QUOTE(heavensea @ Oct 14 2016, 06:48 PM)

thanks for sharing, 5.8% is so high

is it the same as gia we put and received interest rate for monthly basis?

gonna surrender my FD and park in GIA if the 5.8 p.a. is truth

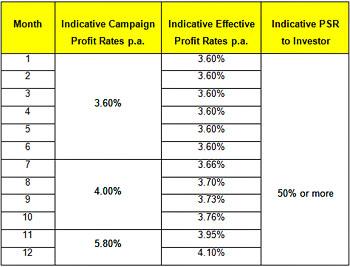

Not a wise move. Removing an existing FD for this FD. You will get less than that at the end of the day. Effective rate only 4.1%. See below.is it the same as gia we put and received interest rate for monthly basis?

gonna surrender my FD and park in GIA if the 5.8 p.a. is truth

QUOTE(wodenus @ Oct 14 2016, 06:49 PM)

The right side banner here is the HLB 4% promo  have to transfer in from another bank via FPX to be eligible

have to transfer in from another bank via FPX to be eligible

Btw, which bank support FPX transfer? How much does FPX transfer cost?QUOTE(starry @ Oct 14 2016, 06:59 PM)

Still good when other bank rates are at <=4%

Oct 14 2016, 07:05 PM

Oct 14 2016, 07:05 PM

Quote

Quote

0.0274sec

0.0274sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled