QUOTE(Tobyby @ May 21 2020, 11:33 PM)

Is this an ongoing eFD promotion by Alliance?

Any website or link to view this campaign? info and detail?

Details in TnC link at Post #16433Any website or link to view this campaign? info and detail?

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

May 22 2020, 12:21 AM May 22 2020, 12:21 AM

|

Senior Member

2,548 posts Joined: May 2005 |

|

|

|

|

|

|

May 22 2020, 12:35 AM May 22 2020, 12:35 AM

|

Senior Member

2,552 posts Joined: Jan 2008 |

QUOTE(GrumpyNooby @ May 21 2020, 10:15 PM) while min is 20k, you basically need to put in 20k now, and have 20k by the same time next year.If you are actually splitting a 40k deposit, the 2nd 20k earns a lot less interest (due to yr1 and current poor FD promo) pushing down your own eff rate |

|

|

May 22 2020, 01:10 AM May 22 2020, 01:10 AM

|

Junior Member

121 posts Joined: Mar 2020 |

QUOTE(adele123 @ May 21 2020, 08:21 PM) If you are referring to the picture below, i would sign up for it. Very worth it. If i walk in can get, i will sign up. Can anyone please upload the complete flyer of that insurance promo. Most of the time, i will caution about savings insurance. But occasionally there is such good deal.  What are the terms and conditions? Do we need to have savings account in OCBC in order to participate in this 3.9% promo? |

|

|

May 22 2020, 01:26 AM May 22 2020, 01:26 AM

|

Senior Member

4,726 posts Joined: Jul 2013 |

QUOTE(senghock @ May 21 2020, 10:28 PM) The guarantee on the 3.9% is from GE. And despite what the flyer say about potential bonus after 2 years, probably the amount gonna be zero or very low.Important note is no early withdrawal, you can lose part of the capital. I'm not sure how ocbc promotes it or sell it. They may have a way to ask you to pay one shot instead of 2 separate years. I am not familiar on mechanism but such plans are not out to con you. I bought etiqa last year pay 2 years kena tahan for 5 years. The issue for me is... i just have to make sure 5 years i cant touch the money. Else lose 10% of the money during the 1st 2 years. While i'm mildy surprise they (GE/ ocbc) did not withdraw despite the interest rate cut, this one is not a fishy plan. You can always ask them for the product disclosure sheet and sales illustration if you worry. Sales person got commission ba, but very low, 0.2%? QUOTE(leo_kiatez @ May 21 2020, 11:40 PM) I got the flyer before mco. But i dont have full details. Usual insurance caveat is dont surrender early. Full 2 years required for the money to be there. Better get info from ocbc. The annoying thing is they want you walk in to get more info. This is the usual tactic la. But the plan itself is legit la. Unless you dont trust GE.Edit: Let me caveat slightly, last year when GE did this, i was told only offer to bank customer, usually priority banking. So i never bothered to find out also i dont have 20k lying around. And i really not GE or OCBC staff just want to let everyone know, not all insurance savings plan is evil. Just need to understand. And yes such plans dont make much money for the insurance company. I share you the promo last year lo. 4.5% but last year when you hear 4.5% maybe not as wow la. This post has been edited by adele123: May 22 2020, 01:47 AM Attached File(s)  MaxSure_2.pdf ( 160.95k )

Number of downloads: 84

MaxSure_2.pdf ( 160.95k )

Number of downloads: 84 MaxSure1_flyer_2019_for_sharing.pdf ( 162.02k )

Number of downloads: 46

MaxSure1_flyer_2019_for_sharing.pdf ( 162.02k )

Number of downloads: 46 |

|

|

May 22 2020, 01:30 AM May 22 2020, 01:30 AM

Show posts by this member only | IPv6 | Post

#16445

|

All Stars

17,510 posts Joined: Feb 2006 From: KL |

QUOTE(WaCKy-Angel @ May 21 2020, 11:06 PM) QUOTE(GrumpyNooby @ May 21 2020, 11:09 PM) QUOTE(leo_kiatez @ May 21 2020, 11:40 PM) QUOTE(ganesh1696 @ May 22 2020, 01:10 AM) Can anyone please upload the complete flyer of that insurance promo. What are the terms and conditions? Do we need to have savings account in OCBC in order to participate in this 3.9% promo? QUOTE(adele123 @ May 22 2020, 01:26 AM) The guarantee on the 3.9% is from GE. And despite what the flyer say about potential bonus after 2 years, probably the amount gonna be zero or very low. imo, insurance should only be for protection. investment wise, u are better off putting ur money even in FD in the long run.Important note is no early withdrawal, you can lose part of the capital. I'm not sure how ocbc promotes it or sell it. They may have a way to ask you to pay one shot instead of 2 separate years. I am not familiar on mechanism but such plans are not out to con you. I bought etiqa last year pay 2 years kena tahan for 5 years. The issue for me is... i just have to make sure 5 years i cant touch the money. Else lose 10% of the money during the 1st 2 years. While i'm mildy surprise they (GE/ ocbc) did not withdraw despite the interest rate cut, this one is not a fishy plan. You can always ask them for the product disclosure sheet and sales illustration if you worry. Sales person got commission ba, but very low, 0.2%? I got the flyer before mco. But i dont have full details. Usual insurance caveat is dont surrender early. Full 2 years required for the money to be there. Better get info from ocbc. The annoying thing is they want you walk in to get more info. This is the usual tactic la. But the plan itself is legit la. Unless you dont trust GE. |

|

|

May 22 2020, 01:32 AM May 22 2020, 01:32 AM

|

All Stars

21,962 posts Joined: Dec 2004 From: KL |

QUOTE(adele123 @ May 22 2020, 01:26 AM) The guarantee on the 3.9% is from GE. And despite what the flyer say about potential bonus after 2 years, probably the amount gonna be zero or very low. U mean they advertised guarantee interest but change the t&c any time? That doesnt sounds rightImportant note is no early withdrawal, you can lose part of the capital. I'm not sure how ocbc promotes it or sell it. They may have a way to ask you to pay one shot instead of 2 separate years. I am not familiar on mechanism but such plans are not out to con you. I bought etiqa last year pay 2 years kena tahan for 5 years. The issue for me is... i just have to make sure 5 years i cant touch the money. Else lose 10% of the money during the 1st 2 years. While i'm mildy surprise they (GE/ ocbc) did not withdraw despite the interest rate cut, this one is not a fishy plan. You can always ask them for the product disclosure sheet and sales illustration if you worry. Sales person got commission ba, but very low, 0.2%? I got the flyer before mco. But i dont have full details. Usual insurance caveat is dont surrender early. Full 2 years required for the money to be there. Better get info from ocbc. The annoying thing is they want you walk in to get more info. This is the usual tactic la. But the plan itself is legit la. Unless you dont trust GE. |

|

|

|

|

|

May 22 2020, 01:41 AM May 22 2020, 01:41 AM

|

Senior Member

4,726 posts Joined: Jul 2013 |

QUOTE(!@#$%^ @ May 22 2020, 01:30 AM) imo, insurance should only be for protection. investment wise, u are better off putting ur money even in FD in the long run. This is true. But this one is also different. QUOTE(WaCKy-Angel @ May 22 2020, 01:32 AM) There is guarantee + non guarantee. 3.90% is guaranteed. The terminal bonus is not guaranteed. Which is not important. 3.90% is great return. Please take note 3.9% does not 'compound' as you can see in the calculation.1am liao, sleepy and hard to explain on the phone. |

|

|

May 22 2020, 01:53 AM May 22 2020, 01:53 AM

|

All Stars

21,962 posts Joined: Dec 2004 From: KL |

QUOTE(adele123 @ May 22 2020, 01:41 AM) This is true. But this one is also different. Im not pro at calculations so a quick count i do 100K @3% @12m + 200k @3% @12m without taking into compounding interest lands roughly less than 10K interests.There is guarantee + non guarantee. 3.90% is guaranteed. The terminal bonus is not guaranteed. Which is not important. 3.90% is great return. Please take note 3.9% does not 'compound' as you can see in the calculation. 1am liao, sleepy and hard to explain on the phone. Assuming our FD interest will be going down trend how can u get anywhere near 3% for 2 years now? So i guess this 3.9% guaranteed is quite good for low risk investment but just that need 200K capital. |

|

|

May 22 2020, 03:10 AM May 22 2020, 03:10 AM

Show posts by this member only | IPv6 | Post

#16449

|

Junior Member

454 posts Joined: Feb 2013 |

QUOTE(??!! @ May 21 2020, 05:46 PM) 3 months 3.15% ..promo for alliance online banking app user. OK Thanks. Checked inbox, nothing so means no offer. pull down 3 months is 2% only.U need to dl the app. The TnC refers to 'selected customers' who will receive a promo code on the inbox when u log into alliance online. No definition of the bank selection criteria. The code is for 1 x use only. Tried to place 2nd time...tak holeh Try and see if you can open this TnC document https://www.alliancebank.com.my/Alliance/me...MPAIGN-16042020 . Place eFd via Alliance online (not the online app) .there's a dropdown to enter promo code after select 3 month tenure. Then u can see the 3.15 % rate |

|

|

May 22 2020, 03:55 AM May 22 2020, 03:55 AM

|

Junior Member

121 posts Joined: Mar 2020 |

QUOTE(adele123 @ May 22 2020, 01:26 AM) The guarantee on the 3.9% is from GE. And despite what the flyer say about potential bonus after 2 years, probably the amount gonna be zero or very low. Anyone have idea until when this promo is going on? Important note is no early withdrawal, you can lose part of the capital. I'm not sure how ocbc promotes it or sell it. They may have a way to ask you to pay one shot instead of 2 separate years. I am not familiar on mechanism but such plans are not out to con you. I bought etiqa last year pay 2 years kena tahan for 5 years. The issue for me is... i just have to make sure 5 years i cant touch the money. Else lose 10% of the money during the 1st 2 years. While i'm mildy surprise they (GE/ ocbc) did not withdraw despite the interest rate cut, this one is not a fishy plan. You can always ask them for the product disclosure sheet and sales illustration if you worry. Sales person got commission ba, but very low, 0.2%? I got the flyer before mco. But i dont have full details. Usual insurance caveat is dont surrender early. Full 2 years required for the money to be there. Better get info from ocbc. The annoying thing is they want you walk in to get more info. This is the usual tactic la. But the plan itself is legit la. Unless you dont trust GE. Edit: Let me caveat slightly, last year when GE did this, i was told only offer to bank customer, usually priority banking. So i never bothered to find out also i dont have 20k lying around. And i really not GE or OCBC staff just want to let everyone know, not all insurance savings plan is evil. Just need to understand. And yes such plans dont make much money for the insurance company. I share you the promo last year lo. 4.5% but last year when you hear 4.5% maybe not as wow la. Because I have some funds reaching at the end July 2020. Is that promo valid till August 2020. Need info pls. |

|

|

May 22 2020, 07:22 AM May 22 2020, 07:22 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(adele123 @ May 22 2020, 01:26 AM) The guarantee on the 3.9% is from GE. And despite what the flyer say about potential bonus after 2 years, probably the amount gonna be zero or very low. But 3.9% pa for a 2-year plan is rather high at current interest rate environment.Important note is no early withdrawal, you can lose part of the capital. I'm not sure how ocbc promotes it or sell it. They may have a way to ask you to pay one shot instead of 2 separate years. I am not familiar on mechanism but such plans are not out to con you. I bought etiqa last year pay 2 years kena tahan for 5 years. The issue for me is... i just have to make sure 5 years i cant touch the money. Else lose 10% of the money during the 1st 2 years. While i'm mildy surprise they (GE/ ocbc) did not withdraw despite the interest rate cut, this one is not a fishy plan. You can always ask them for the product disclosure sheet and sales illustration if you worry. Sales person got commission ba, but very low, 0.2%? I got the flyer before mco. But i dont have full details. Usual insurance caveat is dont surrender early. Full 2 years required for the money to be there. Better get info from ocbc. The annoying thing is they want you walk in to get more info. This is the usual tactic la. But the plan itself is legit la. Unless you dont trust GE. Edit: Let me caveat slightly, last year when GE did this, i was told only offer to bank customer, usually priority banking. So i never bothered to find out also i dont have 20k lying around. And i really not GE or OCBC staff just want to let everyone know, not all insurance savings plan is evil. Just need to understand. And yes such plans dont make much money for the insurance company. I share you the promo last year lo. 4.5% but last year when you hear 4.5% maybe not as wow la. UOB offered only me a 3-year plan with 3%% pa and I believe the plan is underwritten by Prudential (their insurance and wealth management partner), |

|

|

May 22 2020, 09:59 AM May 22 2020, 09:59 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(GrumpyNooby @ May 22 2020, 07:22 AM) But 3.9% pa for a 2-year plan is rather high at current interest rate environment. It is Bancassurance.UOB offered only me a 3-year plan with 3%% pa and I believe the plan is underwritten by Prudential (their insurance and wealth management partner), The money is not with bank, bank is merely a selling agent for those insurance product. It is like endowment plan, just a shorter term. For UOB-Prudential, they called it Guaranteed Income Protection plan. We don't know the 3.9% is still available or not. Normally those product are offered within a short period of time, or once reach the fund size, then no more. |

|

|

May 22 2020, 10:36 AM May 22 2020, 10:36 AM

Show posts by this member only | IPv6 | Post

#16453

|

Senior Member

1,628 posts Joined: May 2013 |

|

|

|

|

|

|

May 22 2020, 10:36 AM May 22 2020, 10:36 AM

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(adele123 @ May 22 2020, 01:26 AM) The guarantee on the 3.9% is from GE. And despite what the flyer say about potential bonus after 2 years, probably the amount gonna be zero or very low. if OPR go up and they still decide to pay you 3.9% then not worth loImportant note is no early withdrawal, you can lose part of the capital. I'm not sure how ocbc promotes it or sell it. They may have a way to ask you to pay one shot instead of 2 separate years. I am not familiar on mechanism but such plans are not out to con you. I bought etiqa last year pay 2 years kena tahan for 5 years. The issue for me is... i just have to make sure 5 years i cant touch the money. Else lose 10% of the money during the 1st 2 years. While i'm mildy surprise they (GE/ ocbc) did not withdraw despite the interest rate cut, this one is not a fishy plan. You can always ask them for the product disclosure sheet and sales illustration if you worry. Sales person got commission ba, but very low, 0.2%? I got the flyer before mco. But i dont have full details. Usual insurance caveat is dont surrender early. Full 2 years required for the money to be there. Better get info from ocbc. The annoying thing is they want you walk in to get more info. This is the usual tactic la. But the plan itself is legit la. Unless you dont trust GE. Edit: Let me caveat slightly, last year when GE did this, i was told only offer to bank customer, usually priority banking. So i never bothered to find out also i dont have 20k lying around. And i really not GE or OCBC staff just want to let everyone know, not all insurance savings plan is evil. Just need to understand. And yes such plans dont make much money for the insurance company. I share you the promo last year lo. 4.5% but last year when you hear 4.5% maybe not as wow la. |

|

|

May 22 2020, 10:39 AM May 22 2020, 10:39 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(majorarmstrong @ May 22 2020, 10:36 AM) The catch of those endowment plan, is that, you can't withdraw until maturity date. Any premature withdraw, may result getting back 90+% only. While FD you get back 100% principal for any premature withdrawal. |

|

|

May 22 2020, 10:40 AM May 22 2020, 10:40 AM

|

All Stars

21,962 posts Joined: Dec 2004 From: KL |

QUOTE(cherroy @ May 22 2020, 09:59 AM) It is Bancassurance. Usually these plan that comes with insurance benefits will deduct the premium "as payment for insurance portion" right?The money is not with bank, bank is merely a selling agent for those insurance product. It is like endowment plan, just a shorter term. For UOB-Prudential, they called it Guaranteed Income Protection plan. We don't know the 3.9% is still available or not. Normally those product are offered within a short period of time, or once reach the fund size, then no more. But how come this OCBC one shows payout 100% of premium paid? That sounds really good since got extra insurance benefits. |

|

|

May 22 2020, 10:45 AM May 22 2020, 10:45 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(WaCKy-Angel @ May 22 2020, 10:40 AM) Usually these plan that comes with insurance benefits will deduct the premium "as payment for insurance portion" right? The insurance benefit is not much generally. The OCBC-GE one, I am not familiar with it. But how come this OCBC one shows payout 100% of premium paid? That sounds really good since got extra insurance benefits. For UOB-Prudential GIP, you put 100K, and get the coverage of 110K for certain age group, and 105K for older age for death benefit, means that extra 10K and 5K coverage only. Please remember, those are insurance product, not FD. |

|

|

May 22 2020, 01:51 PM May 22 2020, 01:51 PM

|

Junior Member

398 posts Joined: Nov 2005 From: Seremban/Puchong |

|

|

|

May 22 2020, 01:52 PM May 22 2020, 01:52 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(eujin @ May 22 2020, 01:51 PM) I tried today using my CIMB clicks for 5k @ 6 months, but the interest rate written there is only 2.05%? CIMB always uses special link for its promotional eFD.Placement link also shared in my earlier post: https://www.cimbclicks.com.my/clicks/#/ |

|

|

May 22 2020, 01:55 PM May 22 2020, 01:55 PM

Show posts by this member only | IPv6 | Post

#16460

|

Junior Member

468 posts Joined: May 2019 |

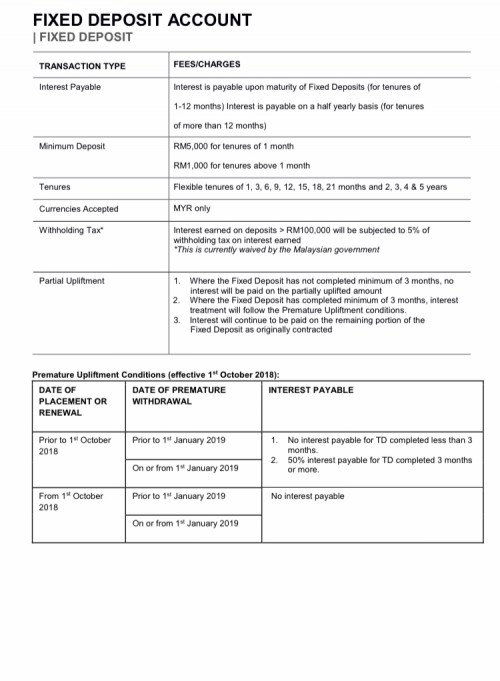

I came across this term that SC mentions on 5% withholding tax for deposits larger than 100k. It is currently waived by the Msian gov. Does anyone know how the general rule works? Would splitting it in several 100k within the same bank help? This post has been edited by TheEquatorian: May 22 2020, 02:05 PM |

| Change to: |  0.0266sec 0.0266sec

0.55 0.55

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 04:26 PM |