Hello CI 1800

STOCK MARKET DISCUSSION V134, CI step into 1800, are you happy?

STOCK MARKET DISCUSSION V134, CI step into 1800, are you happy?

|

|

Jul 23 2013, 07:15 PM, updated 13y ago Jul 23 2013, 07:15 PM, updated 13y ago

Show posts by this member only | Post

#1

|

All Stars

13,681 posts Joined: Mar 2006 |

Hello CI 1800 |

|

|

|

|

|

Jul 23 2013, 07:22 PM Jul 23 2013, 07:22 PM

Show posts by this member only | Post

#2

|

Senior Member

3,019 posts Joined: Oct 2005 |

so fast v134.....

|

|

|

Jul 23 2013, 07:35 PM Jul 23 2013, 07:35 PM

Show posts by this member only | Post

#3

|

Senior Member

1,411 posts Joined: Nov 2010 |

LOL!! number three this time

|

|

|

Jul 23 2013, 07:58 PM Jul 23 2013, 07:58 PM

Show posts by this member only | Post

#4

|

Senior Member

1,059 posts Joined: Jun 2013 |

me no.4

|

|

|

Jul 23 2013, 08:00 PM Jul 23 2013, 08:00 PM

Show posts by this member only | Post

#5

|

Senior Member

2,677 posts Joined: Dec 2010 |

Checking in

|

|

|

Jul 23 2013, 08:01 PM Jul 23 2013, 08:01 PM

Show posts by this member only | Post

#6

|

Senior Member

4,470 posts Joined: Sep 2007 From: Kuala Lumpur |

phew phewwww

|

|

|

|

|

|

Jul 23 2013, 08:09 PM Jul 23 2013, 08:09 PM

Show posts by this member only | Post

#7

|

Senior Member

7,142 posts Joined: Oct 2008 From: Sin City |

Check me in

|

|

|

Jul 23 2013, 08:10 PM Jul 23 2013, 08:10 PM

Show posts by this member only | Post

#8

|

Senior Member

2,991 posts Joined: Jun 2007 |

Check-in #8. Huat AH!

|

|

|

Jul 23 2013, 08:11 PM Jul 23 2013, 08:11 PM

Show posts by this member only | Post

#9

|

Senior Member

4,715 posts Joined: Jan 2011 |

apa ini???

Notice: Service Interruption Please note that OSK188 will not be available for online trading today owing to technical issues. Do check your order status for all orders that were placed earlier in the morning before the system outage. Meanwhile, please contact your Dealer/Remisier for immediate assistance. We apologise for any inconvenience caused. |

|

|

Jul 23 2013, 08:16 PM Jul 23 2013, 08:16 PM

|

Senior Member

1,411 posts Joined: Nov 2010 |

i got really pissed off by cimbclicks

the site is darnnnnn slow anyone facing the same problem? |

|

|

Jul 23 2013, 08:45 PM Jul 23 2013, 08:45 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

1800, are you happy?

i more happy can check in #11. I like number. |

|

|

Jul 23 2013, 08:47 PM Jul 23 2013, 08:47 PM

|

Senior Member

4,342 posts Joined: Apr 2010 From: The place that i call home :p |

sap yee ...... yee hah .....

|

|

|

Jul 23 2013, 08:57 PM Jul 23 2013, 08:57 PM

|

All Stars

17,864 posts Joined: Jan 2005 |

check in.

|

|

|

|

|

|

Jul 23 2013, 09:06 PM Jul 23 2013, 09:06 PM

|

Senior Member

934 posts Joined: Sep 2005 |

check in!

|

|

|

Jul 23 2013, 09:08 PM Jul 23 2013, 09:08 PM

|

Senior Member

852 posts Joined: Jan 2003 |

OnG, Property, Finance counters!

Bull run! |

|

|

Jul 23 2013, 09:30 PM Jul 23 2013, 09:30 PM

|

Senior Member

6,583 posts Joined: Feb 2008 |

QUOTE TPP News US-led trade talks gain complexity as Japan joins KUALA LUMPUR, July 23 (Reuters) - Japan joined U.S.-led trade talks on Tuesday, adding its weight to a pact that covers two-fifths of the world economy but raising further doubt over whether negotiators can prise open sensitive sectors such as farm goods and statelinked firms. Tokyo's entry, which takes to 12 the number of countries in the Trans-Pacific Partnership (TPP), is a key plank of Prime Minister Shinzo Abe's plans to shake up Japan's economy and return it to growth after years of stagnation. His "Abenomics" agenda won a further mandate on Sunday when his coalition won a strong majority in a parliamentary election. A major goal of U.S. President Barack Obama's administration, the TPP aims to tear down barriers in areas such as government procurement and set standards for workers' rights, environmental protection and intellectual property rights. But it faces tough resistance in several countries, including communist Vietnam and Malaysia, where state-linked enterprises and selective handouts of government contracts are entrenched and politically sensitive. Japan's entry adds another layer of complexity. "They'll come up with some agreement, but whether it will be as deep as they want it to be is another question," said Jayant Menon, a senior economist at the Asian Development Bank. "Malaysia and Vietnam will never agree to the rules they want on state-owned enterprises." http://www.theedgemalaysia.com/business-ne...apan-joins.html This post has been edited by ham_revilo: Jul 23 2013, 09:31 PM |

|

|

Jul 23 2013, 10:19 PM Jul 23 2013, 10:19 PM

|

Senior Member

7,960 posts Joined: Dec 2007 From: Kuala Lumpur |

silent reader check in..

and Good News to M2U Stocks for iPad users!!!! check out the latest update... now can view research reports, ta charts, news, and good till date orders.. https://itunes.apple.com/qa/app/m2u-stocks-...d491273619?mt=8 |

|

|

Jul 23 2013, 10:36 PM Jul 23 2013, 10:36 PM

|

Senior Member

650 posts Joined: Oct 2009 From: Formerly Perak, now KL |

#18 good number!

Btw before I go mandi, just wanna say this guy Isaac Chin is one of my investment heroes .... http://www.nextinsight.net/index.php/story...451-isaac-chin- This post has been edited by Veda: Jul 23 2013, 11:01 PM |

|

|

Jul 24 2013, 12:37 AM Jul 24 2013, 12:37 AM

|

Senior Member

1,602 posts Joined: Jun 2010 From: Malaysia |

maybank wa, mbsb, and redtone to watch tomorrow

|

|

|

Jul 24 2013, 01:11 AM Jul 24 2013, 01:11 AM

|

Junior Member

46 posts Joined: Dec 2009 |

silent reader here, check in..

|

|

|

Jul 24 2013, 01:24 AM Jul 24 2013, 01:24 AM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

Maybank IB acts as stabilizer and bought Airasia X stocks. Then what? They will hold those stocks? Or they will sell back to the market later?

|

|

|

Jul 24 2013, 01:31 AM Jul 24 2013, 01:31 AM

|

Senior Member

2,677 posts Joined: Dec 2010 |

|

|

|

Jul 24 2013, 08:13 AM Jul 24 2013, 08:13 AM

|

Junior Member

375 posts Joined: Mar 2012 |

check in

|

|

|

Jul 24 2013, 08:14 AM Jul 24 2013, 08:14 AM

|

Junior Member

375 posts Joined: Mar 2012 |

index record high

|

|

|

Jul 24 2013, 08:25 AM Jul 24 2013, 08:25 AM

|

Senior Member

2,455 posts Joined: Aug 2008 From: Malaysia |

any thoughts on REITs?

|

|

|

Jul 24 2013, 08:26 AM Jul 24 2013, 08:26 AM

|

Senior Member

2,649 posts Joined: Nov 2010 |

What do you guys think about TDM??

|

|

|

Jul 24 2013, 08:48 AM Jul 24 2013, 08:48 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

the price should be 0.775-0.800 big player in game |

|

|

Jul 24 2013, 08:58 AM Jul 24 2013, 08:58 AM

|

Junior Member

374 posts Joined: Mar 2005 From: Sarawak |

|

|

|

Jul 24 2013, 08:59 AM Jul 24 2013, 08:59 AM

|

Senior Member

629 posts Joined: Dec 2007 |

TDM looking for another run today?

|

|

|

Jul 24 2013, 09:11 AM Jul 24 2013, 09:11 AM

|

Senior Member

3,019 posts Joined: Oct 2005 |

|

|

|

Jul 24 2013, 09:12 AM Jul 24 2013, 09:12 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 09:16 AM Jul 24 2013, 09:16 AM

|

Senior Member

3,019 posts Joined: Oct 2005 |

|

|

|

Jul 24 2013, 09:20 AM Jul 24 2013, 09:20 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 09:22 AM Jul 24 2013, 09:22 AM

|

Senior Member

2,714 posts Joined: May 2008 |

Silent reader check in

|

|

|

Jul 24 2013, 09:31 AM Jul 24 2013, 09:31 AM

|

Senior Member

1,633 posts Joined: Jan 2007 |

sap fatt sap fatt ah!!!

1810 now...8 more points to go to the magic number ^^ |

|

|

Jul 24 2013, 09:47 AM Jul 24 2013, 09:47 AM

|

Senior Member

852 posts Joined: Jan 2003 |

|

|

|

Jul 24 2013, 09:50 AM Jul 24 2013, 09:50 AM

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Jul 24 2013, 09:52 AM Jul 24 2013, 09:52 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 09:53 AM Jul 24 2013, 09:53 AM

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Jul 24 2013, 09:56 AM Jul 24 2013, 09:56 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 09:58 AM Jul 24 2013, 09:58 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Babablacksheep @ Jul 24 2013, 09:47 AM) ?This is IGBReit chart since listing.  Is the chart going up? No. Is the chart showing a stock whose price is continuing to fall? Yes Is there any IMMEDIATE indication when the stock will stop falling? No Comparing to historical chart, why is IGBReit interesting? What is the indicative yield at current price? This post has been edited by Boon3: Jul 24 2013, 10:01 AM |

|

|

Jul 24 2013, 10:01 AM Jul 24 2013, 10:01 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(yok70 @ Jul 24 2013, 01:24 AM) Maybank IB acts as stabilizer and bought Airasia X stocks. Then what? They will hold those stocks? Or they will sell back to the market later? As a stabilizing manager, the fund to purchase comes from the IPO proceeds itself, so it is basically AAX buying back itself. No loss to the stabilizing manager as they are merely agents, AAX foots the bill, later all these shares goes back to treasury. This post has been edited by gark: Jul 24 2013, 10:01 AM |

|

|

Jul 24 2013, 10:01 AM Jul 24 2013, 10:01 AM

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(Boon3 @ Jul 24 2013, 09:58 AM) ? Morning Boon3,This is IGBReit chart since listing.  Is the chart going up? No. Is the chart showing a stock whose price is continuing to fall? Yes Is there any IMMEDIATE indication where the stock will stock falling? No Comparing to historical chart, why is IGBReit interesting? What is the indicative yield at current price? here the yield. Attached thumbnail(s)

|

|

|

Jul 24 2013, 10:03 AM Jul 24 2013, 10:03 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ Jul 24 2013, 10:01 AM) As a stabilizing manager, the fund to purchase comes from the IPO proceeds itself, so it is basically AAX buying back itself. No loss to the stabilizing manager as they are merely agents, AAX foots the bill, later all these shares goes back to treasury. If one is not lazy, one can use Uncle Google to check on past Greenshoe options performances.This one is the first one http://www.theedgemalaysia.com/commentary/...hoe-option.html |

|

|

Jul 24 2013, 10:05 AM Jul 24 2013, 10:05 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 24 2013, 10:05 AM Jul 24 2013, 10:05 AM

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(gark @ Jul 24 2013, 10:01 AM) As a stabilizing manager, the fund to purchase comes from the IPO proceeds itself, so it is basically AAX buying back itself. No loss to the stabilizing manager as they are merely agents, AAX foots the bill, later all these shares goes back to treasury. Hi gark,I thought the stabilizing mechanism using own IB $$$, not the $$$ from the IPO listing company? |

|

|

Jul 24 2013, 10:08 AM Jul 24 2013, 10:08 AM

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Jul 24 2013, 10:08 AM Jul 24 2013, 10:08 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Boon3 @ Jul 24 2013, 10:03 AM) If one is not lazy, one can use Uncle Google to check on past Greenshoe options performances. If any IPO requires stabilizing manager on the first day itself already means it is overpriced and is going to fall sooner or later. Anyway I don't subscribe to IPO, most of it overpriced.This one is the first one http://www.theedgemalaysia.com/commentary/...hoe-option.html This post has been edited by gark: Jul 24 2013, 10:09 AM |

|

|

Jul 24 2013, 10:09 AM Jul 24 2013, 10:09 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 24 2013, 10:09 AM Jul 24 2013, 10:09 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Jul 24 2013, 10:15 AM Jul 24 2013, 10:15 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(felixmask @ Jul 24 2013, 10:08 AM) I see.However, prospectus numbers and promises is one thing. Company performing and actually doing what they promise is another thing. So far from Bursa website: http://www.bursamalaysia.com/market/listed...ll&company=5227 IGBReit has only announced ONE dividend payment in Jan 2013 and paid in Feb 2013. DPU was only 1.83 sen. It's now July 2013. I believe that no other dividend has been announced. Could this be another reason why this REIT is sliding and there's a chance that it could even go below its IPO price of 125? |

|

|

Jul 24 2013, 10:15 AM Jul 24 2013, 10:15 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Jul 24 2013, 10:20 AM Jul 24 2013, 10:20 AM

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Jul 24 2013, 10:22 AM Jul 24 2013, 10:22 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 10:27 AM Jul 24 2013, 10:27 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 24 2013, 10:32 AM Jul 24 2013, 10:32 AM

|

Junior Member

20 posts Joined: Aug 2009 |

check in....

YEAH!!! CI more than 1800.... |

|

|

Jul 24 2013, 10:36 AM Jul 24 2013, 10:36 AM

|

Senior Member

1,229 posts Joined: Sep 2006 |

ooo Redtone got show again

|

|

|

Jul 24 2013, 10:36 AM Jul 24 2013, 10:36 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 10:42 AM Jul 24 2013, 10:42 AM

|

Senior Member

4,093 posts Joined: Jul 2011 |

check in with Gadang !

|

|

|

Jul 24 2013, 10:44 AM Jul 24 2013, 10:44 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(StupidGuyPlayComp @ Jul 24 2013, 10:22 AM) Might be some funds are shifting from Maybank to PBB.....Maybank Indonesia faced a heavy write off aka impairment . Indo bank Share price kinda like rp 350 compared to rp 550 when bought ..... Some more need to sell down some share portion in order to keep listed in INdonesia...... Not saying Maybank is bad, just updating my info here only. This post has been edited by SKY 1809: Jul 24 2013, 10:45 AM |

|

|

Jul 24 2013, 10:46 AM Jul 24 2013, 10:46 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 24 2013, 10:47 AM Jul 24 2013, 10:47 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

QUOTE(SKY 1809 @ Jul 24 2013, 10:44 AM) Might be some funds are shifting from Maybank to PBB..... Maybank Indonesia faced a heavy write off aka impairment . Indo Share price kinda like rp 350 compared to rp 550 when bought ..... Some more need to sell down some share portion in order to keep listed. Not saying Maybank is bad, just updating my info here only. they posted a good quarterly report yesterday |

|

|

Jul 24 2013, 10:49 AM Jul 24 2013, 10:49 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 10:52 AM Jul 24 2013, 10:52 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(felixmask @ Jul 24 2013, 09:53 AM) my curiosity until what extend the MGS interest rate will hike to what level, the reits will continue depress Bonds are in sliding mode across since the word "tapering" surface.I wonder how retail can purchase MGS to joy the ride? It is price of bonds go down, that sending yield higher. You don't "enjoy" your bond, when bond yield rising. |

|

|

Jul 24 2013, 10:52 AM Jul 24 2013, 10:52 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 24 2013, 10:54 AM Jul 24 2013, 10:54 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 24 2013, 10:57 AM Jul 24 2013, 10:57 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 10:58 AM Jul 24 2013, 10:58 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Jul 24 2013, 10:59 AM Jul 24 2013, 10:59 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 24 2013, 11:01 AM Jul 24 2013, 11:01 AM

|

Senior Member

4,342 posts Joined: Apr 2010 From: The place that i call home :p |

QUOTE(SKY 1809 @ Jul 24 2013, 10:44 AM) Might be some funds are shifting from Maybank to PBB..... This maybank always got scandal one..... Now tony pua asking for the BII shares sold at what price and to whom? Dun know they bother to answer his question or not....... Maybank Indonesia faced a heavy write off aka impairment . Indo bank Share price kinda like rp 350 compared to rp 550 when bought ..... Some more need to sell down some share portion in order to keep listed in INdonesia...... Not saying Maybank is bad, just updating my info here only. |

|

|

Jul 24 2013, 11:02 AM Jul 24 2013, 11:02 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 24 2013, 11:04 AM Jul 24 2013, 11:04 AM

|

Senior Member

1,229 posts Joined: Sep 2006 |

|

|

|

Jul 24 2013, 11:04 AM Jul 24 2013, 11:04 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 24 2013, 11:06 AM Jul 24 2013, 11:06 AM

|

Senior Member

4,342 posts Joined: Apr 2010 From: The place that i call home :p |

|

|

|

Jul 24 2013, 11:07 AM Jul 24 2013, 11:07 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 24 2013, 11:10 AM Jul 24 2013, 11:10 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 24 2013, 11:10 AM Jul 24 2013, 11:10 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 24 2013, 11:13 AM Jul 24 2013, 11:13 AM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

|

|

|

Jul 24 2013, 11:14 AM Jul 24 2013, 11:14 AM

|

Senior Member

3,806 posts Joined: Feb 2012 |

|

|

|

Jul 24 2013, 11:17 AM Jul 24 2013, 11:17 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 24 2013, 11:19 AM Jul 24 2013, 11:19 AM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

|

|

|

Jul 24 2013, 11:23 AM Jul 24 2013, 11:23 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 24 2013, 11:30 AM Jul 24 2013, 11:30 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 24 2013, 11:31 AM Jul 24 2013, 11:31 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(SKY 1809 @ Jul 24 2013, 10:54 AM) I do not see it rise too far.Just normalise back what it should be. I do not see how quality bond yield can above 4-5% when there is no central banks around the world is hiking interest, nor concern about inflation. |

|

|

Jul 24 2013, 11:36 AM Jul 24 2013, 11:36 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(cherroy @ Jul 24 2013, 11:31 AM) I do not see it rise too far. " Quality Bonds" , not sure which ones u refer to but ( a bit long winded ) :-Just normalise back what it should be. I do not see how quality bond yield can above 4-5% when there is no central banks around the world is hiking interest, nor concern about inflation. (July 23): Borrowing costs for Malaysia’s Syarikat Prasarana Negara Bhd. look set to rise for its planned sukuk as a government guarantee and a drought in new issuance fail to shield the company from a global increase in yields. The state-owned public transport operator plans to sell 1 billion ringgit ($315 million) of debt due in 10 to 15 years in August, which Asian Islamic Investment Management Bhd. predicts will have to offer a 50 basis-point premium over non-Shariah- compliant sovereign notes. Ten-year government bonds pay 3.82 percent, indicating Prasarana’s new securities may yield more than the 3.77 percent it paid for that maturity in August 2012. The world’s biggest sukuk market is experiencing its worst year for sales since 2010, with nothing apart from Prasarana’s offering confirmed in the pipeline from local-currency issuers. Average yields on global corporate Islamic securities increased 27 basis points since the end of May to 4.18 percent amid concern an end to U.S. monetary stimulus will spur outflows from Asia, an index compiled by HSBC Holdings Plc shows. “Even though the corporate debt market is pretty dry, investors won’t chase paper like before,” Fariza Taib, a fixed- income manager overseeing 1 billion ringgit at Kuala Lumpur- based Asian Islamic Investment, said in a July 18 interview. “Still, demand will be there from insurers and pension funds that need to manage assets and liabilities.” Malaysia’s offerings of Islamic bonds, which pay returns on assets to comply with the Koran’s ban on interest, dropped 65 percent to 19.9 billion ringgit this year, after reaching a record 95.8 billion ringgit in 2012, data compiled by Bloomberg show. Issuance from the six-member Gulf Cooperation Council, which includes Saudi Arabia, fell 38 percent to $10.8 billion. Rising Guarantees Prasarana intends to raise 4 billion ringgit this year from sukuk to extend an overhead light railway in and around Kuala Lumpur, with a further 1 billion ringgit planned in September and 2 billion ringgit toward year-end, Mohd. Zahir Zahur Hussain, the group finance director, said in a July 17 interview. The risk of the Federal Reserve cutting bond purchases will have a limited impact on Prasarana’s borrowing costs due to the level of local demand and state backing, Mohd. Zahir said. Prime Minister Najib Razak’s administration is offering government guarantees for debt issuers looking to fund projects under Malaysia’s $444 billion development program to build railways, roads and power plants over the next 10 years. Such securities totaled 147.8 billion ringgit, or 69.4 percent of gross domestic product, as of March, Chua Hak Bin, an economist in Singapore at Bank of America Merrill Lynch, said in an interview yesterday. That’s up from 68.5 percent and 64.8 percent at the end of 2012 and 2011, he said. ‘Red Flag’ At current trajectories, quasi-public debt, which includes government-guaranteed notes, will reach 72 percent by year-end and may test 80 percent in about two years, a level typically regarded as a “red flag,” Chua said. “The rise in government-guaranteed debt isn’t a major concern as the funds raised are used for infrastructure development, which will spur growth in the economy,” Michael Chang, who oversees $1 billion as head of bonds at MCIS Zurich Insurance Bhd. in Kuala Lumpur, said in an interview yesterday. “We would probably buy the Prasarana sukuk as we still need to extend duration.” Prasarana priced 15-year Islamic bonds at 4 percent at the previous sale in 2012. The yield has since climbed 30 basis points, or 0.3 percentage point, to 4.3 percent, the latest prices from Bursa Malaysia show. The rate on similar-maturity 5.248 percent government notes that don’t comply with religious tenets rose 27 basis points this year to 4.06 percent, the highest since March 2012, according to data compiled by Bloomberg. Corporate Gains The Bloomberg-AIBIM Bursa Malaysia Corporate Index, which tracks 57 local-currency Shariah-compliant bonds, climbed 2.2 percent in 2013 to 104.56. Borrowing costs on the nation’s top- rated 15-year non-Islamic notes remained stable in July, rising three basis points to 4.55 percent, a central bank gauge shows. Global sukuk, including company debt and sovereigns, posted a loss of 0.3 percent this year, according to the HSBC/Nasdaq Dubai US Dollar Sukuk index, while JPMorgan Chase & Co.’s EMBI Global Index shows bonds in emerging markets lost 5.9 percent. The premium investors demand to hold Shariah notes sold internationally over the London interbank offered rate narrowed 34 basis points to 183 basis points in July, after widening 38 points in June, the biggest increase since November 2011. No Hindrance Corporate sukuk in the Southeast Asian nation benefits from a higher degree of scarcity than for government debt, Nor Hanifah Hashim, fixed income head at Franklin Templeton Investments Malaysia, said in a July 5 e-mail. Prasarana’s Mohd. Zahir said the company will proceed with its planned bond sale even if the Fed starts tapering its asset purchases. The company, which has total debt of 9.9 billion ringgit outstanding, according to data compiled by Bloomberg, sold 2 billion ringgit of sukuk in August 2012, receiving 3.6 billion ringgit in orders. “In general, we prefer shorter-dated paper because yields have gone up,” Mohd Noor Hj A Rahman, chief executive officer at OSK-UOB Islamic Fund Management Bhd. in Kuala Lumpur, said in a July 19 interview. “We would only buy Prasarana sukuk if yields are attractive.” This post has been edited by SKY 1809: Jul 24 2013, 11:41 AM |

|

|

Jul 24 2013, 12:27 PM Jul 24 2013, 12:27 PM

|

Senior Member

3,109 posts Joined: Aug 2007 From: Malaysia > Singapore |

Not bad INARI & REDTONE!

|

|

|

Jul 24 2013, 12:39 PM Jul 24 2013, 12:39 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 24 2013, 01:03 PM Jul 24 2013, 01:03 PM

|

Senior Member

896 posts Joined: Jul 2012 |

Check in...88 = huat huat...

|

|

|

Jul 24 2013, 01:32 PM Jul 24 2013, 01:32 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Jul 24 2013, 01:39 PM Jul 24 2013, 01:39 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

Bonds : Death of an asset class.

Link here... A very technical but good analysis for bonds returns for the next 7 years, which is expected to perform below cash. This post has been edited by gark: Jul 24 2013, 01:40 PM |

|

|

Jul 24 2013, 01:46 PM Jul 24 2013, 01:46 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Jul 24 2013, 01:51 PM Jul 24 2013, 01:51 PM

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Jul 24 2013, 01:55 PM Jul 24 2013, 01:55 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Jul 24 2013, 02:00 PM Jul 24 2013, 02:00 PM

|

Senior Member

6,356 posts Joined: Aug 2008 |

|

|

|

Jul 24 2013, 02:03 PM Jul 24 2013, 02:03 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Jul 24 2013, 02:03 PM Jul 24 2013, 02:03 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

|

|

|

Jul 24 2013, 02:06 PM Jul 24 2013, 02:06 PM

|

Senior Member

1,411 posts Joined: Nov 2010 |

|

|

|

Jul 24 2013, 02:12 PM Jul 24 2013, 02:12 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 24 2013, 03:11 PM Jul 24 2013, 03:11 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

NEW YORK (Reuters) - Investors raised their longer-dated U.S. Treasuries holdings in the latest week after Federal Reserve Chairman Ben Bernanke sought to reduce worries about rising interest rates, according to a survey released on Tuesday.

He added the Fed will likely hold short-term rates near zero for a long time even after it stops buying Treasuries and mortgage-backed securities. J.P. Morgan surveys 40 to 60 of its Treasuries clients weekly, of which 60 percent are fund managers, 25 percent are speculative accounts and 15 percent are central banks and sovereign wealth funds. It asks 10 to 20 of its active clients each week about their Treasuries holdings, of which 70 percent are speculative accounts and the rest are money managers. http://finance.yahoo.com/news/investors-ad...A3BtaA--;_ylv=3 |

|

|

Jul 24 2013, 03:20 PM Jul 24 2013, 03:20 PM

|

Senior Member

934 posts Joined: Sep 2005 |

tdm very powderful...

|

|

|

Jul 24 2013, 03:23 PM Jul 24 2013, 03:23 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

Redtone manyak ong

|

|

|

Jul 24 2013, 03:36 PM Jul 24 2013, 03:36 PM

|

Senior Member

852 posts Joined: Jan 2003 |

Wow. Ranhill Petronas license got revoked!

Extremely bad news for an IPO listing soon. |

|

|

Jul 24 2013, 03:37 PM Jul 24 2013, 03:37 PM

|

Senior Member

2,178 posts Joined: Oct 2006 From: The Pearl of the Orient - MY |

Meet Mr. Money Mustache. Hundreds of thousands of readers follow his bold advice on his self-titled blog — and for good reason. He has cracked the retirement code while many of us were struggling with student loans. At 23 years old he began working and saving…and saving some more. By age 30, he’d amassed some $800,000 in cash and investments, and then entered early retirement.

How I Retired at 30 |

|

|

Jul 24 2013, 04:18 PM Jul 24 2013, 04:18 PM

|

Senior Member

1,229 posts Joined: Sep 2006 |

|

|

|

Jul 24 2013, 04:19 PM Jul 24 2013, 04:19 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 04:21 PM Jul 24 2013, 04:21 PM

|

Senior Member

3,109 posts Joined: Aug 2007 From: Malaysia > Singapore |

|

|

|

Jul 24 2013, 04:22 PM Jul 24 2013, 04:22 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 04:22 PM Jul 24 2013, 04:22 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

Why people has no problem to trade healthcare sector at PE so high? It's like 50x is very much acceptable. Are they growing that fast? Really? And yield is not so attractive either. I don't see fast growing on KPJ, even IHH. Now Tropicana Medical Center. Not saying they are bad business, in fact they are very good business. But can they grow that much in next 3 years? Or the market is valuating their 10 years later scale?

http://nexttrade.blogspot.com/2013/07/tmcl...hcare-play.html |

|

|

Jul 24 2013, 04:25 PM Jul 24 2013, 04:25 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

|

|

|

Jul 24 2013, 04:26 PM Jul 24 2013, 04:26 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

I just wanna say REITs are selling like hot cakes....then realize is it correct to say that for REIT's case?

|

|

|

Jul 24 2013, 04:27 PM Jul 24 2013, 04:27 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

QUOTE(Icehart @ Jul 24 2013, 04:25 PM) I found this counter is up trend before the excellent quarterly result being announce............. after announce it will go downward on 3rd day if it repeated this time, the best time to sell is the 2nd day after the announcement This post has been edited by StupidGuyPlayComp: Jul 24 2013, 04:28 PM |

|

|

Jul 24 2013, 04:31 PM Jul 24 2013, 04:31 PM

|

Senior Member

3,109 posts Joined: Aug 2007 From: Malaysia > Singapore |

Rm 1

|

|

|

Jul 24 2013, 04:35 PM Jul 24 2013, 04:35 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

|

|

|

Jul 24 2013, 04:35 PM Jul 24 2013, 04:35 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

QUOTE(StupidGuyPlayComp @ Jul 24 2013, 04:27 PM) I found this counter is up trend before the excellent quarterly result being announce............. after announce it will go downward on 3rd day if it repeated this time, the best time to sell is the 2nd day after the announcement |

|

|

Jul 24 2013, 04:40 PM Jul 24 2013, 04:40 PM

|

Senior Member

1,229 posts Joined: Sep 2006 |

|

|

|

Jul 24 2013, 04:40 PM Jul 24 2013, 04:40 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 24 2013, 04:40 PM Jul 24 2013, 04:40 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 24 2013, 04:41 PM Jul 24 2013, 04:41 PM

|

Senior Member

1,229 posts Joined: Sep 2006 |

|

|

|

Jul 24 2013, 04:42 PM Jul 24 2013, 04:42 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

QUOTE(Boon3 @ Jul 24 2013, 04:40 PM) Why have a preset targets? Yes. Listen to the stock. Sometimes the stock can go much higher than the TP but there also many times it falls way short of TPs. Me? I always prefer to listen. Good profits eh? Depending on sentiment at that time, see how it goes actually, but the plan is 95 cents. On the other hand, JCY |

|

|

Jul 24 2013, 04:42 PM Jul 24 2013, 04:42 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

|

|

|

Jul 24 2013, 04:44 PM Jul 24 2013, 04:44 PM

|

Senior Member

1,229 posts Joined: Sep 2006 |

thanks for sharing your observation.

and gratz on your profit QUOTE(StupidGuyPlayComp @ Jul 24 2013, 04:27 PM) I found this counter is up trend before the excellent quarterly result being announce............. after announce it will go downward on 3rd day if it repeated this time, the best time to sell is the 2nd day after the announcement |

|

|

Jul 24 2013, 04:51 PM Jul 24 2013, 04:51 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Icehart @ Jul 24 2013, 04:42 PM) Yes. On the other hand, the observation that redtone consolidates after its quarterly earnings the past few quarterly earnings is spot on.Depending on sentiment at that time, see how it goes actually, but the plan is 95 cents. On the other hand, JCY I do know this a fact ... since when redtone was below 40 sen. JCY on the other hand is actually looking good. It's just digesting its recent gains. No stocks go straight up, its usually 2 steps forward 1 step backward. (ps: me not on this one cos I don't understand its fundamentals. |

|

|

Jul 24 2013, 04:59 PM Jul 24 2013, 04:59 PM

|

Senior Member

852 posts Joined: Jan 2003 |

QUOTE(Boon3 @ Jul 24 2013, 09:58 AM) ? IMO, price looks attractive = cheap buy compare to history price.This is IGBReit chart since listing.  Is the chart going up? No. Is the chart showing a stock whose price is continuing to fall? Yes Is there any IMMEDIATE indication when the stock will stop falling? No Comparing to historical chart, why is IGBReit interesting? What is the indicative yield at current price? Since REIT is long term structure |

|

|

Jul 24 2013, 05:00 PM Jul 24 2013, 05:00 PM

|

Senior Member

7,142 posts Joined: Oct 2008 From: Sin City |

|

|

|

Jul 24 2013, 05:04 PM Jul 24 2013, 05:04 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Babablacksheep @ Jul 24 2013, 04:59 PM) Compare to history price, the price is now much lower.Is it good just cos it's lower? How much dpu has this reit actually paid thid year? 1.83 Sen. It's now almost end July. Why so little so far? When will the next divi be paid? How much? |

|

|

Jul 24 2013, 05:18 PM Jul 24 2013, 05:18 PM

|

Senior Member

896 posts Joined: Jul 2012 |

QUOTE(Boon3 @ Jul 24 2013, 05:04 PM) Compare to history price, the price is now much lower. IPO is in 3 quarter last year so DPU declared was 1.83 (i assume is only 1 quarter profit)Is it good just cos it's lower? How much dpu has this reit actually paid thid year? 1.83 Sen. It's now almost end July. Why so little so far? When will the next divi be paid? How much? If dividend is declare half yearly, then we will expect another one soon.. How much is a question but should expect abt 3.5sen? This post has been edited by Madbull: Jul 24 2013, 05:19 PM |

|

|

Jul 24 2013, 05:49 PM Jul 24 2013, 05:49 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

IGBReit should pay about 7 sen for entire year.

No acquisition in pipeline, so can only consider organic growth. The organic growth is to further utilize Midvalley space, ie. the top cinema floor, they are building 2nd floors on top of some shops. And of course, major growth for the next 3 years or so will come from Garden's rental revision. The traffic in Garden has increased substantially the recent year. This is the same as Pavilion 2-3 years ago, from tiny traffic into fast increasing. Regarding parking issue, in fact, all top shopping malls in Malaysia suffers from this issue. 1U, Pyramid, Midvalley etc. Even fees as high as KLCC is not easy to find parking too. Wondering why is that so difficult to solve. Can't they simply add few more floors of parking in the building? |

|

|

Jul 24 2013, 05:58 PM Jul 24 2013, 05:58 PM

|

|

Elite

3,777 posts Joined: Jan 2003 |

argh. everytime have long meeting sure miss something. Missed my redtone again. gotta enter again :/

|

|

|

Jul 24 2013, 06:00 PM Jul 24 2013, 06:00 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(kuluuluk @ Jul 24 2013, 03:37 PM) Meet Mr. Money Mustache. Hundreds of thousands of readers follow his bold advice on his self-titled blog — and for good reason. He has cracked the retirement code while many of us were struggling with student loans. At 23 years old he began working and saving…and saving some more. By age 30, he’d amassed some $800,000 in cash and investments, and then entered early retirement. How I Retired at 30 |

|

|

Jul 24 2013, 06:05 PM Jul 24 2013, 06:05 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 24 2013, 06:18 PM Jul 24 2013, 06:18 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Madbull @ Jul 24 2013, 05:18 PM) IPO is in 3 quarter last year so DPU declared was 1.83 (i assume is only 1 quarter profit) I understand your point.If dividend is declare half yearly, then we will expect another one soon.. How much is a question but should expect abt 3.5sen? IGBReit is a monster size reit. 3.4 billion shares and a market cap of 4.32 billion. It took a very strong hand to push the stock down from 145 to current price of 127. I, for one, would respect what this strong hand is trying to do first before assuming anything else. If the stock is really good, paying a little bit more when the share price recovers won't hurt. What would hurt is buying now and have no idea why the so-called solid reit keeps dropping. My one sen. |

|

|

Jul 24 2013, 08:21 PM Jul 24 2013, 08:21 PM

|

Junior Member

693 posts Joined: Dec 2009 From: Italy |

this Friday Nuzul Al-Quran is bursa holiday

|

|

|

Jul 24 2013, 09:08 PM Jul 24 2013, 09:08 PM

|

Senior Member

3,019 posts Joined: Oct 2005 |

|

|

|

Jul 24 2013, 09:09 PM Jul 24 2013, 09:09 PM

|

Junior Member

598 posts Joined: Apr 2009 |

|

|

|

Jul 24 2013, 11:21 PM Jul 24 2013, 11:21 PM

|

Senior Member

2,361 posts Joined: Feb 2008 |

|

|

|

Jul 25 2013, 12:18 AM Jul 25 2013, 12:18 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Nobody uses Bursa website? Bursa holidays are stated here: http://www.bursamalaysia.com/corporate/about-us/holidays/ |

|

|

Jul 25 2013, 08:51 AM Jul 25 2013, 08:51 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Morning chart...

Fake stuff...  |

|

|

Jul 25 2013, 08:55 AM Jul 25 2013, 08:55 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Yesterday closing actually not too bad.

So what's the fuss? At 125, IF IGBReit pays as promised in its prospectus, what the yield? Is it something to worth to hunt for? |

|

|

Jul 25 2013, 08:59 AM Jul 25 2013, 08:59 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

The other day, if not mistaken ...

this was suggested for look see-ing....  |

|

|

Jul 25 2013, 08:59 AM Jul 25 2013, 08:59 AM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Jul 25 2013, 09:01 AM Jul 25 2013, 09:01 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Getting nervous after two red days meh?

Don't scared lar... trend still strong, yes?  |

|

|

Jul 25 2013, 09:04 AM Jul 25 2013, 09:04 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

The big money is always in the waiting..

|

|

|

Jul 25 2013, 09:08 AM Jul 25 2013, 09:08 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Me think still OK la...

IMO I think it's just building itself up for the next leg up.  |

|

|

Jul 25 2013, 09:13 AM Jul 25 2013, 09:13 AM

|

Senior Member

2,178 posts Joined: Oct 2006 From: The Pearl of the Orient - MY |

Tambun!!!! 1.50 again....

|

|

|

Jul 25 2013, 09:13 AM Jul 25 2013, 09:13 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Are you in it to win it?

|

|

|

Jul 25 2013, 09:16 AM Jul 25 2013, 09:16 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 25 2013, 09:17 AM Jul 25 2013, 09:17 AM

|

Senior Member

2,178 posts Joined: Oct 2006 From: The Pearl of the Orient - MY |

|

|

|

Jul 25 2013, 09:20 AM Jul 25 2013, 09:20 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

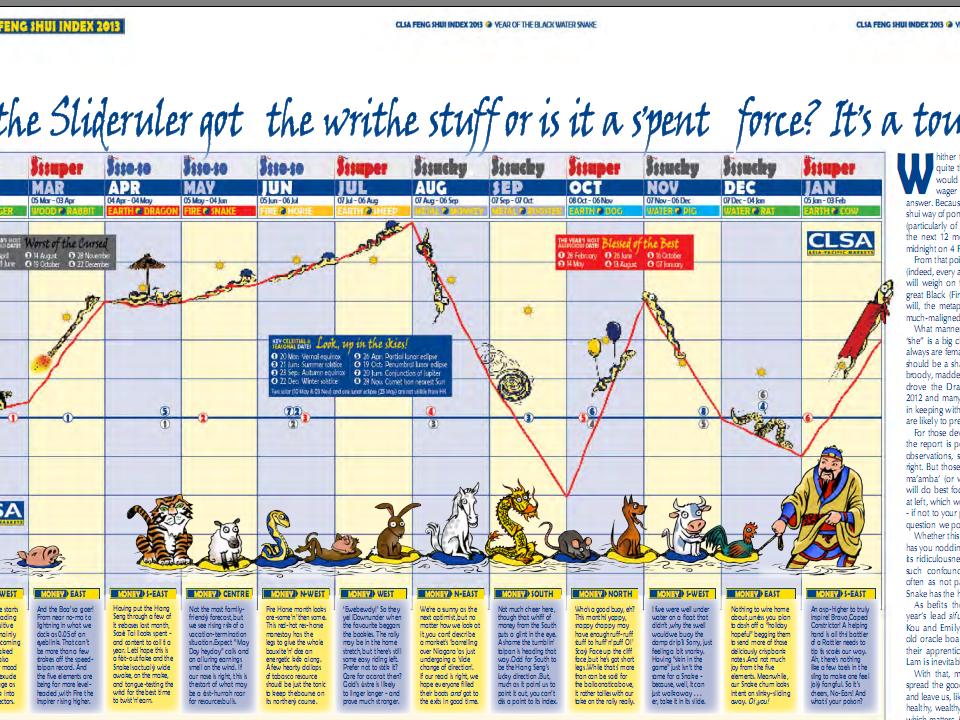

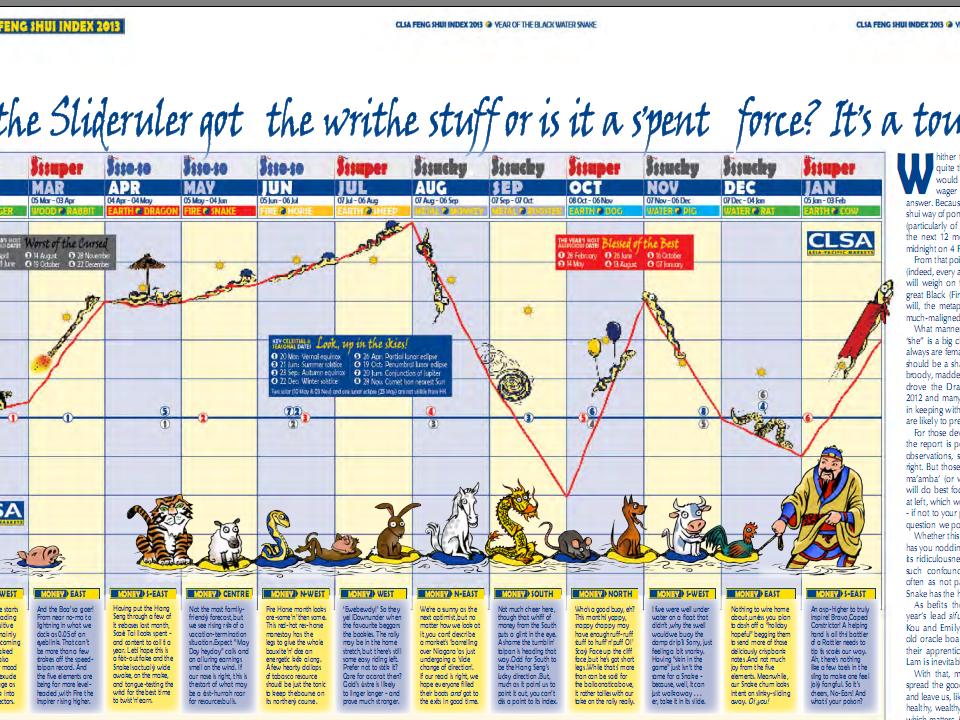

And of course the very scientific chart of the coming weeks....

August and September is coming... Pong Pong Ssway sifoo says all gains will be given back by end Sept... and from where we are ... that should be a loss of over 190 pts and counting.  |

|

|

Jul 25 2013, 09:22 AM Jul 25 2013, 09:22 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(kuluuluk @ Jul 25 2013, 09:17 AM) Why should TP set at 150? I don't use TP la... Ok I lied. The TP I use is toilet paper. Seriously... I am not one to use Target Prices. And if I don't have... like I said... I might even buy at 153! LOL! |

|

|

Jul 25 2013, 09:34 AM Jul 25 2013, 09:34 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

This one also getting whacked until out of shape hor.

Yesterday volume... err ...  |

|

|

Jul 25 2013, 09:37 AM Jul 25 2013, 09:37 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

On the other hand, this other tailou died earlier and it looks as if it's in the process of finding its feet.

|

|

|

Jul 25 2013, 09:42 AM Jul 25 2013, 09:42 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Shiit... spammer.

This other tailou also can be considered died ealier jor.. Looks like it's also in the process of finding of finding its feet... but then some might ask if the *C is the current stabilizing factor?  |

|

|

Jul 25 2013, 09:47 AM Jul 25 2013, 09:47 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Consolidating after announcing another decent set of earnings + *C ?

Or as some might say 'sell on news'? Or should one continue to sit?  |

|

|

Jul 25 2013, 09:51 AM Jul 25 2013, 09:51 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Looks like 32 is the immediate R.  |

|

|

Jul 25 2013, 10:06 AM Jul 25 2013, 10:06 AM

|

Senior Member

896 posts Joined: Jan 2003 From: Ampang |

Boon dailou very rajin

|

|

|

Jul 25 2013, 10:09 AM Jul 25 2013, 10:09 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

Correction.. not rajin la... was just very bored.

|

|

|

Jul 25 2013, 10:11 AM Jul 25 2013, 10:11 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

|

|

|

Jul 25 2013, 10:20 AM Jul 25 2013, 10:20 AM

|

Senior Member

896 posts Joined: Jan 2003 From: Ampang |

|

|

|

Jul 25 2013, 10:30 AM Jul 25 2013, 10:30 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ Jul 25 2013, 10:11 AM) Forever up ones are good especially if you are patiently sitting in it. To get big gains, you have to wait. How to get 3x or 4x winners if you don't wait? It's the same with investing or is the investing following the trading? Investors don't pull the plants out upon seeing the first bloom of flowers, do they? Those falling ones... I know... you like cos .... you are drilled that buying something 'cheaper' is a good thing. I know ... very hard to argue against that reasoning. Haha. But in the stock market, I have seen incidents where all it takes is one bad falling cheap stock to whack you out of the game. I saw it in Transmil last time. Kaki thought when Tranmil fell kau-kau, it was opportunity of life time to buy something 'good' at a much 'cheaper' price. How can it be bad? They argued. Rich man Billionaire Kuok got big stake in the stock wor. How can he let it die. Kaki bought a lot when it limit down the second time. When it rebounded a fair bit, he was convinced he was so right. He bought more. When Tranmil resumed falling.. he constantly bought more. Still saying Kuok will not let Tranmil die. He was wrong. I am sure he lost at least 250k (maybe more) in that stock. He denied. Saying only 100+. When the stock is in its initial falling stage, what would really hurt is buying and then to see the stock continue to fall and have no idea why the stock keeps falling and have no idea when it will stop falling. If I want, I would rather wait a bit first. Let the selling finish first and not do the risky thing of guessing where and when the stock will stop falling. Waiting to buy is as important as waiting to sell. |

|

|

Jul 25 2013, 10:33 AM Jul 25 2013, 10:33 AM

|

Junior Member

184 posts Joined: Jun 2013 |

QUOTE(gark @ Jul 25 2013, 10:11 AM) I do not chase prices which are shooting up,unless there are strong buying signals. I love these types of charts where prices are still falling. Prices cannot continue to keep falling with no end. I will monitor and try to catch rebound. Need to wait to see when selling stops and if likely short-term rebound is strong or not. I have made good profits from stocks which have rebounded from grossly oversold positions. Anyone has any LATEST fundamental data or interesting news to share on this counter AXREIT ? This post has been edited by LOWYAT3AB: Jul 25 2013, 10:59 AM |

|

|

Jul 25 2013, 10:35 AM Jul 25 2013, 10:35 AM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

QUOTE(Boon3 @ Jul 25 2013, 10:30 AM) Forever up ones are good especially if you are patiently sitting in it. Nice transmile story... but the transmile stock falling is together with deteriorating fundamentals. This kind of 'falling' stock I also don't want to touch.To get big gains, you have to wait. How to get 3x or 4x winners if you don't wait? It's the same with investing or is the investing following the trading? Investors don't pull the plants out upon seeing the first bloom of flowers, do they? Those falling ones... I know... you like cos .... you are drilled that buying something 'cheaper' is a good thing. I know ... very hard to argue against that reasoning. Haha. But in the stock market, I have seen incidents where all it takes is one bad falling cheap stock to whack you out of the game. I saw it in Transmil last time. Kaki thought when Tranmil fell kau-kau, it was opportunity of life time to buy something 'good' at a much 'cheaper' price. How can it be bad? They argued. Rich man Billionaire Kuok got big stake in the stock wor. How can he let it die. Kaki bought a lot when it limit down the second time. When it rebounded a fair bit, he was convinced he was so right. He bought more. When Tranmil resumed falling.. he constantly bought more. Still saying Kuok will not let Tranmil die. He was wrong. I am sure he lost at least 250k (maybe more) in that stock. He denied. Saying only 100+. When the stock is in its initial falling stage, what would really hurt is buying and then to see the stock continue to fall and have no idea why the stock keeps falling and have no idea when it will stop falling. If I want, I would rather wait a bit first. Let the selling finish first and not do the risky thing of guessing where and when the stock will stop falling. Waiting to buy is as important as waiting to sell. For the forever up stock, most are selling at high valuation, again back to fundamentals. I also hesitant to buy cause it is overvalued... Sometimes so difficult to play stock market, buy susah, don't buy also susah... |

|

|

Jul 25 2013, 10:40 AM Jul 25 2013, 10:40 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(gark @ Jul 25 2013, 10:35 AM) Nice transmile story... but the transmile stock falling is together with deteriorating fundamentals. This kind of 'falling' stock I also don't want to touch. At that time, Transmil was made to look nice cos of fake accounting. (fake account showed solid growth) For the forever up stock, most are selling at high valuation, again back to fundamentals. I also hesitant to buy cause it is overvalued... Sometimes so difficult to play stock market, buy susah, don't buy also susah... Kaki still bought once the news was announced. Argued based on his buying price vs highest price Argued even more kau-kau citing Kuok factor. Yeah... stock game is sometime very weird one. Sometimes buta-buta machine gun shoot, everything also can win big (as seen after GE. ) Sometimes think-think until brain juice spill all out... buy and then still can lose money. |

|

|

Jul 25 2013, 10:56 AM Jul 25 2013, 10:56 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Boon3 @ Jul 25 2013, 09:34 AM) This one also getting whacked until out of shape hor. Compare the early morning chart...Yesterday volume... err ...  with this one just taken...  See the volume and the fall? Isn't it gathering momentum? Take out the bigger zoom chart to see where we are at...  This post has been edited by Boon3: Jul 25 2013, 10:57 AM |

|

|

Jul 25 2013, 11:00 AM Jul 25 2013, 11:00 AM

|

Senior Member

4,093 posts Joined: Jul 2011 |

|

|

|

Jul 25 2013, 11:01 AM Jul 25 2013, 11:01 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(kueyteowlou @ Jul 25 2013, 11:00 AM) gadang u think today can hit RM1.1? Wait I call Uncle Pong direct line for consultation first...... |

|

|

Jul 25 2013, 11:17 AM Jul 25 2013, 11:17 AM

|

Senior Member

4,093 posts Joined: Jul 2011 |

|

|

|

Jul 25 2013, 11:18 AM Jul 25 2013, 11:18 AM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

Huat lai la

|

|

|

Jul 25 2013, 11:19 AM Jul 25 2013, 11:19 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 25 2013, 11:33 AM Jul 25 2013, 11:33 AM

|

Senior Member

1,213 posts Joined: Apr 2007 |

It's been a while

Almost August, bring out the godly pong sui chart already. I'd love to see bloodbath with KLCI at 1600. |

|

|

Jul 25 2013, 11:40 AM Jul 25 2013, 11:40 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(V-Zero @ Jul 25 2013, 11:33 AM) It's been a while Hard to say. Maybe CI climb up to 2000 pts, where esle some other asset class like reits go down hill.Almost August, bring out the godly pong sui chart already. I'd love to see bloodbath with KLCI at 1600. U see some stocks like palm oil might refuse to follow the CI, by joining the opposition camp. So it is not across the board thing from now on. Might signal the market somehow near the peak too This post has been edited by SKY 1809: Jul 25 2013, 11:43 AM |

|

|

Jul 25 2013, 11:49 AM Jul 25 2013, 11:49 AM

|

Senior Member

896 posts Joined: Jul 2012 |

Kinsteel..buy high sell higher..can ar??

|

|

|

Jul 25 2013, 11:50 AM Jul 25 2013, 11:50 AM

|

Senior Member

1,059 posts Joined: Jun 2013 |

good rrrr

AeonCr climbing back |

|

|

Jul 25 2013, 11:52 AM Jul 25 2013, 11:52 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(V-Zero @ Jul 25 2013, 11:33 AM) It's been a while Where you go? Almost August, bring out the godly pong sui chart already. I'd love to see bloodbath with KLCI at 1600. This time your calculation is correct. 1600 by end Sept hor... 1700 count as Uncle Pong count wrong math hor.. Edit... attach Uncle Pong lengzhai chart.  This post has been edited by Boon3: Jul 25 2013, 12:06 PM |

|

|

Jul 25 2013, 11:59 AM Jul 25 2013, 11:59 AM

|

Senior Member

629 posts Joined: Dec 2007 |

SBC Corp look steady.. may climb further

ILB also.. GABGAQRS warrant out.. |

|

|

Jul 25 2013, 12:07 PM Jul 25 2013, 12:07 PM

|

Senior Member

1,213 posts Joined: Apr 2007 |

|

|

|

Jul 25 2013, 12:07 PM Jul 25 2013, 12:07 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

GOB super strong today.

|

|

|

Jul 25 2013, 12:09 PM Jul 25 2013, 12:09 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 25 2013, 12:09 PM Jul 25 2013, 12:09 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

|

|

|

Jul 25 2013, 12:13 PM Jul 25 2013, 12:13 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 25 2013, 12:14 PM Jul 25 2013, 12:14 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

|

|

|

Jul 25 2013, 12:14 PM Jul 25 2013, 12:14 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(V-Zero @ Jul 25 2013, 12:07 PM) EPF? What also you say one. For the record.. Jan: 1627.55 Feb: 1,637.63 - up 10.08 March: 1,671.63 - up 34.00 Apr: 1,717.65 - up 46.02 May: 1,769.22 - up 52 June: 1773.54 - up 4.3 Now we are at 1810. |

|

|

Jul 25 2013, 12:17 PM Jul 25 2013, 12:17 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

Every month place long no need to think blind blind earn money. So good

|

|

|

Jul 25 2013, 12:18 PM Jul 25 2013, 12:18 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

|

|

|

Jul 25 2013, 12:20 PM Jul 25 2013, 12:20 PM

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Boon3 @ Jul 25 2013, 12:14 PM) EPF? I change my mind like a girl changes her clothes. What also you say one. For the record.. Jan: 1627.55 Feb: 1,637.63 - up 10.08 March: 1,671.63 - up 34.00 Apr: 1,717.65 - up 46.02 May: 1,769.22 - up 52 June: 1773.54 - up 4.3 Now we are at 1810. You know lah our index got strong support one never tumble beyond 1%. On a side note, some REITs look attractive. |

|

|

Jul 25 2013, 12:21 PM Jul 25 2013, 12:21 PM

|

Senior Member

896 posts Joined: Jul 2012 |

|

|

|

Jul 25 2013, 12:27 PM Jul 25 2013, 12:27 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 25 2013, 12:28 PM Jul 25 2013, 12:28 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 25 2013, 12:28 PM Jul 25 2013, 12:28 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

QUOTE(Icehart @ Jul 25 2013, 12:18 PM) This one?Supermax - Bursting to Super Growth Yea.. Confident. Can go already. T4 already over. Wait for Fryday.. |

|

|

Jul 25 2013, 12:29 PM Jul 25 2013, 12:29 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

|

|

|

Jul 25 2013, 12:34 PM Jul 25 2013, 12:34 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 25 2013, 12:35 PM Jul 25 2013, 12:35 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

QUOTE(SKY 1809 @ Jul 25 2013, 12:34 PM) It could be true... You play the share market, one of the most important thing is to know how the players behave so you can guess their moves.. So you can plan ahead and move ahead of them.. This post has been edited by Bonescythe: Jul 25 2013, 12:36 PM |

|

|

Jul 25 2013, 12:39 PM Jul 25 2013, 12:39 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Bonescythe @ Jul 25 2013, 12:29 PM) Uncle Pong put this to try to affect many people into doing the same action together, hence can reflect the same result in the market. Uncle Pong got the best job... Can say 1000 things... 980 things not right... never mind one. the 20 things say correct... means Uncle Pong damn terror the chun! |

|

|

Jul 25 2013, 12:41 PM Jul 25 2013, 12:41 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(Bonescythe @ Jul 25 2013, 12:35 PM) It could be true... But FED Ben has the sole right to alter the directions of the charts.....You play the share market, one of the most important thing is to know how the players behave so you can guess their moves.. So you can plan ahead and move ahead of them.. May as well guess what he intends to do . See reits now, u know what I mean........ |

|

|

Jul 25 2013, 12:44 PM Jul 25 2013, 12:44 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

QUOTE(SKY 1809 @ Jul 25 2013, 12:41 PM) But FED Ben has the sole right to alter the directions of the charts..... Well, FED BEN got his terror-ness. But this time around, I think BN + UMNO more significant this round. KLCI tarak apa apa pun.. More on sendiri world sendiri playMay as well guess what he intends to do . See reits now, u know what I mean........ |

|

|

Jul 25 2013, 12:45 PM Jul 25 2013, 12:45 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

QUOTE(Boon3 @ Jul 25 2013, 12:39 PM) Uncle Pong got the best job... Maybe can start to make another Pong Chart for 2014 before Uncle Pong create one.. Then fast fast post out and circulate it as fast as possible.. Can say 1000 things... 980 things not right... never mind one. the 20 things say correct... means Uncle Pong damn terror the chun! |

|

|

Jul 25 2013, 12:48 PM Jul 25 2013, 12:48 PM

|

Senior Member

6,583 posts Joined: Feb 2008 |

|

|

|

Jul 25 2013, 12:50 PM Jul 25 2013, 12:50 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 25 2013, 12:50 PM Jul 25 2013, 12:50 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 25 2013, 12:54 PM Jul 25 2013, 12:54 PM

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Madbull @ Jul 25 2013, 12:21 PM) Take the market cap divide by the book value, almost less than 1 already.Means paying RM1 for asset worth more than RM1. QUOTE(Boon3 @ Jul 25 2013, 12:50 PM) Come come.Draw one then I help you distribute in whole KL PJ area. |

|

|

Jul 25 2013, 12:56 PM Jul 25 2013, 12:56 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

The chart keep on go up one or got up and down one?

|

|

|

Jul 25 2013, 12:57 PM Jul 25 2013, 12:57 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

|

|

|

Jul 25 2013, 12:59 PM Jul 25 2013, 12:59 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(V-Zero @ Jul 25 2013, 12:54 PM) Take the market cap divide by the book value, almost less than 1 already. Feb - Means paying RM1 for asset worth more than RM1. Come come. Draw one then I help you distribute in whole KL PJ area. Mar - up Apr - up May -up June - July - up Aug - up Sep - up Oct - up Nov -up .................... haiyaaaa.... why susah... just put all also UP la. Sure very popular one. This post has been edited by Boon3: Jul 25 2013, 12:59 PM |

|

|

Jul 25 2013, 01:00 PM Jul 25 2013, 01:00 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 25 2013, 01:01 PM Jul 25 2013, 01:01 PM

|

Senior Member

1,213 posts Joined: Apr 2007 |

Cannot lah like that too fake.

Prefer with some wild swings. |

|

|

Jul 25 2013, 01:01 PM Jul 25 2013, 01:01 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

Over perform everyone in the world. All investor over the world also come to Malaysia KLSE to goreng already..

|

|

|

Jul 25 2013, 01:05 PM Jul 25 2013, 01:05 PM

|

Senior Member

6,583 posts Joined: Feb 2008 |

QUOTE(Boon3 @ Jul 25 2013, 12:59 PM) Feb - Mar - up Apr - up May -up June - July - up Aug - up Sep - up Oct - up Nov -up .................... haiyaaaa.... why susah... just put all also UP la. Sure very popular one. Feb: +100 Mar: +200 Apr: +400 May: -20 June: +100 July: +200 Aug: +400 Sep: -20 Oct: +100 Nov: +200 Dec: +400 like that maybe can reach 5200 malaysia boleh |

|

|

Jul 25 2013, 01:07 PM Jul 25 2013, 01:07 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 25 2013, 01:09 PM Jul 25 2013, 01:09 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

QUOTE(ham_revilo @ Jul 25 2013, 01:05 PM) Feb: +100 Where can?Mar: +200 Apr: +400 May: -20 June: +100 July: +200 Aug: +400 Sep: -20 Oct: +100 Nov: +200 Dec: +400 like that maybe can reach 5200 malaysia boleh Add up total only +2060 points. Now say 1800. Total is 3860 only. You need Feb: +100 Mar: +200 Apr: +300 May: +400 June: +500 July: +600 Aug: -500 Sep: +100 Oct: +300 Nov: +500 Dec: +700 |

|

|

Jul 25 2013, 01:10 PM Jul 25 2013, 01:10 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 25 2013, 01:21 PM Jul 25 2013, 01:21 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jul 25 2013, 02:11 PM Jul 25 2013, 02:11 PM

|

Senior Member

896 posts Joined: Jul 2012 |

wake up guys...wake up...

|

|

|

Jul 25 2013, 03:02 PM Jul 25 2013, 03:02 PM

|

Junior Member

90 posts Joined: Jun 2013 |

0011 any wind ?

|

|

|

Jul 25 2013, 03:12 PM Jul 25 2013, 03:12 PM

|

Senior Member

561 posts Joined: Feb 2009 |

AAX first time drop 1.24.

|

|

|

Jul 25 2013, 03:32 PM Jul 25 2013, 03:32 PM

|

Senior Member

607 posts Joined: Jan 2005 |

|

|

|

Jul 25 2013, 03:42 PM Jul 25 2013, 03:42 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 25 2013, 03:47 PM Jul 25 2013, 03:47 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

my view, all those bought AAX IPO and intention for the price shoot up on listing day................Since the price cant up meaning your intention/objective has failed. Should admit the failure and sell right? why keep? if wanna keep, is that because its good in prospect and fundamental? or just refuse to admit the failure? |

|

|

Jul 25 2013, 03:56 PM Jul 25 2013, 03:56 PM

|

Junior Member

147 posts Joined: Oct 2012 |

Next week another 2 ipo listed- Ranhill and Sona, will c how they go

|

|

|

Jul 25 2013, 04:01 PM Jul 25 2013, 04:01 PM

|

Junior Member

147 posts Joined: Oct 2012 |

4pm Liao, show time for Redtone?

|

|

|

Jul 25 2013, 04:02 PM Jul 25 2013, 04:02 PM

|

Senior Member

896 posts Joined: Jul 2012 |

|

|

|

Jul 25 2013, 04:04 PM Jul 25 2013, 04:04 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 25 2013, 04:07 PM Jul 25 2013, 04:07 PM

|

Junior Member

147 posts Joined: Oct 2012 |

Coastal rebound, good sign?

|

|

|

Jul 25 2013, 04:14 PM Jul 25 2013, 04:14 PM

|

Junior Member

147 posts Joined: Oct 2012 |

|

|

|

Jul 25 2013, 04:19 PM Jul 25 2013, 04:19 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 25 2013, 04:19 PM Jul 25 2013, 04:19 PM

|

|

Elite

3,777 posts Joined: Jan 2003 |

|

|

|

Jul 25 2013, 04:22 PM Jul 25 2013, 04:22 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 25 2013, 04:25 PM Jul 25 2013, 04:25 PM

|

|

Elite

3,777 posts Joined: Jan 2003 |

|

|

|

Jul 25 2013, 04:27 PM Jul 25 2013, 04:27 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 25 2013, 04:27 PM Jul 25 2013, 04:27 PM

|

Junior Member

147 posts Joined: Oct 2012 |

|

|

|

Jul 25 2013, 04:28 PM Jul 25 2013, 04:28 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 25 2013, 04:30 PM Jul 25 2013, 04:30 PM

|

Senior Member

1,411 posts Joined: Nov 2010 |

|

|

|

Jul 25 2013, 04:31 PM Jul 25 2013, 04:31 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 25 2013, 04:32 PM Jul 25 2013, 04:32 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 25 2013, 04:34 PM Jul 25 2013, 04:34 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 25 2013, 04:43 PM Jul 25 2013, 04:43 PM

|

|

Elite

3,777 posts Joined: Jan 2003 |

|

|

|

Jul 25 2013, 04:45 PM Jul 25 2013, 04:45 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jul 25 2013, 04:54 PM Jul 25 2013, 04:54 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

QUOTE(StupidGuyPlayComp @ Jul 25 2013, 03:47 PM) my view, all those bought AAX IPO and intention for the price shoot up on listing day................Since the price cant up meaning your intention/objective has failed. Should admit the failure and sell right? why keep? if wanna keep, is that because its good in prospect and fundamental? or just refuse to admit the failure? If we look at these heavy IPO past performance.. They are more likely to stay stubborn for a couples of week first before shooting upwards. Just my observation on a few counters like 1. Gasmsia 2. IHH Just my lousy half cents.. But there are fail cases like FGV of course. |

|

|

Jul 25 2013, 05:00 PM Jul 25 2013, 05:00 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

CI 1808 making new high

However another red day for me, paper gain is shrinking everyday Sien jor |

|

|

Jul 25 2013, 05:04 PM Jul 25 2013, 05:04 PM

|

Senior Member

1,850 posts Joined: Jan 2003 |

|

|

|

Jul 25 2013, 05:05 PM Jul 25 2013, 05:05 PM

|

Senior Member

7,960 posts Joined: Dec 2007 From: Kuala Lumpur |

|

|

|

Jul 25 2013, 05:05 PM Jul 25 2013, 05:05 PM

|

Junior Member

147 posts Joined: Oct 2012 |

Buy Redtone at rm0.82, no know is a good decision o not?

|

|

|

Jul 25 2013, 05:06 PM Jul 25 2013, 05:06 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

|

|

|

Jul 25 2013, 05:07 PM Jul 25 2013, 05:07 PM

|

|

Elite

3,777 posts Joined: Jan 2003 |

|

|

|

Jul 25 2013, 05:08 PM Jul 25 2013, 05:08 PM

|

Senior Member

739 posts Joined: Jan 2009 |

lemonade, dun worry...report is coming out next week...

hehe.... |

|

|

Jul 25 2013, 05:09 PM Jul 25 2013, 05:09 PM

|

Junior Member

309 posts Joined: Nov 2011 |

noob question. why axreit go from rm1 in 2009 to rm3 plus today, but others like arreit or tower-reit or quill capita can't match the performance?

what's the fundamental strength behind axis? has this fundamental changed lately? » Click to show Spoiler - click again to hide... « |

|

|

Jul 25 2013, 05:09 PM Jul 25 2013, 05:09 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

QUOTE(Bonescythe @ Jul 25 2013, 04:54 PM) I think AAX is not finished yet. If we look at these heavy IPO past performance.. They are more likely to stay stubborn for a couples of week first before shooting upwards. Just my observation on a few counters like 1. Gasmsia 2. IHH Just my lousy half cents.. But there are fail cases like FGV of course. |

|

|

Jul 25 2013, 05:10 PM Jul 25 2013, 05:10 PM

|

Junior Member

147 posts Joined: Oct 2012 |

|

|

|

Jul 25 2013, 05:10 PM Jul 25 2013, 05:10 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 25 2013, 05:13 PM Jul 25 2013, 05:13 PM

|

Junior Member

147 posts Joined: Oct 2012 |

When market will crash??

|

|

|

Jul 25 2013, 05:16 PM Jul 25 2013, 05:16 PM

|

All Stars

13,681 posts Joined: Mar 2006 |

|

|

|

Jul 25 2013, 05:20 PM Jul 25 2013, 05:20 PM

|

|

VIP

37,028 posts Joined: Jan 2003 From: Petaling Jaya |

QUOTE(spiderman17 @ Jul 25 2013, 05:09 PM) noob question. why axreit go from rm1 in 2009 to rm3 plus today, but others like arreit or tower-reit or quill capita can't match the performance? Axis Reit is one of the well managed Reit that has the most assets in their portfolio. what's the fundamental strength behind axis? has this fundamental changed lately? » Click to show Spoiler - click again to hide... « Based on 2012's update, Axreit has Office & warehouses: 25 & Retail: 2, with high occupany rate as well. And it is one of local funds favourite too. I remember the yield used to be >6%, nowadays drop to 4.x% only. |

|

|

Jul 25 2013, 05:58 PM Jul 25 2013, 05:58 PM

|

Senior Member

4,966 posts Joined: Nov 2008 |

|

|

|

Jul 25 2013, 06:07 PM Jul 25 2013, 06:07 PM

|

Senior Member

607 posts Joined: Jan 2005 |

Gadang results very scary oooo

Lets see hows the market reaction... Attached File(s)  1479173797_1628207692.pdf ( 244.39k )

Number of downloads: 75

1479173797_1628207692.pdf ( 244.39k )

Number of downloads: 75 |

|

|

Jul 25 2013, 06:48 PM Jul 25 2013, 06:48 PM

|

Senior Member

7,142 posts Joined: Oct 2008 From: Sin City |

Encorp wins RM114mil construction contract

Encorp Bhd said today its unit, Encorp Construction & Infrastructure, had been awarded the main contract to build a business centre worth RM114mil in Cyberjaya. It said Setia Haruman Sdn Bhd issued the letter of award on July 25th. Work on the project – which encompasses shops, offices, a car park and other amenities, including a 24 storey building – will commence on Sept 2 this year, with delivery date set 24 months down the road on Sept 2, 2015. The company said it did not see any exceptional risk in undertaking the project and expected the contract would contribute positively to the earnings of the Encorp Group during the duration of the contract. |

|

|

Jul 25 2013, 09:24 PM Jul 25 2013, 09:24 PM

|

Senior Member

8,432 posts Joined: Nov 2005 |

I guess this is the first time I login to this new thread. And it is at page 13 already. Wow.

|

|

|

Jul 25 2013, 09:37 PM Jul 25 2013, 09:37 PM

|

All Stars

14,899 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

|

|

|

Jul 25 2013, 09:39 PM Jul 25 2013, 09:39 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(spiderman17 @ Jul 25 2013, 05:09 PM) noob question. why axreit go from rm1 in 2009 to rm3 plus today, but others like arreit or tower-reit or quill capita can't match the performance? Very simple.what's the fundamental strength behind axis? has this fundamental changed lately? » Click to show Spoiler - click again to hide... « Axreit DPU is improving over the time, from last time around 13~14 to now around 18 cents. Somemore, Axreit has shown it has the ability to expand its portfolio that improve DPU and asset base without needing any cent from shareholders nor any dilution effect. Somemore its portfolio is diversified across, so less rely on single or two tenants, or related party. |

|

|

Jul 25 2013, 09:50 PM Jul 25 2013, 09:50 PM

|

Senior Member

8,432 posts Joined: Nov 2005 |

|

|

|

Jul 25 2013, 11:13 PM Jul 25 2013, 11:13 PM

|

Senior Member

2,361 posts Joined: Feb 2008 |

|

|

|

Jul 25 2013, 11:29 PM Jul 25 2013, 11:29 PM

|

Junior Member

435 posts Joined: Jul 2005 From: KL Kepong |

eh guys,just to confirm,tomorrow market close or open ah? i mean 26 July 2013,Friday as KL dont have holiday,selangor yes.

|

|

|

Jul 25 2013, 11:48 PM Jul 25 2013, 11:48 PM

|

Senior Member

640 posts Joined: Jun 2013 |

QUOTE(Darkcursed @ Jul 25 2013, 11:29 PM) eh guys,just to confirm,tomorrow market close or open ah? i mean 26 July 2013,Friday as KL dont have holiday,selangor yes. Earlier Boon3 posted this link:http://www.bursamalaysia.com/corporate/about-us/holidays/ |

|

|

Jul 26 2013, 09:23 AM Jul 26 2013, 09:23 AM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

Forum is deaD?

|

|

|

Jul 26 2013, 09:30 AM Jul 26 2013, 09:30 AM

|

Junior Member

147 posts Joined: Oct 2012 |