QUOTE(kplaw @ May 22 2020, 04:36 PM)

have been to ocbc inquiring about the maxsure2 product. it's not so straightforward as only depositing the money for the 3.9% return. it also requires monthly deposit of certain amount of money for 5 years etc..

it consists of a booster a/c , step up and ,Maxsure2

for example, if we want to invest 100k

1) BOOSTER a/c - have to open if u dont have one.

- the function of this Booster a/c is to topup for the STEPUP and will get 3.1% (1.9%+1.2% ) for 6 month starting from the day register when your BOOSTER a/c have at least 20k inside

if you have less than 20k in your BOOSTER a/c, normal saving rate will be given

the interest of 3.1% in 6 month is calculate on daily basis

2) STEPUP

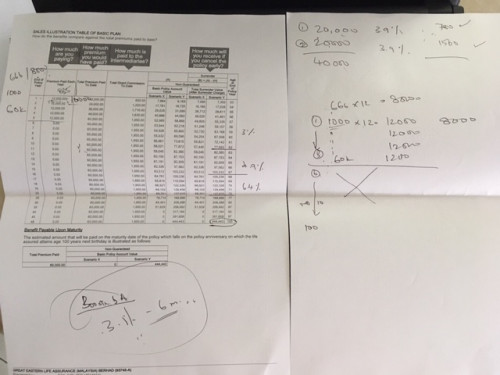

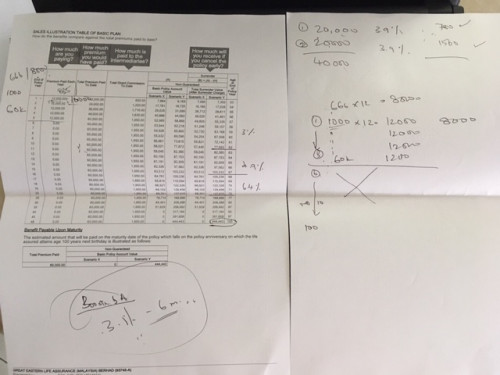

- the left chart is called STEPUP which is a saving insurance by Great Eastern

- When register today u have to bank in 20k and the remaining of 80k need to bank in at 22/5/2023 (20k), 22/5/2024 (20k), 22/5/2025 (20k) and 22/5/2026 (20k)

- You can also choose to bank in RM1666 monthly in which you will get the return by about 2k less compare to paying yearly

- The 20k (topup yearly) or RM1666 (topup monthly) will automatically topup from BOOSTER a/c, so have to make sure there is enough balance or your agent will be reminded by your agent

- have to invest at least 10years to get return, if terminate during first 10 years there is penalty and the money you get back will be less than 100k you invested

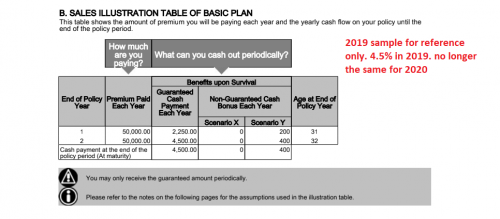

3) MAXSURE2 - 3.9% annual Rate

- the maximum amount you can invest in this SAVING INSUARANCE 3 times of yearly payment ,so it's 3 x 20k = 60k

- after one year, have to put in 60k again to get 3.9%

- 1st year 60k and get interest of RM2340

- 2nd year bank in 60k and total of SAVING INSUARANCE is 60k+60k=120k, so will get another RM4680 of interest

sorry for my poor english and hope you guys can understand

This post has been edited by senghock: May 22 2020, 09:08 PM

This post has been edited by senghock: May 22 2020, 09:08 PM

May 22 2020, 04:13 PM

May 22 2020, 04:13 PM

Quote

Quote

0.0225sec

0.0225sec

0.64

0.64

6 queries

6 queries

GZIP Disabled

GZIP Disabled