Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

TheEquatorian

|

May 8 2019, 01:18 AM May 8 2019, 01:18 AM

|

|

QUOTE(#Victor @ May 7 2019, 05:15 PM) FD rate will go down soon? PETALING JAYA: Bank Negara Malaysia (BNM) decided to cut the Overnight Policy Rate (OPR) by 25 basis points to 3% from 3.25% at its Monetary Policy Committee (MPC) today amid weak economic outlook.BNM trims OPR to 3% on market headwindsAny update on FD rates in the market. I came across this article on the impact from the OPR change - https://mrandmrsmoney.wordpress.com/2019/05...ur-investments/Please share best FD promos after the OPR change |

|

|

|

|

|

TheEquatorian

|

Jan 29 2020, 07:16 PM Jan 29 2020, 07:16 PM

|

|

Any idea where Affin’s rates are after the OPR change?

Is there any tax on the interest income received from deposits?

|

|

|

|

|

|

TheEquatorian

|

Feb 16 2020, 05:23 PM Feb 16 2020, 05:23 PM

|

|

Is there any bank offering 4%? I am ok with >60 months

|

|

|

|

|

|

TheEquatorian

|

Feb 16 2020, 08:48 PM Feb 16 2020, 08:48 PM

|

|

QUOTE(Wedchar2912 @ Feb 16 2020, 07:03 PM) if you are ok with 60 months waiting period, why not just consider buying a combination of maybank, cimb, rhb shares? all giving above 5% dividends with maybank and cimb classified as too big to fail by bnm. The risk is higher, stock dividends are based on profit distribution. Profit outlook for banking is weak with challengers, digitalisation and OPR trending down. I think you based this on a bank stock acting like a bond, I would prefer one of those bank’s bond then. |

|

|

|

|

|

TheEquatorian

|

Feb 16 2020, 09:57 PM Feb 16 2020, 09:57 PM

|

|

QUOTE(kucingfight @ Feb 16 2020, 09:39 PM) u'll be better off with bonds (UT). last year some of them returning 10% PA, some YTD (2020) already 3%. you don't have to be tied to bank for pathetic rates. sell it when you wish off course be wise in choosing bonds, some are underperforming The fixed deposits are to bring down the overall risk. 3.5-3.8 is quite low though, I would be ok with 4%. Any bank’s offering in that range? |

|

|

|

|

|

TheEquatorian

|

Feb 16 2020, 10:58 PM Feb 16 2020, 10:58 PM

|

|

QUOTE(MUM @ Feb 16 2020, 10:45 PM) Few weeks ago, there was a mention about Bangkok Bank 12 mths at 3.85% with min RM5k since you are placing >60 mths, and hopefully if the amount is big, the bank could offer higher than 3.85. try check with them? That’s great, I will check it out. Thanks! |

|

|

|

|

|

TheEquatorian

|

Feb 17 2020, 12:42 PM Feb 17 2020, 12:42 PM

|

|

QUOTE(Cookie101 @ Feb 17 2020, 10:00 AM) Don’t bother. They are not going to entertain. Have a go at bank rakyat instead. They can go up to 4.05 for 60months if u speak with the BM. Also scb offers 4% 6m for new PB Client. Bank Rakyat is definitely on the list. Thanks. |

|

|

|

|

|

TheEquatorian

|

Mar 11 2020, 07:32 AM Mar 11 2020, 07:32 AM

|

|

QUOTE(zenquix @ Mar 10 2020, 03:03 PM) at 270k u might as well push all to CIMB and get their preferred. Usually will get offered slightly better rates edit actually, you can open the SCB 3.8% promo if it still available since you will be new to bank... How do you get this promo (3.8%) at SCB? I have not seen it. |

|

|

|

|

|

TheEquatorian

|

Apr 30 2020, 03:28 PM Apr 30 2020, 03:28 PM

|

|

|

|

|

|

|

|

TheEquatorian

|

Apr 30 2020, 03:32 PM Apr 30 2020, 03:32 PM

|

|

QUOTE(GrumpyNooby @ Apr 30 2020, 03:29 PM) I thought I had shared 3 posts above. ^ My bad, I missed it. Let’s hope for the two predicting SRR change instead of interest rate drop. |

|

|

|

|

|

TheEquatorian

|

May 22 2020, 01:55 PM May 22 2020, 01:55 PM

|

|

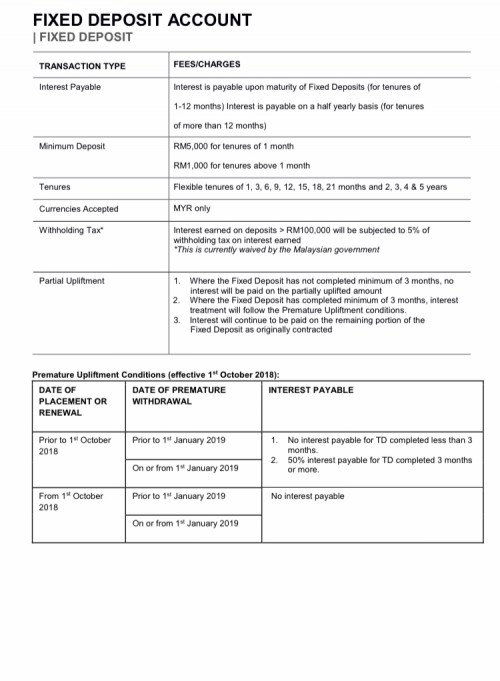

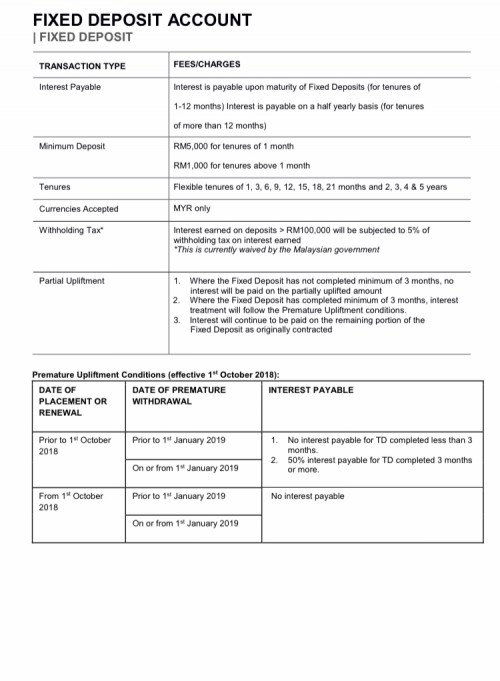

I came across this term that SC mentions on 5% withholding tax for deposits larger than 100k. It is currently waived by the Msian gov. Does anyone know how the general rule works? Would splitting it in several 100k within the same bank help? This post has been edited by TheEquatorian: May 22 2020, 02:05 PM |

|

|

|

|

|

TheEquatorian

|

May 30 2020, 01:31 AM May 30 2020, 01:31 AM

|

|

QUOTE(Rainforest2008 @ May 28 2020, 12:09 PM) Hi all, SCB is offering 2.6% for 12 months FD, for min deposit RM 250k come with free Rm800 groceries voucher. PM me if interested. I have 2 more quotas. Nice, do you have any link? |

|

|

|

|

|

TheEquatorian

|

May 30 2020, 07:34 AM May 30 2020, 07:34 AM

|

|

QUOTE(Rainforest2008 @ May 30 2020, 05:20 AM) Hi, response too good.campaign quota has reached.  Ok, thanks. How did you hear about it? I missed it  |

|

|

|

|

|

TheEquatorian

|

Jun 3 2020, 12:34 PM Jun 3 2020, 12:34 PM

|

|

What is the highest daily transfer limit for online banking? I have only come across 50k so far, banks which have higher?

How do you usually transfer between banks?

|

|

|

|

|

|

TheEquatorian

|

Jun 3 2020, 09:49 PM Jun 3 2020, 09:49 PM

|

|

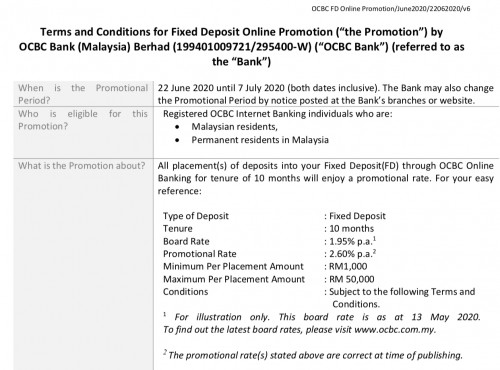

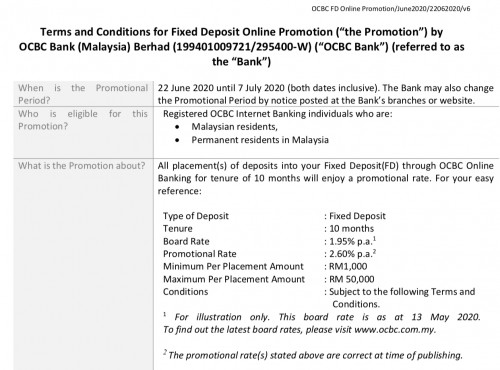

Which is the best (cheapest) account to have with OCBC to have access to their eFD offer? Thanks!

|

|

|

|

|

|

TheEquatorian

|

Jun 21 2020, 07:21 AM Jun 21 2020, 07:21 AM

|

|

QUOTE(batsashimi @ Jun 20 2020, 02:00 PM) I don't know man ..went thru some related threads it seems pidm is a pretty big deal for deposit security Makes sense, I would also be concerned if no PIDM guarantee. https://www.pidm.gov.my/PIDM/files/d9/d918e...d030a4c6615.jpg |

|

|

|

|

|

TheEquatorian

|

Jun 24 2020, 03:18 PM Jun 24 2020, 03:18 PM

|

|

Add OCBC 2.7% for 12 months and CIMB 2.55% for 12 months QUOTE(babysotong @ Jun 24 2020, 12:40 PM) Updated Summary - seems the best rates so far: 2 months - MBB (online) - 2. 43% 3 months - HLB (online) - 2.60% 6 months - Ambank (online) - 2.65% 7 months - UOB (OTC) - 2.65% 9 months - BR (OTC) - 2.80% (no PIDM) 9 months - UOB (OTC) - 2.75% 11 months - BR (OTC) - 3.00% (no PIDM) 12 months - RHB (online) - 2.80% |

|

|

|

|

|

TheEquatorian

|

Jun 29 2020, 02:21 PM Jun 29 2020, 02:21 PM

|

|

QUOTE(Human Nature @ Jun 29 2020, 11:19 AM) Is the OCBC online or OTC? Thanks I did it OTC. I understood can get 2.75% for 13 months also but must be 500k and above. |

|

|

|

|

|

TheEquatorian

|

Jun 30 2020, 09:34 PM Jun 30 2020, 09:34 PM

|

|

QUOTE(zenquix @ Jun 30 2020, 10:24 AM) only ASB / ASW / ASM comes to mind.... since you are looking for capital guarantee And EPF |

|

|

|

|

|

TheEquatorian

|

Jul 5 2020, 11:51 AM Jul 5 2020, 11:51 AM

|

|

QUOTE(a.lifehacks @ Jul 5 2020, 11:28 AM) For OCBC 10 months tenure @ 2.6%pa, the TnC says maximum placement is RM50,000 per placement. Does this refer to 50k per customer or 50k for each online eFD cert? Any Sifu here can advise? Thank you 😊  It’s possible to get 2.7% for 12 months with OCBC also. |

|

|

|

|

May 8 2019, 01:18 AM

May 8 2019, 01:18 AM

Quote

Quote

0.7155sec

0.7155sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled