QUOTE(CANONPIXMA @ Mar 5 2023, 09:57 AM)

of course not la... not listed in the attached aboveit's not sports...not in Olympics, Commonwealth Games, Asian Games, SEA Games, SUKMA

This post has been edited by ronnie: Mar 5 2023, 08:44 PM

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 5 2023, 08:43 PM Mar 5 2023, 08:43 PM

|

All Stars

21,326 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(CANONPIXMA @ Mar 5 2023, 09:57 AM) of course not la... not listed in the attached aboveit's not sports...not in Olympics, Commonwealth Games, Asian Games, SEA Games, SUKMA This post has been edited by ronnie: Mar 5 2023, 08:44 PM MUM liked this post

|

|

|

|

|

|

Mar 6 2023, 12:47 AM Mar 6 2023, 12:47 AM

Show posts by this member only | IPv6 | Post

#9022

|

All Stars

26,532 posts Joined: Jan 2003 |

Anyone see any progress about their refund status? still no record at progress timeline for bayaran balik

|

|

|

Mar 6 2023, 02:43 AM Mar 6 2023, 02:43 AM

Show posts by this member only | IPv6 | Post

#9023

|

Senior Member

1,142 posts Joined: Oct 2018 |

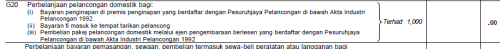

QUOTE(alvinfks78 @ Mar 4 2023, 11:02 AM)  Hi WTA G20 local pelancongan NO. ii Bayaran fi masuk ke tempat tarikan pelancong i paid for myself & mom. Is payment for mom included? if single receipt in your name, then it would be considered as expended by you QUOTE(MUM @ Mar 4 2023, 01:20 PM) If based on the conditions spelled out as per the attached image, I would place my bets on a "NO" to your question. i beg to differ, s46(1)(s) does not state the condition such as 'on himself'. 'for own consumption', etctherefore, expended by him would suffice for relief » Click to show Spoiler - click again to hide... « |

|

|

Mar 6 2023, 02:56 AM Mar 6 2023, 02:56 AM

Show posts by this member only | IPv6 | Post

#9024

|

All Stars

14,950 posts Joined: Mar 2015 |

QUOTE(1mr3tard3d @ Mar 6 2023, 02:43 AM) ................ so if the other (any) tax relief items,....if the clause "does not state the condition such as 'on himself'. 'for own consumption', etc" ,.... then can expended for other person use also?i beg to differ, s46(1)(s) does not state the condition such as 'on himself'. 'for own consumption', etc therefore, expended by him would suffice for relief » Click to show Spoiler - click again to hide... « This post has been edited by MUM: Mar 6 2023, 02:58 AM |

|

|

Mar 6 2023, 08:19 AM Mar 6 2023, 08:19 AM

|

Junior Member

353 posts Joined: Jan 2003 From: kuala lumpur |

QUOTE(Human Nature @ Mar 6 2023, 12:47 AM) Anyone see any progress about their refund status? still no record at progress timeline for bayaran balik same, iirc, normally if submitted by 1/3, 8/3 process and 10/3 credit into back account if excess payment Human Nature liked this post

|

|

|

Mar 6 2023, 09:56 AM Mar 6 2023, 09:56 AM

|

Senior Member

2,704 posts Joined: Apr 2017 |

Hi, want to ask, I pay yearly on medical checkup for my PSV license renewal (its about Rm80), so can I claim that under Medical Self G7 (i)?

|

|

|

|

|

|

Mar 6 2023, 10:18 AM Mar 6 2023, 10:18 AM

|

Junior Member

316 posts Joined: Nov 2012 |

Hi, I was wondering Fitness Gym Bench can be claimed under lifestyle for sports?

|

|

|

Mar 6 2023, 10:31 AM Mar 6 2023, 10:31 AM

Show posts by this member only | IPv6 | Post

#9028

|

All Stars

14,950 posts Joined: Mar 2015 |

QUOTE(babylon52281 @ Mar 6 2023, 09:56 AM) Hi, want to ask, I pay yearly on medical checkup for my PSV license renewal (its about Rm80), so can I claim that under Medical Self G7 (i)? While waiting for responses, you may try to determine if that PSV medical check is considered 'full' medical check per MMC definition.As that condition was stated as a requirement my lhdn. QUOTE(xPrototype @ Mar 6 2023, 10:18 AM) While waiting for real tax sifus to comment.My 2 cenrs of unqualified comments are, .... If dumbells are considered, then I would place my bet on fitness gym bench too. As posted in this site. "This means equipment like dumbbells, shuttlecocks, nets, rackets, golf sets, and more are considered sports equipment. Meanwhile, jerseys, sports shoes, pants, swimsuits are considered as sports attire, which means you can’t claim a lifestyle tax relief. " https://loanstreet.com.my/learning-centre/t...%20tax%20relief. This post has been edited by MUM: Mar 6 2023, 10:40 AM |

|

|

Mar 6 2023, 11:15 AM Mar 6 2023, 11:15 AM

|

All Stars

65,353 posts Joined: Jan 2003 |

fuhhh get love letter audit email from LHDN for YA2020 submission

|

|

|

Mar 6 2023, 11:16 AM Mar 6 2023, 11:16 AM

|

Senior Member

2,704 posts Joined: Apr 2017 |

QUOTE(MUM @ Mar 6 2023, 10:31 AM) While waiting for responses, you may try to determine if that PSV medical check is considered 'full' medical check per MMC definition. Thanks for ur advice. Any idea how to go about checking that MMC definition? Got link? TqAs that condition was stated as a requirement my lhdn. |

|

|

Mar 6 2023, 11:22 AM Mar 6 2023, 11:22 AM

Show posts by this member only | IPv6 | Post

#9031

|

All Stars

14,950 posts Joined: Mar 2015 |

QUOTE(babylon52281 @ Mar 6 2023, 11:16 AM) maybe perhaps can check with MMC?but i googled and found this from this site,... https://landco.my/business-income/ perhaps there are more in google,..... Attached thumbnail(s)

|

|

|

Mar 6 2023, 11:22 AM Mar 6 2023, 11:22 AM

Show posts by this member only | IPv6 | Post

#9032

|

Junior Member

395 posts Joined: Dec 2017 |

Why pensioned public servants entitled to RM7k relief for life insurance premiums, while others only 3k? What is the logic behind this?

|

|

|

Mar 6 2023, 11:34 AM Mar 6 2023, 11:34 AM

Show posts by this member only | IPv6 | Post

#9033

|

All Stars

24,418 posts Joined: Feb 2011 |

|

|

|

|

|

|

Mar 6 2023, 11:49 AM Mar 6 2023, 11:49 AM

|

All Stars

65,353 posts Joined: Jan 2003 |

|

|

|

Mar 6 2023, 11:52 AM Mar 6 2023, 11:52 AM

Show posts by this member only | IPv6 | Post

#9035

|

Junior Member

431 posts Joined: Sep 2010 |

QUOTE(Mattrock @ Mar 6 2023, 11:22 AM) Why pensioned public servants entitled to RM7k relief for life insurance premiums, while others only 3k? What is the logic behind this? While you non-pensioned public servants can claim 4k for EPF (KWSP) and they cannot (as per 2022) if i'm not wrong... that explain??? |

|

|

Mar 6 2023, 12:13 PM Mar 6 2023, 12:13 PM

|

Senior Member

2,704 posts Joined: Apr 2017 |

QUOTE(MUM @ Mar 6 2023, 11:22 AM) maybe perhaps can check with MMC? Oh wow thanks for the quick info, it looks like mine is not meeting the requirement to claim but i googled and found this from this site,... https://landco.my/business-income/ perhaps there are more in google,..... But I very much appreciate the informative sharing here. |

|

|

Mar 6 2023, 12:16 PM Mar 6 2023, 12:16 PM

Show posts by this member only | IPv6 | Post

#9037

|

All Stars

14,950 posts Joined: Mar 2015 |

QUOTE(babylon52281 @ Mar 6 2023, 12:13 PM) Oh wow thanks for the quick info, it looks like mine is not meeting the requirement to claim Just asking, did your receipt got stated types if medical examination?But I very much appreciate the informative sharing here. :thumbsup: Else was wondering how lhdn gonna differentiate it? |

|

|

Mar 6 2023, 12:20 PM Mar 6 2023, 12:20 PM

|

Senior Member

2,704 posts Joined: Apr 2017 |

QUOTE(Mattrock @ Mar 6 2023, 11:22 AM) Why pensioned public servants entitled to RM7k relief for life insurance premiums, while others only 3k? What is the logic behind this? Is this ur first time doing tax filing? If you read that section closely, both sides can max out to 7k only, just that each go their way to save up the retirement funds. Even if civil servants could spare some to keep in EPF (I'm not sure if this is allowed?), they still cannot claim rebate from there. So i think its fair to everyone lah. |

|

|

Mar 6 2023, 01:21 PM Mar 6 2023, 01:21 PM

Show posts by this member only | IPv6 | Post

#9039

|

Junior Member

395 posts Joined: Dec 2017 |

QUOTE(babylon52281 @ Mar 6 2023, 12:20 PM) Is this ur first time doing tax filing? If you read that section closely, both sides can max out to 7k only, just that each go their way to save up the retirement funds. Even if civil servants could spare some to keep in EPF (I'm not sure if this is allowed?), they still cannot claim rebate from there. So i think its fair to everyone lah. Hey dumbfaq, no need to be arrogant when replying, ok. Your answer makes no sense anyway. |

|

|

Mar 6 2023, 01:24 PM Mar 6 2023, 01:24 PM

|

Senior Member

1,286 posts Joined: Jan 2007 |

|

| Change to: |  0.0268sec 0.0268sec

0.86 0.86

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 08:52 PM |