QUOTE(chicaman @ May 31 2016, 11:04 AM)

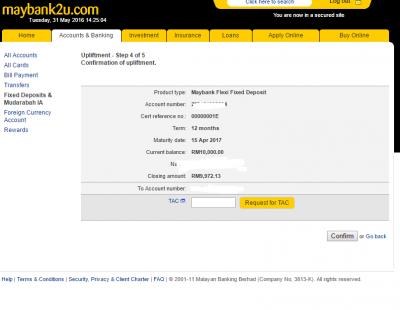

Mine is monthly renewable and going to mature soon.

Currently is 3.1% per month, thinking of getting longer period for higher interest.

From Maybank,

"Terms and Conditions on eFD premature withdrawal

The payment of interest on premature withdrawals of eFixed Deposits' (eFDs) before maturity shall be subjected to the following Terms and Conditions:

1. No interest shall be paid on any 1 month, 2 month or 3 months tenure eFD that has not completed its respective full tenure period.

2. For eFD's with tenures exceeding 3 months no interest shall be paid if the eFixed Deposit (eFD) is uplifted before the completion of the first 3 months period.

3. Other than the circumstances mentioned in (1) and (2) above, interest is payable only for the completed period of the funds have been deposited as below:

The rate payable for an eFixed Deposit uplifted before its fixed maturity date shall be half (1/2) the original contracted rate for each completed month."

U must check/calculate whether is it worth it to uplift/withdraw ur FD before mature date because the interest will be cut in half so for same cases its not worth it to withdraw. For example, if ur FD is going to due in a month, then its not worth it to withdraw it now (u should wait for it to mature).

May 31 2016, 09:33 AM

May 31 2016, 09:33 AM

Quote

Quote

0.0226sec

0.0226sec

1.14

1.14

6 queries

6 queries

GZIP Disabled

GZIP Disabled