Check it up.

This post has been edited by transit: Apr 19 2013, 10:42 AM

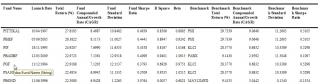

Public Mutual v4, Public/PB series funds

|

|

Apr 19 2013, 10:40 AM Apr 19 2013, 10:40 AM

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

|

|

|

|

|

|

Apr 19 2013, 10:49 AM Apr 19 2013, 10:49 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Apr 21 2013, 11:48 PM Apr 21 2013, 11:48 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

Dear Unitholder, We are pleased to attach the market wrap and regional market review for the week/ fortnight ended 12 April 2013 for your information. Regards Customer Service e-mail proclaimer This e-mail and any attachment is intended for the addressee(s) only and may contain information that is legally privileged and confidential. If you are not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication and its contents is strictly prohibited. If you have received this email in error, please notify us immediately by return email or our hotline 036207 5000 and delete the document. This communication has not been transmitted via a private or secure link or in encrypted form and is therefore subject to the usual hazards of Internet communications, nor can it be guaranteed that this communication has not been the subject of unauthorised interception or modification.

|

|

|

Apr 22 2013, 11:12 AM Apr 22 2013, 11:12 AM

|

Senior Member

1,654 posts Joined: Nov 2011 |

Hi all, on feb 13 i already canceled 1 my fund's auto debit, but on this month april, the auto debit started itself, why is it like that?

|

|

|

Apr 22 2013, 11:23 AM Apr 22 2013, 11:23 AM

|

Senior Member

628 posts Joined: Jul 2010 From: Malaysia |

Hi, I'm new to Public Mutual.

I am meeting one of the agents in few days time and was wondering if I can receive some advise (to self protect and to invest right) from fellow forumers before committing. I was speaking to some colleague and they said most of the fund prices are very expensive now, not worth to invest. What are your thoughts? Can recommend which funds to go for? I am new and am considering other options to invest too. Please help. |

|

|

Apr 22 2013, 11:34 AM Apr 22 2013, 11:34 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(merchant9 @ Apr 22 2013, 12:23 PM) Hi, I'm new to Public Mutual. It is not right to look at nav when investing in UT. Look at the underlying asset of the particular fund valuation. If u plan to invest in malaysia exposure funds, still have some upside potential. Maybe can go in after GE.I am meeting one of the agents in few days time and was wondering if I can receive some advise (to self protect and to invest right) from fellow forumers before committing. I was speaking to some colleague and they said most of the fund prices are very expensive now, not worth to invest. What are your thoughts? Can recommend which funds to go for? I am new and am considering other options to invest too. Please help. |

|

|

|

|

|

Apr 22 2013, 11:36 AM Apr 22 2013, 11:36 AM

|

Senior Member

628 posts Joined: Jul 2010 From: Malaysia |

QUOTE(Kaka23 @ Apr 22 2013, 11:34 AM) It is not right to look at nav when investing in UT. Look at the underlying asset of the particular fund valuation. If u plan to invest in malaysia exposure funds, still have some upside potential. Maybe can go in after GE. Hi Kaka23,Sorry but what is nav and UT? How to look at underlying asset? New investors like myself will buy whatever is recommended by the agent. I wanted to look at track record but was told not to because last year profit does not guarantee this year also profit. Can explain a little bit more on the terms you used? |

|

|

Apr 22 2013, 11:45 AM Apr 22 2013, 11:45 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(merchant9 @ Apr 22 2013, 11:36 AM) Hi Kaka23, My sincere advice - DO NOT go meet the agent before u do some basic homework on your own.Sorry but what is nav and UT? How to look at underlying asset? New investors like myself will buy whatever is recommended by the agent. I wanted to look at track record but was told not to because last year profit does not guarantee this year also profit. Can explain a little bit more on the terms you used? Post #1 at http://forum.lowyat.net/topic/2601692 have some good links that u can read. After u went thru those, maybe u wanna read Post #1 at http://forum.lowyat.net/topic/2719482 to clear some common misunderstandings about unit trusts. |

|

|

Apr 22 2013, 12:58 PM Apr 22 2013, 12:58 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(merchant9 @ Apr 22 2013, 11:23 AM) Hi, I'm new to Public Mutual. Some basics you need to be aware:I am meeting one of the agents in few days time and was wondering if I can receive some advise (to self protect and to invest right) from fellow forumers before committing. I was speaking to some colleague and they said most of the fund prices are very expensive now, not worth to invest. What are your thoughts? Can recommend which funds to go for? I am new and am considering other options to invest too. Please help. 1. Service charges. Public Mutual has entry service charges, but no extra charges in exit. Hence its service charge is higher than other fund houses. It is 5.5% when you enter the fund with your money/savings. 3.0% if the investment is taken out from EPF. (Why the 2.5% difference? No good logical reason here, except maybe EPF has the clout not to give approval if the service charge is unreasonably high. Note the annual fund management fee and trustee fee is already covering the management and operations costs. Both these management & trustee fees are hidden, and not really necessary to split hairs and compare them among the fund houses.) 2. Yes, the stock markets (Malaysia, Indonesia & Thailand) are already in a rally for the past 6 months. KLCI breaking the all time high mark of 1700. Unit trust fund is a pool of funds investing in the stocks. In UT as in the stock market, always "buy low, sell high" for maximum profits. To get around this issue, it is best to enter slowly, using the "Dollar Cost Average" method. 3. If you are investing using EPF money and the withdrawal amount is high, please see my previous post (the so-called 'Pot Black' strategy) on doing DCA using a Bond fund. EPF allows a withdrawal every 3 months; using this strategy, the entries can be made monthly, and the entry can also be delayed if necessary. 4. EPF approved funds are local funds; and they are good, conservative funds to start with. Try to start with 2 funds, a conservative to moderate ones, Public Regular Savings Fund and Public Dividend Select Fund. A good bond fund (EPF-approved), currently, is Public Islamic Income Fund. Cheers, happy investing. PS. Maybe I should give a full list of EPF-approved funds later this weekend. This post has been edited by j.passing.by: Apr 22 2013, 01:01 PM |

|

|

Apr 22 2013, 04:57 PM Apr 22 2013, 04:57 PM

|

Senior Member

5,713 posts Joined: Jan 2003 |

The market have to dip somehow SOON

GE13 is around the corner. If "malaysia spring" become reality... Then it will be FUN market This post has been edited by MakNok: Apr 22 2013, 04:57 PM |

|

|

Apr 22 2013, 06:09 PM Apr 22 2013, 06:09 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(MakNok @ Apr 22 2013, 04:57 PM) The market have to dip somehow SOON Sorry bro/sis.GE13 is around the corner. If "malaysia spring" become reality... Then it will be FUN market Methinks the market doesn't HAVE TO do anything It does what it does - usually predictable a bit BUT can be wildly unpredictable. Bottom line - i think best not to invest based on HOPE. Best to have some plans to execute come high water or hell + some dry-powder for opportunities This post has been edited by wongmunkeong: Apr 22 2013, 06:11 PM |

|

|

Apr 22 2013, 07:42 PM Apr 22 2013, 07:42 PM

|

Senior Member

5,713 posts Joined: Jan 2003 |

QUOTE(wongmunkeong @ Apr 22 2013, 06:09 PM) Sorry bro/sis. Trust me,Methinks the market doesn't HAVE TO do anything It does what it does - usually predictable a bit BUT can be wildly unpredictable. Bottom line - i think best not to invest based on HOPE. Best to have some plans to execute come high water or hell + some dry-powder for opportunities it will happen I am waiting to pounce on it. |

|

|

Apr 22 2013, 08:43 PM Apr 22 2013, 08:43 PM

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

PM's Market wrap and bond market review for the week/ fortnight ended 19 April 2013 for your information.

Market_Wrap_04_19_13__MG_.pdf ( 365.74k )

Number of downloads: 4

Market_Wrap_04_19_13__MG_.pdf ( 365.74k )

Number of downloads: 4 |

|

|

|

|

|

Apr 22 2013, 09:09 PM Apr 22 2013, 09:09 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

Been getting these 'market wrap' emails in my yahoo account... have never bother reading them after opening some... cannot make head or tail out of them, just a waste of my time. To me, it is marketing gimmick so that public mutual can classified as extra service to investors.

Anyone find them useful, and buy/sell/switch funds accordingly? |

|

|

Apr 22 2013, 09:15 PM Apr 22 2013, 09:15 PM

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

I did read on it (sometime) to gathering some information such as P/E ratio and some regional market valuations.

The 2013 Q1 QFR (softcopy) is just available in their website:- http://www.publicmutual.com.my/LinkClick.a...aw%3D&tabid=248 This post has been edited by transit: Apr 22 2013, 09:16 PM |

|

|

Apr 22 2013, 09:16 PM Apr 22 2013, 09:16 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(j.passing.by @ Apr 22 2013, 09:09 PM) Been getting these 'market wrap' emails in my yahoo account... have never bother reading them after opening some... cannot make head or tail out of them, just a waste of my time. To me, it is marketing gimmick so that public mutual can classified as extra service to investors. Tell u what, they even send to my company general enquiries e-mail even though our company is no corporate client of PM Anyone find them useful, and buy/sell/switch funds accordingly? I find it to be a "dry" presentation of market data. |

|

|

Apr 22 2013, 09:53 PM Apr 22 2013, 09:53 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(Pink Spider @ Apr 22 2013, 09:16 PM) Tell u what, they even send to my company general enquiries e-mail even though our company is no corporate client of PM yeah, weekly/fortnightly market data that are of no use to people who is monitoring the market daily; no use to people who don't monitor daily or weekly and looking at longer market trend; no use to people who are just beginning and doing constant "DCA" entries.I find it to be a "dry" presentation of market data. And no use to people who only look into the market now and then, and there are better websites instead of reading old emails on old data. For better news and analysis, I browse the 'other thread' for links... |

|

|

Apr 22 2013, 10:09 PM Apr 22 2013, 10:09 PM

|

Senior Member

2,932 posts Joined: Sep 2007 |

Well, I don't know if it's of any use to investors, but it looks like it's of no use to many of their own fund managers who consistently under-perform the market, and even worse under-perform their own designed benchmarks.

If there's an award for the "Biggest Winner" for under-performing funds, it is quite likely PM will win that too, to go along with their "Biggest Winner for the 10th consecutive year" claim. |

|

|

Apr 23 2013, 05:31 PM Apr 23 2013, 05:31 PM

|

Junior Member

83 posts Joined: Oct 2006 From: Australia |

Hi all,

I believe I have too many bond funds and would like to take one out because I have another with another bank as well. So would appreciate your opinion on which one I should take out. I currently have: PEBF PSBF PIEBF Which would be the best to take out if comparing returns to FD? thanks! |

|

|

Apr 23 2013, 07:06 PM Apr 23 2013, 07:06 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(rachy @ Apr 23 2013, 05:31 PM) Hi all, You can take out either PEBF or PIBEF as they're siblings with the later being Shariah compliant.I believe I have too many bond funds and would like to take one out because I have another with another bank as well. So would appreciate your opinion on which one I should take out. I currently have: PEBF PSBF PIEBF Which would be the best to take out if comparing returns to FD? thanks! |

|

Topic ClosedOptions

|

| Change to: |  0.0228sec 0.0228sec

0.24 0.24

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 09:34 PM |