Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

steadypong

|

Jun 6 2019, 01:23 AM Jun 6 2019, 01:23 AM

|

Getting Started

|

QUOTE(MakcikLum @ Jun 6 2019, 01:22 AM) Thanks for the clarification. Kindly update us if MBSB announce any new promotion for FD. Is the internet banking started for all the MBSB branch already, last time heard only available for few branches (initial stage) More convenience to use internet banking, can uplift online or request for the matured instruction to credit FD, P + I to saving a/c & do instant transfer after that. Lazy go to bank, he he  MBSB Bank internet banking is available since May. Just apply a debit card at any branch then can register for online banking. However the maximum transfer limit is just RM9,000 per day. |

|

|

|

|

|

steadypong

|

Jul 1 2019, 11:49 PM Jul 1 2019, 11:49 PM

|

Getting Started

|

QUOTE(naruko85 @ Jul 1 2019, 11:27 PM) meaning 7.7 4.07% then the remaining 2 months 30 days rate is 3.77? This HLB Digital Day campaign is from 7th-13th July 2019. It means if you put min 10k eFD on 7th July 2019, you will get 4.07% p.a for 3months. However, if you put min 10k eFD between 8th-13th July 2019, you will get 3.77% p.a for 3 months. |

|

|

|

|

|

steadypong

|

Jul 2 2019, 12:32 AM Jul 2 2019, 12:32 AM

|

Getting Started

|

QUOTE(mavistan89 @ Jul 2 2019, 01:03 AM) Must it be fresh fund like transferred from other banks use FPX? Or can directly place fd using our existing hlb account? I guess for short term this will be the highest rate if 4.07% Not sure, but based on my experience last year, it's through FPX from other bank. Yes short term highest now 4.07%. |

|

|

|

|

|

steadypong

|

Oct 12 2019, 05:39 PM Oct 12 2019, 05:39 PM

|

Getting Started

|

QUOTE(anxious @ Oct 12 2019, 05:22 PM) Any bank offering 4% or more for 12 months. My FDs expiring next month, middle. Kuwait Finance House  |

|

|

|

|

|

steadypong

|

Nov 7 2019, 06:24 PM Nov 7 2019, 06:24 PM

|

Getting Started

|

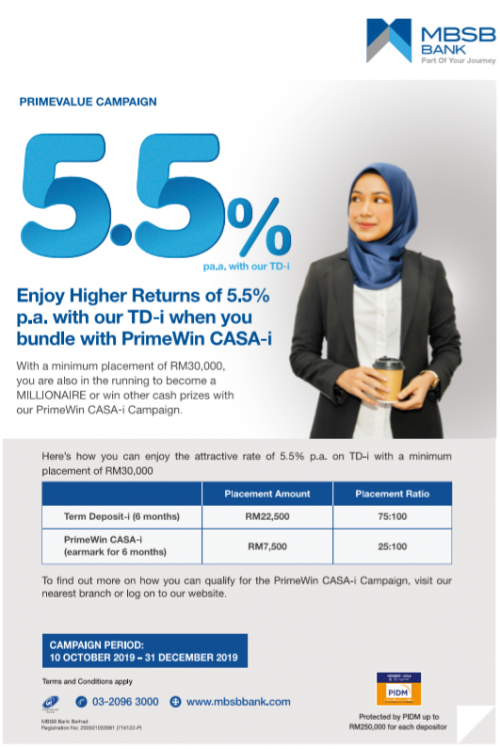

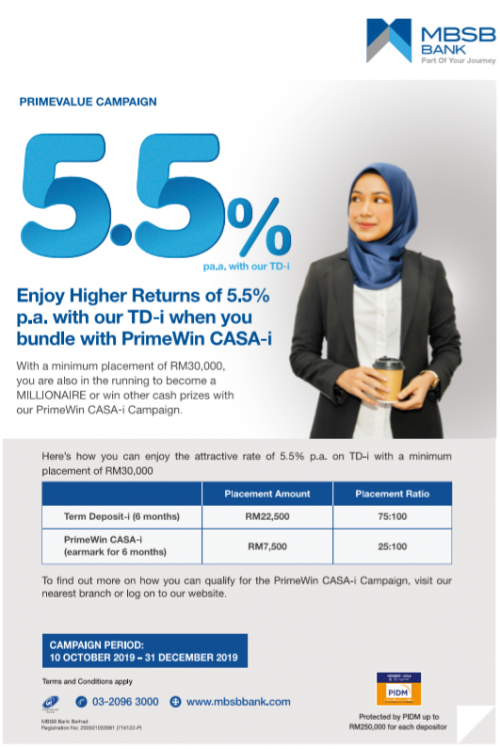

QUOTE(talzer @ Nov 7 2019, 05:34 PM) Hi, assume i want to put RM30k into fixed deposit, what are the rates i can negotiate from banks ? or it is too little for them to care?  If you have 30k, you are eligible to participate in this FD promotion. Effective rate is 4.25% so for me its pretty decent FD rate at this time. |

|

|

|

|

|

steadypong

|

Dec 12 2019, 10:50 PM Dec 12 2019, 10:50 PM

|

Getting Started

|

QUOTE(BoomChaCha @ Dec 12 2019, 10:49 PM) Is MBSB's effective rate 4.25% for 6 months FD promo still available? Yes, until end of this month (31st Dec 19). |

|

|

|

|

|

steadypong

|

Apr 30 2020, 04:24 PM Apr 30 2020, 04:24 PM

|

Getting Started

|

FD matured at MBSB Bank today and managed to rollover FD at MBSB Bank today, 3.50% 1 year. However, negotiation shall be done first with their BM/RM in order to get this rates. I do not need to transfer to AmBank since they giving similar rate (highest rate at this moment).

|

|

|

|

|

|

steadypong

|

Apr 30 2020, 04:33 PM Apr 30 2020, 04:33 PM

|

Getting Started

|

QUOTE(majorarmstrong @ Apr 30 2020, 05:30 PM) I was never assign a RM for mbsb I guess my saving with them very small and they don't give a f You go bank nego or over phone? Just on phone. I told them FD matured today, they give me 3.50% immediately. But you need to write a simple email to instruct them to renew your FD. Then later they will send the scanned new FD cert to you via email, very convenient. |

|

|

|

|

|

steadypong

|

Apr 30 2020, 04:37 PM Apr 30 2020, 04:37 PM

|

Getting Started

|

QUOTE(voonmingloo @ Apr 30 2020, 05:33 PM) No need RM, just call your branch where you deposit to arrange it. You will need to write a simple email saying getting the 3.5% rate spoken with whom and authorise to debit from your saving to FD. Wait for another call and that's it. Ask them email you the cert. Yup, quite similar with what I experienced. Looks like MBSB Bank are trying to hold the cash now? |

|

|

|

|

|

steadypong

|

May 2 2020, 12:44 AM May 2 2020, 12:44 AM

|

Getting Started

|

QUOTE(e-lite @ May 1 2020, 08:03 PM) C BNM should keep the bullet in case more turmoil to come. Now USA already spent most of their bullets already Same thought. C |

|

|

|

|

|

steadypong

|

May 2 2020, 05:20 PM May 2 2020, 05:20 PM

|

Getting Started

|

QUOTE(BeadsCrazee @ May 2 2020, 10:39 AM) I have MBSB FD maturing on Monday. So based on your experience, i need to first call the branch where i placed the FD, talk to the manager to get a good rate. Then send an email to them for the remaining procedures? Yes. They will surely ask you to email before they renew FD for you, for security and clarification purposes. |

|

|

|

|

|

steadypong

|

Aug 30 2021, 09:21 PM Aug 30 2021, 09:21 PM

|

Getting Started

|

Seeking for any FD expert here to answer my curiosity.

Given if I put a 6months FD on this 3 days (29/08/2021, 30/08/2021 & 31/02/2021), when will be the maturity date, 28/02/2022, 01/03/2022 or other date?

|

|

|

|

|

|

steadypong

|

Aug 30 2021, 09:24 PM Aug 30 2021, 09:24 PM

|

Getting Started

|

QUOTE(steadypong @ Aug 30 2021, 10:21 PM) Seeking for any FD expert here to answer my curiosity. Given if I put a 6months FD on this 3 days (29/08/2021, 30/08/2021 & 31/02/2021), when will be the maturity date, 28/02/2022, 01/03/2022 or other date? Typo on date* Seeking for any FD expert here to answer my curiosity. Given if I put a 6months FD on this 3 days (29/08/2021, 30/08/2021 & 31/08/2021), when will be the maturity date, 28/02/2022, 01/03/2022 or other date? |

|

|

|

|

|

steadypong

|

Aug 31 2021, 03:08 PM Aug 31 2021, 03:08 PM

|

Getting Started

|

QUOTE(Human Nature @ Aug 31 2021, 03:00 PM) Anyone know if BR is extending the promo rate or has a new one? Have one maturing on 1st sept Same for me 1 mature on 1st Sept. Just sharing to see if you interested in this. Attached File(s) TnC_FTA_i_Special_Rates_Campaign.pdf

TnC_FTA_i_Special_Rates_Campaign.pdf ( 313.58k )

Number of downloads: 74 |

|

|

|

|

|

steadypong

|

Sep 1 2021, 03:50 PM Sep 1 2021, 03:50 PM

|

Getting Started

|

QUOTE(gratfe @ Sep 1 2021, 01:07 PM) is this still valid? can't find it on their website Valid. Just put 1 FD today. You can put e-FD if already have existing account with Bank Muamalat. |

|

|

|

|

|

steadypong

|

Sep 1 2021, 08:47 PM Sep 1 2021, 08:47 PM

|

Getting Started

|

QUOTE(Deal Hunter @ Sep 1 2021, 06:07 PM) Interesting. I always wanted Bank Rakyat to credit principal to my SA on maturity, but the bank staff always say cannot. So far for me, only the interest can be instructed to credit to SA each month periodically or at maturity. Would be nice if BR can change.  The Bank Muamalat promo is a eFD? That would be some progress into eFD from OTC only last time. If got no internet with Bank Muamalat, maybe have to go and set up things first time or no need? I already have a Bank Muamalat SA with internet from the last best promo at BM. Luckily kept it alive and active to handle this sort of occasions. Now just have to scrape together some money and try if there is no better rate. Any one have been able to place online yet for this BM promo? Any pointers on the experience? Ya. This promotion from BM is eligible for both OTC or eFD as told by the staff today. I did OTC FD today, but they highly encourage me to do e-FD in the future. |

|

|

|

|

|

steadypong

|

Sep 2 2021, 02:45 AM Sep 2 2021, 02:45 AM

|

Getting Started

|

QUOTE(adrianteddy @ Sep 2 2021, 12:25 AM) I don’t have any account with BM yet. Planning to go open a new account with them next week Monday. eFD is it via FPX? or is it from existing fund in BM account? They would ask u to open a saving account 1st. To have online banking ,u must get a debit card RM12 per annum. To put eFD, they will ask you to bank in the money to your saving account 1st, from that then you can proceed to put eFD. |

|

|

|

|

|

steadypong

|

Sep 6 2021, 09:03 PM Sep 6 2021, 09:03 PM

|

Getting Started

|

QUOTE(rocketm @ Sep 2 2021, 10:47 AM) Can I open an account with Bank Mualamat online without going to the branch? Don't think so. In fact, you must make an online appointment with them 1st (then wait for them to call you to confirm the appointment) in order to get your chance to open account. This is what I've been told by the staff when I go there straight after online appointment (without getting call from them), luckily I managed to open account and put FD after discussions on the same day. |

|

|

|

|

|

steadypong

|

Sep 7 2021, 11:48 PM Sep 7 2021, 11:48 PM

|

Getting Started

|

QUOTE(c64 @ Sep 7 2021, 12:10 PM) Just curious...is everybody active in this thread > 50 yrs old? Lol. <50, and still quite far to 50.  |

|

|

|

|

Jun 6 2019, 01:23 AM

Jun 6 2019, 01:23 AM

Quote

Quote

0.0558sec

0.0558sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled