QUOTE(Human Nature @ Aug 31 2021, 03:11 PM)

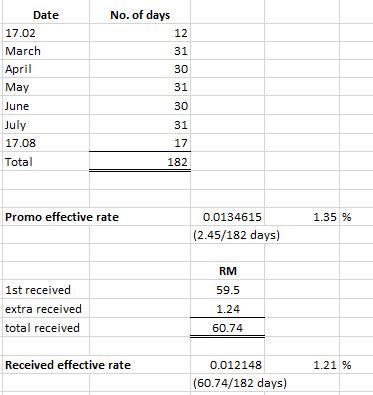

No account with Bank Muamalat. If no promo rate for BR, back up plan gonna be Affin 12m 2.5%, provided it is also not ended yet.

Just checked, my BR branch is close tomorrow and just my luck, that is my only cert with instruction credit everything to SA upon mature. So yay!

Now need to find a new home.

The Bank Muamalat promo is a eFD? That would be some progress into eFD from OTC only last time. If got no internet with Bank Muamalat, maybe have to go and set up things first time or no need? I already have a Bank Muamalat SA with internet from the last best promo at BM. Luckily kept it alive and active to handle this sort of occasions. Now just have to scrape together some money and try if there is no better rate. Any one have been able to place online yet for this BM promo? Any pointers on the experience?

This post has been edited by Deal Hunter: Sep 1 2021, 05:09 PM

Sep 1 2021, 05:07 PM

Sep 1 2021, 05:07 PM

Quote

Quote

0.0225sec

0.0225sec

0.91

0.91

6 queries

6 queries

GZIP Disabled

GZIP Disabled