest is calculated and paid till the adjusted tenor ending and creditted on the adjusted Maturity Date. For those keeping precise records and observing the results, it can be seen that there are cases where the total amount received using the first and the second ways can have some small difference due to technical method. Therefore, it is not precisely correct actually to say that it depends on the number of days, meaning the algebraic equation:-

I=PRTtotal is not always equal to I=PRTnominal + PRTextra.

It is only coincidental if they happen to be the same due to the values of P, R or T used coincidentally or by optimized design by the FD placer, and is affected by the various rounding ways used. Usually people are creatures of habit and slaves of their environment, education and incapable of throwing off their baggage and improve when notice that old method/thinking/worldview is not actually real or effective or efficient.

There are also banks that will not give the extra days interest automatically and need to complain/request for the difference. Usually this is not backdated creditted, so the delay actually means some loss to the FD customer especially if big sums involved.

The number of IBD can be simply viewed as the number of midnites from Effective Date to Maturity Date. Maturity Date had been explained in the previous para. What we need to be careful is to note that the Effective Date does not always happen to be the same as the Placement Date when the FD placement was made, and can be later. The usual problem here is the cut-off time for FD placement at the bank OTC, cheque clearance, or how the bank system treats eFD placement either instantly when placed from account, transfers or FPX or delayed due to some built in rule for when system can process (which may not be as fast as one thinks sometimes).

Effective Date is considered as 1 day as long as your placement occurs before the cut-off time before midnite even if for a few hours or minutes depending on how the different bank system works. This knowledge is vital if busy scraping and transferring in money from various sources to make it in time to place for a particular Effective Date.

It should be noted that Effective Dates can make quite significant differences in the interest/profit collected especially when it is practically applied to monthly, periodic or step type interest payments besides the usual Maturity Date situations. However, to apply this advantage you need to have knowledge or experience and time scenario spreadsheet designed to give you the answers beforehand in planning for the FD placement. There is a big difference/advantage between simply putting in at any arbitrary date and at selected date due to so called compounding effect over time. There are usual days and there are good and also bad days it is only whether you know or observe the effects and how to handle.

This post has been edited by Deal Hunter: Sep 4 2021, 05:47 AM

Sep 2 2021, 03:13 PM

Sep 2 2021, 03:13 PM

Quote

Quote

0.0287sec

0.0287sec

0.73

0.73

6 queries

6 queries

GZIP Disabled

GZIP Disabled