QUOTE(bing0212 @ Mar 21 2025, 11:57 PM)

Studied diploma few years ago and started paying back PTPTN, can claim tax relief under Education fees?

no ...Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 22 2025, 08:20 AM Mar 22 2025, 08:20 AM

Show posts by this member only | IPv6 | Post

#10601

|

Senior Member

5,608 posts Joined: Jan 2010 |

|

|

|

|

|

|

Mar 22 2025, 08:22 AM Mar 22 2025, 08:22 AM

Show posts by this member only | IPv6 | Post

#10602

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(bing0212 @ Mar 21 2025, 11:57 PM) Studied diploma few years ago and started paying back PTPTN, can claim tax relief under Education fees? May I ask, What is the name of that Diploma?If I am not wrong, just some Diploma course that can claim tax relief. Huumph, paid for it few years ago, now only want to claim, ..... during that year of incured that course fees, how much tax did you kena pay for that year? |

|

|

Mar 26 2025, 08:31 AM Mar 26 2025, 08:31 AM

|

Junior Member

87 posts Joined: Oct 2011 |

Hi, my child diploma graduate at June 2024. Am I entitle RM8000 tax relief?

|

|

|

Mar 28 2025, 11:16 PM Mar 28 2025, 11:16 PM

|

Junior Member

98 posts Joined: Dec 2020 |

QUOTE(MUM @ Mar 22 2025, 08:22 AM) May I ask, What is the name of that Diploma? Diploma in EngineeringIf I am not wrong, just some Diploma course that can claim tax relief. Huumph, paid for it few years ago, now only want to claim, ..... during that year of incured that course fees, how much tax did you kena pay for that year? that year was studying, did not pay tax |

|

|

Mar 29 2025, 05:48 AM Mar 29 2025, 05:48 AM

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(bing0212 @ Mar 28 2025, 11:16 PM) Not a tax advice I could be wrong I think cannot claim bcos of this reasoning, .... laptop or handphone purchased in that calender can only be used to claim tax relief for that calendar year. Anyway, as the fees is abit large, it is a waste not to try claim tax relief benefits to reduce taxes, you can try seek answer from lhdn. |

|

|

Mar 29 2025, 11:00 AM Mar 29 2025, 11:00 AM

|

Senior Member

889 posts Joined: Jun 2008 |

I m not sure this is the right place to ask. I am looking for explanatory lhdn notes be 2024 (english) pdf. I manage to get malay version but not english from google.

Please share the link, thanks. |

|

|

|

|

|

Mar 29 2025, 11:06 AM Mar 29 2025, 11:06 AM

Show posts by this member only | IPv6 | Post

#10607

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(CPURanger @ Mar 29 2025, 11:00 AM) I m not sure this is the right place to ask. I am looking for explanatory lhdn notes be 2024 (english) pdf. I manage to get malay version but not english from google. Try this?Please share the link, thanks. Select type and year https://www.hasil.gov.my/en/forms/download-...orm-individual/ CPURanger liked this post

|

|

|

Apr 2 2025, 01:40 PM Apr 2 2025, 01:40 PM

|

Senior Member

1,630 posts Joined: Jun 2006 |

I did not know that losses from property (interest + other expensive vs rental) can be aggregated against loan free income. can I still go back to Hasil for backdated claims ?

|

|

|

Apr 3 2025, 07:55 AM Apr 3 2025, 07:55 AM

Show posts by this member only | IPv6 | Post

#10609

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(ccschua @ Apr 2 2025, 01:40 PM) I did not know that losses from property (interest + other expensive vs rental) can be aggregated against loan free income. can I still go back to Hasil for backdated claims ? Just asking, did you file your rental as "business income under Section 4(a)" or as "non business income under Section 4(d)?"Looks like there is a difference in term of what can claimed, deducted, offset etc etc Guide for landlord to report tax rental income in malaysia https://www.yycadvisors.com/tax-rental-inco...%20Property%20B. Public Ruling No. 12/2018 https://phl.hasil.gov.my/pdf/pdfam/PR_12_2018.pdf This post has been edited by MUM: Apr 3 2025, 08:02 AM |

|

|

Apr 4 2025, 10:24 AM Apr 4 2025, 10:24 AM

|

Senior Member

1,630 posts Joined: Jun 2006 |

noted your points, however, Refering to attached para 7.1, it shows that negative rental can be offset against others.

so far, IRA is not against this. am i missing something ? Attached File(s)  PR_12_2018.pdf ( 586.2k )

Number of downloads: 12

PR_12_2018.pdf ( 586.2k )

Number of downloads: 12 |

|

|

Apr 4 2025, 10:39 AM Apr 4 2025, 10:39 AM

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(ccschua @ Apr 4 2025, 10:24 AM) noted your points, however, Refering to attached para 7.1, it shows that negative rental can be offset against others. When you file your itr, did you follow as per example 14 for rental income.as non business source?so far, IRA is not against this. am i missing something ? |

|

|

Apr 4 2025, 11:45 AM Apr 4 2025, 11:45 AM

|

Senior Member

1,630 posts Joined: Jun 2006 |

QUOTE(MUM @ Apr 4 2025, 10:39 AM) totally agree on this example 14. so now is it possible to rework my past claims and submit to IRA for retro claims (Since IRA has audit rights to 7 years on my claim) ? |

|

|

Apr 4 2025, 12:14 PM Apr 4 2025, 12:14 PM

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(ccschua @ Apr 4 2025, 11:45 AM) totally agree on this example 14. so now is it possible to rework my past claims and submit to IRA for retro claims As I read and intepreted, there are certain tnc for amendments(Since IRA has audit rights to 7 years on my claim) ? https://www.hasil.gov.my/en/individual/othe...assessment/arf/ But as there is this notes in there too "However, taxpayer is not required to submit ARF if the mistakes made are not related to situations as mentioned above. Instead, he can enclosed a detailed letter on the mistakes along with supporting documents (purchase receipts and invoices, etc.) to the HASiL Office that’s handling his tax file." So it is worthwhile to contact them directly |

|

|

|

|

|

Apr 5 2025, 04:48 PM Apr 5 2025, 04:48 PM

|

Junior Member

220 posts Joined: Sep 2021 |

Does anyone know affiliate marketing (like shopee sharing links and earning comission) is categorised under what? B form or BE form? If BE form, is under "other gains"?

The commission I get is very small, total probably rm50 from whole year. Or dont bother to declare? |

|

|

Apr 6 2025, 11:00 AM Apr 6 2025, 11:00 AM

Show posts by this member only | IPv6 | Post

#10615

|

Senior Member

3,305 posts Joined: Dec 2012 |

I have a question:

If I’m working overseas, I would declare my Malaysian income as zero (0). However, I still have insurance and lifestyle in Malaysia that could be used for tax relief. Can I still declare these reliefs like this? • Income: 0 • Tax reliefs: RM5,000 Will this cause any issues with LHDN? Or is it better to just declare everything as zero? |

|

|

Apr 6 2025, 02:04 PM Apr 6 2025, 02:04 PM

|

Senior Member

892 posts Joined: Oct 2007 From: Penang |

|

|

|

Apr 6 2025, 03:20 PM Apr 6 2025, 03:20 PM

Show posts by this member only | IPv6 | Post

#10617

|

Junior Member

70 posts Joined: Dec 2021 |

Hello everyone, can i ask how to file rental income tax ?

I have a unit and rented out, but i am not earning from the rental So do i still need to the filing? Thanks |

|

|

Apr 7 2025, 07:24 AM Apr 7 2025, 07:24 AM

|

All Stars

21,310 posts Joined: Jan 2003 From: Kuala Lumpur |

My friend does "lalamove/grab" on weekends (irregular) on top of his regular 9-5 job, does he need to declare to LHDN ?

If yes, under which column? |

|

|

Apr 7 2025, 07:37 AM Apr 7 2025, 07:37 AM

|

All Stars

14,888 posts Joined: Mar 2015 |

QUOTE(ronnie @ Apr 7 2025, 07:24 AM) My friend does "lalamove/grab" on weekends (irregular) on top of his regular 9-5 job, does he need to declare to LHDN ? Google and found this.If yes, under which column? LHDN briefing for Grab Drivers https://forum.lowyat.net/topic/4757999/+0 |

|

|

Apr 7 2025, 08:03 AM Apr 7 2025, 08:03 AM

|

All Stars

14,888 posts Joined: Mar 2015 |

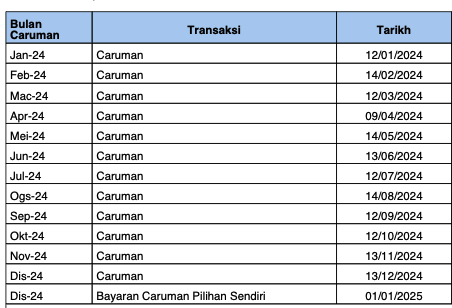

QUOTE(xkaizoku @ Apr 5 2025, 04:48 PM) Does anyone know affiliate marketing (like shopee sharing links and earning comission) is categorised under what? B form or BE form? If BE form, is under "other gains"? Not a qualified tax comment, but I think,The commission I get is very small, total probably rm50 from whole year. Or dont bother to declare? Under declare or did not declare income can be subjected to penalty. Try add the amount received in Form BE under "other gains" as you mentioned. Do remember to keep the income statement from Shopee for audit purposes. QUOTE(jiaen0509 @ Apr 6 2025, 11:00 AM) I have a question: Not a qualified tax comment, but I think,If I’m working overseas, I would declare my Malaysian income as zero (0). However, I still have insurance and lifestyle in Malaysia that could be used for tax relief. Can I still declare these reliefs like this? • Income: 0 • Tax reliefs: RM5,000 Will this cause any issues with LHDN? Or is it better to just declare everything as zero? If you have a tax file in Malaysia before you go work overseas, I think you will need to continue to do the annual income tax submission in April every year until you tell lhdn to temporarily close it giving your reason as are working overseas. Those tax relief that you wanted to claim cannot be claimed as you have no taxable income to seek tax relief for taxable income reduction. Make sure you keep a record of you being taxed or exempted being taxed overseas ..... just incase you need to remit back large sum from overseas. QUOTE(prescott2006 @ Apr 6 2025, 02:04 PM) I made voluntary EPF contribution on 31 Dev 2024. I saw the date in the EPF statement is 1/1/2025. Does this mean I cannot include it for 2024 tax relief? Geee,  Money in on 1/1 will only get 1 day dividend. Money recorded as received on 1/1 will be considered as contribution for that year. QUOTE(leagueoflegend @ Apr 6 2025, 03:20 PM) Hello everyone, can i ask how to file rental income tax ? Not a qualified tax comment, but I think,I have a unit and rented out, but i am not earning from the rental So do i still need to the filing? Thanks Rental income need to be declared as the tenant may hv used that tenant agreement to seek tax deduction during his business income tax declaration. If there is no net profit from the rental, just declare as no profits but keep that working sheets with supporting expense documents just of case of audit. https://www.iproperty.com.my/guides/rental-...ty-owners-46565 This post has been edited by MUM: Apr 7 2025, 08:07 AM |

| Change to: |  0.0263sec 0.0263sec

0.15 0.15

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 05:57 AM |