QUOTE(frozz@holic @ Jul 17 2019, 01:45 PM)

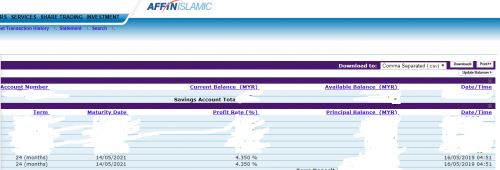

did FD at Affin 4.23% @15mths this morning both bank side by side yet have to spend RM2.65 for bank cheque from Ambank.

Mixed branch yet staff insist have to put RM1k in SA (earmark 3 months) & must be Islamic SA

made noise to BM, gave green light no need 1k and I choose conventional BSA with online banking.

Hmm this confirms my theory. In terms of enforcing rules, Affin Bank lacks other bank. From this thread I already seen a couple of confusion and treatment.

Eg my case, I was told starting in June or July Bank Negara has advised banks to follow strictly the rule that Islamic products' return must be credited to an Islamic saving account. Thus I was required to open a new Islamic saving account for this 4.23% promotion and cannot use conventional saving account. Strangely Affin will charge 10 ringgit for joint name saving account.

Actually RHB has the same rule too I remember, Islamic FD interest must go to Islamic saving account.

FYI 4.23% for 15 months still available as of today.

Feb 5 2019, 08:18 PM

Feb 5 2019, 08:18 PM

Quote

Quote

0.0439sec

0.0439sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled