QUOTE(Tobyby @ May 22 2020, 02:13 PM)

Thanks for rate sharing.

I'm don't have an Affinbank bank account, can I create one online and then do the eFD placement? All can be done online?

Actually I'm using OCBC 360 Account, treating it like a FD account, but currently the rate drop to 2.75%, so I'm thinking of other options...

For Alliance related matters:

QUOTE(??!! @ May 18 2020, 09:38 AM)

I received via email notification. Can see the code in online acct inbox

QUOTE(??!! @ May 18 2020, 01:22 PM)

Copy ---'

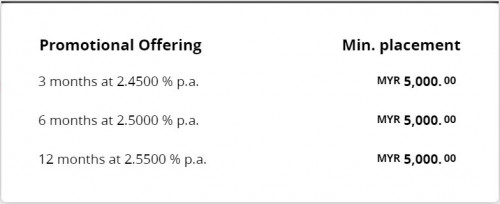

Here’s an exclusive offer that you can be proud of as an allianceonline mobile user. Earn 3.15% p.a. interest rate when you place a 3 months e-Fixed Deposit (“e-FD”) with a minimum placement of RM5,000. Sign up today!

Here’s how:

Campaign steps

*As the last step allianceonline mobile registration, perform a balance inquiry at any MEPS-enabled ATM within 3 days (only applicable for new allianceonline user).

This preferential interest rate is available for a limited time only so don’t miss out.

Campaign Period: 30 March 2020 to 30 June 2020

Terms and Conditions apply.

QUOTE(??!! @ May 21 2020, 05:46 PM)

3 months 3.15% ..promo for alliance online banking app user.

U need to dl the app. The TnC refers to 'selected customers' who will receive a promo code on the inbox when u log into alliance online. No definition of the bank selection criteria.

The code is for 1 x use only. Tried to place 2nd time...tak holeh

Try and see if you can open this TnC document

https://www.alliancebank.com.my/Alliance/me...MPAIGN-16042020.

Place eFd via Alliance online (not the online app)

.there's a dropdown to enter promo code after select 3 month tenure. Then u can see the 3.15 % rate

QUOTE(a.lifehacks @ May 19 2020, 09:47 PM)

Click the link below,

https://www.alliancebank.com.my/banking/per...us-account.aspxSelect “Apply Now”,

Enter your personal details and most importantly,

Choose your “Preferred Branch”,

You’ll get an SMS sent to your mobile no (which you have entered in the online application form).

Print out / screenshot the submission confirmation & the SMS you received.

Walk to your preferred branch, grab a queue number for account opening- For ID verification.

May 22 2020, 01:56 PM

May 22 2020, 01:56 PM

Quote

Quote

0.0251sec

0.0251sec

0.71

0.71

6 queries

6 queries

GZIP Disabled

GZIP Disabled