QUOTE(chiwawa10 @ May 21 2020, 12:12 PM)

31/05/2020

https://www.ocbc.com.my/personal-banking/ac...ed-deposit.html

This post has been edited by GrumpyNooby: May 21 2020, 01:11 PM

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

May 21 2020, 12:14 PM May 21 2020, 12:14 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(chiwawa10 @ May 21 2020, 12:12 PM) 31/05/2020 https://www.ocbc.com.my/personal-banking/ac...ed-deposit.html This post has been edited by GrumpyNooby: May 21 2020, 01:11 PM |

|

|

|

|

|

May 21 2020, 12:15 PM May 21 2020, 12:15 PM

|

All Stars

65,337 posts Joined: Jan 2003 |

|

|

|

May 21 2020, 12:15 PM May 21 2020, 12:15 PM

|

Junior Member

398 posts Joined: Nov 2005 From: Seremban/Puchong |

|

|

|

May 21 2020, 12:34 PM May 21 2020, 12:34 PM

|

Newbie

8 posts Joined: Mar 2018 |

|

|

|

May 21 2020, 12:58 PM May 21 2020, 12:58 PM

|

All Stars

21,963 posts Joined: Dec 2004 From: KL |

QUOTE(GrumpyNooby @ May 21 2020, 12:01 PM) Finally their campaign info is out! Campaign ends 30/6/2020. Just wondering would it better to go for 12m FD now even slightly lower than this Affin 2.88% 6m ? Campaign T&C: https://www.affinonline.com/AFFINONLINE/med...ampaign-Eng.pdf Since like the rate will be going down trend? im bad at calculating pls someone advise me |

|

|

May 21 2020, 01:00 PM May 21 2020, 01:00 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(WaCKy-Angel @ May 21 2020, 12:58 PM) Just wondering would it better to go for 12m FD now even slightly lower than this Affin 2.88% 6m ? Different people has different purpose for the money flow or liquidity.Since like the rate will be going down trend? im bad at calculating pls someone advise me If you foresee yourself has no other usage of the money for that tenure, it's better to lock-in with the rate since the possibility of more OPR cuts is high. |

|

|

|

|

|

May 21 2020, 01:02 PM May 21 2020, 01:02 PM

|

Junior Member

393 posts Joined: Nov 2006 |

Any eFD promo from Hong Leong. Tired of transferring funds especially now that banks are so crowded.

|

|

|

May 21 2020, 01:04 PM May 21 2020, 01:04 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(chiwawa10 @ May 21 2020, 01:02 PM) Any eFD promo from Hong Leong. Tired of transferring funds especially now that banks are so crowded. 3m at 2.6% pa ending 30/6/2020 https://www.hlb.com.my/en/personal-banking/...fd-i-promo.html T&C: https://www.hlb.com.my/content/dam/hlb/my/d...romo-tnc-en.pdf This post has been edited by GrumpyNooby: May 21 2020, 01:05 PM |

|

|

May 21 2020, 01:07 PM May 21 2020, 01:07 PM

|

All Stars

21,963 posts Joined: Dec 2004 From: KL |

QUOTE(GrumpyNooby @ May 21 2020, 01:00 PM) Different people has different purpose for the money flow or liquidity. Yeah i foresee will not be using the money.If you foresee yourself has no other usage of the money for that tenure, it's better to lock-in with the rate since the possibility of more OPR cuts is high. So which 12m or more now that has the highest rate? I have MBB, PBB, CIMB, MBSB, Affin, BI, thats all i think. |

|

|

May 21 2020, 01:13 PM May 21 2020, 01:13 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

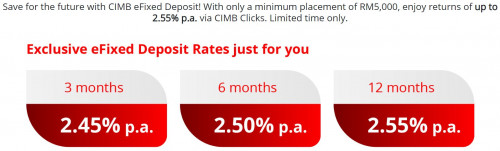

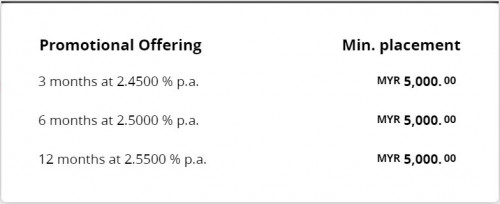

QUOTE(WaCKy-Angel @ May 21 2020, 01:07 PM) Yeah i foresee will not be using the money. Except for BI, only CIMB has promo rate for 12m at 2.55% paSo which 12m or more now that has the highest rate? I have MBB, PBB, CIMB, MBSB, Affin, BI, thats all i think. Next to that tenure is OCBC with 10m @ 2.7% pa Many banks don't want to do promo rate for tenure above 6m which they may expect OPR cuts. We still got 3 more MPC meetings which falls on July, September and November 2020. |

|

|

May 21 2020, 01:37 PM May 21 2020, 01:37 PM

|

Junior Member

393 posts Joined: Nov 2006 |

QUOTE(GrumpyNooby @ May 21 2020, 01:04 PM) 3m at 2.6% pa ending 30/6/2020 Hate it. Every time also want to do FPX. Means fresh fund, need to move money around. https://www.hlb.com.my/en/personal-banking/...fd-i-promo.html T&C: https://www.hlb.com.my/content/dam/hlb/my/d...romo-tnc-en.pdf |

|

|

May 21 2020, 01:45 PM May 21 2020, 01:45 PM

|

Junior Member

384 posts Joined: Oct 2011 |

|

|

|

May 21 2020, 01:47 PM May 21 2020, 01:47 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

May 21 2020, 02:12 PM May 21 2020, 02:12 PM

|

All Stars

21,963 posts Joined: Dec 2004 From: KL |

|

|

|

May 21 2020, 02:16 PM May 21 2020, 02:16 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(WaCKy-Angel @ May 21 2020, 02:12 PM) Already shared few days back. QUOTE(GrumpyNooby @ May 19 2020, 06:37 PM)  This campaign is only applicable for conventional (CIMB) Current Account and Savings Account (CASA) holders. Campaign valid from 18 May until 30 June 2020. Placement link: https://www.cimbclicks.com.my/clicks/#/  Campaign link: https://www.cimbclicks.com.my/efd-may20.htm...FD%20May%202020 T&C link: https://www.cimbclicks.com.my/efd-may20.htm...ay%202020#terms ENG T&C link (detailed): https://www.cimbclicks.com.my/efd-may20.htm...ay%202020#terms |

|

|

May 21 2020, 02:43 PM May 21 2020, 02:43 PM

|

Senior Member

2,368 posts Joined: Feb 2008 |

QUOTE(WaCKy-Angel @ May 21 2020, 11:22 AM) Yes you can. for eg HLB https://www.hlb.com.my/en/personal-banking/...ed-deposit.html ok thank youHowever I suggest u do SSPN-I instead. IINM historical data shows SSPN-I interest will be higher than FD rate. You may check the dedicated SSPN thread about how to open SSPN-I/SSPN-I Plus account via online. |

|

|

May 21 2020, 02:45 PM May 21 2020, 02:45 PM

|

All Stars

12,387 posts Joined: Feb 2020 |

Imagine what you can do for your family with more returns. With our higher rates for Commodity Murabahah Deposit-i (CMD-i) account*, your savings will now benefit your loved ones in a bigger way that’ll bring smiles from one and all.

Promotion Period: 21 May 2020 until 30 June 2020  *Over The Counter only & FF needed Campaign T&C: https://www.rhbgroup.com/280/files/CMD-i_TnC.pdf |

|

|

May 21 2020, 02:46 PM May 21 2020, 02:46 PM

|

Junior Member

99 posts Joined: May 2012 |

|

|

|

May 21 2020, 04:21 PM May 21 2020, 04:21 PM

|

Senior Member

2,239 posts Joined: Aug 2009 |

QUOTE(WaCKy-Angel @ May 21 2020, 11:22 AM) Yes you can. for eg HLB https://www.hlb.com.my/en/personal-banking/...ed-deposit.html can withdraw ka?However I suggest u do SSPN-I instead. IINM historical data shows SSPN-I interest will be higher than FD rate. You may check the dedicated SSPN thread about how to open SSPN-I/SSPN-I Plus account via online. |

|

|

May 21 2020, 04:24 PM May 21 2020, 04:24 PM

|

Junior Member

659 posts Joined: May 2013 |

|

| Change to: |  0.0276sec 0.0276sec

0.42 0.42

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 02:18 PM |