Banks that pay interest for non-working days - Last update by ??!! on 22 January 2015

OCBC

Bank Rakyat

UOB

May Bank (Need to remind May bank staff to add interest)

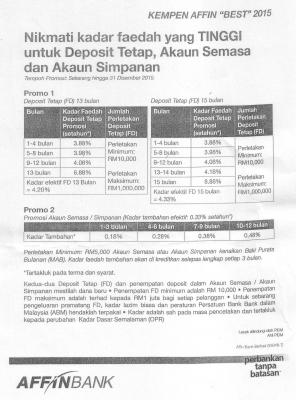

Affin Bank - updated by cybpscyh on 12 Dec 2014

Alliance Bank - updated by ??!! on 22 January 2015

Kuwait Finance House - updated by ??!! on 22 January 2015

Banks that do not pay interest for non-working days

Am Bank

RHB

Standard & Chartered Bank

Bank that non-voluntary credit interest unless appeal

Public Bank (Need to complain to BNM then only pay interest)

New IBG Transfer Timing - Updated by gchowyh on 16 December 2014

Old IBG Transfer Timing

List Of Banks With Survivorship Clause - Updated by magika on 16 November 2014

1. OCBC

2. RHB

3. Alliance

4. Ambank

5. Cimb

6. Hlb

7. Affin

8. MBB

A simple FD calculator to help you - by Human Nature on 13 January 2015

http://www.miniwebtool.com/fixed-deposit-calculator/

Thanks so much to below Contributors:

cherroy

Gen-X

munkeyflo

McFD2R - 4 contributions (Last update: 20 January 2015)

pinpinmiao - 2 contributions

gsc - 11 contributions (Last update: 5 June 2015)

cybpscyh - 31 contributions (Last update: 4 June 2015)

kingofong

FDInvestor - 2 contributions

michaelho - 5 contributions (Last update: 21 April 2015)

wil-i-am - 3 contributions (Last update: 25 May 2015)

X_hunter

HJebat

guy3288 - 2 contributions (Last update: 13 February 2015)

bbgoat - 23 contributions (Last update: 3 June 2015)

giko - 4 contributions

nsx88

raptar_eric - 2 contributions

sylille

harmonics3 - 3 contributions (Last update: 20 January 2015)

xcxa23

RO Player - 3 contributions

Styrroyds

yklooi - 2 contributions

haur

netbuzzchin

nomen

Human Nature

MGM

kinabalu

kwokwah

bearbear

gchowyh - 2 contributions

AVFAN

wr6969

kimmo88

cklimm - 11 contributions (Last update: 3 June 2015)

Lineage

dEviLs - 8 contributions (Last update: 18 March 2015)

Mansamune - 4 contributions

robert82

dagdag1 - 2 contributions (Last update:11 May 2015)

Ramjade - 2 contributions (Last update:26 May 2015)

leo_kiatez

okuribito - 3 contributions

magika - 2 contributions

byshierly

BartS

hcolin

almeizer

munnie

kyenli

Bonescythe - 3 contributions (Last update: 29 May 2015)

??!! (Last Update: 22 January 2015)

muncee (Last Update: 22 January 2015)

adele123 - 3 contributions (Last Update: 11 June 2015)

cj7lee (Last Update: 14 February 2015)

pisces88 (Last Update: 17 February 2015)

eddie2020 (Last Update: 3 March 2015)

zenquix (Last Update: 12 March 2015)

ftan (Last Update: 15 March 2015)

kykit (Last Update: 17 April 2015)

Bonescythe (Last Update: 17 April 2015)

iamkid (Last Update: 17 April 2015)

Dkck (Last Update: 21 April 2015)

familyfirst (Last Update: 21 April 2015)

smas (Last update: 8 May 2015)

Kelv (Last update: 27 May 2015)

This post has been edited by BoomChaCha: Oct 2 2015, 09:20 PM

Jun 9 2015, 10:10 AM

Jun 9 2015, 10:10 AM

Quote

Quote

0.0435sec

0.0435sec

1.06

1.06

7 queries

7 queries

GZIP Disabled

GZIP Disabled