@MakNok

So, may I know your reason?

or could Pink Spider reason is good enough?

Public Mutual v4, Public/PB series funds

Public Mutual v4, Public/PB series funds

|

|

Apr 5 2013, 05:48 PM Apr 5 2013, 05:48 PM

|

Senior Member

2,050 posts Joined: Dec 2009 From: DC |

@MakNok

So, may I know your reason? or could Pink Spider reason is good enough? |

|

|

|

|

|

Apr 5 2013, 06:39 PM Apr 5 2013, 06:39 PM

|

Senior Member

5,713 posts Joined: Jan 2003 |

|

|

|

Apr 5 2013, 07:03 PM Apr 5 2013, 07:03 PM

|

Senior Member

1,654 posts Joined: Nov 2011 |

QUOTE(koinibler @ Apr 5 2013, 03:18 PM) In my opinion, if the value is low (low like <20K), let build up the capital first through DDI. Then, it will make more sense to have a ratio portfolio and then thinking about switching. thanks for the advice, If you already plan to use the money in 2 years time, I think that money not suitable for unit trust/equity. It might suitable for bond funds. Then, when need money in emergency, if value is not right, low loaded unit/bonds fund can be use first. The logic is, most of the time, bonds fund (Malaysia case) doesn't really fluctuate during economic crisis. I switch because I dont really quite understand unit trust, i am doing decision based on my agent |

|

|

Apr 6 2013, 12:26 AM Apr 6 2013, 12:26 AM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(kimyee73 @ Apr 5 2013, 02:31 PM) Thank you. That's what I'm hoping to hear. QUOTE(MakNok @ Apr 5 2013, 05:04 PM) I think you meant to say "... better switch back to EPF investment..."Yes, should use EPF investment (3% service charge) instead of cash investment (5.5% s.c.), if you're over 50. Allow 3-5 years to even out the 3% per year, then you have loaded units "cleaned" of service charge to play... I even intend to put extra money back into EPF account 1 to boost up the total... since the withdrawal to invest into UT is on a formula... there would still be a big chunk left over if withdraw all from EPF at age 55. QUOTE(Pink Spider @ Apr 5 2013, 05:43 PM) I think you have misunderstand my previous post when I said (tongue in cheek) that I already profited 2.5% before getting started.The 2.5% is from the difference between EPF and cash investment. |

|

|

Apr 6 2013, 01:10 AM Apr 6 2013, 01:10 AM

|

Senior Member

1,639 posts Joined: Nov 2010 |

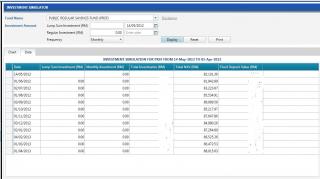

QUOTE(tehoice @ Apr 4 2013, 06:26 PM) thanks for the reply... Vietnam, Cambodia, Laos & Myanmar - I don't think there is any Public Mutual funds in these countries; PM investments are usually very conservative, and these countries are risky and have not achieved "investment standard" yet. Even Philippines just got the investment rating last month... only a very small percentage of a fund (if any) would be in Philippines directly.I understand, but which type of fund do you recommend? if you are to choose? since there are so many funds available, but I'd try to avoid those overseas funds in vietnam cambodia china and etc... not for now... local one would suit me more.... I don't mind passively invest say 200 into my portfolio, for future income... ============ ... back to the "Always Pot Black Strategy" in previous post. This strategy is good if you are able to withdraw a big sum from EPF, say at least 10k. A bond fund is about RM1 per unit; and the minimal units to switch is 1000. So you are switching at least RM1000 each time; which can be spread over 10 months or more. It is following the DCA (Dollar Cost Averaging) method of investment. It looks a bit more confusing in the story telling, because I threw in how to lock-in any gains using a Money Market fund; due to the fact that there is zero switching fee switching into a money market fund after 90 days. Actually, Public Mutual have the same strategy (of using a bond fund, and then switching regularly to an equity fund) in their latest promotion, Regular Investment Instruction Campaign 2013 (from 27/12/2012 to 26/12/2013). This RII campaign allows a minimal of 200 units to switch. But it must be cash investment. The service charge in this promotion is 5% instead of 5.5% |

|

|

Apr 6 2013, 10:45 AM Apr 6 2013, 10:45 AM

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(MakNok @ Apr 5 2013, 06:39 PM) actually i am still trying to figure out my PRSF fund if i have not done any switching? Morning MakNok,

Can help to calculate ar? i see my fund until i blur liao I see your details, you keen switching everything to fund that going to declare Distribution. I believe you started doing such switching started 2012 MAY. Not sure you consider the NAV before Distribution, NAV after Distribution and switching fee. You are Mutual Gold Member, enjoying switching entitlment. Can you specific your question, i still blur blur what you want to ask. This post has been edited by felixmask: Apr 6 2013, 10:50 AM |

|

|

|

|

|

Apr 6 2013, 12:43 PM Apr 6 2013, 12:43 PM

|

Senior Member

5,713 posts Joined: Jan 2003 |

QUOTE(felixmask @ Apr 6 2013, 10:45 AM) Morning MakNok, hi felix,I see your details, you keen switching everything to fund that going to declare Distribution. I believe you started doing such switching started 2012 MAY. Not sure you consider the NAV before Distribution, NAV after Distribution and switching fee. You are Mutual Gold Member, enjoying switching entitlment. Can you specific your question, i still blur blur what you want to ask. you see, i divide my total monies and spilt equally to PRSF & PAGF My AIM at that time was to cash in "Income TAX rebate" from above equity. Year 2012, both equity declared 4.5cents/unit but it seem PRSF gives better "Income Tax Rebate" percentage as compared to PAGF. My MAIN question now is if i have not switch that PRSF on 15/05/2012. What will be the nett worth of that PRSF portion using my repurchase price on 28/03/2013 which is 0.6746? This post has been edited by MakNok: Apr 6 2013, 12:43 PM |

|

|

Apr 6 2013, 08:35 PM Apr 6 2013, 08:35 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(MakNok @ Apr 6 2013, 12:43 PM) hi felix, Ignore the NAV price since there were distributions... use the total amounts given on 15/05/12 & 28/03/13.... RM162,755.63 you see, i divide my total monies and spilt equally to PRSF & PAGF My AIM at that time was to cash in "Income TAX rebate" from above equity. Year 2012, both equity declared 4.5cents/unit but it seem PRSF gives better "Income Tax Rebate" percentage as compared to PAGF. My MAIN question now is if i have not switch that PRSF on 15/05/2012. What will be the nett worth of that PRSF portion using my repurchase price on 28/03/2013 which is 0.6746? & RM177,594.51... so an increase of 9.12%. Now see the performance chart in Public Mutual website and insert the same dates on PRSF... 8.96%. So after all the ting ting tong tong, not much difference... Cheers. PS. Interestingly, Public Mutual treated the reinvested distribution units as more than 90 days when switched, and don't incur the 0.75% switching charge. edit: correction... This post has been edited by j.passing.by: Apr 6 2013, 08:46 PM |

|

|

Apr 7 2013, 01:06 AM Apr 7 2013, 01:06 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(Kaka23 @ Apr 4 2013, 06:50 PM) You plan for 10-15 yrs, so time is on your side. Just pick one or two malaysia funds to invest monthly. yes, I'm planning to invest for long term, of up to say 15 years, so meaning, I have to consistently make payments or invest every month throughout the whole period?? I mean award winninh malaysian funds.. pick one or two award winning malaysian funds... but I really got no idea how to go about it, I know I can google, but if you don't mind, if you can drop me a pm on the selections? I will then try to assess from there... really thank you very much |

|

|

Apr 7 2013, 01:07 AM Apr 7 2013, 01:07 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(koinibler @ Apr 5 2013, 11:56 AM) @tehoice ok, thanks for the link, I will try to read it up during weekend.... do some homework first...for fund selection, you can use j.passing.by summarize. Quite useful for me too. here ; http://forum.lowyat.net/topic/2466037/+760# search previous post will help you a lot. Just remember, its used as a reference only, you need to decide yourself which one that you're comfortable with |

|

|

Apr 7 2013, 11:45 AM Apr 7 2013, 11:45 AM

|

Junior Member

371 posts Joined: Aug 2008 |

Weekly Market Wrap & Regional Market Review:

Market_Wrap_032913__MG_.pdf ( 529.11k )

Number of downloads: 5

Market_Wrap_032913__MG_.pdf ( 529.11k )

Number of downloads: 5 |

|

|

Apr 7 2013, 12:03 PM Apr 7 2013, 12:03 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(tehoice @ Apr 7 2013, 01:06 AM) yes, I'm planning to invest for long term, of up to say 15 years, so meaning, I have to consistently make payments or invest every month throughout the whole period?? For Pub-Mut,being the jaguh kampung that they are, only their local funds are worth looking at.pick one or two award winning malaysian funds... but I really got no idea how to go about it, I know I can google, but if you don't mind, if you can drop me a pm on the selections? I will then try to assess from there... really thank you very much PISEF, PIDF, PFSF Xuzen This post has been edited by xuzen: Apr 7 2013, 02:52 PM |

|

|

Apr 7 2013, 08:10 PM Apr 7 2013, 08:10 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

Something to be aware of, especially if you're a newbie and thinking to take a big leap into Unit Trusts because you think it is safer than buying shares in the share market; and because you're thinking that you're missing out the bull rally and missing out on the profits that could be made.

"Mom and pop: The world’s worst investors." Commentary: They buy high, sell low, and the ending is predictable. http://www.marketwatch.com/story/mom-and-p...tors-2013-04-04 Can be summarised in 4 sentences: Buy low, sell high = major profit. Buy high, sell higher = minor profit. Buy low, sell lower = minor lost. Buy high, sell low = major lost. Better to take small steps, and invest conservatively using DCA (Dollar Cost Average) method. Cheers... happy investing. This post has been edited by j.passing.by: Apr 7 2013, 08:13 PM |

|

|

|

|

|

Apr 7 2013, 10:12 PM Apr 7 2013, 10:12 PM

|

Senior Member

6,356 posts Joined: Aug 2008 |

QUOTE(MakNok @ Apr 6 2013, 12:43 PM) hi felix, HI MakNok,you see, i divide my total monies and spilt equally to PRSF & PAGF My AIM at that time was to cash in "Income TAX rebate" from above equity. Year 2012, both equity declared 4.5cents/unit but it seem PRSF gives better "Income Tax Rebate" percentage as compared to PAGF. My MAIN question now is if i have not switch that PRSF on 15/05/2012. What will be the nett worth of that PRSF portion using my repurchase price on 28/03/2013 which is 0.6746? I dunno how to calculate for you - maybe you can refer j.passing.by feedback. |

|

|

Apr 7 2013, 11:12 PM Apr 7 2013, 11:12 PM

|

Senior Member

2,050 posts Joined: Dec 2009 From: DC |

QUOTE(MakNok @ Apr 6 2013, 12:43 PM) My MAIN question now is if i have not switch that PRSF on 15/05/2012. As I only see 2 transaction of PRSF on 15/05/2013; so its worth on 1st April 2013What will be the nett worth of that PRSF portion using my repurchase price on 28/03/2013 which is 0.6746?

(only for portion of PRSF that switch out on 15/05/2013) This post has been edited by koinibler: Apr 7 2013, 11:16 PM |

|

|

Apr 8 2013, 06:39 AM Apr 8 2013, 06:39 AM

|

Senior Member

5,713 posts Joined: Jan 2003 |

|

|

|

Apr 8 2013, 06:39 AM Apr 8 2013, 06:39 AM

|

Senior Member

5,713 posts Joined: Jan 2003 |

QUOTE(j.passing.by @ Apr 6 2013, 08:35 PM) Ignore the NAV price since there were distributions... use the total amounts given on 15/05/12 & 28/03/13.... RM162,755.63 Thanks& RM177,594.51... so an increase of 9.12%. Now see the performance chart in Public Mutual website and insert the same dates on PRSF... 8.96%. So after all the ting ting tong tong, not much difference... Cheers. PS. Interestingly, Public Mutual treated the reinvested distribution units as more than 90 days when switched, and don't incur the 0.75% switching charge. edit: correction... |

|

|

Apr 8 2013, 06:40 AM Apr 8 2013, 06:40 AM

|

Senior Member

5,713 posts Joined: Jan 2003 |

|

|

|

Apr 8 2013, 11:13 AM Apr 8 2013, 11:13 AM

|

Senior Member

5,379 posts Joined: Jul 2009 |

the updated price today on 5/4/2013.

All the Public Far East series, the price has been drop around 2%, except for the Public Far East Property and Resorts funds, against the trend up by 2%. Anyone knows why? |

|

|

Apr 8 2013, 11:41 AM Apr 8 2013, 11:41 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(cheahcw2003 @ Apr 8 2013, 11:13 AM) the updated price today on 5/4/2013. PFEPRF = hard properties & REITsAll the Public Far East series, the price has been drop around 2%, except for the Public Far East Property and Resorts funds, against the trend up by 2%. Anyone knows why? This asset class has been running on fire for the past several years non-stop (2009 onwards) |

|

Topic ClosedOptions

|

| Change to: |  0.0200sec 0.0200sec

0.60 0.60

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 11:09 PM |